CMP stands for Commercial Multiple Peril. It is a type of insurance policy that combines several property and general liability insurance policies into a single package, covering multiple hazards. CMP insurance is designed to protect an organization from various property and liability exposures. It offers at least two forms of commercial insurance coverage, including a variety of potential losses incurred from numerous causes. This type of policy is often available at a discount compared to purchasing multiple separate policies.

| Characteristics | Values |

|---|---|

| Full Form | Commercial Multiple Peril |

| Type | Commercial insurance |

| Number of Forms | 2 or more |

| Purpose | Protect an organization from various property and liability exposures |

| Components | Declarations pages, insurance coverage forms, definitions, conditions, limitations, exclusions |

What You'll Learn

- CMP stands for Commercial Multiple Peril

- CMP insurance offers at least two forms of commercial insurance coverage

- CMP insurance covers a variety of potential losses incurred from numerous causes

- CMP insurance bundles several property and general liability insurance policies into one

- CMP insurance is often available at a discount compared to multiple separate policies

CMP stands for Commercial Multiple Peril

Commercial Multiple Peril insurance policies are popular in the property and casualty insurance market, particularly in the United States. They are designed to mitigate various risks that businesses may encounter. By consolidating multiple insurance types into one convenient package, CMP policies offer a streamlined approach to risk management. This means businesses can obtain comprehensive protection without the hassle of managing multiple policies and premiums.

The specific coverages available in a CMP policy can vary, but they often include a wide range of options tailored to different business needs. For example, a CMP policy may include general liability, property insurance, business income protection, business crime insurance, flood damage, wind damage, and more. One common example is Multiple Peril Crop Insurance (MPCI), which is used by farmers and ranchers to protect against incidents that may lead to a loss of crops, such as drought, flood, or natural disasters.

The term "CMP" is also sometimes used in auto insurance policies, where it can refer to a comprehensive claim. This could include repairs or replacements due to a range of issues, such as windshield damage, animal strikes, theft, or fire.

Daughters of Veterans: USAA Auto Insurance Eligibility

You may want to see also

CMP insurance offers at least two forms of commercial insurance coverage

CMP stands for "Commercial Multiple Peril". A CMP insurance policy offers at least two forms of commercial insurance coverage, bundling together several property and general liability insurance policies into a single package. This type of policy is designed to protect an organisation from various property and liability exposures.

CMP insurance typically includes coverage for a wide range of potential losses incurred from numerous causes. For example, some of the types of coverage offered include business crime, business automobile, boiler and machinery, marine and farm, flood damage, wind damage, and general liability. By combining many different types of coverage under a single policy, CMP insurance provides a convenient all-in-one package for the insured.

CMP insurance is often available at a discount compared to purchasing multiple separate policies. This makes it a popular choice for businesses, as it offers a comprehensive level of protection at a reduced cost. The specific details of CMP insurance coverage can vary, but it generally includes several important components. These components may include declarations pages, insurance coverage forms, definitions, conditions, limitations, and exclusions.

Declarations pages outline the specifics of the insurance policy, including the name of the insurance company, the insured party, the period covered, and the policy coverage limits. Insurance coverage forms provide detailed information about the coverage granted, while definitions clarify key terms used throughout the policy. Conditions establish the contractual "ground rules" and describe the responsibilities and obligations of both the insured and the insurance company. Limitations define the boundaries of coverage to remove ambiguity regarding the scope of protection. Finally, exclusions specify the types of losses that are not covered by a particular coverage form.

Auto Insurer: Your Attorney?

You may want to see also

CMP insurance covers a variety of potential losses incurred from numerous causes

CMP stands for "Commercial Multiple Peril". A CMP policy packages two or more insurance coverages together to protect an organization from various property and liability exposures. CMP insurance covers a variety of potential losses incurred from numerous causes.

CMP insurance is a popular form of commercial package insurance in the US property and casualty insurance market. It is typically sold by property and casualty insurers to businesses of various types. CMP policies combine several property and general liability insurance policies into a single one, covering multiple hazards. This type of insurance is often available at a discount compared to multiple separate policies.

There are several important components to a CMP insurance policy. These include declarations pages, which outline the specifics of the policy, such as the name of the insurance company, the insured party, the period the policy covers, and the policy coverage limits. Insurance coverage forms contain details of the coverage granted, while definitions explain key terms used throughout the policy. Conditions establish the contractual "ground rules" and describe the responsibilities and obligations of both the insured party and the insurance company. Limitations establish the boundaries of coverage and help to remove ambiguity regarding the breadth or scope of coverage, while exclusions describe the types of losses that are not covered by a particular coverage form.

CMP insurance policies can include a wide range of coverages that apply to various business types. These include business and personal property, equipment breakdown protection, business income and extra expense coverage, employee theft and forgery, liquor liability, hired and non-owned auto liability, and professional liability for specific industries such as barber shops, hair salons, and pharmacies.

Understanding Comprehensive Auto Insurance Coverage: What's Included?

You may want to see also

CMP insurance bundles several property and general liability insurance policies into one

Commercial Multiple Peril (CMP) insurance is a policy that offers at least two forms of commercial insurance coverage, bundling several property and general liability insurance policies into one. This type of policy is designed to cover a variety of potential losses resulting from multiple causes.

CMP insurance is a convenient way to protect a full spectrum of risks, as it consolidates all essential coverages into a single package. It is often available at a discount compared to purchasing multiple separate policies. CMP insurance is the most popular type of commercial package insurance policy in the US property and casualty insurance market.

Some of the types of coverage offered by CMP insurance include business crime, business automobile, boiler and machinery, marine and farm, flood damage, wind damage, and general liability. It can also include equipment breakdown protection coverage, business income and extra expense coverage, and employee theft and forgery coverage.

A popular form of CMP insurance is Multiple-Peril Crop Insurance (MPCI), used by farmers and ranchers to protect against incidents that may lead to a loss of crops. MPCI covers loss of crop yields from drought, flood, excessive moisture, and other natural causes. It also provides peace of mind for farmers in case of natural disasters and acts as a credit enhancement for agricultural loans.

Breaking Down the Road to Becoming an Auto Insurance Appraiser

You may want to see also

CMP insurance is often available at a discount compared to multiple separate policies

CMP stands for "Commercial Multiple Peril". A CMP policy combines two or more insurance coverages to protect an organisation from various property and liability exposures. It is a convenient all-in-one package for the insured, encompassing a variety of potential losses incurred from numerous causes.

The specific components of a CMP policy will depend on the organisation's needs and the insurance provider. However, every insurance policy, including CMP policies, typically contains several important components, including declarations pages, insurance coverage forms, definitions, conditions, limitations, and exclusions.

Declarations pages outline the specifics of the insurance policy, such as the name of the insurance company, the name of the insured party, the period that the policy covers, and the policy coverage limits. Insurance coverage forms contain details of the coverage granted, while definitions explain key terms used throughout the policy. Conditions establish the contractual "ground rules" and describe the responsibilities and obligations of both the insured and the insurance company. Limitations establish the boundaries of coverage and help remove ambiguity regarding the breadth or scope of coverage, while exclusions describe the types of losses that a particular coverage form does not cover.

Doc Auto Insurance: Comprehensive Coverage for Your Vehicle

You may want to see also

Frequently asked questions

CMP stands for "Commercial Multiple Peril".

A CMP auto insurance policy covers two or more insurance coverages to protect an organization from various property and liability exposures. This includes business crime, business automobile, boiler and machinery, and general liability.

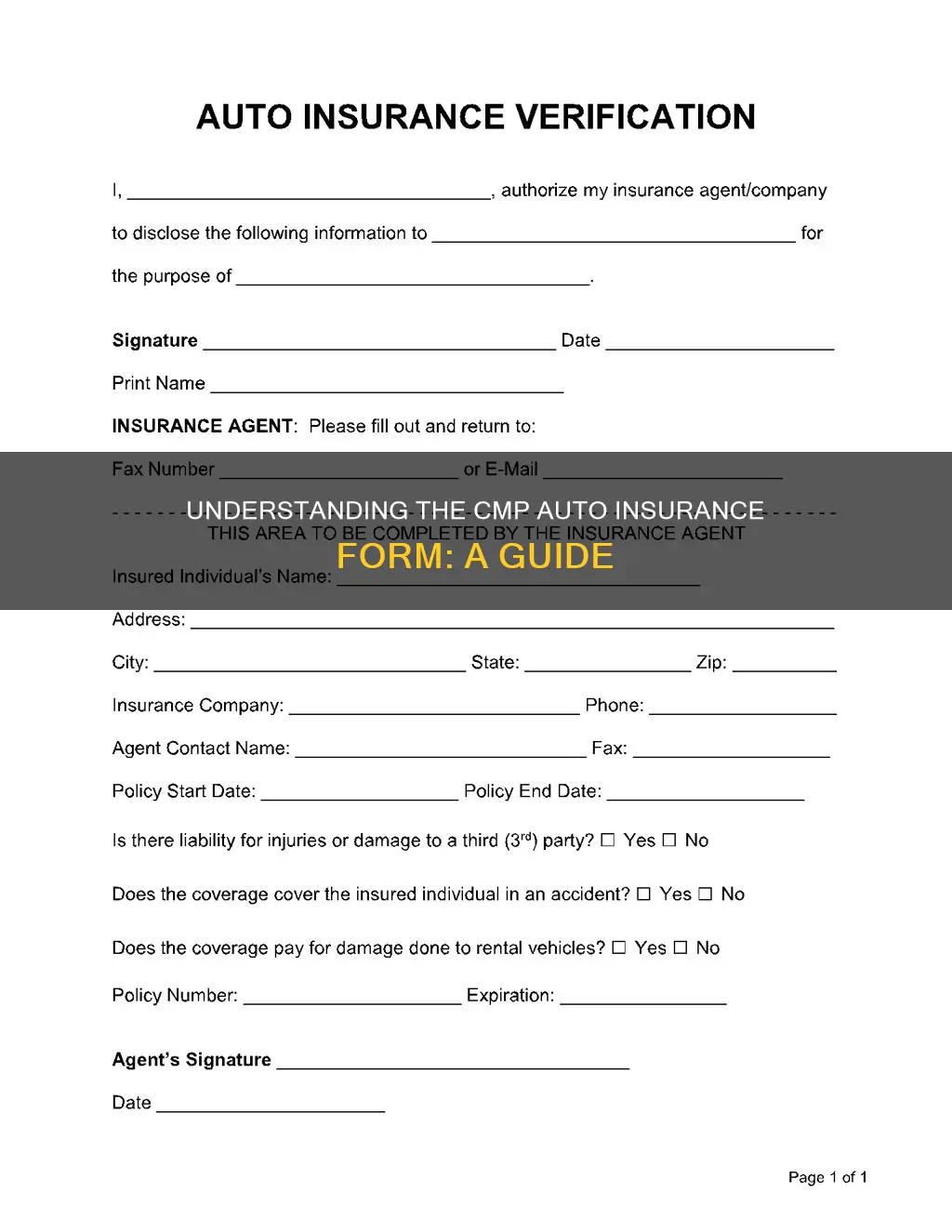

A CMP auto insurance form includes declarations pages, insurance coverage forms, definitions, conditions, limitations, and exclusions.

Commercial Multiple Peril policies are available from property and casualty insurers to businesses of various types.