Life insurance brokers in New Jersey play a crucial role in helping individuals and families secure financial protection for their loved ones. One of the key aspects of this profession is understanding the commission structure that brokers work with. The life insurance broker commission in New Jersey is a fee-based system where brokers earn a percentage of the premium paid by the policyholder for each new policy sold. This commission is typically a percentage of the annual premium and can vary depending on the type of policy, the insurance company, and the broker's experience and reputation. Understanding these commissions is essential for both brokers and clients to ensure transparency and fair compensation in the life insurance industry.

What You'll Learn

- Commission Structure: How are commissions calculated for insurance brokers in New Jersey

- Regulations: What are the state regulations regarding insurance broker commissions

- Commission Rates: What are the average commission rates for life insurance brokers in NJ

- Compensation Methods: How do brokers in New Jersey get compensated

- Commission Disclosures: Are there any legal requirements for disclosing commissions to clients

Commission Structure: How are commissions calculated for insurance brokers in New Jersey?

The commission structure for insurance brokers in New Jersey, particularly in the life insurance sector, is a critical aspect for both brokers and clients. Understanding how commissions are calculated is essential for anyone looking to navigate the insurance market in this state. Here's a detailed breakdown of the commission structure:

Commission Calculation Methods:

In New Jersey, life insurance brokers typically earn commissions based on a percentage of the premium paid by the policyholder. This commission structure is standard across the industry and is regulated by the state's insurance department. The commission rate can vary depending on the insurance company, the type of policy, and the broker's agreement with the carrier. For instance, a broker might earn a 5% commission on the first year's premium for a term life insurance policy. This commission is usually paid in installments over the policy's duration, ensuring a steady income for the broker.

Factors Influencing Commission Rates:

Several factors can impact the commission rates offered by insurance companies to brokers. Firstly, the type of insurance policy plays a significant role. Term life insurance, for instance, often has higher commission rates compared to permanent life insurance policies. Additionally, the broker's experience, reputation, and the volume of policies they sell can influence the commission structure. Established brokers with a strong client base may negotiate higher commission rates with insurance carriers.

Commission Structure for Different Policies:

New Jersey's insurance market offers various life insurance products, each with its own commission structure. For instance, term life insurance, which provides coverage for a specified period, typically has higher upfront commissions. These commissions are designed to incentivize brokers to sell policies with longer terms, as they provide a more stable income stream. On the other hand, permanent life insurance, such as whole life or universal life, may have lower initial commissions but offer ongoing commissions and potential bonuses over time.

Regulations and Disclosures:

It is crucial for both brokers and clients to be aware of the regulations governing commissions in New Jersey. The state's insurance department requires brokers to provide clients with detailed disclosures, including commission information. This ensures transparency and allows clients to understand the costs associated with the insurance policies they purchase. Brokers must adhere to these regulations to maintain their professional integrity and build trust with their clients.

Understanding the commission structure is vital for insurance brokers in New Jersey to effectively manage their business and provide value to their clients. By offering transparent and detailed information, brokers can build long-lasting relationships with policyholders, ensuring a sustainable and successful career in the insurance industry.

Life Flight Insurance: Worth the Cost?

You may want to see also

Regulations: What are the state regulations regarding insurance broker commissions?

In New Jersey, the regulation of insurance broker commissions is primarily governed by the New Jersey Department of Banking and Insurance. The state has implemented specific guidelines to ensure fair and transparent practices within the insurance industry. One of the key regulations is the prohibition of kickbacks and undisclosed commissions. Insurance brokers are required to disclose any commissions or compensation received from insurance companies to their clients, ensuring transparency in the process. This regulation aims to protect consumers by providing them with a clear understanding of the costs associated with their insurance policies.

The state also mandates that insurance brokers must provide a detailed breakdown of the commission structure to their clients. This includes information about the percentage or amount of the commission earned on various insurance products. By doing so, New Jersey ensures that consumers are well-informed about the fees involved, allowing them to make more informed decisions when choosing insurance coverage.

Additionally, New Jersey has established guidelines for the payment of commissions to insurance brokers. The regulations specify that commissions should be paid directly to the broker or their designated entity, ensuring that the funds reach the intended recipient. This practice helps prevent any potential conflicts of interest and promotes ethical standards within the industry.

Furthermore, the state has implemented rules regarding the timing and frequency of commission payments. Brokers are required to receive regular updates on commission earnings and must be provided with accurate and timely information about their compensation. This regulation ensures that brokers are aware of their earnings and can manage their finances effectively.

These regulations aim to foster a competitive and ethical insurance market in New Jersey. By setting clear guidelines for commission disclosure, payment, and management, the state empowers consumers to make informed choices and promotes fair practices among insurance brokers and companies. It is essential for insurance professionals to stay updated with these regulations to ensure compliance and maintain a positive reputation in the industry.

Selling Life Insurance: Strategies for Success

You may want to see also

Commission Rates: What are the average commission rates for life insurance brokers in NJ?

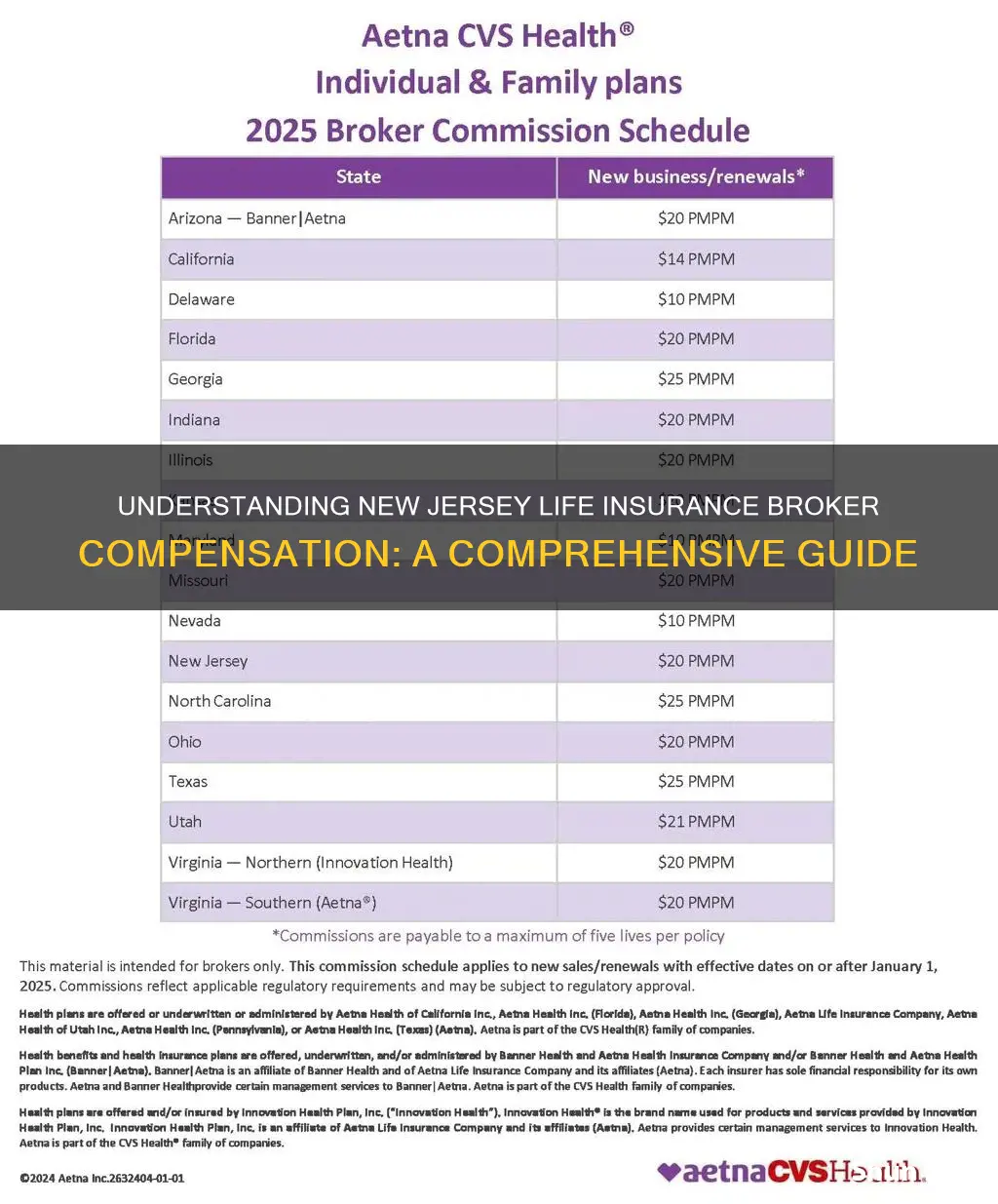

The commission structure for life insurance brokers in New Jersey can vary depending on several factors, including the type of insurance, the carrier, and the broker's experience. However, understanding the average commission rates can provide a general idea of the financial incentives for these professionals.

In New Jersey, life insurance brokers typically earn commissions based on the premiums collected from the insurance policies they sell. The commission rates can range from 5% to 15% or even higher, depending on the specific policy and the insurance company. For instance, a broker might earn a 10% commission on a term life insurance policy with a 10-year term and a $50,000 coverage amount. This commission would be calculated on the annual premium paid by the policyholder.

It's important to note that commission rates can vary significantly between different insurance carriers. Some companies may offer higher commissions to brokers to encourage sales, while others might have lower rates but provide other incentives, such as bonuses or residual income. Additionally, the broker's experience and the complexity of the policy can also influence the commission structure. More experienced brokers might negotiate higher commission rates, especially for high-value policies.

To give you a more concrete example, let's consider a scenario. Suppose a life insurance broker in New Jersey sells a whole life insurance policy with a $200,000 coverage amount. If the annual premium is $2,000, the broker could potentially earn a commission of around 10% on that premium, which amounts to $200 per year. Over the policy's lifetime, this commission could accumulate to a substantial figure, especially if the broker has a high volume of sales.

Understanding these commission rates is essential for both life insurance brokers and consumers. Brokers need to be aware of their potential earnings and the factors that influence commission structures, while consumers can use this information to compare quotes and understand the costs associated with different insurance policies.

Term vs Universal Life Insurance: Key Differences Explained

You may want to see also

Compensation Methods: How do brokers in New Jersey get compensated?

In New Jersey, life insurance brokers play a crucial role in helping individuals and families secure appropriate coverage. When it comes to compensation, brokers in this state have a few different methods to earn their income. Understanding these compensation structures is essential for both brokers and clients to ensure transparency and fair practices.

One common approach is through commissions. Brokers typically earn a commission based on the premiums collected from the insurance policies they sell. This commission rate can vary depending on the insurance company and the type of policy. For instance, a broker might receive a percentage of the annual premium for each policy they place, which could range from 2% to 5% or more. This commission-based structure incentivizes brokers to promote policies with higher premiums, as they earn more from those sales.

Another compensation method is through a combination of commission and a flat fee. Some brokers in New Jersey might charge a one-time flat fee for their services, which is agreed upon before the policy is purchased. This fee is in addition to the commission earned from the insurance company. This model allows brokers to provide additional value, such as policy analysis, comparison shopping, and ongoing support, for a more comprehensive service.

Additionally, brokers may also receive compensation through a process known as "contingency." This involves earning a commission based on the total amount of premiums collected over a specific period, often a year. The contingency commission is a percentage of the total premiums, and it encourages brokers to focus on long-term client relationships and policy retention. This method aligns the broker's interests with the client's needs, ensuring a more personalized and sustainable approach to insurance brokerage.

It's important to note that New Jersey's insurance regulations require brokers to provide transparent information about their compensation methods to clients. This ensures that individuals are aware of how their brokers are paid, allowing for informed decision-making when choosing an insurance policy. Understanding these compensation structures can help clients recognize and value the services provided by brokers, fostering a more trusting and productive relationship between the two parties.

Understanding Life Insurance: The Accord Format Explained

You may want to see also

Commission Disclosures: Are there any legal requirements for disclosing commissions to clients?

In the context of life insurance brokerage, New Jersey, like many other states, has specific regulations in place to ensure transparency and protect consumers. One crucial aspect of this transparency is the disclosure of commissions to clients. The question of whether there are legal requirements for disclosing commissions is an important one for both brokers and clients.

The answer is yes; there are legal requirements and industry standards that mandate the disclosure of commissions to clients in New Jersey. These regulations are designed to provide clients with clear and comprehensive information about the costs associated with purchasing life insurance. The primary goal is to ensure that clients are fully informed and can make decisions based on complete knowledge of the financial implications.

The New Jersey Department of Banking and Insurance has established guidelines that require life insurance brokers to provide clients with a detailed breakdown of the various fees and commissions involved in the insurance process. This disclosure must be presented in a clear and understandable manner, ensuring that clients are not misled or misinformed about the costs. The information should include the specific amount of the commission, the basis for its calculation, and any other relevant fees associated with the insurance policy.

Brokers are typically required to provide this disclosure at various stages of the insurance process. For instance, when presenting the policy options to the client, the broker must clearly outline the commission structure and its impact on the overall cost. Additionally, the disclosure should be provided in writing, allowing clients to review and understand the terms at their convenience. This written disclosure serves as a record of the agreement and ensures that both parties are aware of their respective responsibilities.

Compliance with these legal requirements is essential for life insurance brokers to maintain their credibility and ensure a positive relationship with their clients. By providing transparent commission disclosures, brokers can build trust and demonstrate their commitment to ethical business practices. Clients, in turn, can make more informed decisions, knowing exactly how much they are paying in commissions and how it affects the final policy premium.

Carrier Life Insurance: Common Carrier Policy Benefits

You may want to see also

Frequently asked questions

Life insurance brokers in New Jersey are typically paid a commission based on the premiums collected from the insurance policies they sell. This commission structure is common in the insurance industry and can vary depending on the specific insurance company and the type of policy.

The commission rate can vary widely, but it often ranges from 5% to 10% of the annual premium. For example, if a life insurance policy has an annual premium of $1000, the broker might earn a commission of $50 to $100 per year.

No, the commission structure can differ between brokers and insurance companies. Some companies may offer higher commissions to incentivize brokers, while others might have lower rates but provide additional benefits or incentives for long-term business relationships.

Yes, the state of New Jersey has regulations in place to ensure transparency and fair practices in the insurance industry. Brokers must adhere to these regulations, which may include disclosing commission structures to clients and providing accurate information about policy costs and benefits.

Yes, in addition to the initial commission, brokers may be eligible for bonuses, overrides, or residual commissions. These additional earnings can be based on factors such as the number of policies sold, the duration of the policy, or the total premium volume.