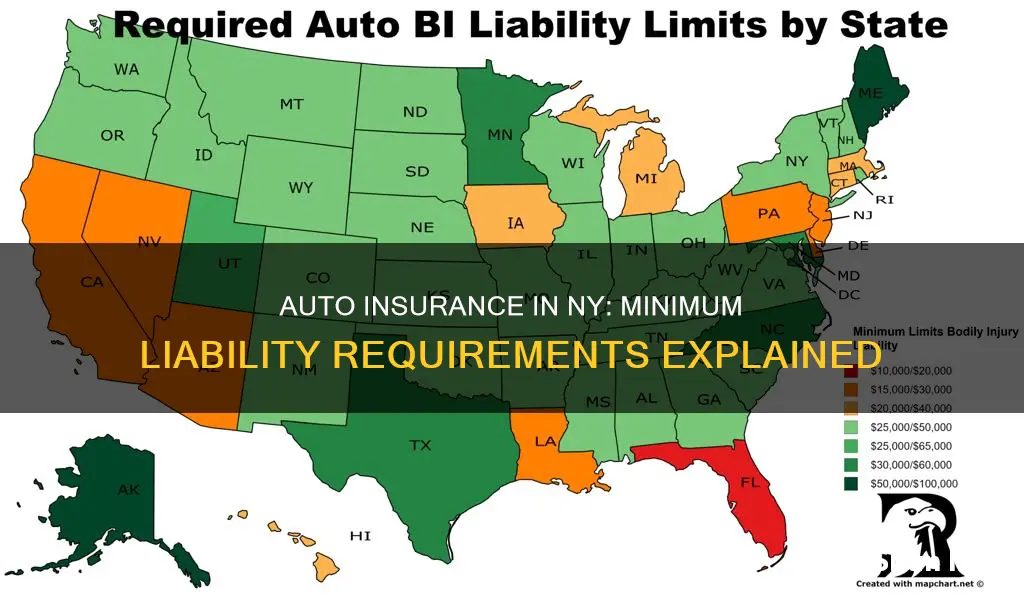

In New York, drivers must carry minimum auto liability insurance to operate a vehicle legally. These requirements safeguard against potential financial losses from accidents. The minimum amounts of car insurance coverage required are: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident, $25,000 uninsured motorist bodily injury per person, $50,000 uninsured motorist bodily injury per accident, $50,000 personal injury protection per person, $50,000 death liability per person, and $100,000 death liability per accident.

| Characteristics | Values |

|---|---|

| Bodily injury liability per person | $25,000 |

| Bodily injury liability per accident | $50,000 |

| Property damage liability per accident | $10,000 |

| Uninsured motorist bodily injury per person | $25,000 |

| Uninsured motorist bodily injury per accident | $50,000 |

| Personal injury protection per person | $50,000 |

| Death liability per person | $50,000 |

| Death liability per accident | $100,000 |

What You'll Learn

No-Fault (Personal Injury Protection)

Basic No-Fault auto insurance coverage in New York includes a $2,000 death benefit, payable to the estate of a person eligible for No-Fault benefits who dies in a motor vehicle accident, in addition to the $50,000 basic No-Fault limit.

Under No-Fault insurance, your insurer provides you and all relatives living in your household with protection against economic losses arising from injuries sustained in motor vehicle accidents anywhere within the United States, its territories and possessions, or Canada. It also covers any passengers injured in accidents in New York State while in your vehicle, as well as any guest passengers who are New York State residents injured in your vehicle anywhere in the United States, its territories and possessions, or Canada, if they are not covered under another auto insurance policy in New York State. All pedestrians injured by motor vehicles in New York State are also protected by No-Fault insurance.

A person will be ineligible for No-Fault benefits if they were injured while driving while intoxicated or impaired by drugs, intentionally causing their own injuries, riding an ATV or motorcycle (unless they were a pedestrian struck by a motorcycle or ATV), injured while committing a felony, injured while in a vehicle known to be stolen, or if they are the owner of an uninsured vehicle.

Auto Insurance Laws: Understanding PA State Requirements

You may want to see also

Liability

Minimum Liability Coverage in New York:

The minimum liability insurance requirements in New York State are as follows:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident. This coverage protects against legal liability for accidental injury or death of others (excluding passengers) caused by the operation of your car.

- Death Liability: $50,000 per person and $100,000 per accident.

- Property Damage Liability: $10,000 per accident. This coverage is for any damage caused to another person's property, typically their vehicle.

These minimum liability limits in New York are often referred to as "25/50/10" or ""$25,000/$50,000/$10,000." It's important to note that these are the minimum requirements, and purchasing higher liability limits can provide added protection.

Understanding Liability Insurance:

In New York, liability insurance is mandatory for all registered vehicles. Failure to maintain the required liability insurance can result in suspension of your vehicle registration and driver's license by the DMV.

No-Fault Insurance and Liability:

It is important to distinguish between no-fault insurance (Personal Injury Protection, or PIP) and liability insurance. While no-fault insurance covers your own medical expenses and those of your passengers, regardless of who is at fault in an accident, liability insurance covers the expenses of the other party involved in the accident if you are at fault.

Optional Add-On Coverages:

While the minimum liability coverage is a legal requirement in New York, it is recommended to consider additional coverages to enhance your protection. Optional add-ons include:

- Collision Coverage: Covers the cost of repairing or replacing your car after a collision with another vehicle or object.

- Comprehensive Coverage: Protects your car from damage not related to a collision, such as natural disasters, fires, vandalism, and more.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you are in an accident with a driver who does not have insurance or has insufficient coverage.

Choosing the Right Liability Coverage:

When deciding on the appropriate liability coverage, it is essential to consider your unique circumstances and financial situation. Evaluate aspects such as the value of your car, your ability to cover medical expenses, and your comfort level with potential out-of-pocket costs in the event of an accident.

In summary, liability insurance is a vital component of auto insurance in New York, providing financial protection in case you cause harm to others or their property. By understanding the minimum requirements and optional add-ons, you can make informed decisions about the level of liability coverage that best suits your needs.

Auto Insurance Requirements: Understanding the Two Laws

You may want to see also

Uninsured Motorists

In the state of New York, drivers are required to have uninsured motorist coverage as part of their auto insurance policy. This coverage protects the policyholder, their family members, and any passengers in their vehicle in the event of an accident with an uninsured or hit-and-run driver. Uninsured motorist coverage provides bodily injury protection and helps cover the cost of medical expenses, lost earnings, and other reasonable and necessary expenses resulting from the accident.

The minimum limit for uninsured motorist coverage in New York is $25,000 per person and $50,000 per accident. This means that if you are involved in an accident with an uninsured or hit-and-run driver, your insurance policy will provide up to $25,000 of coverage per person injured in the accident, and up to a total of $50,000 for all injuries resulting from the accident.

It is important to note that uninsured motorist coverage only applies to bodily injuries and does not cover physical damage to your vehicle. If you want to protect your vehicle from damage caused by an uninsured or hit-and-run driver, you will need to purchase additional coverage, such as collision coverage.

In addition to the mandatory uninsured motorist coverage, New York drivers also have the option to purchase Supplementary Uninsured/Underinsured Motorist (SUM) coverage. SUM coverage provides protection beyond the basic uninsured motorist coverage and includes injuries caused by underinsured drivers. An underinsured driver is someone who has liability insurance but their coverage limits are not sufficient to cover the injuries they cause. SUM coverage also provides protection outside of New York State, covering you and your family anywhere in the United States, its territories, and Canada.

To register a vehicle in New York State, it is mandatory to have automobile liability insurance coverage issued by a company licensed by the New York State Department of Financial Services and certified by the New York State DMV. Failure to maintain the required insurance coverage can result in the suspension of your vehicle registration and driver's license, as well as monetary penalties.

Vehicle Insurance: Am I Overpaying?

You may want to see also

Bodily Injury Liability

In New York, Bodily Injury Liability coverage is a requirement for all drivers. This type of insurance coverage protects you (and anyone driving your car with your permission) if a claim is made against you by another person (a "third party") alleging that you were negligent or at fault for an accident that resulted in serious injury or death.

The minimum amount of Bodily Injury Liability coverage required by law in New York is $25,000 per person and $50,000 per accident. This means that if you are found to be at fault for an accident, your insurance company will pay up to $25,000 for bodily injuries to one person and up to $50,000 total if two or more people are injured in the same accident.

It is important to note that these minimum limits may not be sufficient to cover all potential costs associated with an accident. If the damages exceed your policy limits, you may be personally liable for any additional costs. As such, it is generally recommended that individuals purchase more than the minimum required coverage if they can afford to do so.

In addition to Bodily Injury Liability coverage, New York also requires drivers to have Property Damage Liability coverage of at least $10,000 per accident, as well as Personal Injury Protection (PIP) and Uninsured Motorist Bodily Injury (UMBI) coverage.

Best Auto Insurance: Is It Worth the Hype?

You may want to see also

Property Damage Liability

In the state of New York, drivers are required to carry a minimum of $10,000 in property damage liability coverage per accident. This means that if you, a household member, or another authorized driver cause an accident, your insurance will cover the damage to another person's property, typically their vehicle, up to $10,000. This coverage is essential to protect yourself financially in the event of an accident, as it can help cover the costs of repairs or replacements for the other person's property.

In New York, the minimum property damage liability coverage required by law is $10,000 per accident. This means that if you cause an accident and damage someone else's property, your insurance company will pay up to $10,000 to repair or replace that property. It is worth noting that this coverage only applies to property damage, not bodily injury. For bodily injury coverage, separate liability insurance is required, with minimum limits of $25,000 per person and $50,000 per accident in New York.

While the minimum property damage liability coverage in New York is $10,000, it is important to consider your individual needs and circumstances when deciding on the appropriate amount of coverage. If you are involved in an accident and the property damage exceeds your coverage limit, you may be personally responsible for paying the remaining costs out of pocket. Therefore, it may be wise to consider increasing your coverage limit to provide more financial protection in the event of a more severe accident.

In addition to property damage liability coverage, there are other types of auto insurance that New York drivers are required to carry. These include bodily injury liability coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP). Understanding the different types of coverage and their respective limits is crucial to ensure you are adequately protected in the event of an accident.

Switching Auto Insurance: The Art of a Smooth Transition

You may want to see also

Frequently asked questions

The minimum liability insurance coverage for most vehicles in New York is $10,000 for property damage for a single accident, $25,000 for bodily injury and $50,000 for death for a person involved in an accident, and $50,000 for bodily injury and $100,000 for death for two or more people in an accident.

In New York, the minimum auto liability insurance required is $25,000 per person and $50,000 per accident for bodily injury liability, $10,000 for property damage liability, and $50,000 in Personal Injury Protection (PIP) per person. Uninsured/underinsured motorist coverage is also mandated at $25,000 per person and $50,000 per accident.

To register a vehicle in New York, you must have New York State-issued automobile liability insurance coverage. The minimum liability insurance coverage for most vehicles is $10,000 for property damage for a single accident, $25,000 for bodily injury and $50,000 for death for a person involved in an accident, and $50,000 for bodily injury and $100,000 for death for two or more people in an accident.

Unlike most other motor vehicles, motorcycles are registered for one year and all motorcycle registrations expire on April 30. You are not required to surrender your plate if you terminate your motorcycle liability insurance, but under no circumstances may your motorcycle operate on public highways without liability coverage in effect.