Life insurance is a financial tool that provides a safety net for individuals and their families. Its primary personal use is to offer financial protection and peace of mind in the event of the insured's death. The primary personal use of life insurance is to ensure that the insured's loved ones are financially secure and can maintain their standard of living in the event of the insured's untimely passing. This can include covering funeral expenses, paying off debts, providing for children's education, and replacing lost income for the family. It is a way to protect one's family and loved ones from the financial burden that could arise from the insured's death.

What You'll Learn

- Financial Security: Life insurance provides financial protection for beneficiaries in the event of the insured's death

- Debt Management: It helps cover debts and expenses, ensuring a stable financial future for loved ones

- Income Replacement: Policies offer a regular income stream to replace lost wages and maintain lifestyle

- Mortgage Protection: Life insurance can pay off mortgages, preventing foreclosure and providing peace of mind

- Education Funding: Policies can be used to fund children's education, ensuring their financial security

Financial Security: Life insurance provides financial protection for beneficiaries in the event of the insured's death

Life insurance is a financial tool that offers a crucial safety net for individuals and their loved ones. Its primary personal use is to provide financial security and peace of mind during challenging times. When someone purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit upon the occurrence of a specific event—the insured's death. This contract is a promise that, should the insured pass away, the insurance company will pay out a predetermined sum to the designated beneficiaries.

The financial protection offered by life insurance is particularly valuable for several reasons. Firstly, it ensures that the family's essential expenses are covered in the event of the primary breadwinner's death. This includes mortgage or rent payments, utility bills, and other regular outgoings. By providing a lump sum or regular income to the beneficiaries, life insurance prevents the financial strain that could otherwise lead to significant debt or the loss of essential amenities.

Secondly, life insurance can be a powerful tool for long-term financial planning. It allows individuals to secure their family's future by providing funds for education, starting a business, or covering future expenses. For example, a parent might take out a life insurance policy to ensure their children's college fees are covered, or a small business owner might use it to protect their enterprise from the financial impact of their untimely death.

Moreover, life insurance can also be a strategic asset for estate planning. It enables individuals to leave a financial legacy, ensuring that their beneficiaries receive a substantial sum that can be used to maintain their standard of living, invest in new opportunities, or simply provide financial security. This aspect of life insurance is especially important for those with dependents, as it guarantees that their loved ones will be cared for even if they are no longer around.

In summary, the primary personal use of life insurance is to offer financial security and protection to beneficiaries when the insured individual passes away. It provides a safety net, covering essential expenses and ensuring the well-being of dependents. Additionally, it facilitates long-term financial planning and estate management, allowing individuals to leave a lasting financial impact on their loved ones. Understanding the value of life insurance is the first step towards making informed decisions about one's financial future and the future of those who depend on them.

BGA's Role in Life Insurance Explained

You may want to see also

Debt Management: It helps cover debts and expenses, ensuring a stable financial future for loved ones

Life insurance is a financial tool that provides a safety net for individuals and their families, offering peace of mind and financial security. While it is often associated with providing for loved ones in the event of an untimely death, one of its primary personal uses is debt management. This aspect of life insurance is crucial for those who want to ensure a stable financial future for their families and themselves.

When an individual takes out life insurance, they essentially enter into a contract with an insurance company. In this contract, the individual agrees to pay regular premiums in exchange for a death benefit, which is a lump sum of money paid out upon their passing. This death benefit can be a powerful tool for debt management. Here's how:

Debt Coverage: Life insurance can be used to cover various debts and expenses. This includes mortgage payments, which are often a significant financial burden for many families. By having a life insurance policy with a substantial death benefit, the policyholder can ensure that their mortgage is paid off in full, preventing the family from facing financial strain due to housing costs. Similarly, it can cover car loans, personal loans, and even credit card debt, providing a comprehensive solution for debt management.

Ensuring Stability: The primary personal use of life insurance in debt management is to provide financial stability for the family. When an individual passes away, the death benefit can be used to cover immediate expenses, such as funeral costs and outstanding bills. This ensures that the family is not burdened with unexpected financial obligations during a difficult time. Moreover, it can be used to create a financial cushion, allowing the surviving family members to maintain their standard of living and cover essential expenses without going into debt themselves.

Long-Term Financial Planning: Life insurance can also be a part of a long-term financial strategy. By regularly reviewing and adjusting life insurance policies, individuals can ensure that the death benefit keeps pace with the rising cost of living and any increasing debts. This proactive approach to debt management can help individuals stay on top of their financial obligations and provide a sense of security, knowing that their loved ones will be financially protected.

In summary, life insurance is a versatile financial tool that goes beyond providing for loved ones in the event of death. It plays a crucial role in debt management, helping individuals cover various debts and expenses, ensuring a stable financial future for their families. By utilizing life insurance effectively, people can navigate financial challenges and provide a safety net for their loved ones, even in their absence.

Approaching Prospects for Life Insurance: A Guide to Success

You may want to see also

Income Replacement: Policies offer a regular income stream to replace lost wages and maintain lifestyle

The primary personal use of life insurance is often to provide financial security and peace of mind for individuals and their families. One of the key benefits of life insurance is its ability to offer a regular income stream, which can be a crucial aspect of financial planning. This feature is particularly important when considering the potential loss of income due to unforeseen circumstances.

Income replacement is a fundamental concept in life insurance, especially for those with dependents or financial obligations. When an individual purchases a life insurance policy, they essentially create a financial safety net for their loved ones. The policy's death benefit, which is the amount paid out upon the insured's passing, can be structured to provide a steady income for the beneficiaries. This income stream can help cover various expenses, such as mortgage payments, living costs, education fees, or even daily household expenses, ensuring that the family's standard of living is maintained even if the primary breadwinner is no longer present.

For example, consider a scenario where a family's primary income earner has a high salary and contributes significantly to the household finances. If an unexpected event leads to their untimely demise, the family's financial stability could be severely impacted. However, with a life insurance policy in place, the beneficiaries can receive regular payments that mirror the lost wages. This financial support can help the family adapt to their new circumstances, ensuring that they can continue to meet their financial commitments and maintain their desired lifestyle.

The income replacement aspect of life insurance policies is particularly valuable for those with long-term financial goals. It allows individuals to plan for the future, knowing that their loved ones will have a consistent financial source. This can include funding education expenses for children, saving for retirement, or even starting a business venture. By providing a steady income, life insurance ensures that the family's financial objectives remain on track, even in the absence of the primary earner.

In summary, income replacement is a critical feature of life insurance policies, offering a practical solution to the financial challenges that arise from the loss of a primary income earner. It empowers individuals to take control of their family's financial future, providing the necessary support to maintain a comfortable lifestyle and achieve long-term financial goals. Understanding this aspect of life insurance is essential for anyone seeking to secure their family's financial well-being.

Understanding Life Insurance: Death Benefits Explained

You may want to see also

Mortgage Protection: Life insurance can pay off mortgages, preventing foreclosure and providing peace of mind

Life insurance is a financial tool that provides a safety net for individuals and their families, offering a range of benefits that can be particularly valuable in the context of mortgage protection. When it comes to the primary personal use of life insurance, mortgage protection stands out as a critical aspect. This type of insurance is designed to safeguard homeowners from the financial burden of their mortgage in the event of their death.

Mortgage protection life insurance is a specialized policy that ensures the outstanding balance of a mortgage is paid off if the insured individual passes away. This is especially important for those with substantial mortgages, as the loss of income due to death can quickly lead to financial strain and, in extreme cases, foreclosure. By having this insurance, individuals can ensure that their loved ones are protected from the potential loss of their home, which can be a devastating consequence of a sudden death. The policy typically pays out a lump sum or regular payments to the mortgage lender, allowing the mortgage to be settled and preventing the sale of the property.

The peace of mind that comes with knowing your mortgage is protected is invaluable. It allows individuals to focus on their daily lives, careers, and relationships without constantly worrying about the financial implications of their passing. This type of insurance provides a sense of security, knowing that your family's home is secure and that the financial responsibilities associated with it are covered. It is a practical way to ensure that your loved ones are not burdened with unexpected expenses and can maintain their standard of living, even in the face of tragedy.

Furthermore, mortgage protection insurance can be tailored to individual needs. Policies can be adjusted to cover a specific percentage of the mortgage balance or to provide a lump sum payment that can be used to pay off the mortgage and any remaining debts. This flexibility ensures that the insurance is a precise fit for the policyholder's financial situation and goals.

In summary, mortgage protection is a primary and essential use of life insurance. It provides a safety net for homeowners, ensuring that their mortgages are paid off in the event of their death, thus preventing foreclosure and offering financial security for their families. This aspect of life insurance is a powerful tool for individuals to protect their most significant financial asset—their home.

Understanding Life Events: Impact on Health Insurance Coverage

You may want to see also

Education Funding: Policies can be used to fund children's education, ensuring their financial security

Life insurance is a financial tool that provides a safety net for individuals and their families, and it can be a primary personal use to ensure financial security and peace of mind. While the primary purpose of life insurance is often associated with providing financial protection in the event of the insured's death, it can also be utilized for various personal and long-term financial goals, such as education funding for children.

Education funding is a significant aspect of personal financial planning, as it ensures that children have the necessary resources to pursue their academic aspirations. Life insurance policies can be structured to include educational benefits, which can be a powerful tool for parents and guardians. By incorporating education funding into life insurance plans, individuals can create a dedicated financial stream for their children's future. This approach allows parents to set aside a portion of the insurance payout specifically for educational expenses, such as tuition fees, books, and other educational costs.

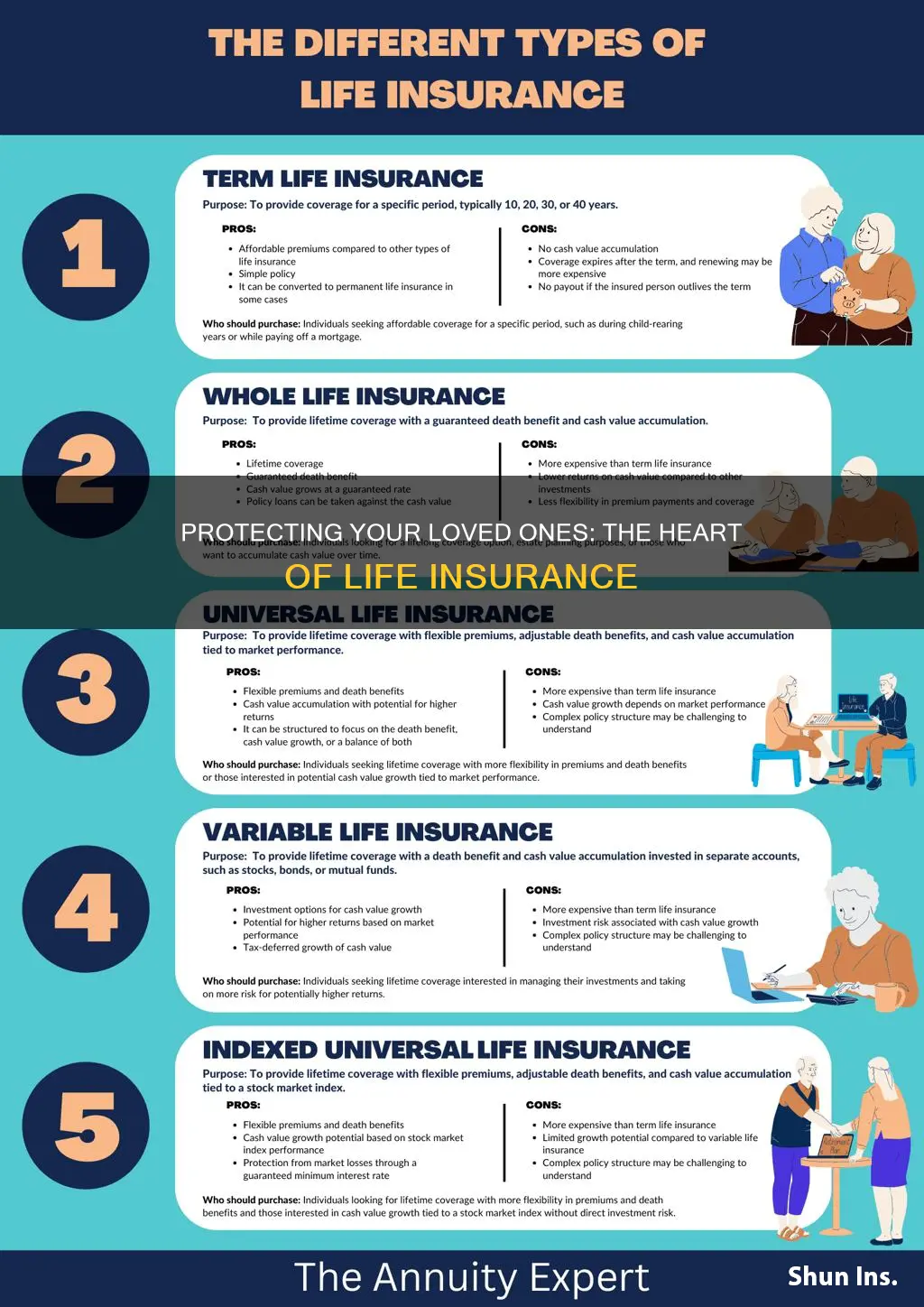

One way to achieve this is by utilizing a policy with a flexible payout structure. For instance, a term life insurance policy can be designed to include an education rider, which is an additional benefit that provides a lump sum or regular payments for educational purposes. This rider ensures that the insurance proceeds are directly allocated to the child's education, providing a secure financial foundation for their studies. Parents can also consider whole life insurance policies, which offer lifelong coverage and accumulate cash value over time, allowing for potential education funding through policy loans or withdrawals.

In addition to providing financial security, life insurance with education funding can offer other advantages. It allows parents to plan ahead and ensure that their children's educational goals are met, regardless of unforeseen circumstances. This proactive approach can alleviate the financial burden on the family and provide a sense of reassurance. Moreover, by incorporating education funding into life insurance, individuals can take advantage of potential tax benefits, as the proceeds may be tax-free or eligible for favorable tax treatment, depending on the jurisdiction.

In summary, life insurance can be a valuable tool for education funding, enabling parents to secure their children's financial future. By integrating education-focused benefits into life insurance policies, individuals can create a robust financial strategy that combines insurance protection with long-term savings. This approach ensures that children have the necessary financial support to pursue their education, fostering a secure and prosperous future.

Alpha Life Insurance: What's Covered and What's Not?

You may want to see also

Frequently asked questions

The primary personal use of life insurance is to provide financial protection and peace of mind for individuals and their loved ones. It ensures that in the event of the insured person's death, a financial benefit is paid out to designated beneficiaries, covering expenses such as funeral costs, outstanding debts, mortgage payments, or providing financial support to dependents.

Life insurance can significantly impact your family's financial well-being. It provides a financial safety net, ensuring that your loved ones have the resources to maintain their standard of living, cover daily expenses, and achieve their financial goals even if you are no longer there to provide directly.

No, life insurance offers more than just financial support. It can also be a valuable tool for estate planning, allowing you to pass on your assets to heirs according to your wishes. Additionally, some life insurance policies offer investment components, providing potential long-term growth and tax advantages.

Absolutely. Life insurance can be a powerful tool for debt management. The death benefit can be used to pay off debts like credit card balances, personal loans, or even large debts like student loans, ensuring that your loved ones are not burdened with financial obligations after your passing.

Life insurance can be a great way to secure your children's future. You can choose to have the proceeds of the policy dedicated to education funds, ensuring that your children have the financial means to pursue their desired education, even if you are no longer around to provide directly.