Underwriting is the process through which an insurance company evaluates its risk and profitability of offering a policy to someone. Underwriters are professionals who assess and analyse the risks involved in insuring people and assets. They establish pricing for accepted insurable risks. In the context of auto insurance, underwriters check factors including the applicant's driving record, age, gender, vehicle make and model, and safety features. They also consider personal data such as marital status and employment. This information helps underwriters determine the likelihood of claims and set the insurance premium accordingly.

| Characteristics | Values |

|---|---|

| Definition | The process through which an individual or institution takes on financial risk for a fee. |

| Origin of the term | The term "underwrite" originated in the 17th century when marine vessels would be underwritten for insurance risk for overseas voyages. |

| Who does it | Insurance underwriters are professionals who evaluate and analyze the risks involved in insuring people and assets. |

| What they do | Underwriters assess the degree of risk within a given business, and establish pricing for accepted insurable risks. |

| How they do it | Underwriters use specialized software and actuarial data to determine the likelihood and magnitude of a risk. |

| Types | There are three major types of underwriting: loans, insurance, and securities. |

| Factors considered | For auto insurance, underwriters consider factors such as age, vehicle usage, driving record, make and model of the vehicle, personal data, etc. |

| Impact on pricing | The more risk you present, the more you’ll pay for insurance. |

| Other functions | Underwriters also look for solutions to reduce the risk of future claims, and negotiate with agents or brokers to find ways to insure high-risk customers. |

| Legal limitations | State laws prohibit underwriting decisions based on race, income, education, marital status, or ethnicity. |

What You'll Learn

How do underwriters determine risk?

Underwriters determine the risk of insuring a driver and a vehicle. They assess the likelihood that a customer will make a claim that costs the insurance company money. They also determine how much to charge the customer to ensure the company makes a profit while offering competitive prices.

Underwriters use specialised software and actuarial data to determine the likelihood and magnitude of a risk. They review different variables depending on the type of insurance being applied for. For auto insurance, underwriters check factors including driving record, age, gender, vehicle make and model, safety features, marital status, and employment.

Underwriters also alter or restrict coverage using endorsements, a special insurance policy provision that overrides other policy information. They may also negotiate with insurance brokers or agents to add or remove certain policy coverage options.

In some cases, the "insurance underwriter" is just a software program. On standard auto insurance policies, most underwriting can be performed automatically with underwriting software. However, for other policies, a human underwriter might be involved.

Insurance Coverage Doubling: Is It Possible?

You may want to see also

What is the role of an underwriter?

An underwriter is a financial professional who assesses the financial risk of an insurance policy, security, or loan. They determine whether an institution should take on the risk and, if so, how much it should charge to ensure a profit.

Underwriters are trained professionals who understand risks and how to prevent them. They have a special knowledge of risk assessment and use skill and information to decide whether to insure something or someone and at what cost. They review information to find the risk and determine the kind of policy coverage the insurance company agrees to insure and under what conditions.

In the context of auto insurance, an underwriter evaluates a person's driving record, age, gender, vehicle make and model, and safety features to determine the cost of insurance. They also check personal data, including marital status and employment, as claims data shows that certain types of people have fewer claims than others. For example, unmarried people have more claims than married people, and job hoppers have more claims than those who stay with the same company for a long time.

Underwriters also work with agents or brokers to create policies that work for the customer without being too risky for the company. They may change coverage by endorsement or look for solutions to reduce the risk of future claims.

Windshield Woes: Understanding Auto Insurance Coverage for Free Replacement States

You may want to see also

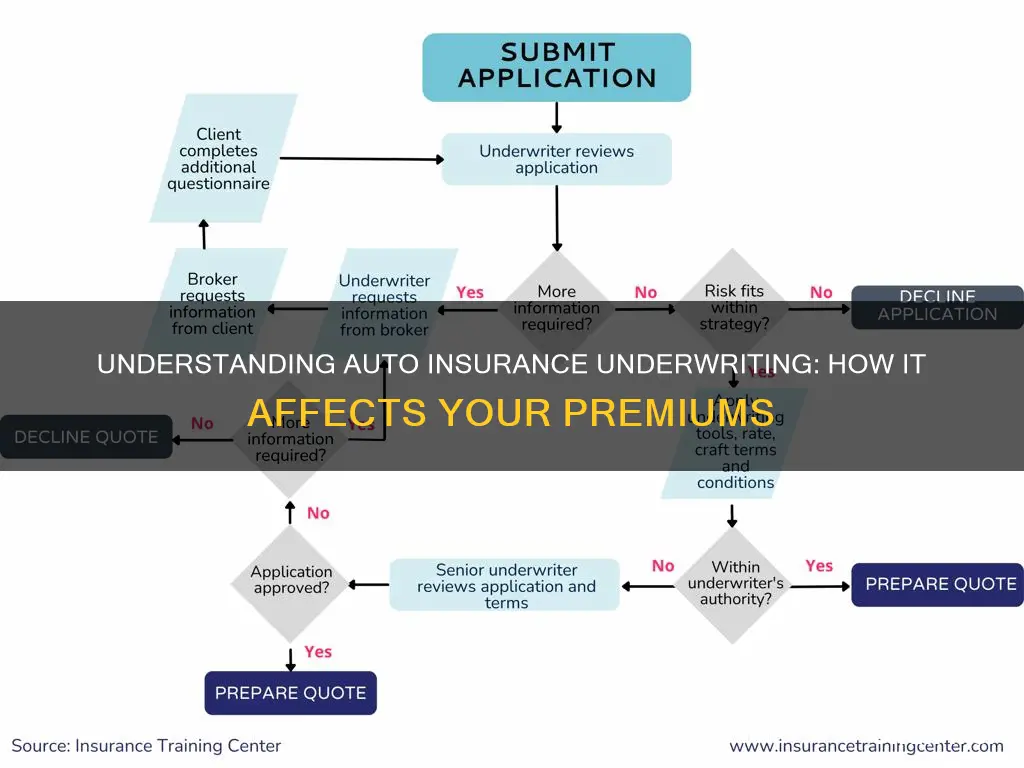

How does underwriting work?

Underwriting is the process by which insurance companies evaluate their risk in taking on a new client. It is a complex process that involves data, statistics, and guidelines provided by actuaries. Underwriters are trained professionals who understand risks and how to prevent them. They have special knowledge of risk assessment and use this skill to decide whether to insure someone and at what cost.

When you apply for car insurance, the insurance company will use underwriting to determine your coverage eligibility, the risk of insuring you, and how much you should pay for coverage. They will analyse the information you provide in your application, as well as information from other sources. Factors that may be considered include your age, vehicle usage, driving record, the make and model of your vehicle, and safety features.

Underwriters will also review information to identify risks and find solutions that might reduce the risk of future claims. For example, if a driver has made several glass claims on their car insurance policy, an underwriter may increase their deductible or offer limited coverage for that specific risk.

In addition to assessing risk, underwriters also play a role in negotiating with agents or brokers to find ways to insure clients when there are issues. They may become involved when more assessment is needed, such as when an insured person has made multiple claims, when new policies are issued, or when there are payment issues.

The process of underwriting helps to standardise the insurance market, ensuring that similarly qualified applicants pay similar amounts for coverage. By understanding the underwriting process, individuals can better navigate the application process and work towards obtaining desirable rates for their insurance policies.

Insurance Coverage for Your Volvo XC90: How Much Is Enough?

You may want to see also

What factors do underwriters consider?

Underwriters are professionals who evaluate and analyse the risks involved in insuring people and assets. They establish pricing for accepted insurable risks. In the context of auto insurance, underwriters consider a range of factors to determine the risk of insuring a driver and set the premium accordingly. Here are some of the key factors that underwriters take into account:

- Driving record: Underwriters review a driver's history, including accidents, traffic violations, and claims. A driver with a clean record is generally considered lower risk.

- Age and gender: Younger and less experienced drivers are often considered higher risk and may face higher premiums. Gender can also impact rates, with male drivers under 20 typically paying more than their female peers.

- Vehicle details: The make, model, and current replacement value of a car are considered. More expensive vehicles may cost more to insure.

- Safety features: Underwriters may offer discounts for vehicles with advanced safety features like collision avoidance systems or anti-theft devices.

- Insurance history: A driver's previous insurance coverage and claims history can impact their risk assessment.

- Credit score: In some states, underwriters consider credit scores as an indicator of financial responsibility. A higher credit score may result in lower premiums.

- Geographical location: Underwriters take into account factors such as the distance from emergency services and the crime rate in the area where the vehicle is garaged.

- Personal information: Marital status and employment history can also influence rates. For example, unmarried individuals or job hoppers may have higher premiums.

These factors help underwriters assess the likelihood of claims and determine the appropriate premium to charge for auto insurance coverage. It's important to note that each insurance company may weigh these factors differently, resulting in variations in premiums offered to drivers.

DWI Accidents and Auto Insurance: What's Covered?

You may want to see also

How does underwriting set the market price?

Underwriting is the process through which an individual or institution takes on financial risk for a fee. Underwriters assess the degree of risk within a given business and help set fair prices for insurance policies.

Underwriters evaluate loans, insurance, and securities. In the case of insurance, underwriters seek to assess a policyholder's health and related factors, a driver's safety record, or the security of a home. They aim to price insurance premiums appropriately while spreading the potential risk among as many people as possible.

Underwriters help establish the true market price of risk by deciding, on a case-by-case basis, which transactions they are willing to cover and what rates they need to charge to make a profit. They also help expose unacceptably risky applicants by rejecting coverage. This vetting function substantially lowers the overall risk of expensive claims or defaults, allowing insurance companies to offer more competitive rates to less risky customers.

In the context of auto insurance, underwriters consider factors such as the applicant's age, vehicle usage, driving record, the make and model of the vehicle, and safety features. They use this information to determine the likelihood and magnitude of a risk, which in turn helps set the market price for the insurance policy.

The process of underwriting helps standardize the insurance market, ensuring that similarly qualified applicants pay roughly the same amount for coverage. By understanding the factors that underwriters consider and managing these factors where possible, individuals can work towards obtaining a desirable rate for their insurance policy.

Key Considerations for Choosing Auto Insurance

You may want to see also

Frequently asked questions

Underwriting is the process through which an insurance company evaluates its risk and determines coverage eligibility. Underwriters assess the risk of insuring people and assets and establish pricing for accepted insurable risks.

Auto insurance underwriters consider factors such as age, vehicle usage, driving record, the make and model of the vehicle, safety features, and personal data including marital status and employment.

Underwriting helps insurance companies decide whether taking a chance on providing coverage to a person is worth the risk. It also helps standardize the insurance market, ensuring that similarly qualified applicants pay similar amounts for coverage.

Underwriting helps to ensure fair borrowing rates and insurance premiums by accurately pricing risk. It also helps to create a market for securities by pricing investment risk.