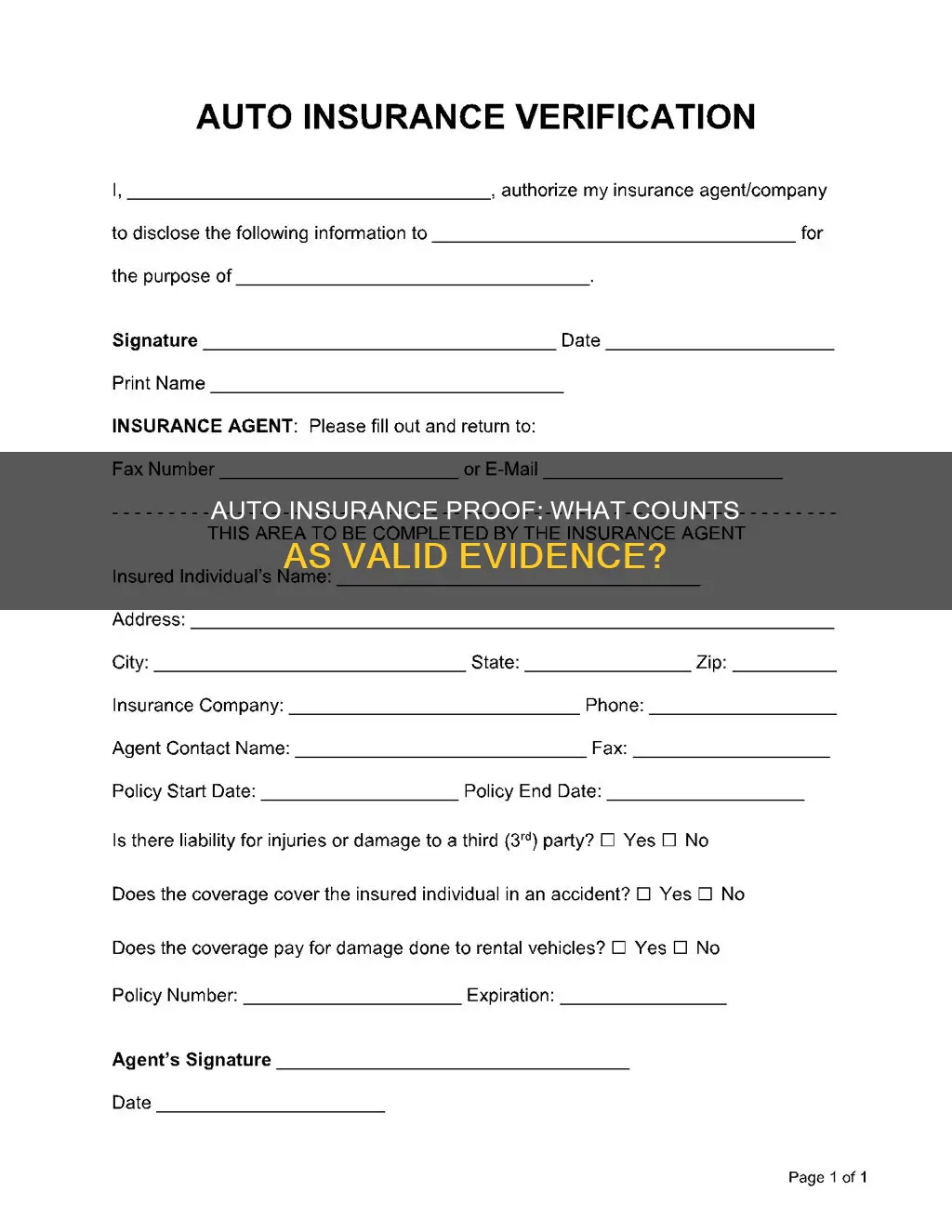

Proof of auto insurance is a document or ID card that shows you have the car insurance coverage required to legally drive in your state. It is a vital document for all motorists and demonstrates a driver's compliance with their state's legal requirements and financial responsibility for operating a vehicle. This document may be needed when registering a vehicle, during traffic stops, or after an accident. It typically includes the policyholder's name, policy number, effective dates of coverage, information about the vehicle, and the insurer's name and information.

| Characteristics | Values |

|---|---|

| Policyholder's name | Yes |

| Insurance company's name | Yes |

| Policy number | Yes |

| Effective dates of coverage | Yes |

| Vehicle information | Yes |

| Insurer's contact information | Yes |

| Types of coverage | Sometimes |

| Policy limits | Sometimes |

What You'll Learn

When do you need proof of auto insurance?

During a Traffic Stop

If you're pulled over by the police, you'll usually be asked to provide proof of insurance, along with your driver's license and vehicle registration. This is to verify that you have current insurance coverage as required by law. In most states, it's illegal to drive without car insurance, so make sure you always have proof of insurance with you when driving.

After an Accident

If you're involved in a car accident, it's important to exchange insurance information with the other drivers involved. Proof of insurance allows drivers to demonstrate that they have the necessary coverage to handle any damages or injuries resulting from the accident.

When Registering a Vehicle

When registering a vehicle with a Department of Motor Vehicles (DMV) or similar agency, you'll generally need to provide proof of insurance. This ensures that the vehicle has the required insurance coverage to be legally operated on public roads. Without proof of insurance, your registration may be denied or revoked.

When Leasing or Financing a Car

If you're leasing or financing a car, lenders and leasing companies will typically require proof of insurance before finalising the agreement. This protects their financial interests by ensuring the vehicle is adequately insured. You may also need to provide proof of insurance periodically throughout the lease or loan term to maintain compliance with the agreement.

PIP's Place in Auto Insurance: Understanding No-Fault Coverage

You may want to see also

What information does proof of auto insurance include?

Proof of auto insurance includes the following information:

- The name of the policyholder.

- The name and contact information of the insurance company.

- The effective dates of coverage.

- A description of the insured vehicle, including its make, model, and vehicle identification number (VIN).

- The policy number.

- The National Association of Insurance Commissioners (NAIC) number.

- Confirmation that the policy meets the state's minimum requirements for car insurance coverage.

- Outline of the types of coverage and policy limits.

In addition to the above, some drivers may also need an SR-22 form, also known as a certificate of financial responsibility, which is typically required if the driver has been convicted of a DUI or DWI, has had multiple speeding tickets in a short period, or has a hardship license.

Auto Insurance Rates: Why the Spike?

You may want to see also

How do you get proof of auto insurance?

Proof of auto insurance is a requirement in most states in the US. It is a document that shows you have a current and valid auto insurance policy. You can get proof of auto insurance from your insurance company after buying a policy. Depending on the insurance company, you may receive immediate proof of insurance via fax or email once you make your first premium payment. You may also receive this document electronically, or by mail.

Via the Insurance Company's Mobile App

Almost all states allow you to show electronic proof of insurance through your insurer's mobile app. This is the most convenient way to access your proof of insurance, as you can simply pull out your phone and access the digital proof of insurance. However, it is important to note that New Mexico is the only state that does not accept electronic proof during a traffic stop.

Printed Card from the Insurance Company

You can also obtain a printed card from your insurance company, which you can keep in your glove compartment. This card typically includes your policy number, effective date, expiration date, vehicle information, and other relevant details.

Insurance ID Card

An insurance ID card is another common form of proof of insurance. This card will include your policy number, effective dates, vehicle information, and other necessary information. Most big insurance companies, such as GEICO, Progressive, and State Farm, allow you to print off your own copy at home.

Proof of Coverage Letter

A proof of coverage letter from your insurance company can also serve as valid proof of insurance. This letter will include details about your policy, such as the policy number, effective dates, and vehicle information. However, some states may not accept this as valid proof, so it is always good to check with your state's requirements.

It is important to remember that driving without proof of insurance can result in fines or even jail time, depending on the state. Additionally, if you are in an accident, it is crucial to exchange insurance information with the other party, making it essential to have valid proof of insurance at all times.

Gap Insurance: Which Auto Insurers Offer This?

You may want to see also

Can you use digital proof of auto insurance?

Yes, you can use digital proof of auto insurance in almost all states in the US. 49 states and Washington, D.C. allow drivers to provide digital copies of their insurance cards, usually through their insurer's mobile app. This means that if you are pulled over by the police, it is acceptable to show an electronic copy of your proof of insurance.

The only exception is New Mexico, which does not recognize electronic proof of insurance during a traffic stop or in the event of an accident. Here, you will need to provide a physical copy of your insurance card.

Digital proof of insurance is a convenient way to ensure you always have your insurance details to hand. Most major insurance companies, including State Farm, Geico, and Progressive, provide customers with digital insurance cards that can be accessed on a smartphone or tablet.

It is important to note that driving without proof of insurance is not the same as driving without insurance. Failure to provide proof of insurance typically results in a fix-it ticket, while a no-insurance conviction can result in a fine and a suspension of your driver's license.

Auto Insurance: Child Support Add-on

You may want to see also

What happens if you can't show proof of auto insurance?

Failing to show proof of auto insurance can lead to various consequences, including fines, higher insurance premiums, and even jail time, depending on the state. If you are stopped by the police and cannot provide proof of insurance, you will likely be issued a citation and face penalties such as fines or other fees. In most cases, you can contest the ticket by providing proof of insurance at a later date, either by mail or by attending a court hearing. However, failure to respond to the ticket and subsequent correspondence may result in more severe consequences, such as license suspension or revocation.

It is important to note that driving without insurance is a more serious offence than simply not being able to provide proof of insurance. If you are caught driving without valid insurance, you may face substantial fines, licence suspension or revocation, higher insurance rates, and even jail time, depending on the state.

To avoid these issues, it is essential to keep your proof of insurance with you at all times when driving. Most insurance companies provide a physical insurance ID card or allow you to access a digital copy through their mobile app. Additionally, keeping a photocopy or a photograph of your insurance card in a safe place can be helpful in case you need to provide proof of insurance for a contested ticket or other purposes.

Intimidate Insurance Adjusters: Know Your Rights, Get Fair Compensation

You may want to see also

Frequently asked questions

A valid proof of auto insurance is typically a document or ID card provided by your insurance company. It includes basic details of your policy, such as your name, the insurance company's name, the policy number, and effective dates. This proof can be in physical or digital form, presented through your insurer's mobile app or a printed copy.

You will generally need to provide proof of auto insurance when registering a vehicle, during traffic stops, after an accident, or when leasing or financing a vehicle. It is also required when obtaining a driver's license or vehicle inspection sticker.

Failing to provide proof of auto insurance when requested by law enforcement may result in penalties, including fines, license suspension, or even jail time, depending on the state. These consequences vary in severity and can occur even if you have valid insurance but cannot provide proof at the time.

A proof of insurance confirms that you have an active insurance policy and is typically provided after purchasing a policy. An insurance binder, on the other hand, is a temporary contract that provides coverage while your policy is still being reviewed and finalized. It serves as short-term proof of insurance until the official policy takes effect.