Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It offers a range of benefits, including a guaranteed death benefit, a cash value component that grows over time, and the ability to borrow against the policy's cash value. Unlike term life insurance, which only provides coverage for a specified period, whole life insurance remains in force as long as the premiums are paid. This type of insurance is an excellent option for those seeking long-term financial security and a reliable source of coverage that can grow with their needs over time.

What You'll Learn

- Definition: Whole life insurance is a permanent policy with guaranteed death benefit and cash value

- Benefits: It offers lifelong coverage, savings, and investment opportunities

- Premiums: Premiums are fixed and remain the same over time

- Features: Includes a death benefit, investment component, and guaranteed returns

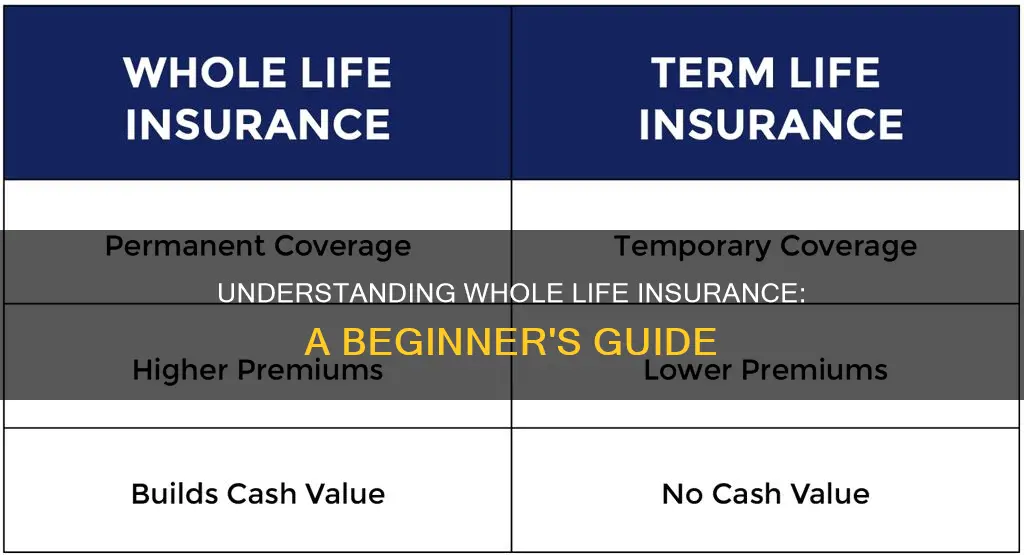

- Comparison: How it differs from term life insurance in cost and coverage

Definition: Whole life insurance is a permanent policy with guaranteed death benefit and cash value

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, hence the name. It is a long-term commitment, offering financial protection and peace of mind to individuals and their families. One of the key features of whole life insurance is its guaranteed death benefit. This means that, as long as the policy is in force, the insurance company will pay out a specified amount to your beneficiaries when you pass away. This guaranteed benefit is a significant advantage, ensuring that your loved ones receive the financial support they need during a difficult time.

In addition to the death benefit, whole life insurance also accumulates cash value over time. This is a unique aspect of this insurance type, as it allows the policyholder to build a savings component within the policy. As you make regular premium payments, a portion of each payment goes towards building this cash value. This cash value grows tax-deferred, providing a valuable asset that can be borrowed against or withdrawn if needed. The accumulation of cash value is a long-term investment strategy, allowing individuals to potentially build a substantial savings account within their insurance policy.

The permanent nature of whole life insurance is another crucial aspect. Unlike term life insurance, which provides coverage for a specific period, whole life insurance remains in force for the entire lifetime of the insured individual. This means that the coverage is always there, providing continuous protection and financial security. It is a long-term financial commitment that ensures your loved ones are protected, regardless of changes in your life or health over the years.

With whole life insurance, the death benefit and cash value are locked in, providing stability and predictability. The guaranteed death benefit ensures that your beneficiaries receive a set amount, which can be a significant financial cushion during their time of grief. Meanwhile, the growing cash value can be utilized in various ways, such as taking out loans for major purchases or using it as an emergency fund. This flexibility and security make whole life insurance an attractive option for those seeking long-term financial protection.

In summary, whole life insurance is a permanent policy with a guaranteed death benefit and a growing cash value component. It offers financial security and peace of mind, ensuring that your loved ones are protected and that you have a valuable savings asset. Understanding the definition and key features of whole life insurance is essential for making informed decisions about your long-term financial planning and protection.

Understanding Two-Decade Renewable Term Life Insurance

You may want to see also

Benefits: It offers lifelong coverage, savings, and investment opportunities

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as the name suggests. One of its key benefits is the lifelong coverage it offers, ensuring that your loved ones are protected financially even in your absence. Unlike term life insurance, which provides coverage for a specific period, whole life insurance remains in force for as long as you make the required premium payments. This means that your beneficiaries will receive a death benefit when you pass away, providing them with a financial safety net.

In addition to the coverage, whole life insurance also offers a unique savings component. As you pay premiums, a portion of your money is invested, and the earnings accumulate over time. This investment aspect allows your policy to grow, and you can build a substantial cash value that can be borrowed against or withdrawn if needed. The savings aspect of whole life insurance can be particularly beneficial for long-term financial goals, such as funding your child's education or planning for retirement.

The investment opportunities within whole life insurance policies can be advantageous for those seeking to grow their money. The policy's cash value can be invested in various options, such as stocks, bonds, or mutual funds, depending on the insurance company's offerings. This investment strategy can potentially provide higher returns compared to traditional savings accounts, allowing your money to work harder over time. As the cash value grows, it can be used to pay for future expenses or even taken out as a loan, providing financial flexibility.

Furthermore, the savings and investment features of whole life insurance can be a powerful tool for wealth accumulation. The policy's ability to grow over time can help individuals build a substantial nest egg, which can be passed on to beneficiaries or used for personal financial goals. This aspect makes whole life insurance an attractive option for those seeking a comprehensive financial planning solution.

In summary, whole life insurance provides lifelong coverage, ensuring financial protection for your loved ones. The savings and investment opportunities within the policy allow for potential wealth growth and financial flexibility. By understanding these benefits, individuals can make informed decisions about their insurance needs and take advantage of the long-term financial security that whole life insurance offers.

Who Gets Life Insurance Payouts When a Minor is Beneficiary?

You may want to see also

Premiums: Premiums are fixed and remain the same over time

Whole life insurance is a type of permanent life insurance that offers lifelong coverage. One of its key advantages is the predictability and stability it provides when it comes to premiums. Unlike term life insurance, where premiums can vary based on the term length, whole life insurance premiums are fixed and remain constant throughout the policy's duration. This means that once you start paying for this insurance, your monthly, quarterly, or annual premium payments will stay the same, providing a sense of financial certainty.

The fixed nature of these premiums is a significant benefit for policyholders. It allows individuals to plan their finances more effectively, as they know exactly how much they need to pay each period. This predictability is especially valuable for long-term financial planning, as it enables you to budget accurately and avoid unexpected increases in insurance costs. With whole life insurance, you can rest assured that your premiums will not fluctuate, providing a stable financial commitment.

This stability is particularly attractive to those who want to ensure consistent financial protection for their loved ones or to build a substantial cash value over time. By locking in the premium rate, whole life insurance offers a sense of security and control, allowing individuals to focus on other financial goals without worrying about potential premium hikes. It's a reliable choice for those seeking a long-term financial strategy.

When considering whole life insurance, it's essential to understand that the fixed premiums are set based on various factors, including your age, health, and the desired coverage amount. The insurance company calculates these premiums to ensure they can adequately fund the policy's benefits and maintain the cash value accumulation. This process is designed to provide a fair and consistent pricing structure for policyholders.

In summary, the fixed premiums of whole life insurance offer a unique advantage by providing long-term financial stability and predictability. This feature allows individuals to make informed financial decisions and plan for the future with confidence, knowing their insurance costs will remain consistent over the life of the policy.

No Exam Life Insurance: Instant Coverage or Waiting Periods?

You may want to see also

Features: Includes a death benefit, investment component, and guaranteed returns

Whole life insurance is a type of permanent life insurance that offers a range of features to provide financial security for you and your loved ones. Here's a breakdown of its key features:

Death Benefit: This is the primary purpose of life insurance—to provide financial support to your beneficiaries in the event of your passing. With whole life insurance, the death benefit is guaranteed and will be paid out as a lump sum to your designated beneficiaries. This financial safety net ensures that your family can cover essential expenses, such as mortgage payments, education costs, or daily living expenses, even if you're no longer around.

Investment Component: Whole life insurance policies often include an investment aspect, allowing your money to grow over time. A portion of your premium payments goes into an investment account, which is professionally managed by the insurance company. This investment component can offer potential returns, and the growth of your money is typically tax-deferred. As your investment grows, it can accumulate cash value, providing a source of funds that you can borrow against or use to pay for future needs, such as college tuition or retirement.

Guaranteed Returns: One of the most attractive features of whole life insurance is the guarantee of returns. Unlike term life insurance, which focuses solely on providing coverage during a specified period, whole life insurance offers long-term financial security. The insurance company promises a certain rate of return on the investment portion of your policy. This guarantee ensures that your money will grow according to the agreed-upon terms, providing a stable and predictable financial future. Over time, the cash value of your policy can accumulate, and you can access this money tax-free, providing financial flexibility and security.

In summary, whole life insurance offers a comprehensive approach to financial planning. It provides a death benefit to protect your loved ones, an investment component to grow your money, and guaranteed returns to ensure long-term financial stability. This type of insurance is a valuable tool for those seeking to secure their family's future and build a financial legacy.

Finding Recent Life Insurance Leads to Sell: Effective Strategies

You may want to see also

Comparison: How it differs from term life insurance in cost and coverage

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, hence the name. It offers a range of benefits and guarantees that set it apart from other life insurance policies, especially term life insurance. Understanding the differences in cost and coverage between these two types of insurance is crucial for making an informed decision when choosing a life insurance plan.

One of the key distinctions is the cost structure. Whole life insurance typically has higher premiums compared to term life insurance. This is because whole life policies provide coverage for the entire life of the insured, which means the insurance company is taking on a longer-term commitment. The higher premiums reflect the increased risk and the promise of lifelong coverage. Additionally, whole life insurance policies often include an investment component, allowing the policyholder to build cash value over time, which can be borrowed against or withdrawn. This feature can be advantageous for long-term financial planning.

In terms of coverage, whole life insurance offers a fixed death benefit that remains the same throughout the life of the policyholder. This means that the beneficiary will receive the full death benefit amount when the insured person passes away, providing financial security for their future needs. Term life insurance, on the other hand, provides coverage for a specified term, such as 10, 20, or 30 years. Once the term ends, the coverage expires, and the policyholder may need to decide whether to renew or purchase a new policy. This flexibility in term length allows term life insurance to be more affordable for those who only need coverage for a specific period, such as during the repayment of a mortgage or until children become financially independent.

The cost-effectiveness of term life insurance is particularly appealing to those seeking affordable coverage for a defined period. As the term ends, the policyholder can choose to renew the policy, often at a higher premium, or opt for a new term life insurance plan. This renewability aspect makes term life insurance a popular choice for individuals who want coverage during specific life stages without the long-term commitment of whole life insurance. However, it's important to note that once the term ends, the coverage is no longer guaranteed, and the policyholder may need to undergo a new medical examination to qualify for a renewed policy.

In summary, the comparison between whole life and term life insurance highlights the trade-offs between cost and coverage. Whole life insurance offers lifelong coverage with a fixed death benefit and an investment component, but at a higher cost. Term life insurance provides affordable coverage for a specified term, allowing for flexibility and renewability, but with the potential for increased costs if renewed. Understanding these differences is essential for individuals to choose the life insurance option that best aligns with their financial goals, risk tolerance, and long-term needs.

Life Insurance and Credit Reports: What's the Connection?

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, is a long-term insurance policy that provides coverage for your entire life. It offers a combination of a death benefit and a savings component, known as cash value. This type of insurance is designed to be a permanent financial tool, providing coverage and savings benefits for your entire lifetime.

When you purchase a whole life insurance policy, you pay a fixed premium over a set period, typically for the rest of your life. The insurance company invests a portion of your premium payments into an investment account, which grows over time. This investment component allows your policy to accumulate cash value, which can be borrowed against or withdrawn. The death benefit is guaranteed and will be paid out to your beneficiaries upon your passing.

Whole life insurance offers several advantages. Firstly, it provides lifelong coverage, ensuring your loved ones are financially protected even after your passing. The cash value accumulation can be used for various purposes, such as funding college education, starting a business, or supplementing retirement income. Additionally, whole life insurance offers a fixed premium, meaning your payments remain consistent over time, providing long-term financial security.

The premium for whole life insurance is calculated based on several factors, including your age, health, lifestyle, and the amount of coverage you choose. Younger and healthier individuals typically pay lower premiums. The premium is usually fixed for the life of the policy, providing stability and predictability in your insurance costs. It's important to note that the premium may increase slightly over time to account for the growing cash value and investment returns.