Foremost Insurance is a specialty insurance company that serves markets by providing insurance choices that may not be offered by other companies. It is a member of the Farmers Insurance Group of Companies, which is one of the nation's largest insurers of personal property. Farmers Insurance Group of Companies was founded in Los Angeles, California, in 1928 and has become a multi-line, multi-company insurance and financial services group. The company offers a wide array of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, personal injury protection, and rental car reimbursement. Foremost Insurance, on the other hand, is well-known for its specialty products, such as mobile homes, motorcycles, boats, RVs, trailers, luxury vehicles, golf carts, commercial vehicles, and snowmobiles. It also offers home insurance options, including mobile homes, vacant homes, seasonal homes, and condominiums.

| Characteristics | Values | |

|---|---|---|

| Type of Insurance | Foremost is a specialty insurance company that offers insurance for mobile homes, speciality dwellings, motor homes, motorcycles, travel trailers, boats, etc. | Farmers Insurance is a multi-line, multi-company insurance and financial services group. They offer homeowners insurance, auto insurance, commercial insurance, and financial services. |

| History | Foremost Insurance Company was founded on June 12, 1952. | Farmers Insurance Group was founded in Los Angeles, California in 1928. |

| Parent Company | Foremost became a member of the Farmers Insurance Group of Companies in 2000. | Zurich Insurance Group is the parent company of Farmers Insurance Group. |

| Customer Satisfaction | Foremost has a good rating from the National Association of Insurance Commissioners (NAIC) Complaint Index. | Farmers has mixed reviews for customer satisfaction. |

| Financial Strength | Foremost has an AM Best rating of A (Excellent). | Farmers has an AM Best rating of A (Excellent) for financial stability. |

What You'll Learn

- Foremost is a specialty insurance company, whereas Farmers offers standard insurance products

- Foremost is ideal for customers who have trouble qualifying for car insurance with traditional carriers

- Farmers is ideal for those who do not need specialty insurance for their home or car

- Foremost offers insurance for specialty products like mobile homes, motorcycles, and boats

- Farmers offers a wide range of insurance products, including auto, home, life, and business insurance

Foremost is a specialty insurance company, whereas Farmers offers standard insurance products

Foremost Insurance is a specialty insurance company that offers a range of insurance products, including auto, home, and specialty insurance for motorcycles, RVs, mobile homes, boats, and more. On the other hand, Farmers Insurance is a well-known provider of standard insurance products, including auto, home, renters, life, and business insurance. While Foremost caters to specific insurance needs, Farmers offers a broader range of insurance options for a wider audience.

Foremost, as a specialty insurance company, focuses on providing insurance choices that may not be offered by other companies. They serve unique markets and offer extensive insurance options, including customizable auto, home, and umbrella insurance. Foremost is known for its expertise in insuring specialty products such as mobile homes, specialty dwellings, motor homes, motorcycles, travel trailers, and boats. They are a leader in this space and have introduced innovative insurance policies, such as the first insurance policy specifically for travel trailers. Foremost also has a strong financial strength rating, indicating their ability to handle claims effectively.

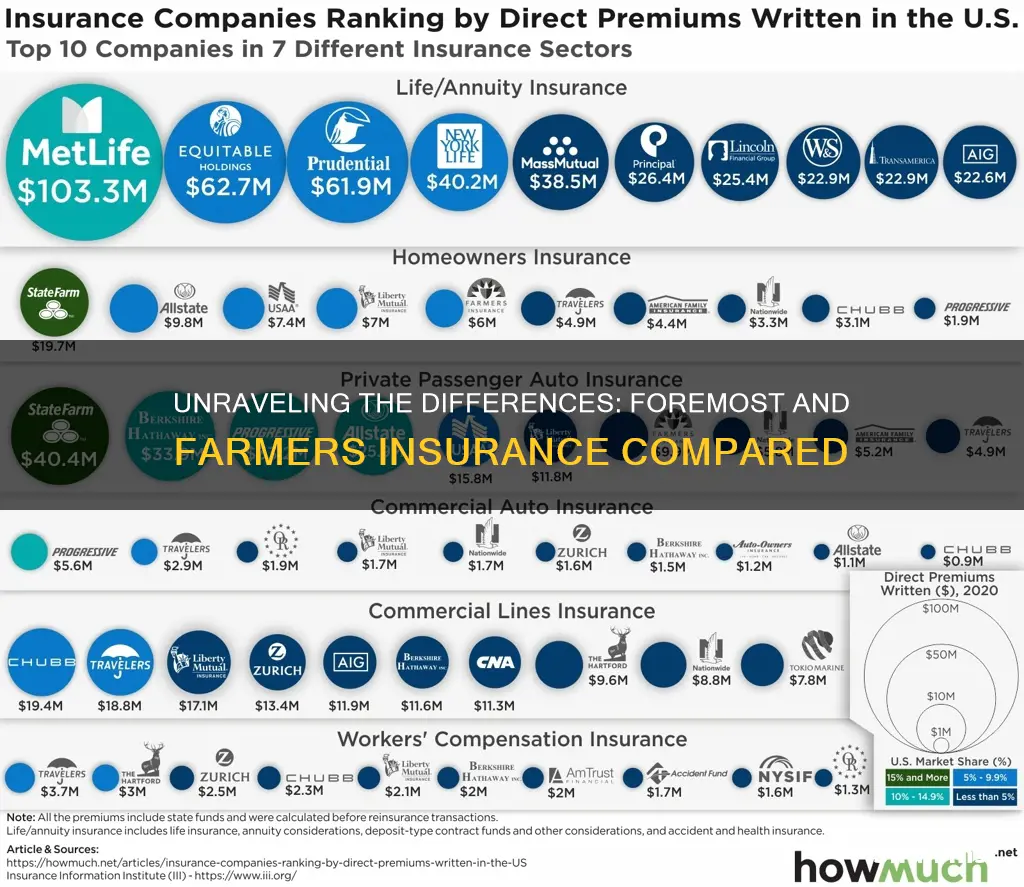

Farmers Insurance, on the other hand, is a multi-line, multi-company insurance and financial services group. They offer standard auto insurance coverage, homeowners insurance, commercial insurance, and financial services throughout the United States. Farmers has a long history, dating back to 1928, and has grown into a major national insurer with over 19 million policies written across all 50 states and Washington, D.C. They provide a wide array of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist coverage, medical payments, and personal injury protection. Farmers also offers numerous discounts, such as good student discounts, multi-car discounts, safe driver discounts, and bundling discounts.

In summary, the key difference between Foremost and Farmers Insurance lies in their target market and range of products. Foremost is a specialty insurance company that caters to specific insurance needs, offering unique and extensive insurance options. Farmers, on the other hand, is a well-established provider of standard insurance products, serving a broader range of customers with a variety of insurance choices. While Foremost focuses on niche markets, Farmers offers a comprehensive suite of insurance solutions for individuals and businesses.

Purse Preview: Unveiling the Prize Money at the Farmers Insurance Open

You may want to see also

Foremost is ideal for customers who have trouble qualifying for car insurance with traditional carriers

Foremost is a good option for customers who have trouble qualifying for car insurance with traditional carriers. Foremost is a specialty insurance company that serves markets by providing insurance choices that may not be offered by other companies. Foremost is ideal for customers who need unusual coverage, such as high-risk drivers or seasonal homeowners.

Foremost car insurance is available through several partner companies, including Bristol West, Coast National, Economy Preferred, and Security National. Foremost's auto insurance includes all the standard car insurance coverage types, plus many add-ons like rental reimbursement, roadside assistance, rideshare coverage, and gap insurance.

Partner company Bristol West specializes in high-risk car insurance for drivers who may have trouble finding insurance with other carriers. Bristol West can also file an SR-22 or FR-44 for drivers who require it. Foremost is a member of the Farmers Insurance Group and has been since 2000. As such, customers of Foremost Insurance may be eligible for certain discounts and benefits offered by Farmers Insurance, such as bundling discounts or access to a network of agents.

Farmers Direct Insurance: Unraveling the Benefits and Coverage for Agricultural Communities

You may want to see also

Farmers is ideal for those who do not need specialty insurance for their home or car

Farmers Insurance is ideal for those who do not need specialty insurance for their home or car. Farmers Insurance is a good option for those who want a smooth claim experience and superior customer service. The company has more than 48,000 exclusive and independent agents and approximately 21,000 employees available across all 50 states. Farmers Insurance offers a wide range of insurance products, including auto, home, renters, flood, earthquake, life, and business insurance. They also provide financial services such as mutual funds and variable annuities.

Farmers Insurance has a strong financial rating from AM Best and high ratings from J.D. Power. The company's customer reviews are generally positive, with many citing friendly agents who are ready to handle claims efficiently. Farmers Insurance also has a user-friendly mobile app that allows customers to pay bills, access their proof of insurance, contact their agent, file a claim, and track its status.

Farmers Insurance offers a variety of coverage options for both auto and home insurance. For auto insurance, they provide all the standard coverage options, as well as notable optional coverages such as the New Car Pledge, Towing & Roadside Assistance, and Extended Customized Equipment Coverage. Home insurance policies are available at three different tiers: Standard, Enhanced, and Premier. Each tier includes customizable coverage options and limits to meet the unique needs of the policyholder.

While Farmers Insurance offers a range of discounts, their rates tend to be higher than those of major competitors for both home and auto insurance. Therefore, Farmers Insurance may not be the best choice for those seeking the most affordable option. However, for those who prioritize customer service and a wide range of coverage options, Farmers Insurance is a solid choice.

Farmers Insurance Military Discounts: Unraveling the Benefits for Service Members

You may want to see also

Foremost offers insurance for specialty products like mobile homes, motorcycles, and boats

Foremost Insurance is a specialty insurance company that offers insurance for products that may not be covered by other companies. Foremost is a leader in insuring specialty products and has been in the business for 65 years.

Foremost Insurance offers insurance for mobile homes, motorcycles, and boats, among other specialty products. They also provide insurance for recreational vehicles, such as motor homes, travel trailers, and RVs. In addition, Foremost offers insurance for seasonal and vacant homes, which many other insurance companies do not.

Foremost was the first insurance company to introduce a travel trailer insurance policy, and they have worked closely with government agencies to establish mobile home building codes and safety regulations.

Foremost Insurance is a part of the Farmers Insurance Group, which is a subsidiary of Zurich Insurance Group. While Foremost operates as a separate entity with its own products and services, customers may be eligible for certain discounts and benefits offered by Farmers Insurance. Foremost has a strong financial rating of A (Excellent) from AM Best, indicating its ability to handle claims effectively.

Farmers Insurance and DUI: What You Need to Know

You may want to see also

Farmers offers a wide range of insurance products, including auto, home, life, and business insurance

Farmers Insurance Group is a subsidiary of Zurich Insurance Group, which acquired Foremost Insurance in 2000. Farmers Insurance Group is one of the largest insurers in the United States, offering a wide range of insurance products, including auto, home, life, and business insurance.

Farmers Insurance has been in business for 95 years and offers nearly 30 different types of insurance. The company was founded in 1928 as a small family provider with a customer base of rural farmers. Today, Farmers Insurance is a major national insurer with more than 19 million policies written across all 50 states and Washington, D.C.

Auto Insurance

Farmers Insurance offers a wide array of coverage options for auto insurance, including liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, personal injury protection, and rental car reimbursement. The company also provides several discounts, such as good student, multi-car, safe driver, and anti-theft discounts.

Home Insurance

Farmers Insurance provides coverage for single-family homes, duplexes, condominiums, mobile homes, and rental properties. They also offer specialized coverage for earthquakes, floods, and second homes. Home insurance coverage can be customized with various add-ons, and Farmers offers competitive rates through multi-line insurance discounts.

Renters Insurance

Farmers Insurance offers renters insurance to protect tenants' personal belongings in the event of a fire or other covered disasters. This type of insurance is important because a landlord's insurance policy typically does not cover the possessions of renters.

Life Insurance

Farmers Life® offers several types of life insurance coverage, including term life insurance, whole life insurance, and universal life insurance. Life insurance can help ease the financial burden on loved ones after an individual passes away, providing support for expenses such as funeral costs, mortgage payments, or college tuition.

Business Insurance

Farmers Insurance provides customized business insurance packages to reduce financial risks and protect investments. Their business insurance coverage includes property coverage, liability coverage, and business interruption insurance, among other options.

In summary, Farmers Insurance offers a comprehensive range of insurance products to meet the diverse needs of its customers. With a long history, financial stability, and a wide network across the United States, Farmers Insurance has established itself as a prominent and reliable insurance provider.

The Agricultural Backbone: Understanding the Vital Role of Farmers

You may want to see also

Frequently asked questions

Yes, Foremost Insurance is part of the Farmers Insurance Group. Foremost became a member of the Farmers Insurance Group of Companies in 2000.

While Foremost Insurance is part of the Farmers Insurance Group, it operates as a separate entity with its own products, services, and underwriting guidelines. Foremost Insurance specialises in insuring specialty products such as mobile homes, speciality dwellings, motor homes, motorcycles, travel trailers, and boats. Farmers Insurance, on the other hand, offers a wider range of insurance products and services, including auto, home, life, and business insurance.

Foremost Insurance Company was founded on June 12, 1952, to provide insurance for a new and growing market of mobile home owners. By 1961, Foremost sold mobile home insurance in every state except Hawaii. Over the years, Foremost expanded its offerings to include insurance for motorcycles, motor homes, travel trailers, boats, and more. In 2000, Foremost was acquired by the Farmers Insurance Group.

Farmers Insurance Group was founded in Los Angeles, California, in 1928. What began as a simple car insurance company for farmers has become a multi-line, multi-company insurance and financial services group. Farmers Insurance offers a range of insurance products and services, including auto, home, life, and business insurance. The company serves more than 10 million households with over 19 million individual policies nationally.