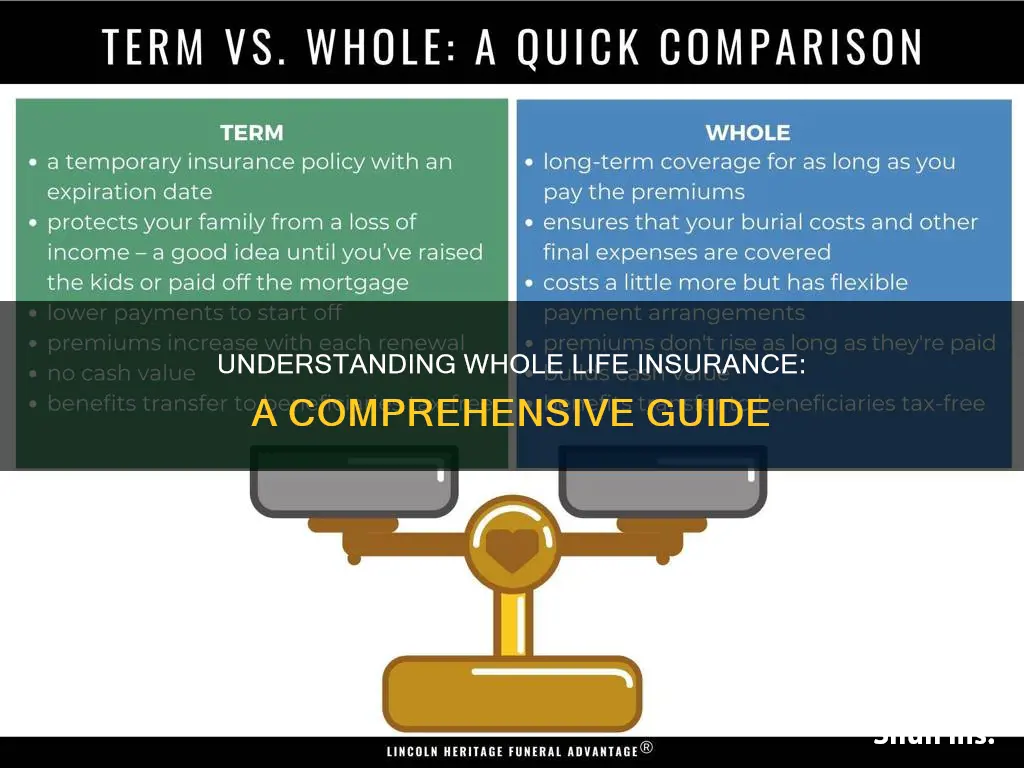

Whole life insurance, also known as permanent life insurance, is a long-term financial product that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specified period, whole life insurance offers a guaranteed death benefit and a cash value component that grows over time. This type of insurance is designed to provide financial security and peace of mind, ensuring that beneficiaries receive a payout upon the insured's death while also offering a savings element that can be borrowed against or withdrawn. It is a popular choice for those seeking a comprehensive and reliable insurance solution.

What You'll Learn

- Definition: Whole life insurance is a permanent policy with a guaranteed death benefit and cash value accumulation

- Premiums: Premiums are fixed and remain the same throughout the policy's life

- Death Benefit: The death benefit is paid out as a lump sum upon the insured's death

- Cash Value: Policyholders can borrow against or withdraw the cash value, tax-free, after a few years

- Investments: The cash value can be invested in various options, growing tax-deferred

Definition: Whole life insurance is a permanent policy with a guaranteed death benefit and cash value accumulation

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is a long-term financial commitment that offers a range of benefits and features. One of the key aspects of whole life insurance is its guaranteed death benefit, which means that the insurance company promises to pay out a specific amount to the policyholder's beneficiaries upon the insured's death. This guarantee provides financial security and peace of mind, knowing that there will be a substantial payout to support loved ones in the event of the insured's passing.

In addition to the death benefit, whole life insurance also includes a cash value component. This is a unique feature that sets it apart from other types of insurance. As the policyholder, you will build up a cash value over time, which can be used for various purposes. The cash value grows tax-deferred, allowing it to accumulate and potentially be borrowed against or withdrawn. This feature provides a financial safety net and can be particularly valuable for long-term financial planning, such as funding education expenses or starting a business.

The cash value accumulation in whole life insurance is a result of regular premium payments. These payments are invested by the insurance company, and the earnings are credited to the policy's cash value. Over time, this cash value can grow, providing a substantial sum that can be utilized for various financial goals. It is important to note that the investment performance of the policy's cash value is not guaranteed and may vary depending on market conditions and the specific insurance company's investment strategies.

Whole life insurance is a permanent policy, meaning it remains in force for the insured's entire life, provided the premiums are paid. This is in contrast to term life insurance, which provides coverage for a specified period. The permanence of whole life insurance ensures that the death benefit and cash value accumulation are available throughout the insured's life, offering long-term financial protection and flexibility.

In summary, whole life insurance is a comprehensive and permanent solution for life coverage. It offers a guaranteed death benefit, ensuring financial security for beneficiaries, and a cash value component that allows for tax-deferred growth and potential financial flexibility. Understanding the features and benefits of whole life insurance can help individuals make informed decisions about their long-term financial planning and risk management.

New York Life Insurance: Drug Testing Policy Explained

You may want to see also

Premiums: Premiums are fixed and remain the same throughout the policy's life

Whole life insurance is a type of permanent life insurance that offers lifelong coverage. One of its key features is the fixed premium structure, which sets it apart from other insurance policies. When you purchase whole life insurance, you agree to pay a set premium amount regularly, typically on a monthly, quarterly, or annual basis. This premium is agreed upon at the time of policy inception and remains unchanged for the entire duration of the policy.

The concept of fixed premiums is a significant advantage of whole life insurance. Unlike term life insurance, where premiums can vary based on market fluctuations or the insured's age, whole life insurance provides stability and predictability. Policyholders can budget and plan their finances effectively since they know exactly how much they will pay each period. This predictability is especially beneficial for long-term financial planning, as individuals can ensure that their insurance coverage remains affordable over the years.

The fixed nature of premiums also means that the insurance company's costs are stable. They can accurately predict their expenses, allowing them to offer competitive rates. This stability is a result of the insurance company's ability to calculate the expected risk and set premiums accordingly. By locking in the premium rate, the insurer ensures that the policyholder's coverage is secure, and the financial commitment is consistent.

Furthermore, the fixed premium structure of whole life insurance encourages policyholders to maintain their coverage for the long term. With predictable costs, individuals are more likely to continue their insurance payments, ensuring that their loved ones are protected even in their later years. This aspect of whole life insurance provides a sense of security and peace of mind, knowing that the policy will remain effective throughout the insured's life.

In summary, the fixed and unchanging nature of premiums in whole life insurance is a distinctive feature that sets it apart from other insurance products. It offers policyholders financial stability, predictability, and long-term security, making it an attractive choice for those seeking lifelong coverage and a consistent insurance premium. Understanding this aspect is crucial when evaluating the benefits of whole life insurance for personal financial planning.

Understanding Life Insurance: Face Value and Payouts Explained

You may want to see also

Death Benefit: The death benefit is paid out as a lump sum upon the insured's death

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. One of its key features is the death benefit, which is a crucial aspect of the policy. When the insured person passes away, the death benefit is paid out as a lump sum amount to the designated beneficiaries. This lump sum payment can be a significant financial resource for the beneficiaries, providing them with a substantial sum to cover various expenses and financial obligations.

The death benefit is a guaranteed amount, meaning it is not subject to investment risk. Unlike some other forms of insurance, whole life insurance policies are designed to accumulate cash value over time, which is then used to pay for the death benefit when the insured dies. This ensures that the beneficiaries receive the full amount specified in the policy, providing financial security and peace of mind.

Upon the insured's death, the process of claiming the death benefit begins. The beneficiaries, who are typically named in the policy, must initiate the claim by providing the necessary documentation, such as proof of death and identification. The insurance company then reviews the claim and, upon verification, disburses the lump sum amount to the beneficiaries. This process is designed to be straightforward and efficient, ensuring that the financial support is provided promptly to those who need it most.

The death benefit can be utilized for various purposes, such as covering funeral expenses, paying off debts, funding education, or providing financial support to dependents. It offers a tax-free benefit, which means the recipients can use the funds without incurring additional tax liabilities. This aspect makes whole life insurance an attractive option for those seeking to provide long-term financial security for their loved ones.

In summary, the death benefit is a fundamental component of whole life insurance, offering a guaranteed lump sum payment upon the insured's death. This feature ensures financial protection and peace of mind for the beneficiaries, allowing them to access a significant sum to cover essential expenses and secure their future. Understanding the death benefit is crucial when considering whole life insurance as a means of safeguarding one's loved ones and leaving a lasting financial legacy.

Life Insurance Options Post-Melanoma: What You Need to Know

You may want to see also

Cash Value: Policyholders can borrow against or withdraw the cash value, tax-free, after a few years

Whole life insurance is a type of permanent life insurance that offers a range of benefits, including a guaranteed death benefit and a cash value component. This unique feature of whole life insurance allows policyholders to build up a significant cash value over time, which can be utilized in various ways.

One of the key advantages of the cash value in whole life insurance is the ability to borrow against it. Policyholders can take out a loan against the cash value, which is typically interest-free, as long as the loan is repaid with interest. This can be particularly useful for those who need immediate access to funds for various purposes, such as home improvements, education expenses, or business ventures. By borrowing against the cash value, policyholders can utilize their insurance policy as a source of financing without disrupting their long-term coverage.

In addition to borrowing, policyholders can also withdraw the cash value from their whole life insurance policy. This process is known as a surrender or a withdrawal. After a certain period, usually a few years, the policyholder can request to withdraw a portion of the cash value, and the funds can be taken out tax-free. This provides financial flexibility, allowing individuals to access their money without incurring taxes or penalties. Withdrawing the cash value can be beneficial when policyholders need to make significant purchases or investments, providing them with a lump sum amount without disrupting their insurance coverage.

The tax-free nature of cash value withdrawals is a significant advantage. Unlike some other investment vehicles, whole life insurance cash value growth is not subject to capital gains taxes when withdrawn. This feature ensures that policyholders can access their funds without incurring additional tax liabilities, making it an attractive option for long-term financial planning.

In summary, whole life insurance offers policyholders the opportunity to build and utilize cash value. Borrowing against the cash value provides immediate access to funds, while withdrawing it tax-free allows for financial flexibility. These features make whole life insurance a comprehensive financial tool, providing both insurance protection and a means to build wealth over time. Understanding these aspects can help individuals make informed decisions about their long-term financial strategies.

Life Insurance Proceeds: Separate Property or Not?

You may want to see also

Investments: The cash value can be invested in various options, growing tax-deferred

Whole life insurance is a type of permanent life insurance that offers a range of features and benefits, including an investment component. One of its key advantages is the ability to accumulate cash value over time, which can be invested in various options, providing an opportunity for tax-deferred growth.

When you purchase a whole life insurance policy, a portion of your premium payments goes towards building cash value. This cash value grows over time, often at a guaranteed interest rate, and it can be used for various purposes. One of the primary benefits is the potential for tax-deferred growth. Unlike traditional savings accounts or investments, the cash value in a whole life policy grows without being subject to annual income taxes. This means that the investment portion of your policy can potentially accumulate wealth faster, providing a long-term financial advantage.

The investment options within a whole life insurance policy can vary. Typically, policyholders have the flexibility to choose how their cash value is invested. Common investment options include fixed accounts, which offer a guaranteed rate of return, and variable accounts, which allow for potential higher returns but also carry more risk. Some policies may also offer a combination of both, providing a balanced approach. These investment options can be tailored to an individual's risk tolerance and financial goals, allowing them to make the most of their whole life insurance policy.

Investing the cash value in these options can be a strategic move for several reasons. Firstly, it provides a way to build a substantial cash reserve within the policy, which can be borrowed against or withdrawn if needed. Secondly, the tax-deferred growth can result in significant long-term gains, especially when compared to traditional savings accounts. Additionally, the investment aspect of whole life insurance can be particularly beneficial for those seeking to maximize their retirement savings or build a legacy for their beneficiaries.

In summary, whole life insurance offers a unique combination of insurance protection and investment opportunities. The cash value accumulation, coupled with the ability to invest in various options, provides policyholders with a powerful tool for growing their wealth tax-deferred. This feature sets whole life insurance apart from other investment vehicles and can be a valuable component of a comprehensive financial plan.

Credit Union Members: Life Insurance Coverage and Benefits

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, is a long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a combination of death benefit, savings component, and investment opportunities.

When you purchase a whole life policy, you pay a fixed premium over a set period, typically for the rest of your life. The insurance company guarantees to pay out a death benefit to your beneficiaries when you pass away. Additionally, a portion of your premium contributes to a cash value account, which grows over time through interest and investment gains.

Whole life insurance offers several advantages. Firstly, it provides lifelong coverage, ensuring your loved ones are financially protected even if you're no longer around. Secondly, the cash value accumulation can be used to borrow funds or withdraw money, providing financial flexibility. It also offers a guaranteed death benefit and potential investment returns.

The premium for whole life insurance is calculated based on various factors, including your age, health, gender, and the amount of coverage you choose. Younger and healthier individuals typically pay lower premiums. The premium remains fixed for the entire duration of the policy, providing stability and predictability.

Yes, one of the key features of whole life insurance is the ability to access the cash value. You can borrow against it or make permanent withdrawals. This feature allows you to utilize the policy's savings component for various financial needs, such as funding education, starting a business, or supplementing retirement income.