Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their loved ones. While the primary purpose of life insurance is to provide a financial safety net in the event of the insured's death, it's important to understand that there are various types of life insurance policies that offer different benefits and can be utilized during the insured's lifetime. In this article, we will explore the different types of life insurance that can be used while alive, including term life insurance, whole life insurance, and universal life insurance, and discuss their unique features and advantages.

What You'll Learn

- Term Life Insurance: Temporary coverage for specific periods

- Whole Life Insurance: Permanent policy with cash value accumulation

- Universal Life Insurance: Flexible premiums and adjustable death benefits

- Variable Life Insurance: Investment-linked policy with potential for higher returns

- Critical Illness Insurance: Covers major health issues, providing financial support

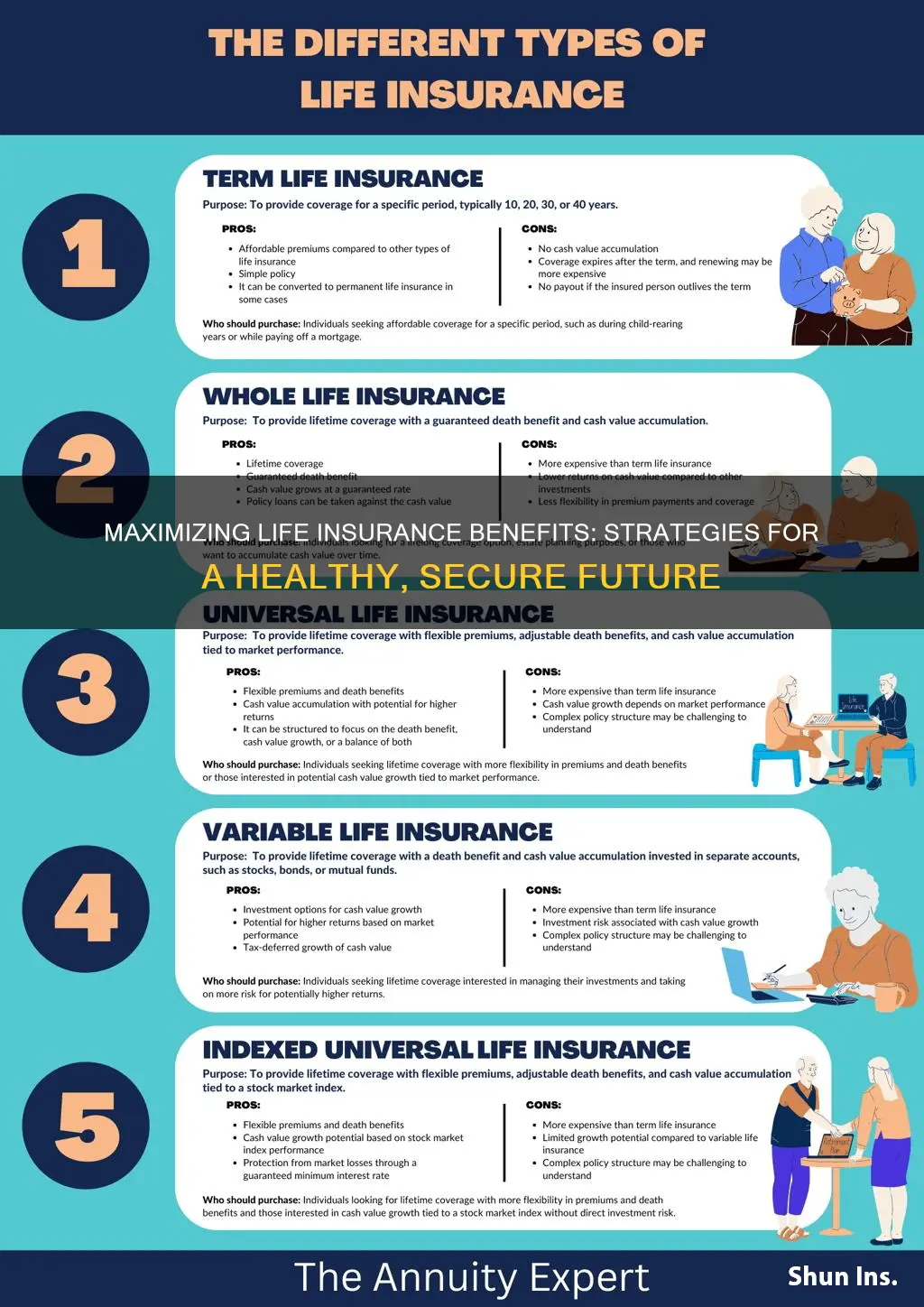

Term Life Insurance: Temporary coverage for specific periods

Term life insurance is a type of coverage that provides financial protection for a specific period, often referred to as the "term." It is a straightforward and cost-effective way to ensure your loved ones are financially secure if something happens to you during that defined period. This type of insurance is particularly useful for those who want to cover a specific financial gap, such as providing for a child's education or paying off a mortgage, without the need for long-term coverage.

The beauty of term life insurance lies in its simplicity. You agree to pay a premium for a set period, and in return, you receive a death benefit if you pass away during that term. This benefit can be a lump sum or paid out over time, depending on the policy. The key advantage is that it offers high coverage amounts at lower costs compared to permanent life insurance, making it an attractive option for those seeking temporary financial security.

There are various types of term life insurance policies, each tailored to different needs. For instance, level term life insurance provides a consistent death benefit and premium rate throughout the term. This type is ideal for those who want predictable payments and coverage. On the other hand, decreasing term life insurance has a death benefit that reduces over time, which can be suitable for those whose financial needs may decrease as they age.

When considering term life insurance, it's essential to evaluate your specific circumstances. The length of the term should align with your financial goals. For example, if you're looking to cover a 10-year mortgage, a 10-year term policy would be appropriate. Additionally, the amount of coverage should be sufficient to meet your family's needs during that period. It's a good practice to regularly review and adjust your policy as your life changes and financial goals evolve.

In summary, term life insurance offers a temporary safety net, allowing individuals to focus on their current financial priorities without the burden of long-term commitments. It is a versatile and affordable option, providing peace of mind and financial security during the specified term. By understanding the different types and their benefits, you can make an informed decision to protect your loved ones and achieve your financial objectives.

Key Employee Life Insurance Proceeds: Taxable or Not?

You may want to see also

Whole Life Insurance: Permanent policy with cash value accumulation

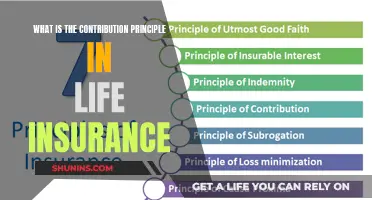

Whole life insurance is a permanent policy that offers a range of benefits, including a guaranteed death benefit and a cash value component. This type of insurance is designed to provide long-term financial security and can be a valuable tool for those seeking a reliable and consistent financial plan. Here's a detailed look at how whole life insurance can be utilized while alive:

When you purchase a whole life insurance policy, you're essentially entering into a long-term contract with an insurance company. The policy remains in force for your entire lifetime, providing a sense of security and stability. One of the key advantages is the accumulation of cash value. With each premium payment, a portion is allocated to build up a cash reserve. This cash value grows over time, earning interest, and can be used in various ways while you are alive. You have the flexibility to access this cash value through policy loans or withdrawals, allowing you to utilize the funds for various financial needs.

The cash value in a whole life policy can serve multiple purposes. Firstly, it can be used to secure a loan, providing immediate access to funds without the need for extensive paperwork. This can be particularly useful for major purchases, business investments, or any financial gap that may arise. Secondly, the cash value can be withdrawn as a lump sum or in installments, offering financial flexibility. This feature is especially beneficial for those who want to access their funds without incurring penalties, as is often the case with other types of insurance policies.

Another advantage is the potential for tax-deferred growth. The cash value in a whole life policy grows tax-free, providing a compound effect over time. This means that the accumulated value can grow significantly, offering a substantial financial cushion. Additionally, the death benefit, which is typically a multiple of the policy's cash value, ensures that your beneficiaries receive a guaranteed amount upon your passing, providing financial security for your loved ones.

In summary, whole life insurance with its permanent policy structure and cash value accumulation offers a versatile and reliable financial solution. It provides a safety net, loan opportunities, and the potential for tax-advantaged growth. By understanding and utilizing these features, individuals can make the most of their whole life insurance policy while alive, ensuring financial security and peace of mind.

Understanding Life Insurance: Adult Children's Inclusion and Automatic Listing

You may want to see also

Universal Life Insurance: Flexible premiums and adjustable death benefits

Universal life insurance offers a unique and flexible approach to life coverage, providing policyholders with a range of benefits that can adapt to their changing needs. One of its key advantages is the ability to customize both the premium payments and the death benefit, making it a versatile option for those seeking long-term financial security.

With universal life insurance, policyholders typically pay a flexible premium, which means they can choose to pay a fixed amount or adjust the payments based on their financial situation. This flexibility is particularly beneficial for individuals who may experience fluctuations in income or those who want to ensure they have the financial capacity to meet their insurance obligations. For instance, during periods of higher income, a policyholder can opt to pay more, building up the cash value of the policy and potentially increasing the death benefit. Conversely, if financial circumstances change, they can reduce the premium payments, ensuring the policy remains affordable.

The adjustable nature of the death benefit is another attractive feature of universal life insurance. Policyholders can increase or decrease the amount of death benefit coverage as their needs evolve. This is especially useful for those who want to provide financial security for their loved ones, ensuring that the insurance keeps pace with the rising cost of living or other financial goals. For example, a policyholder might start with a basic death benefit to cover immediate expenses and then gradually increase it over time to align with their family's future needs.

This type of insurance also offers a valuable financial tool in the form of a cash value accumulation. As premiums are paid, a portion is allocated to build up cash value, which can be borrowed against or withdrawn, providing financial flexibility. This feature can be particularly useful for those who want to access funds for various purposes, such as starting a business, funding education, or investing in other opportunities, all while maintaining the death benefit coverage.

In summary, universal life insurance provides a dynamic and customizable solution for individuals seeking long-term financial protection. Its flexible premium payments and adjustable death benefits allow policyholders to tailor the insurance to their specific needs, ensuring they have the necessary coverage while also providing financial flexibility and security. This type of insurance is an excellent choice for those who want to take control of their financial future and adapt their insurance strategy as life circumstances change.

Life Assurance or Insurance: What's the Real Difference?

You may want to see also

Variable Life Insurance: Investment-linked policy with potential for higher returns

Variable life insurance is a unique and powerful financial tool that offers both life coverage and investment opportunities. This type of policy is designed to provide a flexible and dynamic approach to insurance, allowing policyholders to potentially earn higher returns compared to traditional life insurance options. Here's an in-depth look at how variable life insurance works and why it can be a valuable asset for those seeking to make the most of their insurance premiums.

In its core, variable life insurance is a type of permanent life insurance that incorporates investment features. When you purchase this policy, a portion of your premium goes towards funding a cash value account, which serves as an investment vehicle. The beauty of this arrangement is that the cash value can grow over time, providing a financial reserve that can be utilized in various ways. Unlike traditional whole life insurance, where premiums are fixed and primarily used to build cash value, variable life insurance offers a more adaptable investment strategy.

One of the key advantages of variable life insurance is the potential for higher returns. The investment component allows policyholders to allocate their money across a range of investment options, such as stocks, bonds, and mutual funds. These investment choices are typically offered by the insurance company and may include various risk levels to cater to different preferences. By diversifying your investments, you can potentially earn higher returns compared to fixed-rate investment accounts, providing an attractive incentive for those seeking to maximize their financial growth.

The investment aspect of variable life insurance also offers policyholders more control over their finances. You can make adjustments to your investment strategy as needed, allowing for a personalized approach to wealth management. This flexibility enables you to adapt to changing market conditions and potentially optimize your returns. Additionally, the policy provides a safety net in the form of life insurance coverage, ensuring that your beneficiaries receive the death benefit even if the investment portion underperforms.

When considering variable life insurance, it's essential to understand the associated risks. As with any investment-linked product, there are potential downsides, including market volatility and the possibility of losing some or all of your investment. It requires careful research and a clear understanding of your financial goals and risk tolerance. Consulting with a financial advisor can be beneficial to ensure that variable life insurance aligns with your overall financial strategy.

In summary, variable life insurance offers a unique blend of life coverage and investment opportunities, providing policyholders with the potential for higher returns and greater financial flexibility. By combining insurance and investment, this policy allows individuals to take control of their financial future while also providing a safety net for their loved ones. As with any financial decision, thorough research and professional guidance are essential to making an informed choice.

VA Life Insurance: Cash Value and Benefits Explained

You may want to see also

Critical Illness Insurance: Covers major health issues, providing financial support

Critical Illness Insurance is a type of life insurance policy that offers financial protection and support during a critical illness, providing a safety net for individuals and their families. This insurance is designed to cover major health issues that can significantly impact one's life and financial stability. When diagnosed with a critical illness, such as cancer, heart attack, stroke, or other severe conditions, individuals often face substantial medical expenses, loss of income, and emotional stress. Critical Illness Insurance steps in to alleviate these burdens by providing a lump-sum payment or regular income, depending on the policy terms.

The primary purpose of this insurance is to offer financial security and peace of mind. Upon diagnosis, the policyholder can access the insured amount, which can be used to cover various expenses. These may include medical bills, hospitalization costs, rehabilitation, and even daily living expenses if the illness prevents the individual from working. The financial support can significantly ease the financial strain associated with critical illnesses, allowing policyholders to focus on their recovery and well-being.

One of the key advantages of Critical Illness Insurance is its ability to provide coverage for a wide range of critical illnesses. These policies typically include a comprehensive list of covered conditions, ensuring that individuals are protected against some of the most common and severe health issues. The insurance company will verify the diagnosis and, if the condition is covered, initiate the claims process to provide the insured amount. This process can be less complex and more straightforward compared to other insurance claims, ensuring that policyholders receive the support they need promptly.

When considering Critical Illness Insurance, it is essential to review the policy details carefully. Different insurance providers may offer varying coverage amounts, waiting periods before benefits are paid, and specific illness definitions. Understanding these terms is crucial to ensure that the policy aligns with your needs and provides adequate financial protection. Additionally, individuals should assess their overall insurance portfolio and consider how Critical Illness Insurance fits into their long-term financial planning strategy.

In summary, Critical Illness Insurance is a valuable tool for individuals seeking financial protection against major health issues. It provides a safety net during challenging times, allowing policyholders to manage medical expenses and maintain financial stability. By understanding the coverage and benefits, individuals can make informed decisions about their insurance needs and ensure they are prepared for potential critical illnesses. This type of insurance offers a proactive approach to financial security, empowering individuals to focus on their health and recovery without the added worry of financial burdens.

MetLife Insurance: Understanding Payout Times and Processes

You may want to see also

Frequently asked questions

Life insurance is a financial tool designed to provide financial security and peace of mind. While it is often associated with death benefits, it can also offer valuable living benefits. These include critical illness coverage, disability income protection, and long-term care insurance, which can help you manage medical expenses, replace income, and cover the costs of long-term care should you need it.

You can leverage your life insurance policy to ensure your family's financial well-being. Consider converting a term life insurance policy into a permanent one, which can provide lifelong coverage. Additionally, you can use the policy's cash value (in the case of whole life insurance) to borrow money or take out a loan, providing immediate funds for various purposes, such as education expenses or home improvements.

Yes, life insurance can offer tax benefits. For instance, with certain types of policies, you can take tax-free loans against the cash value, allowing you to access funds without paying taxes on the withdrawals. Additionally, the death benefit received by your beneficiaries is generally tax-free, providing a significant financial advantage.

Absolutely. Many life insurance policies offer education benefits, allowing you to set aside funds specifically for your children's education. You can use the policy's features, such as an education rider, to ensure that a portion of the death benefit is dedicated to covering college or university fees, providing a valuable financial resource for your family's future.

One common misconception is that life insurance is only useful for providing financial support to beneficiaries after your passing. In reality, life insurance can be a versatile tool with various living benefits. Another myth is that it's too expensive to be worth it. With proper planning and the right policy choices, you can find affordable options that provide valuable coverage during your lifetime.