After a car accident, it's normal to feel shocked and overwhelmed. However, it's important to be cautious when speaking to an insurance adjuster, as they are trained to find ways to reduce their company's payout. Here are some things you should avoid saying to protect yourself and ensure a fair settlement:

- Admitting Fault: Avoid any language that could be interpreted as taking responsibility for the accident, even if you think you may be partially at fault. Phrases like I didn't see them or I'm sorry can be used against you to reduce or deny your claim.

- Downplaying Injuries: Don't minimize your injuries or say that you're fine or okay. The full extent of your injuries may not be apparent, and insurance adjusters will try to use your words against you to lower the settlement amount.

- Describing Injuries: It's best not to discuss your injuries in detail with the adjuster. Refer them to your lawyer or medical professional, who can provide an accurate assessment of your condition.

- Speculating About the Accident: Stick to the facts and avoid speculating about what happened. Inaccurate or inconsistent statements can be used to reduce your compensation. It's okay to say I don't know or I don't remember.

- Providing a Recorded Statement: You are not obligated to provide a recorded statement. A written statement reviewed by your lawyer gives you more control over what you say and protects you from having your words taken out of context.

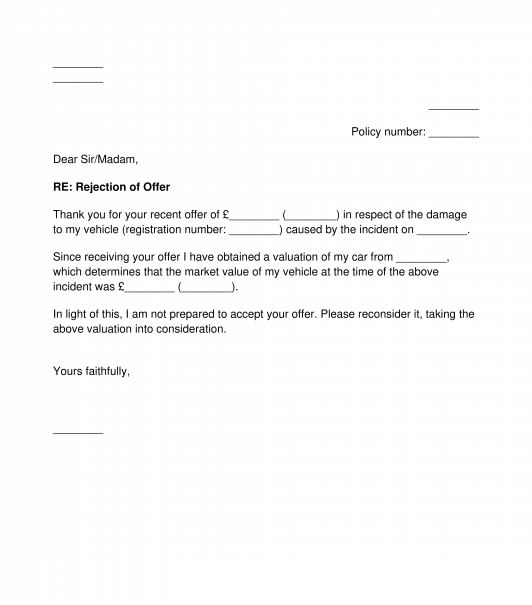

- Accepting the Initial Settlement Offer: Insurance adjusters may pressure you to accept their first offer, claiming it's the final one. However, it's almost always lower than the true value of your claim. Consult with your lawyer before accepting any settlement.

Remember, insurance adjusters are not on your side. Consult with a personal injury lawyer who can guide you through the process and help protect your rights and best interests.

| Characteristics | Values |

|---|---|

| Admitting Fault | "I'm sorry", "It was my fault", "I didn't see him there", "It was all/partly my fault", "I did not see the other person/driver" |

| Discussing Injuries | "I'm fine", "I don't think I'll need to see a doctor", "It hasn't impacted my life that much" |

| Describing Injuries | Providing details about injuries |

| Speculating About the Accident | "I think he was speeding", "I may have been changing the radio", "He was trying to avoid a pothole" |

| Providing a Recorded Statement | Recorded statements |

| Accepting the Initial Settlement Offer | Accepting the first settlement offer |

What You'll Learn

Don't admit fault or apologise

Admitting fault or apologising to an insurance adjuster can significantly reduce your compensation or even lead to your claim being denied. It is therefore imperative that you avoid any language that could be construed as apologetic or blameful.

Even if you think you may be partly at fault for the accident, do not discuss this with an adjuster. Phrases such as “I didn't see him there” or “It was my fault” can be used as evidence of your fault and reduce your chances of receiving fair compensation.

In the aftermath of an accident, it is natural to feel shaken and apologetic. However, insurance adjusters are trained to play on this shock and vulnerability to get you to admit fault or apologise. They may seem friendly and concerned, but their goal is to minimise the company's payout.

To protect yourself, it is advisable to wait for the official investigation and police report to determine fault. Consult with a personal injury lawyer who can guide you through the process and ensure your rights are protected.

Remember, insurance adjusters are not on your side. They are trained to look for statements that can be used against you. By remaining calm, polite, and concise during conversations with adjusters, you can avoid inadvertently admitting fault or apologising.

The Secrets Behind Insurance Adjusters: Unveiling the Unspoken

You may want to see also

Don't minimise or describe injuries

When dealing with an insurance adjuster, it is important to remember that they are not on your side. Their goal is to keep the insurance company's payout as low as possible. Here are some reasons why you should not minimise or describe your injuries to an insurance adjuster:

Adrenaline and Shock Can Mask the Extent of Your Injuries

In the aftermath of an accident, your body releases adrenaline, which can mask the extent of your pain and injuries. You may feel grateful to be alive and brush off your injuries as minor. However, it is important to wait for a proper medical diagnosis before discussing your injuries with an adjuster. A report from a medical professional will be taken much more seriously than a self-diagnosis.

Your Injuries May Worsen or New Injuries May Be Discovered

The full extent of your injuries may not be apparent immediately after an accident. By downplaying your injuries early on, you risk the insurance company doubting you later if your symptoms worsen or new injuries are discovered. You have the right to seek compensation for all your injuries, so minimising them will only hurt you in the long run.

The Adjuster May Try to Attribute Your Injuries to a Pre-Existing Condition

Insurance adjusters will often ask for access to your medical records or a blanket records release. They do this under the guise of verifying your injuries, but they are also looking for pre-existing conditions or prior injuries that they can use to reduce their settlement offer. For example, if you have a history of back problems and suffer spinal injuries in an accident, the insurance company may claim that your pre-existing condition contributed to or exacerbated your new injuries.

You May Inadvertently Give Them Ammunition to Use Against You

When discussing your injuries, it is easy to accidentally say something that the insurance adjuster can use against you. For instance, saying something as simple as "I'm fine" or "I'm OK" can cause the adjuster to reduce their settlement offer. It is best to avoid discussing your injuries altogether and refer any questions to your lawyer.

Navigating the Path to Becoming an Insurance Adjuster in Florida: A Comprehensive Guide

You may want to see also

Don't speculate about the accident

When speaking to an insurance adjuster, it is important to remember that they are not on your side. They work for the insurance company, and their goal is to pay out as little as possible. As such, anything you say can be used against you.

- Stick to the facts: Only provide factual information that you are certain of. Do not fill in gaps or speculate about what might have happened, as this could be used against you by the insurance company.

- Let the adjuster do their job: The adjuster's role includes investigating the accident, so let them do their job. It is perfectly fine to say that you don't know or can't remember certain details.

- Avoid misrepresenting the facts: If you speculate about the accident and your speculation turns out to be incorrect, it could cast doubt on the rest of your statement and make it easier for the insurance company to deny your claim.

- Don't give hypothetical or conjectural statements: Stick to providing factual information and avoid making hypothetical or conjectural statements about the accident.

- Don't admit fault: Even saying something as simple as “I’m sorry” could be taken as admitting fault. Avoid making any statements that could be construed as accepting responsibility for the accident.

Remember, it is always best to consult with an attorney before speaking to an insurance adjuster. An experienced attorney can guide you through the process and help protect your rights.

Understanding Your Rights: Communicating with Insurance Adjusters After Water Damage

You may want to see also

Don't give a recorded statement

After a car accident, it is common for an insurance adjuster to request a recorded statement from those involved. However, providing such a statement is not mandatory and can often harm one's claim. Here are some reasons why you should avoid giving a recorded statement:

- Recorded statements can be used against you: Insurance adjusters are trained to ask questions designed to catch inconsistencies in your story. They may use your statement to argue that you are an unreliable witness or that your later claims are untruthful.

- It can devalue your claim: Insurance adjusters may try to get you to say something that indicates your injuries are not serious or that you are partially at fault. Any admission of fault or downplaying of injuries can significantly reduce the value of your claim or even lead to a denial.

- You may not have all the facts: Immediately after an accident, you may still be in shock or disoriented and may not have a clear recollection of the events. Providing a recorded statement before fully understanding the extent of your injuries and the circumstances of the accident can be detrimental.

- You are not obligated to provide one: In most cases, you are not legally required to give a recorded statement, especially to the other driver's insurance company. You have the right to decline and consult with an attorney first.

- Written statements are often preferable: A written statement allows you to carefully craft your response with the help of an attorney. It ensures that you provide accurate and concise information without inadvertently disclosing unnecessary details that could harm your claim.

- Insurance adjusters are not your friend: Remember that insurance adjusters are not on your side. Their goal is to resolve claims for the lowest amount possible. They may come across as friendly and sympathetic, but they are trained to get you to say things that can weaken your claim.

If you are asked to provide a recorded statement, politely decline and seek legal representation. An experienced personal injury attorney can guide you through the process, protect your rights, and help you navigate the tactics of insurance adjusters.

Navigating the Path to Becoming an Insurance Adjuster in California: A Comprehensive Guide

You may want to see also

Don't accept the initial settlement offer

The initial settlement offer made by the insurance adjuster is rarely close to the amount they are willing to pay. It is a tactic to pressure you into accepting a low offer and quickly close the claim. The adjuster's goal is to minimise the insurance company's financial payout. They will try to settle claims quickly and for a low amount.

The first offer is usually made before you have a clear understanding of the full extent of your injuries and the impact on your life. It is important to wait for a proper medical diagnosis and to calculate the costs of future medical treatment and lost income. You may also be entitled to compensation for pain and suffering, and the emotional impact of the accident.

You are under no obligation to accept the first offer. It is normal for there to be a back-and-forth negotiation, and it is your right to refuse any settlement offer. Your lawyer will be able to advise you on what constitutes a fair settlement and help you negotiate.

Insurance adjusters may try to pressure you by claiming their offer is final, but this is rarely the case. They are hoping you will accept a lower amount without question. By rejecting their initial offer, you indicate that you understand your rights and the value of your claim. This often spurs the insurance adjuster to make a better offer.

Remember, once you accept an offer and sign a release form, you cannot change your mind, even if your injuries turn out to be worse than expected. So, it is crucial to be fully informed about the extent of your injuries and the value of your claim before accepting any settlement.

The Eagle-Eyed Approach: Insurance Adjusters' Roof Inspection Secrets

You may want to see also

Frequently asked questions

No, you are not obligated to answer the insurance adjuster's questions about the accident. You should avoid discussing the details of the accident, as this could be used against you. Only provide basic information such as your name and contact details.

No, you should not admit fault or apologise to the insurance adjuster, even if you believe you are at fault. Any statements about fault can be used to reduce or deny your claim. It is best to wait for the official investigation and speak to an attorney before discussing fault.

No, you should not provide details about your injuries to the insurance adjuster. They may try to minimise the extent of your injuries or use your statements against you to reduce the settlement offer. It is recommended to speak to an attorney before discussing your injuries.