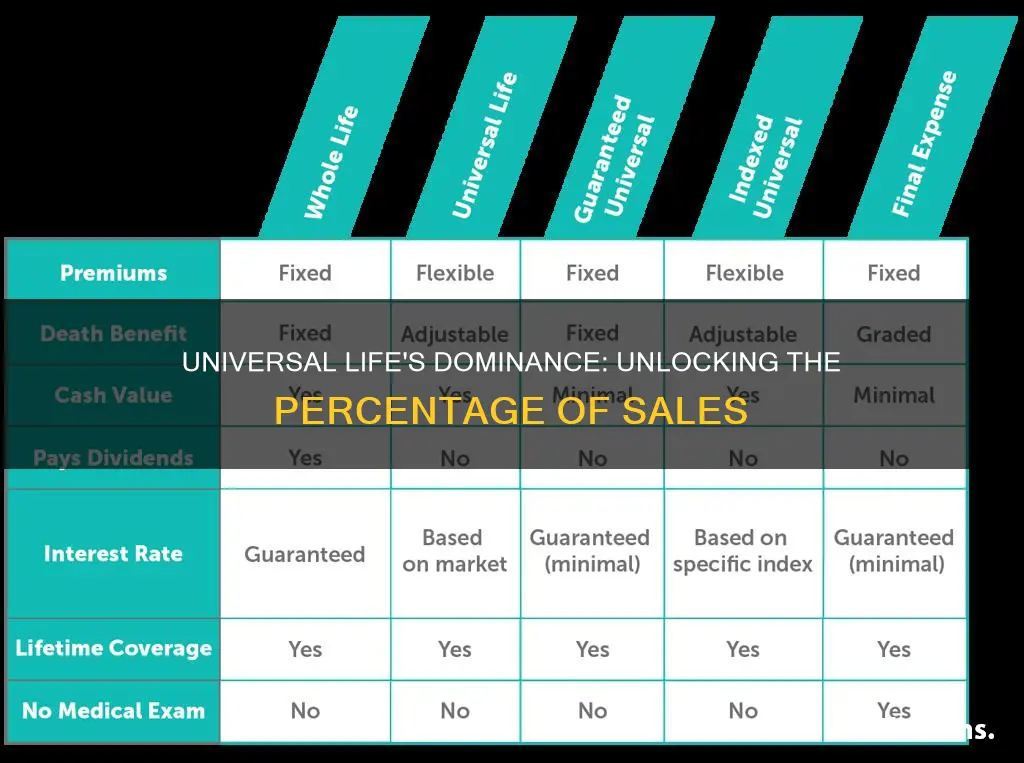

Universal life insurance has become an increasingly popular choice among consumers, but what percentage of all life insurance sold is universal life? This question delves into the market share of universal life policies, which offer flexibility and long-term coverage, compared to other types of life insurance. Understanding this distribution can provide valuable insights for both consumers and insurance providers, as it highlights the preferences and trends in the life insurance industry. By exploring this topic, we can gain a clearer picture of how universal life insurance fits into the broader landscape of life coverage options.

What You'll Learn

- Market Share: What percentage of life insurance policies sold are universal life

- Consumer Trends: How has the popularity of universal life insurance changed over time

- Regional Variations: Do certain regions have higher universal life insurance sales

- Demographic Factors: Are certain age groups or income brackets more likely to buy universal life

- Regulatory Impact: How do regulations influence the sales of universal life insurance

Market Share: What percentage of life insurance policies sold are universal life?

The concept of universal life insurance has gained significant traction in the financial services industry, but what percentage of all life insurance policies sold are universal life? This question is crucial for both consumers and insurance providers, as it provides insight into the market's preferences and trends.

According to recent industry reports and market analysis, universal life insurance currently holds a substantial market share in the life insurance sector. While the exact percentage can vary depending on the source and the time period considered, it is generally estimated that universal life policies account for a significant portion of all life insurance sales. Industry experts suggest that this type of insurance has been steadily growing in popularity, especially among younger generations who value flexibility and long-term financial planning.

One of the key reasons for the increasing demand for universal life insurance is its unique features. Unlike traditional term life insurance, universal life policies offer a combination of death benefit coverage and an investment component. Policyholders can allocate a portion of their premiums to investment options, allowing them to build cash value over time. This feature provides financial security and the potential for tax-deferred growth, making it an attractive choice for those seeking both insurance protection and investment opportunities.

Market research indicates that the appeal of universal life insurance lies in its adaptability. Policyholders have the freedom to adjust their premiums and death benefits according to their changing financial circumstances. This flexibility is particularly beneficial for individuals who want to ensure their insurance coverage keeps pace with their evolving needs. Moreover, the investment aspect of universal life insurance can be advantageous for those who prefer a more hands-on approach to managing their finances.

In summary, while the exact market share of universal life insurance policies sold may vary, it is evident that this type of insurance has captured a substantial portion of the life insurance market. The combination of insurance protection and investment potential has made universal life an attractive choice for many consumers, especially those seeking long-term financial security and flexibility. As the insurance industry continues to evolve, understanding the market share of universal life insurance becomes increasingly important for both industry players and consumers alike.

Cigna Life Insurance: Comprehensive Coverage, Peace of Mind

You may want to see also

Consumer Trends: How has the popularity of universal life insurance changed over time?

The popularity of universal life insurance has experienced a notable evolution over the years, reflecting shifting consumer preferences and economic landscapes. In the early 2000s, universal life insurance gained traction as a popular alternative to traditional whole life insurance. This surge in popularity can be attributed to several factors. Firstly, the flexibility it offers was appealing to consumers who wanted more control over their insurance policies. Unlike traditional whole life insurance, which provides a fixed premium and death benefit, universal life insurance allows policyholders to adjust their premiums and death benefits over time, providing a level of customization that resonated with many.

Secondly, the economic climate played a significant role in its growing popularity. During this period, the stock market was performing well, and investors were seeking opportunities to grow their money. Universal life insurance, with its investment component, offered a way to potentially increase the value of the policy over time, making it an attractive option for those looking to make the most of their insurance premiums. As a result, many consumers opted for universal life insurance, especially those who wanted to tie their insurance coverage to investment opportunities.

However, the financial crisis of 2008 brought about a shift in consumer behavior and attitudes towards insurance products. The crisis led to a more cautious approach among investors, and many individuals re-evaluated their financial strategies. As a result, the demand for universal life insurance decreased, as some consumers sought more stable and guaranteed options. This period marked a temporary setback for the product, with sales declining as consumers favored safer, more traditional insurance products.

Despite this setback, universal life insurance has continued to adapt and evolve to meet changing consumer needs. In recent years, there has been a resurgence in its popularity, driven by a renewed interest in long-term financial planning and the desire for personalized insurance solutions. Modern consumers are increasingly seeking insurance products that align with their individual goals and risk tolerances. Universal life insurance, with its adjustable features, allows policyholders to tailor their coverage to their specific needs, making it an appealing choice for those who value flexibility and customization.

Additionally, the rise of digital platforms and online insurance marketplaces has made it easier for consumers to compare and purchase various insurance products, including universal life insurance. This accessibility has further contributed to its growing popularity, as more people are now able to explore and understand the benefits of this type of insurance. As a result, the percentage of all life insurance sold that is universal life has likely increased, reflecting a more informed and diverse consumer base.

Check Your SBI Life Insurance Status: Quick and Easy Steps

You may want to see also

Regional Variations: Do certain regions have higher universal life insurance sales?

The sales of universal life insurance vary significantly across different regions, influenced by a multitude of factors including economic conditions, cultural attitudes, and regulatory frameworks. Understanding these regional variations is crucial for insurance providers, financial advisors, and consumers alike, as it can impact sales strategies, product offerings, and consumer behavior.

In North America, particularly the United States, universal life insurance has seen substantial growth. This can be attributed to the region's mature insurance market, where consumers are more inclined to invest in long-term financial planning. The availability of favorable tax treatment for life insurance policies in the US has also played a pivotal role in driving sales. For instance, in states like New York and California, where insurance markets are highly regulated and competitive, universal life policies often offer higher cash values and more flexible premium payments, making them attractive to high-net-worth individuals and those seeking tax-efficient wealth accumulation.

In contrast, the European market presents a different picture. While universal life insurance is available in many European countries, its adoption rates vary widely. Countries like the United Kingdom and Switzerland have a strong tradition of private pension plans and savings-oriented financial products, which have historically been more popular than life insurance. However, in recent years, there has been a growing interest in universal life policies, especially among the affluent population, due to the perceived benefits of long-term wealth preservation and tax efficiency.

Asia-Pacific regions exhibit a diverse landscape for universal life insurance sales. In countries like Japan and South Korea, traditional savings and pension systems are well-established, which has led to a more cautious approach towards life insurance. However, in regions like China and India, where the middle class is expanding rapidly, there is a growing awareness of the importance of financial security and long-term wealth planning. This shift in mindset has resulted in a surge in universal life insurance sales, particularly among the younger, more affluent demographic.

Regulatory and economic factors also play a significant role in shaping regional variations. For instance, regions with favorable tax regulations on life insurance, such as certain European countries and the US, tend to witness higher sales of universal life policies. Additionally, economic stability and growth can influence consumer confidence, with more prosperous regions often showing higher insurance penetration rates.

In conclusion, the sales of universal life insurance are not uniform across regions, and understanding these variations is essential for industry players. Economic, cultural, and regulatory factors significantly influence consumer preferences and behavior, impacting the growth and adoption of universal life insurance in different parts of the world.

Employer's Right to Cancel Group Life Insurance: Explained

You may want to see also

Demographic Factors: Are certain age groups or income brackets more likely to buy universal life?

When considering the purchase of universal life insurance, it is important to understand the demographic factors that influence this decision. Age is a significant determinant, as younger individuals often have a longer life expectancy, which can make universal life insurance more appealing due to its flexibility and potential for long-term savings. This type of policy allows policyholders to build cash value over time, providing a financial cushion and the option to borrow against it. As a result, younger individuals may be more inclined to opt for universal life as a long-term financial strategy.

On the other hand, older individuals might view universal life insurance as a way to secure their financial legacy. With a shorter life expectancy, they may prioritize ensuring their loved ones are financially protected. Universal life insurance can provide a sense of security, allowing older individuals to leave a financial cushion for their beneficiaries. Additionally, older adults may have accumulated more wealth and assets, making them more likely to consider investing in universal life as a way to optimize their financial resources.

Income level also plays a crucial role in the decision to purchase universal life insurance. Higher-income earners often have more disposable income and may view universal life as an investment opportunity. The potential for long-term savings and the ability to build cash value can be attractive to those with substantial financial resources. They may also be more inclined to take on the higher premiums associated with universal life insurance.

However, lower-income individuals might face different considerations. They may prioritize more immediate financial needs and concerns, such as covering daily expenses and securing basic necessities. As a result, they might opt for term life insurance, which provides coverage for a specific period without the long-term savings component of universal life. Lower-income earners may also be more price-sensitive and prefer policies with lower premiums, even if they lack the long-term investment features of universal life.

In summary, demographic factors significantly influence the decision to purchase universal life insurance. Younger individuals and those with higher incomes may be more inclined to choose universal life due to its flexibility and potential for long-term savings. Older adults and those with substantial financial resources may view it as a way to secure their legacy and optimize their wealth. Meanwhile, lower-income individuals might prioritize more immediate financial needs and opt for term life insurance instead. Understanding these demographics can help insurance providers tailor their offerings to specific customer segments.

IRS and Spouse Life Insurance: Tax Implications?

You may want to see also

Regulatory Impact: How do regulations influence the sales of universal life insurance?

The regulatory environment plays a pivotal role in shaping the sales of universal life insurance, a type of life insurance that offers flexibility in premium payments and death benefits. Regulations can either facilitate or hinder the growth of this product, depending on their design and implementation. One of the primary ways regulations influence universal life insurance sales is through the establishment of clear guidelines and standards. These standards ensure that the product is sold ethically and transparently, providing consumers with the necessary information to make informed decisions. For instance, regulations may require insurers to disclose the long-term cost implications of various universal life policies, helping customers understand the value proposition and make choices that align with their financial goals.

Moreover, regulations can impact the sales of universal life insurance by affecting the overall cost of doing business for insurers. Stringent rules and compliance requirements can increase operational costs, which may be passed on to consumers in the form of higher premiums. This can potentially reduce the attractiveness of universal life insurance, especially for those seeking more affordable coverage options. On the other hand, well-designed regulations can also stimulate innovation in the market. By setting clear parameters, insurers are encouraged to develop new products that meet regulatory standards while offering unique benefits to customers. This can lead to a more diverse and competitive market, ultimately benefiting consumers.

In recent years, the regulatory landscape for universal life insurance has evolved to address specific concerns. For example, regulations may focus on protecting consumers from misleading sales practices or ensuring that the product's complexity is adequately explained. These measures are crucial in building trust and confidence among consumers, which is essential for the long-term success of the industry. Additionally, regulations can influence the distribution channels for universal life insurance. Certain rules may favor direct sales or encourage the use of licensed financial advisors, impacting the way insurers reach and engage with potential customers.

The impact of regulations on universal life insurance sales is also evident in the area of risk management. Regulators often mandate that insurers maintain sufficient capital to back their commitments, ensuring that policyholders' interests are protected. This aspect of regulation is particularly important in the context of universal life insurance, where policyholders have the flexibility to adjust their coverage over time. By setting capital requirements, regulators provide a safety net for policyholders, even in the event of insurer financial distress.

In summary, regulations have a profound impact on the sales of universal life insurance, shaping the market's dynamics and consumer behavior. While some regulations may present challenges for insurers, they also contribute to a more robust and consumer-friendly market. Striking the right balance in regulatory design is essential to fostering innovation, ensuring transparency, and ultimately driving the growth of universal life insurance products that meet the diverse needs of consumers. Understanding these regulatory influences is crucial for insurers, financial advisors, and policymakers alike.

Insurable Interest: When Life Insurance Becomes Legally Binding

You may want to see also

Frequently asked questions

Universal life insurance accounts for a relatively small portion of the total life insurance market. According to various industry reports, it typically represents around 5-10% of all life insurance policies sold. This percentage can vary depending on factors such as geographic location, market trends, and the specific insurance providers and their product offerings.

In recent years, there has been a slight increase in the popularity of universal life insurance. This growth can be attributed to several factors, including improved product features, lower costs compared to traditional whole life insurance, and the flexibility it offers to policyholders. However, it's important to note that the overall market share of universal life insurance remains relatively small compared to other types of life insurance policies.

When compared to other life insurance products, universal life insurance often has a lower market share. Term life insurance, for example, is typically the most popular and accounts for a significant portion of sales. Whole life insurance also holds a substantial market share. While universal life insurance offers certain advantages, it may not be as widely chosen due to its complexity and the availability of more straightforward and cost-effective alternatives.