Life insurance is a crucial financial safety net for families and loved ones. It can help replace lost income, cover debts and funeral costs, and provide a tax-free inheritance. While it is a necessity for many, it is also often misunderstood. For instance, the cost of term life insurance is often overestimated. In 2019, 48% of Americans had term life insurance, down from 52% in 1998. However, the face value of these policies has increased over time. Term life insurance is a popular choice, especially among Millennials and Gen X, who are more likely to have it than other generations. Despite this, 99% of term policies never pay out, often due to policyholders letting their policies lapse. As of 2025, roughly 60% of Americans have some form of life insurance, but half of them are underinsured.

What You'll Learn

Millennials and Gen X are more likely to own term life insurance

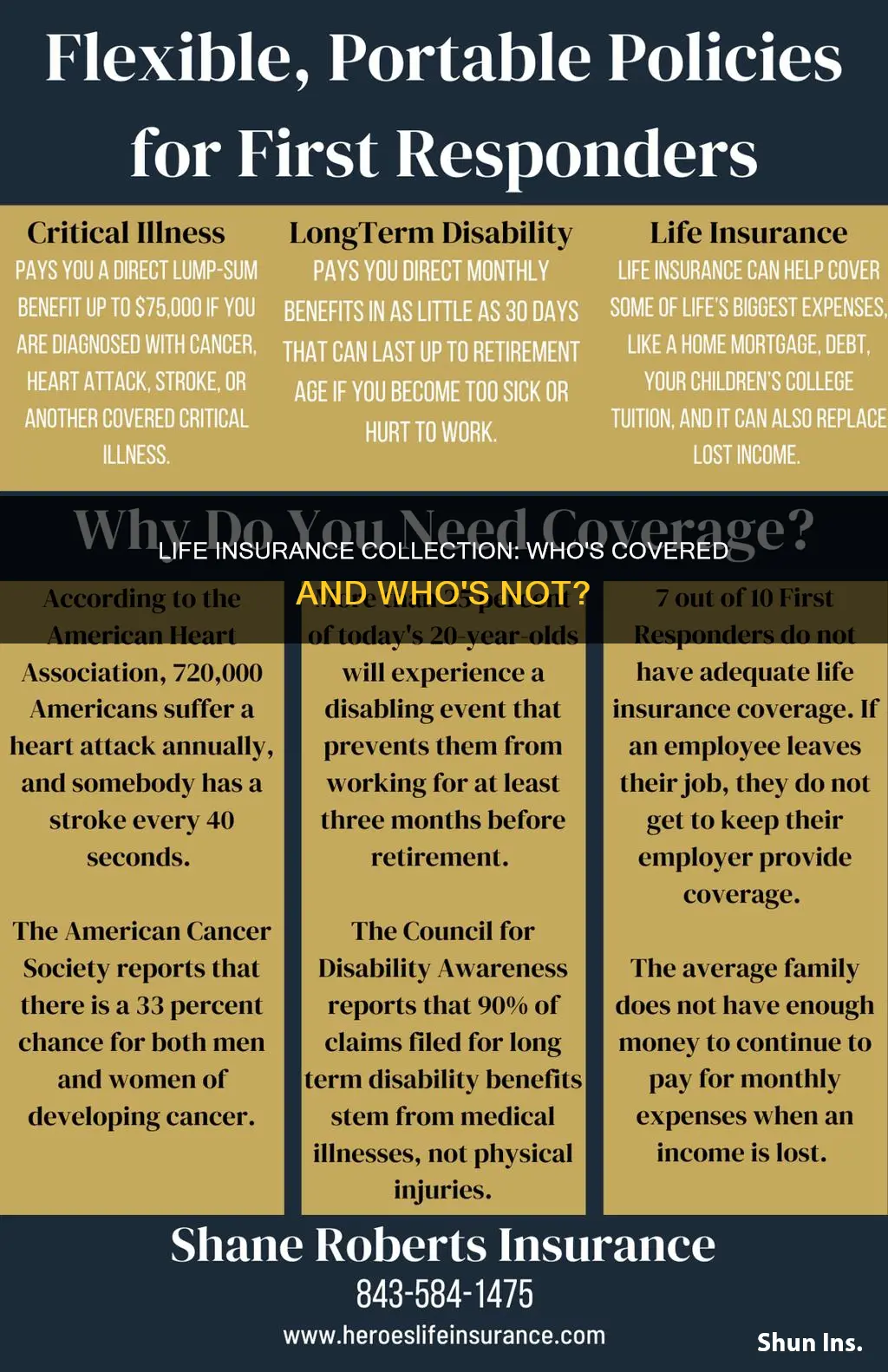

Life insurance is a valuable financial tool that can protect loved ones financially in the event of the policyholder's death. The death benefit can be used to replace lost income, cover outstanding debts, pay for final expenses, or provide a tax-free inheritance to beneficiaries. While many people lack adequate coverage or any life insurance policy at all, millennials (ages 28-43) and Gen X (ages 44-59) are leading the way in term life insurance ownership, with 50% and 55% ownership, respectively. These generations are significantly more likely to own term life insurance when compared to younger and older generations.

There are several reasons why millennials and Gen X are more inclined to invest in term life insurance. Firstly, they have experienced significant economic and social disruptions due to technological advances, globalization, and political unrest, resulting in higher levels of financial insecurity than previous generations. This has created a sizable wealth gap and impacted their financial outlook and priorities. Additionally, the COVID-19 pandemic has heightened their awareness of mortality and the importance of financial preparedness, with 45% of millennials surveyed in 2021 stating that they are more likely to purchase life insurance due to the pandemic.

Another factor contributing to the higher ownership rates among millennials and Gen X is their increased financial literacy and planning. Millennials, in particular, are turning towards digital platforms and online resources to educate themselves about financial planning and investment options. They are also more likely to seek expert advice from agents while utilizing digital application processes to purchase life insurance. This combination of digital convenience and personalized guidance makes acquiring life insurance more accessible and appealing to these generations.

Furthermore, millennials and Gen X may recognize the value of life insurance in addressing their financial concerns. With rising costs of living, they worry about their ability to pay for necessities, save for retirement, and achieve short-term goals. Life insurance can provide a sense of financial security and protection against unforeseen circumstances. However, it is important to note that common myths and misunderstandings about life insurance coverage and costs still exist among these generations, which may impact their decision-making.

In conclusion, millennials and Gen X are more likely to own term life insurance due to a combination of factors, including heightened financial insecurity, the impact of the global pandemic, increased financial literacy, and the recognition of life insurance as a protective tool against financial challenges. These generations are taking steps to secure their financial future and protect their loved ones, contributing to the overall growth and revitalization of the life insurance industry.

GM Retiree Benefits: Life Insurance Coverage Explained

You may want to see also

99% of term policies never pay out

While term life insurance is a popular choice, it's important to note that 99% of term policies never pay out a claim. This is primarily due to policyholders letting their policies lapse. Term life insurance policies do not allow for the withdrawal of funds, and with time, the impact of inflation can significantly erode the value of the policy. For instance, a $250,000, 20-year term policy with 4% annual inflation will lose 56% of its value over those two decades.

Term life insurance is a form of insurance that provides coverage for a specified period, often 10 years or more. The premiums are generally predictable and remain constant throughout the term. However, as the policyholder ages, their premium amount may increase by 8-10% on average each year. Age can also determine whether an individual qualifies for coverage, with the maximum approval age ranging from 70 to 85 years old.

In contrast to whole life insurance, term life insurance does not allow policyholders to build cash value over time. This means that funds contributed to the policy cannot be withdrawn. While term life insurance is typically more affordable, especially for younger individuals, whole life insurance offers the advantage of accumulating cash value, which can be accessed while the policy is active. Whole life insurance also provides the stability of a fixed premium price, protecting policyholders from inflation.

When considering term life insurance, it's essential to be aware of its limitations. Term life insurance may not cover accidental death, death by self-inflicted injuries, hazardous activities, intoxication, drug overdose, homicide, or natural disasters. Additionally, term life insurance policies may be rescinded, resulting in non-payment of claims. Understanding these exclusions and the potential for non-payment is crucial when deciding between term life insurance and other options like whole life insurance or universal life insurance.

While term life insurance has its drawbacks, it remains a popular choice, especially among Millennials and Gen X, who are more likely to opt for term life insurance than other generations. This preference may be due to the lower cost of term life insurance, which averages around $20 per month for a 10-year, $500,000 policy for a healthy 40-year-old male. However, it's worth noting that many Americans lack sufficient coverage or any life insurance policy at all, with about 33% believing they are underinsured.

Life Insurance Payouts After Suicide: What Families Need to Know

You may want to see also

50% of people with life insurance will struggle to cover expenses

While the percentage of people who have term life insurance varies across different sources, it is evident that a significant proportion of the population lacks sufficient coverage. According to a Forbes Advisor report, about five out of ten Americans (50%) do not have any life insurance or have inadequate coverage. This highlights a gap between the coverage people have and the amount they need.

Several factors contribute to this disparity. One of the main reasons is the misconception about the cost of life insurance. Many people assume that life insurance is more expensive than it actually is. This misconception often arises from a lack of understanding about how life insurance works and the factors that determine its cost. Age, gender, health history, and lifestyle choices, such as nicotine use, driving record, and criminal history, all play a role in calculating life insurance premiums.

The type of policy chosen also affects the cost. Term life insurance, for example, is generally cheaper than whole life insurance, which offers additional features and allows for cash value accumulation. However, it's important to note that term life insurance policies do not allow for cash value withdrawals, and the policyholder cannot withdraw their contributions at any time. Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured as long as premium payments are maintained and offers the ability to build cash value.

The COVID-19 pandemic has also influenced people's perspectives on life insurance. It has increased the push for individuals to secure affordable life insurance, especially among younger generations like Gen Z and millennials. According to the 2023 Insurance Barometer Study, a record-high 39% of consumers intended to purchase life insurance within the next year, with even higher percentages among Gen Z (44%) and millennials (50%). This shift in mindset reflects a growing recognition of the value of life insurance and a desire for greater financial security and preparedness.

Despite the increasing interest in life insurance, the struggle to cover expenses persists. This is particularly evident in the case of single mothers, who often face a heightened sense of financial concern. While they have a higher need for life insurance as the sole source of financial support for their children, only 41% of single mothers reported having life insurance, significantly below the general population rate. This gap in coverage can potentially leave their loved ones vulnerable to financial hardships in the event of an untimely death.

American Life Insurance: Legit or a Scam?

You may want to see also

Life insurance costs increase 8-10% on average per year of age

While the exact percentage of people who collect term life insurance is unclear, several surveys and studies provide insights into the ownership and trends of life insurance policies. According to a 2023 Insurance Barometer Study, 39% of consumers intended to purchase life insurance within the next year, with higher percentages among Gen Z adults (44%) and millennials (50%). This study also found that parents of minor children were more likely to own life insurance (59%) compared to the general population (52%).

Separating the data by generation, 50% of millennials (ages 28-43) own life insurance, while Gen X (ages 44-59) and Baby Boomers (ages 60-78) have higher ownership percentages at 55% and 57%, respectively. Interestingly, Gen Z represents the highest number of individuals with a need for more coverage (49%), indicating a potential increase in life insurance ownership in the future.

The cost of life insurance is a significant factor influencing ownership. The average cost of life insurance is $26 per month, based on a 40-year-old purchasing a 20-year, $500,000 term life policy, the most common option. However, life insurance costs increase with age, and the premium amount rises by 8-10% for every year of age. This increase is much more pronounced at older ages, with an average increase of 86% between ages 60 and 65.

Other factors that influence life insurance rates include gender, health status, job, weight, smoking status, and family health history. Men tend to pay more than women due to shorter life expectancies and riskier jobs and lifestyles. Additionally, health indicators such as blood pressure, smoking, and cholesterol levels impact rating classifications, which directly affect the rates.

Life insurance is a long-term commitment, typically lasting 10 years or more. The shorter the term, the cheaper the annual rates. Additionally, the type of policy, such as term or whole life insurance, also impacts the cost. Whole life insurance policies are significantly more expensive but offer the ability to build cash value, which can be withdrawn while the policy is active.

Group Term Life Insurance: Taxable in Canada?

You may want to see also

39% of consumers intend to purchase life insurance within the year

The percentage of people who have term life insurance has decreased over the years. In 1998, 52% of people had term life insurance, while in 2019, only 48% did. However, the median face value of these policies increased from $60,000 to $110,000 during this period. This decrease in the number of people with term life insurance may be due to the assumption that it is more expensive than it actually is. In reality, the average cost of a term life insurance policy is about $20 per month.

Despite this, there seems to be a growing interest in life insurance. According to the 2023 Insurance Barometer Study, 39% of consumers said they intended to purchase life insurance within the next year. This proportion was even higher for Gen Z adults (44%) and millennials (50%), indicating a recognition of the value of life insurance among younger generations. This trend continued into the third quarter of 2024, with most types of life insurance coverage, including term life insurance, seeing notable increases.

The COVID-19 pandemic may have contributed to this increased interest in life insurance. The pandemic highlighted the importance of financial preparedness, as individuals and families sought to protect themselves and their loved ones in the event of unforeseen circumstances. Life insurance provides a financial safety net, ensuring that beneficiaries can replace lost income, cover outstanding debts, pay for final expenses, or receive a tax-free inheritance.

While the interest in life insurance is encouraging, it also reveals a coverage gap. Overall, 52% of American adults report owning life insurance, but 41% of adults, both insured and uninsured, feel they do not have sufficient coverage. This gap is particularly pronounced among younger generations, with only 40% of Gen Z adults and 48% of millennials reporting having life insurance. Nearly half of these generations feel they need to either get coverage or increase their protection.

Uncovering Your Parent's Legacy: Life Insurance Discovery

You may want to see also

Frequently asked questions

As of 2025, 54% of people in the US are covered by some type of life insurance, which includes term life insurance. However, in 2019, 48% of Americans had term life insurance, down from 52% in 1998.

Approximately 60% of Americans have some sort of life insurance policy. However, 50% of people are underinsured, meaning their plan isn't enough to cover expenses in the event of death.

According to the 2023 Insurance Barometer Study, 39% of consumers intended to purchase life insurance within the next year. This proportion is higher for Gen Z adults (44%) and millennials (50%).

Many people don't have life insurance or lack sufficient coverage because they assume it's more expensive than it actually is. 99% of term policies never pay out a claim, which may be due to policyholders letting their policies lapse because of the cost.