Life events can significantly impact an individual's health insurance coverage and eligibility. These events, such as marriage, the birth of a child, or a change in employment status, can trigger specific actions and requirements for health insurance providers. Understanding what qualifies as a life event is crucial for individuals to navigate their insurance options effectively and ensure they have the necessary coverage for their changing circumstances. This knowledge empowers people to make informed decisions and take appropriate actions to maintain their health insurance benefits.

What You'll Learn

- Births and Adoptions: New life arrivals trigger policy adjustments and premium changes

- Marriages and Divorces: Legal unions or separations often impact coverage and costs

- Relocation: Moving to a new area may require changes in insurance providers

- Job Loss or Change: Significant employment shifts can affect coverage and eligibility

- Health Status Changes: Diagnoses, treatments, or recovery can lead to policy modifications

Births and Adoptions: New life arrivals trigger policy adjustments and premium changes

Births and adoptions are significant life events that can have a substantial impact on an individual's or family's health insurance coverage and costs. When a new life is brought into the family, it often necessitates a review and potential adjustment of existing health insurance policies. Here's a detailed breakdown of how these life events can affect health insurance:

Policy Adjustments: When a child is born or adopted, it is crucial to inform your health insurance provider promptly. This is because the birth or adoption qualifies as a 'life event' under most insurance policies, which triggers a requirement to update your coverage. Insurance companies may need to adjust the policy to accommodate the new dependent, ensuring that the coverage meets the family's needs. This could involve adding the new family member to the policy, updating the coverage type, or making changes to the policy's benefits and exclusions. For instance, a family's health insurance might need to be amended to include pediatric-specific coverage, additional dependent benefits, or specialized services for the newborn.

Premium Changes: The arrival of a new child can lead to changes in insurance premiums. Insurance providers often calculate premiums based on various factors, including the number of covered individuals, their age, health status, and the specific benefits included in the policy. With the addition of a newborn or adopted child, the insurance company may increase the premium to account for the expanded coverage. This adjustment ensures that the policy adequately covers the healthcare needs of the new family member. It is essential for policyholders to be aware of these potential premium changes and plan their finances accordingly.

Special Considerations: In some cases, the birth or adoption of a child may also trigger other policy adjustments. For instance, if the child has a pre-existing condition or requires specialized medical care, the insurance provider might need to offer additional coverage or accommodations. Moreover, certain insurance plans may have specific provisions for newborn care, including well-baby visits, immunizations, and emergency services. Policyholders should review their insurance documents to understand these provisions and ensure they are adequately covered.

Timely Action: It is imperative to act promptly when a life event occurs. Insurance companies often have grace periods or specific timelines for reporting life events to avoid penalties or the loss of coverage. Missing these deadlines could result in a temporary lapse in insurance benefits or additional fees. Therefore, individuals should stay informed about their insurance policy's requirements and take the necessary steps to update their coverage promptly after a birth or adoption.

In summary, births and adoptions are significant life events that can lead to policy adjustments and premium changes in health insurance. Being proactive in informing the insurance provider and understanding the potential impact on coverage and costs is essential for ensuring that the family's healthcare needs are met effectively.

Whole Life Insurance: Cash Surrender Value After Modifications?

You may want to see also

Marriages and Divorces: Legal unions or separations often impact coverage and costs

Marriages and divorces are significant life events that can have a substantial impact on an individual's health insurance coverage and costs. When you get married, you and your spouse typically gain access to a combined health insurance plan, which can offer more comprehensive coverage and potentially lower premiums. This is because insurance providers often consider the combined income and health factors of both individuals, which can result in more favorable rates. Additionally, married couples may be eligible for spousal benefits, such as dependent coverage for children or extended family members, further enhancing their insurance benefits.

On the other hand, divorce can lead to changes in insurance coverage as well. When a marriage ends, individuals may need to make adjustments to their insurance plans. One of the critical considerations is determining who will be responsible for the health insurance coverage. In many cases, the ex-spouse may continue to be covered under the original plan for a certain period, especially if the divorce was amicable and both parties agreed to maintain coverage. However, if the divorce is complex or contentious, the individual may need to seek new insurance coverage, which could result in higher costs, especially if they have pre-existing conditions or require specialized care.

During the divorce process, it is essential to review and update your insurance information promptly. This includes notifying your insurance provider of the divorce and any changes in your marital status. Failure to do so could result in unexpected coverage gaps or financial burdens. In some cases, individuals may need to switch to a different insurance plan, which could involve higher premiums, especially if they are no longer eligible for group coverage through their former spouse's employer.

Furthermore, marriages and divorces can also trigger other life events that impact health insurance, such as changes in income, tax status, and dependent coverage. For instance, getting married often results in a combined income, which may affect tax brackets and, consequently, insurance premiums. Similarly, divorces can lead to changes in tax status, as individuals may no longer be able to claim each other as dependents. These adjustments can significantly influence the overall cost and coverage of health insurance.

In summary, marriages and divorces are critical life events that can directly affect health insurance coverage and costs. Understanding the implications of these legal unions and separations is essential for individuals to make informed decisions about their insurance plans. By staying proactive and promptly updating their insurance information, individuals can ensure they receive the appropriate coverage and manage their healthcare expenses effectively during these significant life transitions.

Credit Cards with Life Insurance: What's the Deal?

You may want to see also

Relocation: Moving to a new area may require changes in insurance providers

Relocation can significantly impact your health insurance needs, and it's essential to understand how this life event can trigger changes in your coverage. When you move to a new area, several factors come into play that may necessitate adjustments to your insurance plan. Firstly, the healthcare facilities and medical professionals available in your new location might differ from those in your previous area. Researching and identifying in-network providers in your new region is crucial to ensure that your insurance covers the costs of your medical care effectively. This process involves contacting your insurance company and inquiring about the network of healthcare providers in your new location, allowing you to make informed decisions about your healthcare options.

Additionally, the cost of living and healthcare expenses in your new area can vary, which may affect your insurance premiums. Moving to a region with a higher cost of living might lead to increased insurance costs, as healthcare services and medications could be more expensive. Conversely, if you move to an area with lower healthcare costs, your insurance premiums might decrease. It is advisable to review your insurance policy and understand how these regional variations impact your coverage and out-of-pocket expenses.

Another critical aspect of relocation is the potential change in your employment status and, consequently, your insurance coverage. If your new location offers different employment opportunities, you might need to consider alternative insurance options, especially if your current employer-provided plan is not available or does not transfer easily. Exploring individual health insurance plans or market-based options can ensure that you maintain comprehensive coverage during your transition.

When you relocate, it is also essential to consider the specific health needs and challenges that your new environment might present. For example, if you are moving to an area with a higher prevalence of certain health conditions or unique environmental factors, your insurance should provide adequate coverage for these specific circumstances. Understanding these regional health trends can help you make informed decisions about your insurance plan and ensure that you have the necessary coverage for any potential health issues.

In summary, relocating to a new area is a significant life event that can impact your health insurance in various ways. From finding in-network providers to managing regional healthcare costs and employment-based coverage, careful consideration and proactive steps are required to ensure a smooth transition. Being proactive in reviewing and adjusting your insurance plan will help you navigate this life event with confidence and maintain comprehensive health coverage throughout your move.

Expat Life Insurance: Is It Possible to Get Covered?

You may want to see also

Job Loss or Change: Significant employment shifts can affect coverage and eligibility

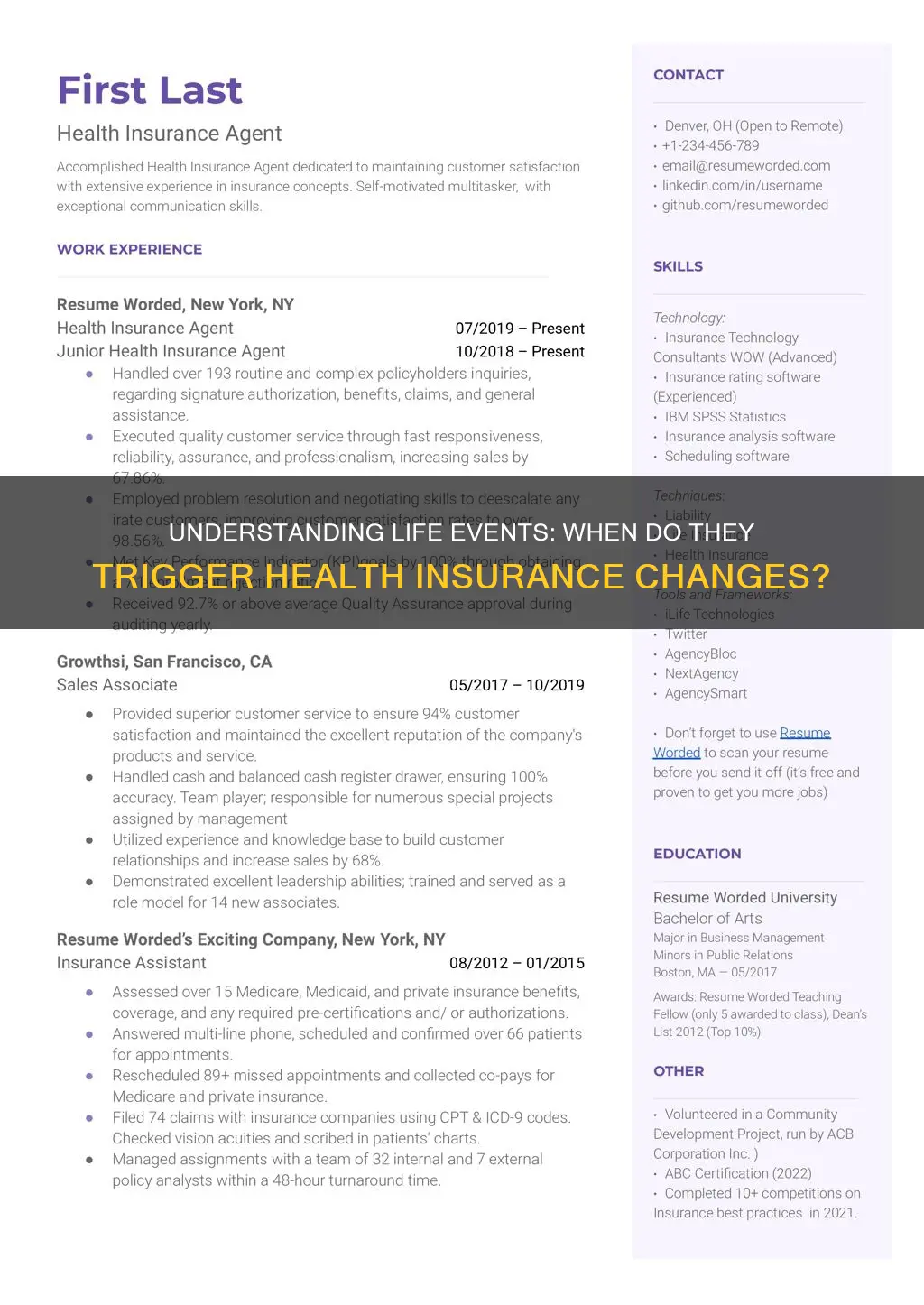

Significant changes in employment status, such as job loss or a major career shift, can have a substantial impact on an individual's health insurance coverage and eligibility. When these life events occur, it is crucial to understand the potential implications and take appropriate actions to ensure continued access to healthcare benefits. Here's a detailed guide on how these employment transitions can affect health insurance:

Job Loss: When an individual loses their job, it triggers a series of events that may directly impact their health insurance. Firstly, the loss of employment often means the end of employer-sponsored group health insurance. Many employers offer health coverage as a benefit, and when an employee leaves, this coverage typically ceases. This sudden change can leave individuals without health insurance, especially if they were previously covered by a comprehensive plan. During this period, it is essential to explore alternative coverage options, such as purchasing a private health insurance plan or enrolling in a government-subsidized program like Medicaid or the Affordable Care Act (ACA) marketplace, depending on individual circumstances.

Career Transitions: Significant career changes, such as transitioning to a new industry or starting a new job, can also affect health insurance. When individuals change careers, their new employer may offer different benefits packages, including health insurance. It is important to review the new employer's benefits and understand the coverage provided. Sometimes, individuals may need to make adjustments to their existing coverage, especially if the new job offers a different level of coverage or requires specific health insurance plans. This transition period may also involve a temporary gap in coverage, requiring individuals to consider short-term health insurance options or COBRA (Continuation of Coverage) to maintain their current insurance during the transition.

Impact on Eligibility: Employment shifts can influence an individual's eligibility for certain health insurance programs. For instance, the ACA's marketplace offers subsidies and tax credits to make health insurance more affordable for those with moderate incomes. However, these subsidies are income-based, and a significant change in employment can affect income levels, potentially impacting eligibility for these subsidies. Similarly, Medicaid eligibility is often tied to income and household size, so a change in employment status might require individuals to re-evaluate their eligibility for this public health insurance program.

Taking Action: When facing job loss or a significant employment change, proactive steps are essential to maintain health insurance coverage. Individuals should promptly notify their current insurance provider about the employment transition. Many insurance companies have processes in place to handle such changes, and they may offer options to continue coverage or provide guidance on transitioning to new plans. Additionally, exploring the options available through the ACA's marketplace or other state-based exchanges can provide access to a range of health insurance plans, ensuring individuals can find suitable coverage during this period of transition.

In summary, significant employment shifts, such as job loss or career transitions, can have a direct impact on health insurance coverage and eligibility. Understanding the potential consequences and taking timely action is vital to ensure individuals can access the healthcare they need during these life events. Being proactive and informed about available options can help individuals navigate these changes effectively.

Universal Life Insurance: Is It Worth the Hype?

You may want to see also

Health Status Changes: Diagnoses, treatments, or recovery can lead to policy modifications

Health insurance policies often include provisions for policy modifications in response to significant life events, including changes in health status. When an individual's health condition undergoes a substantial transformation, it can trigger a review and potential adjustment of their insurance coverage. This process is designed to ensure that the policy remains appropriate and adequate for the individual's evolving needs. Here's a detailed look at how health status changes can lead to policy modifications:

Diagnosis of a New Condition: When a person is diagnosed with a new medical condition, it can significantly impact their insurance policy. Insurance companies typically review existing policies to determine if the new diagnosis qualifies for coverage. For instance, if a person is diagnosed with a chronic illness like diabetes or heart disease, their insurance provider might adjust the policy to include specific treatments, medications, or regular check-ups related to this condition. This ensures that the policyholder receives appropriate care and that the insurance company covers the necessary expenses.

Treatment Initiation or Modification: The commencement or alteration of treatment can also prompt policy changes. If a person starts a new treatment regimen, such as a complex surgery, a course of intensive therapy, or a long-term medication plan, their insurance policy may need to be updated. Insurance providers often review the treatment plan to ensure it is covered under the policy. This review might lead to adjustments in the policy's benefits, including coverage for specific medications, hospital stays, or follow-up appointments.

Recovery and Improved Health: In some cases, a person's recovery from a significant health issue can result in policy modifications. For example, if an individual has undergone a major surgery and is now in the recovery phase, their insurance policy might be adjusted to accommodate post-operative care, rehabilitation, and follow-up visits. As the individual's health improves, the insurance provider may reassess the policy to reflect the reduced need for certain benefits, potentially leading to cost savings for the policyholder.

Regular Health Assessments: Health insurance policies often include provisions for regular health assessments or check-ups. These assessments can identify new health concerns or changes in existing conditions. When such changes are detected, insurance companies may initiate policy modifications to address these new health status developments. This proactive approach ensures that the policy remains relevant and beneficial to the policyholder's long-term health management.

In summary, health status changes, including diagnoses, treatments, and recovery, are critical factors in determining whether a policy modification is necessary. Insurance providers closely monitor these changes to ensure that the policyholder receives appropriate coverage and that the insurance company's obligations are met. Being aware of these potential modifications can help individuals navigate the complexities of health insurance and make informed decisions regarding their healthcare and coverage.

Life Insurance Traps: Can Trail Commissions Be Revoked?

You may want to see also

Frequently asked questions

Life events such as marriage, divorce, the birth of a child, adoption, or the loss of a dependent are significant milestones that can qualify as life events. These events often lead to changes in an individual's or family's health insurance needs.

If you experience a change in employment, such as losing your job or changing employers, it can be a qualifying life event. This may allow you to enroll in a new health plan or make changes to your existing coverage, especially if you become eligible for employer-sponsored insurance or a government-subsidized program.

Yes, relocating to a different geographic area can be a valid reason to review and potentially update your health insurance. This is because the cost of healthcare and insurance plans can vary significantly by region, and you may need to find a new provider or plan that suits your needs in your new location.

A major change in health status, such as a new medical condition, diagnosis, or significant treatment, can be a life event. This may trigger a need to update your insurance coverage to ensure it adequately covers your medical expenses and provides the necessary support for your health needs.

Yes, attending or enrolling in a new educational institution can be a qualifying life event. This could include starting college, changing schools, or a dependent child's enrollment in school, which may require adjustments to your health insurance coverage to accommodate the unique healthcare needs of students or dependents.