There are many reasons why your insurance might change, and it's important to ask the right questions to ensure you're getting the best coverage for your needs. Some key questions to consider are:

- What has changed in my life that might impact my insurance needs? This could include changes in marital status, family structure, income, or property ownership.

- Am I getting the right type of insurance for my current situation? For example, do I need health, home, car, or life insurance, or a combination of these?

- What is my budget, and what can I afford in terms of premiums and deductibles?

- What is and isn't covered by my insurance plan? Are there any exclusions or circumstances where benefits won't be paid out?

- Is my insurance provider reputable and financially stable?

- How easy is it to get support and advice with this plan?

By asking these questions, you can ensure that your insurance coverage is up-to-date and adequate for your changing needs.

What You'll Learn

What questions should I ask about health insurance?

When choosing a health insurance plan, there are several important questions to ask to ensure that you get the right coverage for your needs and budget. Here are some key questions to consider:

Cost and Coverage:

- What type of plan is it? Find out if it is an indemnity health plan or a managed care system. With indemnity plans, you typically pay a percentage of medical costs, while the insurer pays the rest, and you can often choose your own doctors. With managed care, such as an HMO or PPO, you have minimal out-of-pocket expenses but more restricted provider choices.

- How much will you have to pay for medical care? Consider the monthly premium, co-payments, deductibles, and out-of-pocket maximums.

- What benefits are included? Check if the plan covers dental, vision, prescriptions, routine examinations, and any other specific services you may need.

- Are there extra perks and benefits? Some plans offer unexpected benefits like health coaches, gym membership discounts, or virtual clinic visits.

- Are your doctors covered by this plan? Ensure that the doctors and clinics you want to visit are included in the plan's network to keep costs down.

- What happens when you're away from home? Understand if and how the plan covers medical care when you are travelling.

- Is the insurer financially stable? Check how long the company has been in business to ensure they are reputable and can offer stable coverage.

- How does the company handle disputes over claims? Understand the process for appealing denied claims and the average turnaround time for resolving disputes.

- What does the plan pay for and what does it exclude? Most plans have essential health benefits they must cover, but it's important to know any exclusions and limitations.

- Do you have coinsurance or a copay? Understand how much you will need to pay out-of-pocket for these and how often.

- Are your prescriptions covered? Check if your medications are on the plan's list of covered drugs (the "formulary").

- Are there limits on receiving a service? Find out if there are any caps on the number of times you can receive a particular service.

- Are there requirements to get your care covered? Determine if you need prior authorization for certain services and how to obtain it.

- Does the plan exclude coverage for some types of care? Understand any specific exclusions, especially related to pre-existing conditions.

Life Changes and Flexibility:

- Will this plan still be right for you if your needs change? Consider how the plan will accommodate life changes, such as moving, getting a new job, having a baby, or developing a serious health condition.

- Do you want flexibility in choosing specialists or services? Compare HMO and PPO plans, as PPOs often offer more flexibility in choosing providers but typically come with higher monthly premiums.

Other Practical Considerations:

- Who will your health plan cover? Consider how many people need coverage and their expected medical needs.

- Are there specific providers or facilities you want to use? Verify that your preferred doctors, clinics, or hospitals are part of the plan's network to avoid higher out-of-pocket costs.

- Will your plan cover the medical care you need? Ensure that the plan covers any known medical expenses for you or your family, including prescriptions, chronic condition care, home medical equipment, and planned procedures.

- How much can you afford to pay? Assess the plan's premiums, deductibles, co-pays, and co-insurance fees against your budget to ensure you can manage any unexpected costs.

By asking these questions, you can make an informed decision about your health insurance plan, ensuring it meets your unique needs and budget.

Understanding Insurance Applications: Unraveling the 'Representation' Clause

You may want to see also

What questions should I ask about life insurance?

Life insurance is a contract between an insurance policyholder and an insurer, where the insurer promises to pay a designated beneficiary a sum of money in exchange for a premium, upon the death of the insured person. Other events, such as terminal illness or critical illness, can also trigger payment.

What kind of life insurance policy should I get?

There are two main types of life insurance: term insurance and permanent insurance. Term life insurance provides coverage for a specified number of years and will provide a death benefit if you pass away while your policy is active. Permanent life insurance, on the other hand, is intended to cover the policyholder for their entire life as long as premiums are paid. Permanent insurance can be further divided into whole, universal, variable, and variable universal life insurance.

How much life insurance do I need?

This will depend on how much your loved ones will need financially to maintain their current lifestyles, as well as how much debt you're in and how long it will take to pay it off. A common rule of thumb is to get coverage that's 6 to 12 times your annual salary, but this may vary depending on your circumstances.

How much does a life insurance policy cost?

The cost of your life insurance policy will depend on factors such as your age, gender, lifestyle, the type of life insurance you need, and your medical status. Anything that could potentially impact your health, such as your job or hobbies, can increase your risk level and influence your rate.

Will my life insurance provide living benefits?

Some life insurance policies provide living benefits that the insured party can access while they are still alive. These may include coverage for terminal illness, long-term care, or short-term care.

What life insurance benefits are guaranteed?

While death benefits are typically guaranteed if you pass away while your policy is active, there are certain instances where a claim may be denied, such as if you die by suicide within the policy's contestability period or if the company determines that you misrepresented your health during the application process.

What if my health changes?

If your health improves, you may be able to undergo another medical exam and underwriting process to potentially decrease your premium. If your health declines and you become disabled, some policies provide benefits such as waiving premiums.

What if I need more coverage in the future?

Your life insurance needs may change as you age, so it's important to consider a policy that offers flexibility. With a term life insurance policy, you may need to add a term conversion rider if you foresee needing to extend your coverage after your term expires.

Do I really need life insurance?

If anyone is dependent on your salary to sustain their standard of living, then you should consider what life insurance options work best for you. Life insurance can help cover the cost of burial, rent or mortgage payments, bills, and remaining medical costs.

Accessing Your Suncoast Insurance Bill: A Step-by-Step Guide

You may want to see also

What questions should I ask about car insurance?

When it comes to car insurance, there are many factors to consider and questions to ask to ensure you get the best deal and the right level of coverage for your needs. Here are some key questions to ask when reviewing car insurance options:

Understanding Your Policy

- What types of coverage does the insurance company offer?

- What is included in the basic car insurance coverage, and what additional coverages can I add?

- What is the excess, and how does it affect my premium?

- Are there any additional fees or hidden costs when claiming?

- Are other drivers covered if they drive my car?

- Is my vehicle covered for market, trade, or retail value?

- What is the turnaround time for claims?

- Are there any limitations on where or when I can drive my car?

- Does the insurance company offer any discounts?

Understanding Your Needs

- How many miles/kilometres do I drive each year/month?

- Will I be using my car for work or commercial purposes?

- What type of car do I drive, and what are the associated risks (e.g. theft statistics, value, performance, etc.)?

- Where do I park my car, and how secure is the parking area?

- Who else will be driving my car, and do I need to list them on my policy?

- What are the legal requirements for car insurance in my state/area?

- Is my car financed, leased, or owned outright?

Understanding Your Costs

- What is my deductible, and how does it affect my insurance bill?

- What is my premium, and how is it calculated?

- Are there any discounts I can get (e.g. multi-policy, safe driver, good student, etc.)?

- How can I lower my premium (e.g. through security measures, higher excess, etc.)?

- What happens if I miss a payment or pay late?

By asking these questions, you can make a well-informed decision about your car insurance, ensuring you have the right coverage at a cost that fits your budget.

The Hammer Clause: Understanding Insurance Policies' "Get Tough" Provision

You may want to see also

What questions should I ask about home insurance?

When it comes to home insurance, there are several questions you should ask to ensure you have the right coverage for your needs. Here are some essential questions to consider:

What does a standard home insurance policy cover?

Standard home insurance policies typically include four main types of coverage: dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. Dwelling coverage protects your home's physical structure, while personal property coverage insures the belongings inside your home. Liability coverage takes care of any bodily injuries sustained by someone in your home, and additional living expenses coverage provides for extra costs if you need to live elsewhere temporarily due to displacement.

Do I need separate flood insurance?

Flood insurance is rarely included in standard home insurance policies, so if you live in an area prone to flooding or extreme weather, it's a good idea to purchase separate flood insurance. Your mortgage lender may even require this. Keep in mind that flood insurance is different from hazard insurance, which covers fire damage, theft, and damage from other natural disasters.

How are home insurance rates calculated?

Several factors influence home insurance rates. One significant factor is your claims history. If you've made multiple claims in the past, insurers may view you as a higher risk and charge higher rates. The condition and age of your home, structural issues, and the neighbourhood's safety also play a role. Larger homes generally cost more to insure, as they are more expensive to replace.

How much home insurance do I need?

It's crucial to strike a balance when deciding on the amount of insurance coverage. You don't want to be underinsured, but you also don't want to pay for more coverage than you need. Consider your financial situation and long-term plans. If you intend to stay in your home for an extended period, you may want the option to restore your home to its original value, which means opting for replacement cost coverage.

What should my deductible be?

Your deductible is the amount you pay out of pocket before your insurance company covers the remaining repair costs. A higher deductible typically results in lower annual insurance premiums. However, if you choose a higher deductible, be prepared to contribute more towards repairs if your home sustains damage.

How much personal liability protection do I need?

Personal liability protection shields you from financial responsibility if someone is injured on your property. This coverage is typically included in your home insurance policy and isn't purchased separately. The standard amount is $100,000, but you can increase this limit if you feel you need more protection.

How can I save on my home insurance?

There are several strategies to reduce your home insurance costs. One approach is to minimise risk. For instance, installing a security system or deadbolt locks can lower your chances of theft claims, while smoke detectors and sprinkler systems can reduce the likelihood of fire damage claims. Additionally, you can take advantage of discounts, such as bundling your home and auto insurance policies, which often results in a multi-policy discount.

Navigating Out-of-Network Glasses Insurance: A Comprehensive Guide to Billing and Benefits

You may want to see also

What questions should I ask about insurance for valuables?

When it comes to insurance for valuables, there are several questions you should ask to ensure you have the right coverage for your needs. Here are some essential questions to consider:

What type of insurance do I need for my valuables?

Ask your insurance agent about the different types of insurance policies available for covering valuables. For example, you may need a separate rider or endorsement for high-value items such as jewellery, fine art or antiques. Understand the limitations of your current policy and whether additional coverage is necessary.

How much coverage do I need for my valuables?

Assess the value of your valuables and determine if your current policy provides sufficient coverage. Consider getting a professional appraisal for high-value items to ensure they are adequately insured. You may need to increase your coverage limits or add a rider to your policy to properly insure valuable possessions.

Are there any exclusions or limitations to my coverage?

Understand what is specifically covered and what is excluded under your policy. For example, ask about coverage limits, deductibles, and any circumstances under which a claim may be denied. Clarify if there are any geographical limitations, especially if you travel frequently or live in an area prone to natural disasters.

What steps should I take to protect my valuables?

Inquire about preventative measures you can take to reduce the risk of loss or damage to your valuables. This may include installing security systems, using safe deposit boxes, or taking other proactive steps to safeguard your possessions. Ask your insurance agent about any discounts or incentives offered for implementing recommended security measures.

What documentation do I need for my valuables?

Maintain detailed records of your valuables, including receipts, appraisals, and photographs. This documentation will be crucial in the event of a claim. Ask your insurance agent about any specific requirements for documenting and inventorying your valuables.

How do I file a claim for lost or damaged valuables?

Understand the claims process and what steps you need to take if your valuables are lost, stolen, or damaged. Ask about the timeframe for filing a claim, the documentation required, and the process for reimbursement or replacement of your valuables. Knowing this information in advance will help ensure a smoother claims process if the need arises.

Updating Your Email Address with Hagerty Insurance: A Step-by-Step Guide

You may want to see also

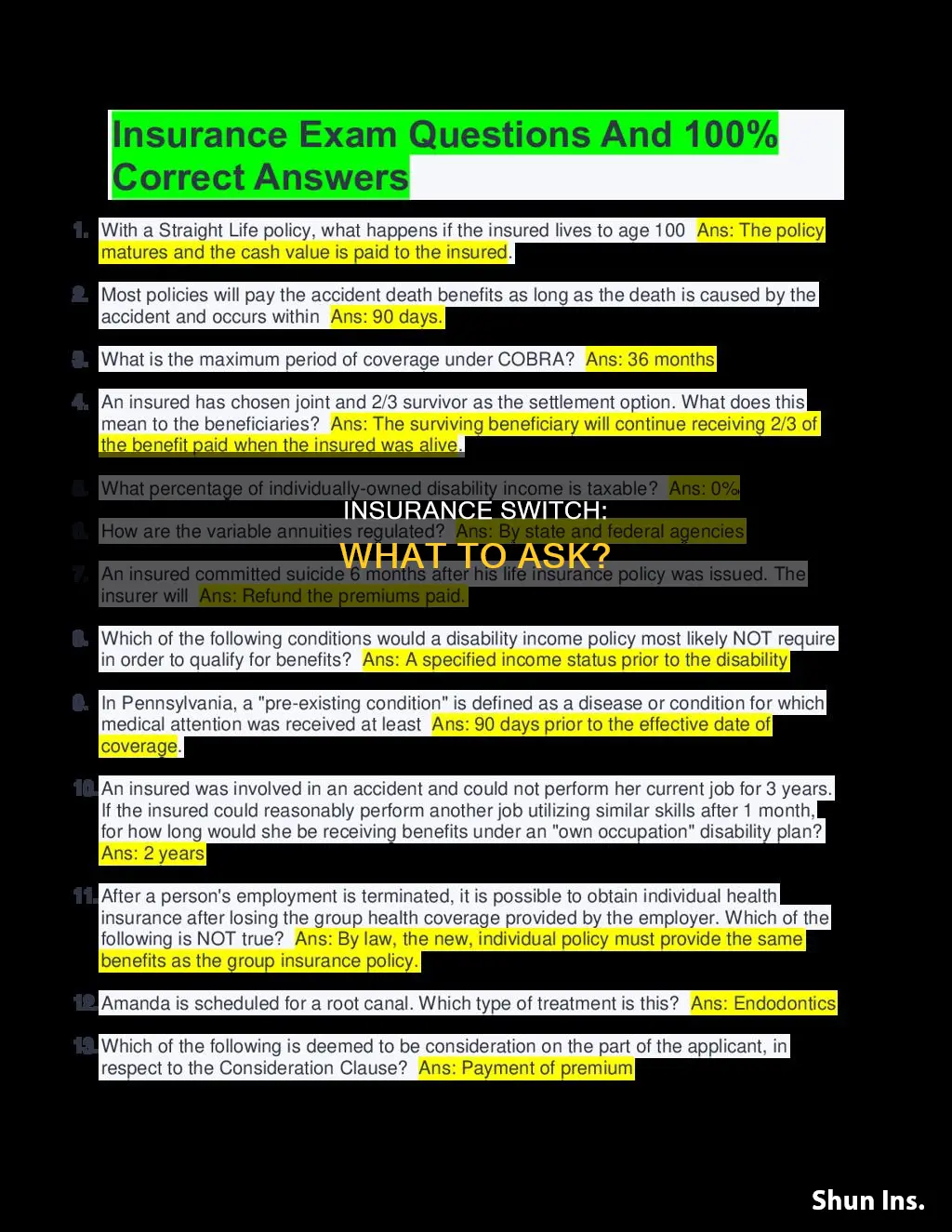

Frequently asked questions

Ask about the monthly and annual premium, the deductible, and the out-of-pocket maximum. Inquire about the coverage network and whether your doctors are included. Also, ask about prescription drug coverage and alternative therapy coverage.

Review your insurance coverage, especially if you get married, divorced, have a baby, or adopt a child. These life changes can impact your insurance needs and you may need to update your policies.

If your income increases, review your life and disability insurance to ensure it aligns with your new financial commitments. If your income decreases, consider reducing your life insurance premiums or switching to a more affordable type of policy, such as term life insurance.

Inquire about the address where the vehicle is kept, the make and model of the car, the number of drivers in your household, and the primary use of the vehicle. Also, ask about the presence of an anti-theft device, the status of your license, your marital status, and your occupation. These factors can impact your insurance rates.