When considering life insurance, it's crucial to understand the various factors that can influence your decision. The right policy should align with your unique needs and financial goals, offering both financial protection and peace of mind. Key aspects to evaluate include the coverage amount, which should adequately support your dependents in the event of your passing, and the policy's duration, ensuring it remains relevant throughout your life stages. Additionally, consider the policy's flexibility, allowing adjustments as your circumstances change, and the insurer's reputation for reliability and customer service. By carefully assessing these elements, you can make an informed choice, ensuring your loved ones are protected and your financial future is secure.

What You'll Learn

- Coverage Needs: Assess your financial obligations and choose appropriate coverage

- Policy Types: Understand term, whole life, and universal life policies

- Benefits and Riders: Explore additional benefits and riders for customization

- Premiums and Affordability: Evaluate premium costs and ensure affordability over time

- Company Reputation: Research the financial strength and reputation of insurance providers

Coverage Needs: Assess your financial obligations and choose appropriate coverage

When considering life insurance, one of the most crucial aspects is understanding your coverage needs, which directly relates to your financial obligations and future commitments. This process involves a thorough assessment of your current and potential future expenses to ensure that your insurance policy provides adequate financial protection for your loved ones. Here's a detailed guide to help you navigate this essential step:

Identify Your Financial Responsibilities: Start by making a comprehensive list of all your financial obligations. This includes regular expenses such as mortgage or rent payments, car loans, student loans, credit card debts, and any other long-term financial commitments. Also, consider one-time expenses that might arise in the future, such as the cost of your child's education or a planned home renovation. By listing these, you can get a clear picture of the financial impact your death could have on your dependents.

Calculate Potential Future Expenses: Life insurance is not just about covering current expenses; it's also about providing for future financial needs. Consider the long-term financial goals of your family. This could include funding your children's education, ensuring a comfortable retirement for your spouse or partner, or even covering the cost of a future business venture. Calculate these potential expenses to determine the total amount of coverage required.

Determine the Coverage Amount: The coverage amount you choose should be sufficient to meet your identified financial obligations and future goals. A common rule of thumb is to purchase life insurance equal to 10 to 15 times your annual income. However, this is just a starting point. You may also want to consider the cost of funeral expenses, which can vary significantly depending on your preferences and location. Additionally, review your policy regularly to ensure it keeps up with your changing financial situation.

Consider Additional Benefits: Beyond the basic coverage, life insurance policies often offer various optional benefits. These can include critical illness coverage, disability insurance, or accidental death benefits. Assess whether these additional features align with your specific needs and provide value for your premium dollars. For instance, critical illness coverage can provide financial support if you are diagnosed with a serious illness, while disability insurance can replace your income if you become unable to work.

Review and Adjust Regularly: Life insurance needs can change over time due to various life events, such as marriage, the birth of a child, or a career change. It's essential to review your policy periodically and adjust the coverage amount as necessary. This ensures that your insurance remains relevant and effective in providing financial security for your loved ones.

Banks Selling Insurance: Unemployed, Covered or Exploited?

You may want to see also

Policy Types: Understand term, whole life, and universal life policies

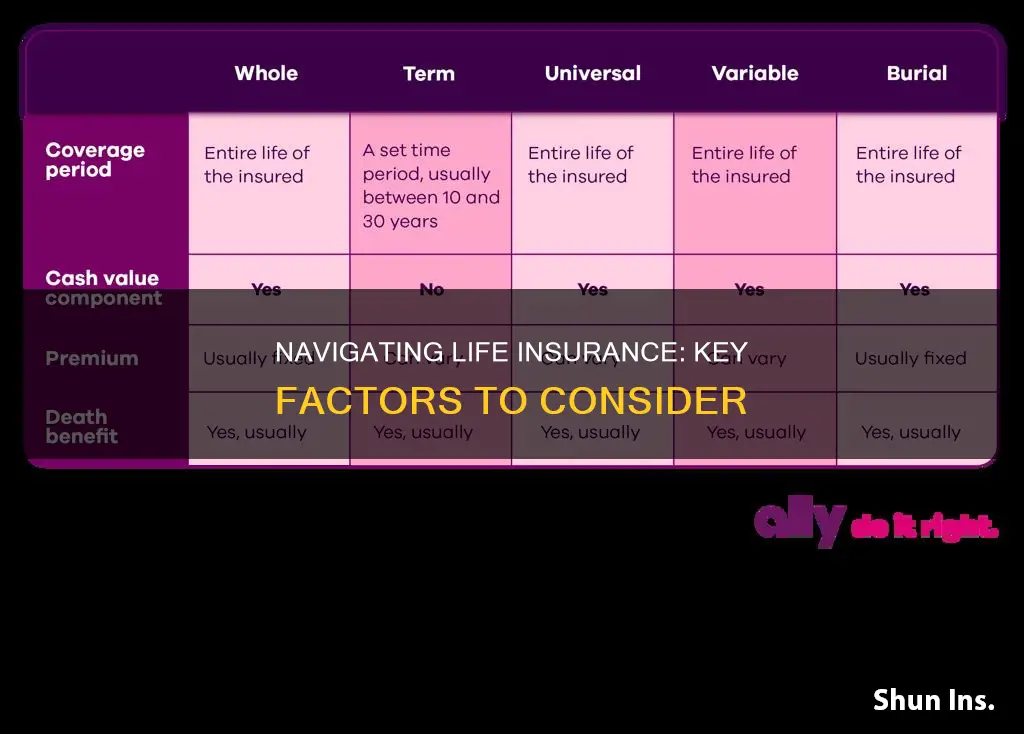

When considering life insurance, it's crucial to understand the different policy types available to ensure you choose the right coverage for your needs. Here's an overview of the three primary policy types: term life, whole life, and universal life.

Term Life Insurance: This is a straightforward and cost-effective type of policy that provides coverage for a specified period, known as the 'term.' It is ideal for individuals seeking temporary protection, often for a specific financial goal or period, such as covering mortgage payments or providing financial security for children's education. Term life insurance offers a fixed death benefit if the insured person passes away during the term. The premiums are typically lower compared to other policy types, making it an attractive option for those on a budget. However, it's important to note that term life insurance does not accumulate cash value, and the coverage ends once the term is over, requiring you to renew or purchase a new policy if needed.

Whole Life Insurance: In contrast, whole life insurance provides lifelong coverage, as the name suggests. It offers a combination of insurance protection and an investment component. With whole life, you pay a fixed premium throughout your life, and the policy builds cash value over time, which can be borrowed against or withdrawn. This type of policy provides a guaranteed death benefit, ensuring your beneficiaries receive the full amount upon your passing. The cash value accumulation can be a significant advantage, allowing you to build a substantial fund that can be used for various financial purposes. However, whole life insurance is generally more expensive than term life due to the long-term commitment and the investment aspect.

Universal Life Insurance: This policy offers flexibility and adaptability, providing permanent coverage with a focus on long-term financial benefits. Universal life insurance allows you to adjust your premiums and death benefits over time, providing more control and customization. It also accumulates cash value, which can be invested and grow tax-deferred. One of the key advantages is the ability to borrow against the cash value, providing access to funds when needed. Universal life policies typically have higher minimum death benefits and offer a flexible premium payment system. This type of policy is well-suited for those seeking both insurance protection and an investment vehicle that can adapt to changing financial goals.

Understanding the differences between term, whole life, and universal life policies is essential in making an informed decision. Each type has its own advantages and considerations, and the choice depends on your specific financial goals, budget, and long-term plans. It is recommended to consult with a financial advisor or insurance professional to determine the most suitable policy type that aligns with your needs and provides the necessary coverage for your loved ones.

Broker Fees on Life Insurance: What You Need to Know

You may want to see also

Benefits and Riders: Explore additional benefits and riders for customization

When considering life insurance, it's essential to delve beyond the basic coverage and explore the additional benefits and riders that can significantly enhance your policy. These features provide customization, ensuring your insurance plan aligns perfectly with your unique needs and goals. Here's a breakdown of what to look for:

Benefits:

Life insurance policies often come with a range of benefits that go beyond the core death benefit. These benefits can provide financial security and peace of mind. Common benefits include:

- Accidental Death Benefit: This rider ensures that if the insured person dies as a result of an accident, the beneficiary receives the full death benefit, potentially providing additional financial support.

- Critical Illness Rider: This rider offers financial assistance if the insured person is diagnosed with a critical illness, such as cancer or heart attack. It can help cover medical expenses and provide income replacement during treatment.

- Disability Income Rider: If the insured person becomes disabled and unable to work, this rider provides a regular income stream to replace lost wages. It offers financial security during challenging times.

- Long-Term Care Rider: This benefit is crucial for individuals who want to plan for potential long-term care needs. It provides coverage for nursing home or assisted living expenses, ensuring financial protection for yourself and your loved ones.

Riders:

Riders are optional add-ons to your life insurance policy, allowing you to customize coverage according to your specific requirements. Here's how to make the most of them:

- Term Life with Convertibility: This rider allows you to convert your term life insurance into a permanent policy (whole life) after a certain period. It provides flexibility, ensuring you have long-term coverage without the need for a new application process.

- Return of Premium: With this rider, you receive a refund of your premiums paid if you outlive the term period. It's beneficial for those who want to ensure they get something back from their insurance investment.

- Guaranteed Income Benefit: This rider guarantees a minimum income stream for the beneficiary, providing a steady financial flow even if the insured person dies early.

- Childrider or FamilyRider: These riders extend coverage to your children or family members, ensuring they are protected even if the primary breadwinner passes away.

When reviewing life insurance options, carefully assess these benefits and riders to find the ones that best suit your circumstances. Customizing your policy with the right add-ons can provide comprehensive financial protection and peace of mind. Remember, the goal is to create a tailored plan that addresses your specific needs and offers the necessary support for your loved ones.

Absolute Assignment: Life Insurance Beneficiary Transfer

You may want to see also

Premiums and Affordability: Evaluate premium costs and ensure affordability over time

When considering life insurance, one of the most critical aspects to evaluate is the premium cost. The premium is the amount you pay regularly (usually monthly or annually) to maintain your life insurance policy. It's essential to understand that the cost of a policy can vary significantly depending on several factors, including your age, health, lifestyle, and the type of policy you choose.

To ensure affordability, start by assessing your financial situation. Calculate your monthly or annual income and expenses to determine how much you can comfortably allocate towards insurance premiums. It's important to strike a balance between adequate coverage and financial responsibility. A good rule of thumb is to ensure that your life insurance premiums are manageable and don't strain your budget.

Age plays a significant role in determining premium costs. Younger individuals often benefit from lower premiums as they are considered less risky by insurance companies. As you age, premiums tend to increase due to the higher likelihood of health-related issues. Therefore, if you're considering long-term coverage, it's advisable to purchase a policy at a younger age when premiums are typically more affordable.

Another factor influencing premium prices is your health and lifestyle. Insurance companies may request medical examinations or ask about your medical history to assess your overall health. Factors such as smoking, excessive alcohol consumption, or pre-existing medical conditions can significantly impact premium rates. Maintaining a healthy lifestyle and managing any health issues can help keep premiums lower.

Additionally, the type of life insurance policy you choose will affect the premium. Term life insurance, which provides coverage for a specified period, generally has lower premiums compared to permanent life insurance, which offers lifelong coverage. Understanding these differences will enable you to make an informed decision based on your long-term financial goals and needs.

Felons Selling Life Insurance: Is It Possible?

You may want to see also

Company Reputation: Research the financial strength and reputation of insurance providers

When considering life insurance, one of the most critical aspects to evaluate is the financial stability and reputation of the insurance company. This is because the financial health of the insurer directly impacts your ability to receive the promised benefits in the event of a claim. Here's a breakdown of why and how to assess this:

Why Company Reputation Matters:

Life insurance policies often span decades, and you want to ensure that the company you choose will be around to honor its commitments. A financially stable insurer is less likely to face insolvency, which could leave you without the coverage you need. Additionally, a reputable company is more likely to have the resources to efficiently process claims, providing you with the support you deserve during difficult times.

Researching Financial Strength:

Financial strength ratings are a crucial tool for assessing an insurance company's financial stability. These ratings, provided by independent agencies like A.M. Best, Moody's, and Standard & Poor's, evaluate the insurer's ability to meet its financial obligations. Look for companies with "A" or "A-" ratings or higher, indicating a strong financial position.

Online Reviews and Customer Feedback:

While financial ratings are essential, they don't tell the whole story. Online reviews and customer feedback can provide valuable insights into the actual experience of policyholders. Pay attention to common themes in reviews, such as claim processing efficiency, customer service quality, and overall satisfaction.

Longevity and History:

A company with a long history and a strong track record is often a good indicator of reliability. Established insurers have likely weathered economic downturns and market fluctuations, demonstrating their resilience. However, be cautious of very old companies that have been in business for decades but have a history of financial troubles or scandals.

Transparency and Communication:

A reputable insurer will be transparent about its financial health and policies. They should provide clear information about their ratings, financial reports, and any potential risks associated with their business. Open communication regarding financial matters is a positive sign and ensures you have all the necessary information to make an informed decision.

Understanding MEC: Life Insurance's Essential Clause

You may want to see also

Frequently asked questions

Life insurance is a financial safety net designed to provide financial security and peace of mind for your loved ones in the event of your untimely death. It ensures that your family can maintain their standard of living, cover essential expenses, and achieve their financial goals even if you're no longer there to provide.

The choice depends on your individual needs and circumstances. Term life insurance offers coverage for a specified period, typically 10, 20, or 30 years, and is often more affordable. Permanent life insurance, such as whole life or universal life, provides lifelong coverage and includes a savings component, making it a more expensive option. Consider your financial goals, the duration of coverage needed, and your budget when making this decision.

Several factors influence the cost of life insurance. Age is a significant determinant, as younger individuals typically pay lower premiums. Your overall health, including any pre-existing medical conditions, plays a crucial role. Lifestyle factors like smoking, excessive alcohol consumption, or dangerous hobbies can also impact rates. Additionally, the amount of coverage you choose and your occupation may affect the premium.

Yes, it is possible to obtain life insurance with pre-existing health conditions, but it may be more challenging and expensive. Insurers often consider factors like the severity and management of the condition. Some companies offer specialized policies for individuals with health issues, while others may require a medical examination and may deny coverage or charge higher premiums. It's essential to disclose all relevant health information accurately during the application process.