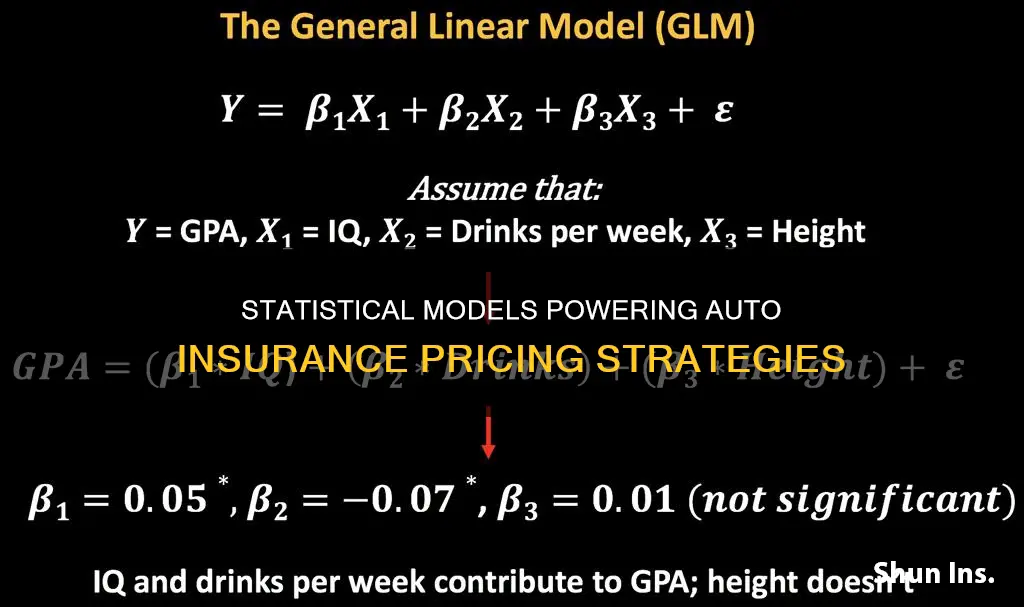

The cost of auto insurance is determined by a range of factors, from the type of car to the driver's age, gender, and location. To calculate insurance premiums, insurance companies use statistical models that take into account various variables. One of the most commonly used models in the auto insurance industry is the Generalized Linear Model (GLM), which combines the conditional expectation of claim frequency with the expected claim amount. This model helps determine the pure premium based on observable characteristics of the policyholders. Another model that has gained attention from researchers and actuarial pricing professionals is the Generalized Additive Model (GAM), which is an extension of the GLM and allows for the inclusion of non-linear components and interactions between different variables. These models enable insurance companies to assess risk and set premiums accordingly.

| Characteristics | Values |

|---|---|

| Statistical model | Generalized Linear Models (GLM) |

| Extension of GLM | Generalized Additive Models (GAM) |

What You'll Learn

Generalised Linear Models

The number of claims is a random variable and, based on Pearson's chi-squared test, it is assumed that the number of claims on a contract follows a Poisson distribution. The expected value of a Poisson-distributed random variable is equal to its variance, leading to heteroskedasticity. Therefore, the classical linear regression model cannot be used. Instead, GLMs are used with a Poisson-distributed response variable and a logarithmic link function to guarantee positivity.

The GLMs approach is compared with the commonly used linear regression model, highlighting the advantages of GLMs in handling non-normal data and allowing for multiplicative effects on the mean. The simplicity of the model is also important for its use in practice.

In the context of auto insurance, GLMs are used to predict the relation of annual claim frequency on given risk factors. The models are compared using analysis of deviance and Akaike Information Criterion (AIC) to select the model that best estimates annual claim frequency.

A case study based on a large real-world sample of data from 57,410 vehicles proposed a classification analysis approach that addresses the selection of predictor variables. The best model included three factors: the age group of the policyholder, vehicle age, and area of residence. This demonstrates the importance of certain factors in determining insurance premiums.

In summary, GLMs are a valuable tool for modelling actuarial data and have become the standard approach in many countries for tariff analysis in the insurance industry. They offer flexibility in handling various types of variables and distributions while providing interpretability and ease of implementation.

Removing Relatives from Your Auto Insurance

You may want to see also

Generalised Additive Models

GAMs are applied to near-miss event data from a sample of drivers to identify the risk factors associated with a higher risk of near-miss occurrence. The study reveals that certain factors are associated with a higher expected number of near-miss events, which may be useful when implementing dynamic risk monitoring through telematics. GAMs are also used to model loss frequency and severity involving both categorical and continuous numerical variables. The additivity nature of GAMs maintains the desired model interpretability in terms of the significance of contribution by each component. The ease of producing variable importance measures associated with each component makes GAMs even more interpretable in explaining which risk factors contribute more or less.

From an actuarial pricing perspective, some monotonic functions, such as the relativity function of driving records, may be required and must be imposed on pricing. GAMs provide flexibility in specifying the functionality of the given predictor based on the need, resulting in more practically applicable predictive modelling techniques for rate regulation purposes. GAMs are also used to reduce the dimension of output model parameters, which is particularly important and meaningful when adding additional variables from Usage-Based Insurance (UBI) datasets to the traditional risk factors for regulation purposes. The estimation of functionality using a set of basis functions within each additive component provides an easy and intuitive explanation of the relationship between risk factors and response.

GAMs are beneficial for capturing the functional pattern of a given risk factor. The exploration of such functionality over major risk factors reveals the important non-linear relationship between major risk factors and claim probability or amounts. Moreover, the additive nature of its components in the GAM model helps improve its interpretability.

Rental Car Insurance: Is It Worth the Extra Cost?

You may want to see also

Driving record

A person's driving record is a key factor in determining the cost of their car insurance. A good driving record will generally result in lower insurance premiums, while a history of accidents or traffic violations will lead to higher costs. Insurance companies view a driver with a history of infractions as a higher risk and will charge them more for coverage.

In the United States, each state maintains a record of an individual's driving history, including any violations or accidents. Most states use a points system to quantify the severity of driving violations, with more serious infractions, such as speeding or running a stop sign, resulting in a higher number of points. Accumulating a certain number of points within a given period can lead to a suspended license. For example, in California, a driver will be suspended for four points in a year, six points in two years, or eight points within three years.

When calculating insurance premiums, insurance companies typically look back at an individual's driving record for the past three years, though some may check records as far back as seven to ten years. Minor violations, such as a single speeding ticket, can result in a 10% to 15% increase in insurance premiums. More serious violations, such as reckless driving or driving under the influence (DUI), can lead to significantly higher premiums, with some companies increasing rates by up to 300%. A DUI conviction can also result in a permanent criminal record, impacting future sentencing for any criminal charges.

In addition to insurance costs, a bad driving record can have far-reaching consequences. It can affect an individual's credit score, career prospects, and even their right to vote in some cases. For instance, an unpaid traffic ticket can result in additional fees and, if left unpaid, can be turned over to a collection agency, damaging one's credit rating. A DUI or reckless driving charge may be classified as a felony in some states, resulting in the loss of certain rights, such as holding public office or receiving federal aid for education.

Therefore, maintaining a clean driving record is essential for keeping insurance costs low and avoiding negative repercussions in other areas of life.

Endurance Auto Insurance: Is It Worth the Hype?

You may want to see also

Location

Insurers calculate the likelihood of an auto accident based on the county or state in which the insured lives. The more populated an area is, the higher the chance of an accident. Urban drivers pay a higher price than those in small towns or rural areas due to higher rates of vandalism, theft, and accidents. The likelihood of an accident also increases with the number of miles driven, so residents in rural areas who travel long distances as part of their daily routine are more likely to be in an accident. This is reflected in the higher-than-average insurance rates in states like Montana.

The risk of vehicle theft or vandalism is calculated based on the city or neighborhood in which the insured lives. Car theft and vandalism typically occur when a vehicle is parked, so the location of parking (on the street or in a secure garage) is an important factor in determining insurance rates. Living in a neighborhood with high theft or vandalism rates will result in higher insurance premiums.

Other location-based factors that affect insurance rates include the frequency and cost of litigation, medical care and car repair costs, prevalence of insurance fraud, and weather trends. For example, states prone to harsh weather conditions like hail storms, such as Oklahoma, tend to have higher insurance rates to cover vehicle damage.

Additionally, the minimum auto insurance limits required by a state can influence insurance rates. States with extensive claim requirements, such as Michigan, tend to have higher insurance rates to cover the cost of payouts. In contrast, states with lower minimum coverage requirements, like Wisconsin, tend to have cheaper insurance rates.

Third-Party Auto Insurance: What's Covered and What's Not

You may want to see also

Age and gender

Young drivers typically pay the most for auto insurance. Age correlates with driving experience and the risk of getting into a car accident. The high rates that young drivers pay start to go down at age 25. The best rates are usually offered to people in their 50s and early 60s, assuming they have a good driving record. Then, auto insurance rates start to creep back up again around age 65.

In most states, gender is used as a rating factor when determining car insurance premiums. Generally, men are statistically more likely to engage in risky driving behaviour and are, therefore, riskier to insure. Men typically drive more miles than women and are more likely to practice risky driving behaviours like speeding, driving under the influence of alcohol, and not wearing seat belts. According to the Insurance Institute for Highway Safety (IIHS), in nearly every year from 1975 to 2019, men died in car crashes twice as much as women. In 2019, 71% of all motor vehicle crash deaths were males.

However, as drivers age and gain more driving experience, the gender gap in rates narrows. In some age groups, women pay slightly more than men, but around age 35, average rates are the same. As drivers get older, women start paying less again.

It is important to note that not all states permit the use of age and gender as rating factors. For example, Hawaii and Massachusetts ban the use of age as a rating factor, and California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania prohibit the use of gender.

Driving Hospital Vehicles: Get Insured

You may want to see also

Frequently asked questions

The most common statistical model used in pricing auto insurance is the actuarial model, which predicts future claims and premium costs based on factors like age, driving history, and vehicle type.

Auto insurance companies use statistical models and various factors to calculate risk and set premiums. These factors include age, gender, driving record, vehicle type, location, credit score, and coverage type, among others.

The MWACP model is a statistical tool that considers risk factors such as driver age and claim frequency/severity to help insurers set premiums that reflect the actual cost of providing coverage.

Yes, some other commonly used models include the Markowitz model, the F-distribution model, and the Cox proportional hazards regression model.

Location can significantly influence auto insurance prices due to varying rates of vandalism, theft, and accidents in different areas. Urban drivers generally pay higher premiums than those in small towns or rural areas due to higher risks.