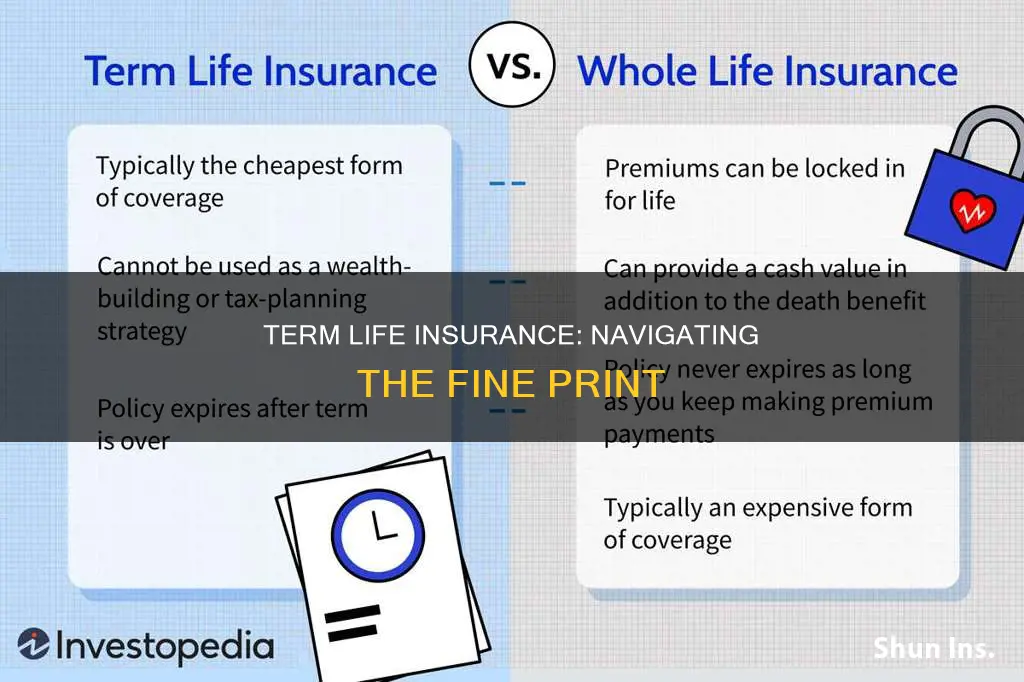

When considering term life insurance, it's crucial to understand the specific terms and conditions of the policy. One key factor is the duration of the term, which determines how long the insurance coverage will last. Additionally, review the policy's death benefit amount, ensuring it aligns with your financial needs and goals. It's essential to assess your personal and financial situation, including your age, health, and lifestyle, to determine the appropriate coverage. Furthermore, consider the insurer's reputation, customer service, and claim settlement history to ensure a reliable and trustworthy experience. Understanding these aspects will help you make an informed decision when signing up for term life insurance.

| Characteristics | Values |

|---|---|

| Coverage Amount | Determine the financial needs and select a coverage amount that provides sufficient protection for your family's expenses and future goals. |

| Term Length | Choose a term length that aligns with your financial goals and the desired level of coverage. Common terms include 10, 15, 20, or 30 years. |

| Premiums | Compare premium rates from different insurers. Consider your budget and the long-term affordability of the premiums. |

| Underwriting Process | Understand the underwriting criteria and requirements. Be transparent about your health, lifestyle, and any pre-existing conditions to ensure a smooth application process. |

| Policy Features | Look for additional features like conversion options, riders for critical illness or accident coverage, and the ability to add or decrease coverage over time. |

| Cash Value (Whole Life) | If considering whole life insurance, evaluate the potential cash value accumulation and the investment options offered by the insurer. |

| Premiums Payment Options | Decide on the payment frequency (annual, semi-annual, monthly) and method (lump sum, automatic payments) that suits your preferences. |

| Exclusions and Limitations | Review the policy's terms and conditions to understand any exclusions, limitations, and conditions that may affect your coverage. |

| Customer Service and Support | Assess the insurer's reputation for customer service, claim processing efficiency, and overall support availability. |

| Financial Stability of the Insurer | Research the financial strength and stability of the insurance company to ensure they can fulfill their obligations in the long term. |

| Tax Implications | Consider the tax treatment of life insurance proceeds and any potential tax benefits or implications for your specific situation. |

| Regular Review and Adjustment | Plan to review and potentially adjust your policy periodically to ensure it remains appropriate as your circumstances change. |

What You'll Learn

- Term Length: Choose a term that matches your coverage needs and budget

- Death Benefit: Ensure the death benefit aligns with your family's financial goals

- Premiums: Compare rates and payment options to find the best value

- Exclusions and Limitations: Understand what is not covered to avoid surprises

- Medical History: Disclose health information accurately to get approved and avoid issues

Term Length: Choose a term that matches your coverage needs and budget

When it comes to term life insurance, one of the most crucial decisions you'll make is choosing the term length. This decision directly impacts your coverage and financial security, so it's essential to understand your options and select the term that best suits your needs. The term length refers to the duration for which the policy is in effect, and it's a critical factor in determining the cost and benefits of your insurance.

The standard term lengths for life insurance policies are typically 10, 15, 20, or 30 years. Each term length offers a different level of coverage and flexibility. For instance, a 10-year term is often the most affordable, providing a temporary safety net for a specific period. This option is ideal for those who want coverage for a particular goal, such as paying off a mortgage or covering the cost of their children's education. On the other hand, a 30-year term provides long-term security, ensuring that your loved ones are protected throughout your working years and beyond.

When deciding on the term length, consider your current and future financial obligations. If you have a substantial mortgage or a long-term debt commitment, a longer term might be necessary to ensure that your family is protected in case of your untimely passing. Similarly, if you have young children or a spouse who relies on your income, a longer term could provide peace of mind, knowing that they will be financially secure for an extended period.

Additionally, your budget plays a significant role in this decision. Longer-term policies generally come with higher premiums, as the insurance company takes on a more extended risk. However, the increased coverage can be a worthwhile investment, especially if you have a long-term financial plan or a family that relies on your income. It's essential to strike a balance between your coverage needs and your financial capabilities.

In summary, choosing the right term length for your term life insurance policy is about aligning your coverage with your financial goals and obligations. It requires careful consideration of your current and future needs, as well as a realistic assessment of your budget. By selecting a term that matches your circumstances, you can ensure that you have the appropriate level of protection without unnecessary financial strain. Remember, the term length is a critical aspect of your insurance decision, and it can significantly impact the overall value and effectiveness of your policy.

Insurance or Life Insurance: What's in a Name?

You may want to see also

Death Benefit: Ensure the death benefit aligns with your family's financial goals

When considering term life insurance, one of the most critical aspects to evaluate is the death benefit, which is the amount of money paid out to your beneficiaries upon your passing. This financial payout is a cornerstone of your insurance policy and should be carefully chosen to meet your family's unique financial needs and goals.

The death benefit should be a reflection of your family's current and future financial obligations. It is essential to consider the various expenses that your loved ones might incur in the event of your death. These expenses could include mortgage payments, children's education costs, daily living expenses, and even funeral and burial arrangements. By assessing these potential costs, you can determine the appropriate death benefit to ensure your family's financial stability. For instance, if your family relies on your income to cover daily expenses and has a substantial mortgage, a higher death benefit would be necessary to bridge the financial gap until they can adjust their finances.

Moreover, it's important to consider the time frame in which your family might need the death benefit. Term life insurance policies often offer different coverage periods, such as 10, 20, or 30 years. During this term, the death benefit is guaranteed, providing a sense of security. After the term ends, the policy may convert to a permanent life insurance policy, but the premiums could increase significantly. Therefore, it's crucial to evaluate your family's long-term financial goals and ensure the death benefit covers their needs for the specified term.

Additionally, the death benefit should be adjusted for inflation to account for the rising cost of living. Over time, the purchasing power of money decreases due to inflation, meaning that a larger sum today might not provide the same level of financial security in the future. By regularly reviewing and adjusting the death benefit, you can ensure that it keeps pace with the ever-increasing cost of living.

In summary, when signing for term life insurance, the death benefit is a critical component that should be tailored to your family's specific circumstances. It should adequately cover their financial obligations, both present and future, and be adjusted for inflation to maintain its value over time. By carefully considering these factors, you can provide your loved ones with the financial security they need during a challenging period.

How Voya Life Insurance Benefits Your Adult Child

You may want to see also

Premiums: Compare rates and payment options to find the best value

When considering term life insurance, understanding the premium structure is crucial. Premiums are the regular payments you make to maintain your insurance coverage. Here's a breakdown of how to approach this aspect:

Compare Rates: Life insurance premiums can vary significantly between providers. It's essential to obtain quotes from multiple insurers to get a comprehensive understanding of the market. Rates are typically influenced by factors such as your age, health, lifestyle, and the coverage amount you desire. Younger individuals and those in good health may secure lower premiums. By comparing rates, you can identify the most competitive offers and potentially save money in the long run.

Payment Options: Insurance companies often offer flexibility in payment terms. You can choose between annual, semi-annual, or monthly payments. Annual payments are a straightforward option, but they may require a larger upfront investment. Semi-annual payments can provide a slight discount, while monthly payments offer convenience but might come with higher overall costs due to interest. Consider your financial situation and opt for a payment plan that aligns with your budget and ensures timely payments.

Review and Adjust: Life circumstances change, and so should your insurance coverage. Regularly review your policy to ensure the premium amount remains appropriate. If your financial situation improves, you might be able to increase your coverage without a substantial premium hike. Conversely, if you downsize your coverage, the premium should decrease accordingly. Staying proactive in managing your policy can help you optimize the cost-effectiveness of your term life insurance.

Long-Term Savings: Term life insurance premiums are generally lower compared to permanent life insurance. This is because term policies provide coverage for a specific period, typically 10, 20, or 30 years. By choosing a term policy, you can allocate the savings from lower premiums to other financial goals during the coverage period. This strategy allows you to build a financial cushion without compromising on essential insurance protection.

Tax Liens: Life Insurance and Federal Law

You may want to see also

Exclusions and Limitations: Understand what is not covered to avoid surprises

When considering term life insurance, it's crucial to understand the exclusions and limitations to ensure you're adequately protected. These aspects define what is not covered by the policy, and being aware of them can help you make informed decisions and avoid unexpected issues. Here's a detailed breakdown:

Common Exclusions:

- Pre-existing Conditions: Term life insurance policies often exclude coverage for pre-existing medical conditions, such as chronic illnesses, heart disease, or cancer. If you have a significant health issue, you may need to disclose it to the insurer and potentially face higher premiums or denial of coverage.

- Extreme Sports and Hobbies: Engaging in high-risk activities like skydiving, scuba diving, rock climbing, or professional racing can lead to exclusions. These activities are considered dangerous and may result in the insurer denying claims if the insured person's death is linked to these pursuits.

- Intoxication and Substance Abuse: Policies typically exclude coverage if the insured person's death is attributed to alcohol or drug intoxication. This includes accidents or health complications directly caused by excessive drinking or drug use.

- Criminal Activities: Term life insurance may exclude coverage for deaths resulting from criminal activities, such as murder, attempted murder, or participation in illegal operations.

Limitations and Restrictions:

- Age and Health Restrictions: Policies often have maximum age limits for coverage. Additionally, certain health conditions, even if they weren't pre-existing, may be excluded if they develop within a specific period after taking out the policy.

- Term Length: Term life insurance is typically designed for a specific period, such as 10, 15, or 20 years. The death benefit is only paid out if the insured person dies during this term. Once the term ends, the policy may lapse unless renewed.

- Lapse of Coverage: If you fail to make premium payments on time, your policy may lapse, and coverage could be terminated. This means the insurer will no longer be obligated to pay the death benefit.

Understanding the Exclusions and Limitations:

Carefully review the policy documents and ask the insurer to clarify any ambiguous terms. Pay close attention to the specific exclusions and limitations relevant to your circumstances. Knowing these details will help you assess the extent of your coverage and identify potential gaps in protection.

Avoiding Surprises:

- Read the Fine Print: Carefully review the entire policy document, including the exclusions and limitations section. Don't rely solely on the summary or sales materials.

- Seek Professional Advice: Consult a financial advisor or insurance specialist who can explain the policy in detail and help you choose the right coverage for your needs.

- Disclose Information Truthfully: Be transparent about your health history, hobbies, and any other relevant factors. Misrepresenting information can lead to denied claims and future coverage issues.

Life Insurance Payouts: Who Benefits and How?

You may want to see also

Medical History: Disclose health information accurately to get approved and avoid issues

When applying for term life insurance, your medical history is a critical piece of information that can significantly impact your eligibility and the terms of your policy. Insurance companies use this data to assess your risk profile and determine the premium rates and coverage options available to you. Therefore, it is essential to provide accurate and comprehensive medical details to ensure a smooth application process and avoid potential issues down the line.

Disclosing your medical history accurately is a crucial step in securing the best possible insurance coverage. This includes providing a detailed account of any past or present medical conditions, illnesses, surgeries, medications, and any relevant health-related information. Be transparent about any chronic diseases, such as diabetes, hypertension, or heart conditions, as well as any recent or past infections, injuries, or surgeries. Even minor health issues can become relevant when assessing your risk, so it's important to provide a full picture.

The key to a successful insurance application is honesty and completeness. Omitting or misrepresenting medical information can lead to several problems. Firstly, if you are found to have provided inaccurate details, the insurance company may reject your application or cancel the policy once it is discovered. This can result in financial loss and a lack of coverage when you need it most. Secondly, failing to disclose a pre-existing condition could lead to a claim being denied if the insurance company determines that the condition was not adequately considered during the underwriting process.

When reviewing your medical history, consider the following:

- Current and Past Conditions: List all current medical issues and provide a detailed account of any past illnesses or surgeries. Include the date of diagnosis, treatment, and any ongoing management or medications.

- Medications: Disclose all medications you are currently taking, including prescription drugs, over-the-counter medicines, and supplements. This is crucial as some medications can affect your health and may impact insurance rates.

- Lifestyle Factors: Be honest about lifestyle choices such as smoking, alcohol consumption, drug use, and physical activity. These factors can significantly influence your risk profile and insurance rates.

- Family Medical History: Provide information about any hereditary conditions or diseases in your family. This can help the insurance company assess your genetic risk factors.

Remember, insurance companies have access to extensive medical databases and can verify the information you provide. It is in your best interest to be thorough and accurate in your disclosures. If you are unsure about specific medical details or how to present them, consider consulting a healthcare professional or a financial advisor who can guide you through the process and ensure your application is as strong as possible.

Adverse Selection: Life Insurance Markets' Dark Secret

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, or "term," typically ranging from 10 to 30 years. It is designed to offer financial protection during a particular stage of life, such as when you have a family or significant financial responsibilities. Unlike permanent life insurance, which provides coverage for the entire lifetime of the insured, term life insurance does not accumulate cash value and is generally more affordable.

Selecting the appropriate term length depends on your individual circumstances and financial goals. Consider your current and future obligations. If you have a mortgage, children's education expenses, or a specific period of financial dependency, you might opt for a longer term, such as 20 or 30 years. This ensures coverage throughout the duration of these responsibilities. Alternatively, a shorter term, like 10 years, can be suitable if you have immediate short-term needs and want more affordable premiums.

Yes, several factors can influence your eligibility and premium rates. Age is a significant factor, as younger individuals often qualify for lower rates. Your overall health and medical history play a crucial role; a comprehensive medical examination may be required, and any pre-existing health conditions could impact your premium. Additionally, lifestyle choices like smoking, excessive alcohol consumption, or dangerous hobbies may affect your rates. It's essential to provide accurate and honest information during the application process to ensure fair pricing.