An auto insurance ID card is a document that demonstrates proof of insurance. It is often the most common way of meeting the requirement to have auto insurance or proof of financial responsibility. The information that insurance ID cards contain varies by state but generally includes the policy number, policy effective dates, vehicles, and policyholders. It is important to make sure that you have the correct ID card in the correct vehicle to ensure there are no problems when you need to show your proof of insurance.

| Characteristics | Values |

|---|---|

| Purpose | Demonstrate proof of insurance |

| Information Contained | Policy number, policy effective dates, vehicles and policyholders |

| Usage | Register your vehicle or keep it in your car as proof of insurance for law enforcement |

| Format | Physical card or digital card |

What You'll Learn

Understanding what an auto insurance ID card is

An auto insurance ID card is a document that demonstrates proof of insurance coverage for your vehicle. In the US, auto insurance or proof of financial responsibility is a requirement in most states, and an auto insurance ID card is the most common way of meeting this requirement.

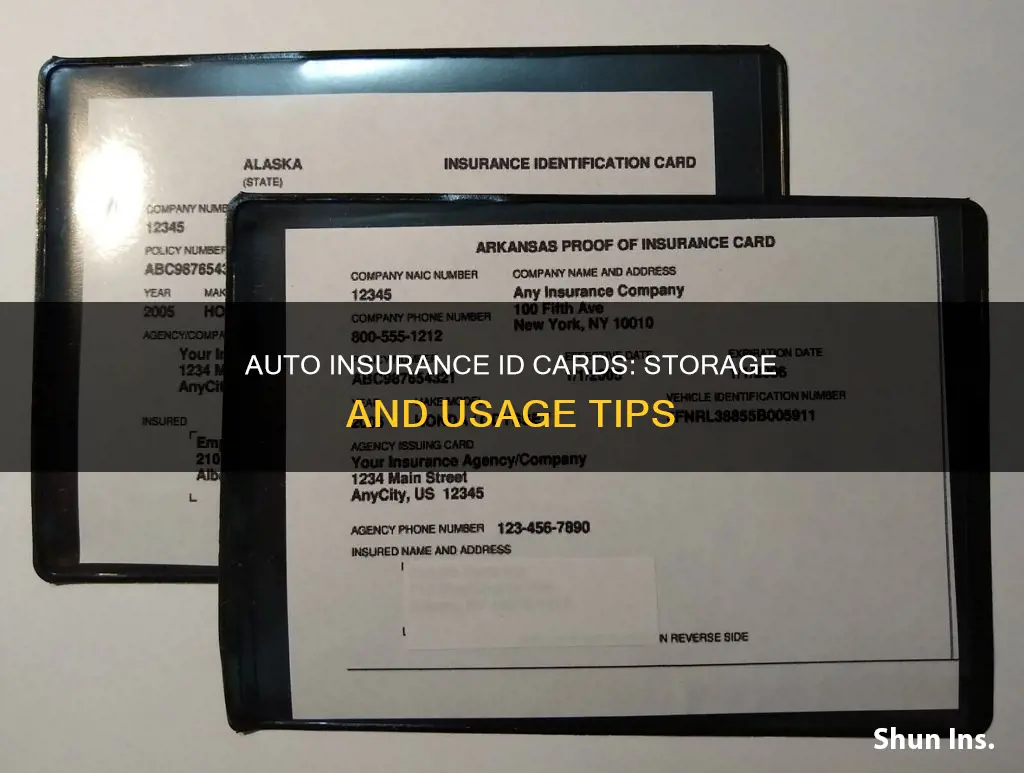

The information on an auto insurance ID card varies by state but generally includes the policy number, the name of the insurance company, the name of the insurance agency, the policy effective and expiration dates, the named insured on the policy, the VIN number of the vehicle, and the year, make and model of the vehicle. Some states also require proof of financial responsibility, which is usually provided in the form of an SR-22 or FR-44 certificate.

You should receive a temporary auto insurance card directly from your insurer or agent when you purchase coverage, followed by a permanent card that arrives with your policy in the mail. With the rise of technology, some insurers now also provide instant proof of insurance through their mobile apps. However, it is important to check if your state accepts digital ID cards as valid proof of coverage.

Auto insurance ID cards should be kept in your vehicle at all times as proof of insurance for law enforcement. It is also important to ensure that you have the correct ID card in the correct vehicle, especially if you have multiple vehicles, to avoid any fines. Additionally, remember to update your card every time your insurance agent sends you a new copy, as policies typically expire every 6-12 months.

Gap Insurance and Auto Theft: Understanding the Coverage

You may want to see also

How to obtain an auto insurance ID card

An auto insurance ID card is a document that demonstrates proof of insurance. It is often the most common way of meeting the requirement to have auto insurance or proof of financial responsibility. You should receive a temporary card or online card immediately upon purchasing a policy.

Online

You can obtain your auto insurance ID card online by visiting the insurance company's website. Look for a "policy documents" or similar section on their online service center. You may need to create an account and log in to access your ID card. From there, you can download a PDF copy of your ID card.

Through an App

Many insurance companies also offer mobile apps that allow you to access your auto insurance ID card. After downloading the app, create an account or log in. Then, find and click on the "ID cards" section on the home screen and select the correct policy and vehicle. You can then save the ID card for future use.

By Phone

If you would prefer to speak to a customer service representative, you can usually call the insurance company and request your auto insurance ID card. They may be able to send it to you via email or physical mail.

It is important to note that the specific process for obtaining an auto insurance ID card may vary depending on your insurance provider and your state's requirements. Additionally, while some states allow digital ID cards as valid proof of coverage, others may require a physical copy, so be sure to review your state's laws and requirements.

Girlfriend's Auto Insurance: USAA Eligibility

You may want to see also

What to do if you can't find your auto insurance policy

If you can't find your auto insurance policy, the first step is to stay calm and retrace your steps. Think about the last time you saw the document and try to recall the mindset you had when you last handled it. Walk through all the locations you've been to since then and systematically search the areas where the policy should be, as well as a broader area surrounding it. Check your pockets and bags, and don't forget to look in places you don't usually bring the document.

If you still can't find it, try cleaning and tidying up the area to remove any clutter that might be hiding it. Ask friends, family members, or coworkers if they've seen it or know where it is. If you think you may have lost it in a public place, visit the lost-and-found or call the establishment to see if it's been turned in.

If all else fails, contact your insurance provider. They should be able to provide you with a new copy of your policy. You can also access your insurance ID card online or through a mobile app, which serves as proof of insurance.

Auto Insurance Lapse: North Carolina's Penalties and Fines

You may want to see also

How to use an auto insurance ID card

An auto insurance ID card is a document that demonstrates proof of insurance. It is often the most common way to meet the requirement of having auto insurance or proof of financial responsibility. This card typically includes information such as the policy number, policy effective dates, the vehicle(s) covered, and the policyholder(s). Here are some steps on how to use an auto insurance ID card effectively:

Obtaining Your Auto Insurance ID Card

When you purchase auto insurance coverage, you should receive a temporary auto insurance ID card directly from your insurer or agent. This will be followed by a permanent card that arrives with your policy in the mail. With the rise of technology, some insurers now provide instant proof of insurance through their websites or mobile apps. For example, companies like State Farm, Nationwide, and GEICO offer digital options for accessing your auto insurance ID card. However, before relying solely on digital cards, check your state's requirements as not all states may accept them as valid proof of insurance.

Keeping Your Card Accessible

It is important to keep your auto insurance ID card easily accessible. You can choose to keep a physical copy in your wallet or glove box, ensuring it is in the correct vehicle, especially if you have multiple cars. Alternatively, if you have a digital card, you can save it to your phone's wallet or bookmark it within your insurer's mobile app for quick access. Having your auto insurance ID card readily available is essential for when you need to provide proof of insurance, such as during a traffic stop or when registering your vehicle.

Updating Your Card

Auto insurance policies typically expire every 6-12 months. Therefore, it is crucial to update your auto insurance ID card whenever your policy renews or changes. If you have a physical card, request an updated copy from your insurer and replace the old one. For digital cards, your insurer may automatically update the card within their app or your phone's wallet when your policy renews. Nevertheless, it is always a good idea to confirm that the information on your card is current.

Providing Proof of Insurance

Your auto insurance ID card serves as proof of insurance when interacting with law enforcement, registering your vehicle, or providing coverage information to a lienholder or leasing company. When asked for proof of insurance, simply present your physical or digital auto insurance ID card. This card demonstrates that you meet the state's minimum liability requirements and have valid insurance coverage for your vehicle.

Auto Insurance and Physical Therapy: What's Covered?

You may want to see also

The information that auto insurance ID cards contain

An auto insurance ID card is a document that demonstrates proof of insurance. It is a small document that can provide you with a great deal of protection when you’re out on the road. While the information on the card may vary from state to state and from company to company, there are several key details that you can expect to find on your auto insurance ID card.

Firstly, the card will contain information about your insurance policy. This includes the effective or start date and the expiration date of your coverage, as well as your policy number. It is important to keep your card up to date, as an expired card will not be valid.

Secondly, the card will contain details about the insured person or persons. This includes the name of the policyholder, as well as the names of any other drivers covered under the policy. Note that car insurance coverage “follows” the vehicle rather than the person driving, so if someone drives your car routinely, they will need to be added to the policy.

Thirdly, the card will contain information about the insured vehicle. This includes the Vehicle Identification Number (VIN), as well as the year, make, and model of the vehicle. The VIN number should help you identify which vehicle is covered by the policy, especially if you have multiple vehicles.

Lastly, the card will contain the name and contact information of the insurance company or insurance agency from which you purchased the coverage.

Overall, the auto insurance ID card is an important document that allows you to demonstrate proof of insurance when needed.

Auto Insurance: Good Drivers Face High Premiums

You may want to see also

Frequently asked questions

An auto insurance ID card is a document that demonstrates proof of insurance. It is often the most common way of meeting the requirement to have insurance or proof of financial responsibility. The information that insurance ID cards contain varies by state but generally includes the policy number, policy effective dates, vehicles and policyholders.

You should receive a temporary auto insurance card directly from your insurer or agent when you purchase coverage, followed by a permanent card which arrives with your policy in the mail. You can also obtain a card online or via an app.

Keep it in your car as proof of insurance for law enforcement. You can also use it to register your vehicle.