Auto insurance coverage is a necessity for all vehicle owners. While the specific requirements vary by state, most states require liability insurance, which covers the cost of injuries and damages caused to others in an accident. The minimum coverage limits are typically set at $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage per accident. However, it is recommended to have higher coverage limits to adequately protect yourself financially. Collision and comprehensive insurance are also important considerations, especially if you have a loan or lease, as they cover the cost of repairs or replacement of your vehicle in the event of an accident or damage from incidents other than collisions. When deciding on the right auto insurance coverage, it is crucial to consider your state's requirements, the value of your vehicle, and your financial situation to ensure you have sufficient protection.

| Characteristics | Values |

|---|---|

| Liability insurance | $25,000 per person and $50,000 per accident for bodily injury and $25,000 for physical damage |

| Collision insurance | Covers the cost to repair or replace your vehicle if it is damaged by another vehicle or object |

| Comprehensive insurance | Protects your vehicle from things outside your control, such as theft, vandalism, fire, collisions with animals, glass breakage, and damage from weather |

| Uninsured motorist coverage | Covers medical expenses, lost wages, and car damage if you’re hit by a driver who doesn’t have insurance |

| Underinsured motorist coverage | Covers you when you’re in an accident caused by a driver whose insurance coverage falls below the state’s required minimums |

| Medical payments coverage | Covers medical bills for you and your passengers no matter who caused the car accident |

| Personal injury protection | Covers medical bills, lost wages, funeral expenses, and replacement services you can’t do because of injuries, like cleaning services or child care |

| Gap insurance | Covers the difference between the actual cash value of your car and how much you owe on the loan or lease |

| Rental reimbursement insurance | Covers the cost of a rental car or substitute transportation while your car is in the shop |

| Roadside assistance insurance | Covers services like a tow truck, jump-start, fuel delivery, or a locksmith |

What You'll Learn

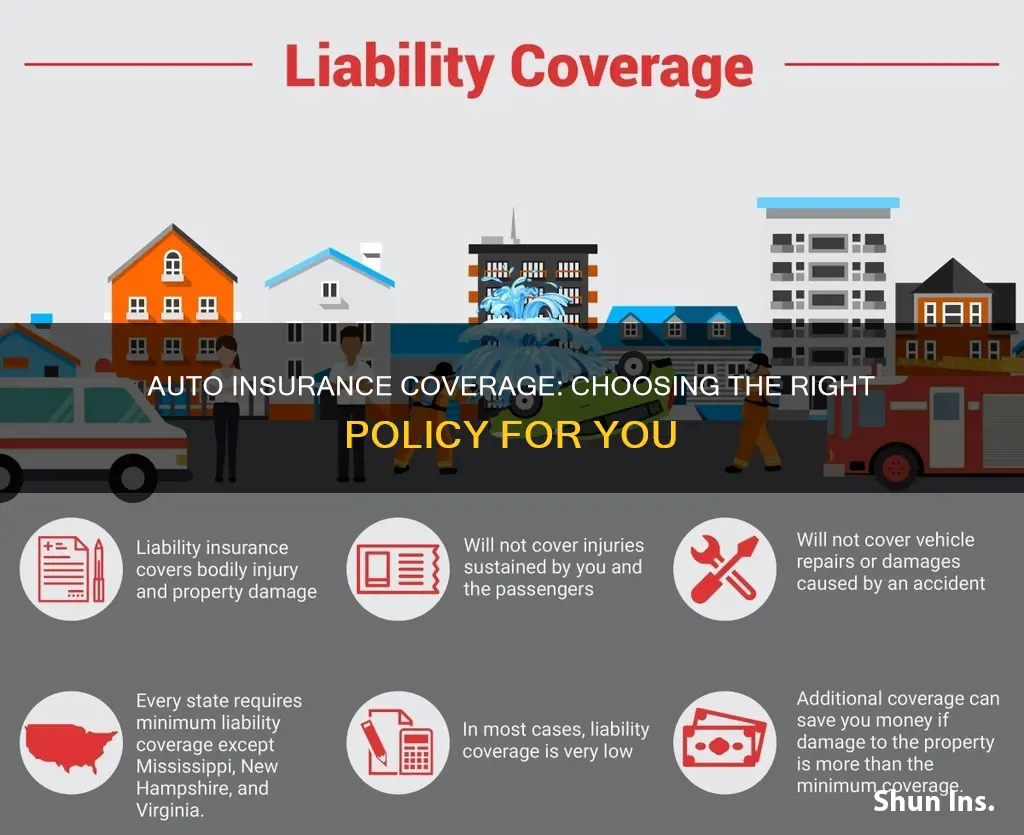

Liability coverage

Property damage coverage pays for the repair or replacement of the other driver's vehicle, any rental vehicle expenses they may incur, and damage to buildings, fences, or other structures and personal property. It also covers legal fees if you are sued for property damage.

Bodily injury coverage takes care of the medical expenses of the injured party and may include lost wages and legal fees if the injured party files a lawsuit.

The minimum liability limits vary from state to state, and it is important to understand your state's requirements. The coverage limits are typically expressed as three numbers, such as 25/50/10, indicating the maximum coverage for bodily injury per person, per accident, and property damage per accident, respectively.

While liability coverage is essential, it is important to note that it does not cover damages to your property or your injuries. To protect yourself, you may need additional coverages such as Personal Injury Protection and Uninsured/Underinsured Motorist Coverages.

Unraveling the Replacement Value Mystery: Auto Insurance Companies' Strategies Revealed

You may want to see also

Collision coverage

The benefits of collision coverage include knowing your car is covered in the event of an accident and avoiding paying out of pocket for repairs above the cost of your deductible. It can also provide coverage for your loss when your damaged vehicle is deemed totaled. Additionally, adding a deductible fund alongside your collision insurance coverage can potentially result in paying nothing at all for repairing or replacing your vehicle.

When choosing collision coverage, you will need to decide on the amount of your deductible. This will depend on factors such as the cost of your car and its potential repair costs, as well as your willingness to pay for repairs under the deductible amount. A higher collision deductible will lower your monthly premium, but it's important to consider your ability to cover the costs of repairs when needed.

Auto Club Renters Insurance: What's the Verdict on Stolen Bikes?

You may want to see also

Comprehensive coverage

If your vehicle has a high cash value or you cannot afford to repair or replace it out of pocket, comprehensive coverage is a smart choice. However, if your vehicle has a low cash value and you have a higher deductible, it may not be worth the additional cost.

Best Auto Insurance Company in New York: Who's Top?

You may want to see also

Uninsured motorist coverage

- Uninsured motorist bodily injury (UMBI) covers medical bills for you and your passengers if you're hit by an uninsured driver.

- Uninsured motorist property damage (UMPD) covers damage to your vehicle caused by an uninsured driver.

- Underinsured motorist bodily injury (UIMBI) covers medical bills for you and your passengers if you're hit by a driver with insufficient insurance.

- Underinsured motorist property damage (UIMPD) covers damage to your vehicle caused by a driver with insufficient insurance.

The cost is the only significant downside of purchasing uninsured motorist coverage. However, it is relatively inexpensive compared to the potential benefits. When deciding on the amount of coverage, consider matching the limits of your UMBI and UIMBI coverage with your liability coverage. For UMPD coverage, you can select a limit that reflects the value of your vehicle.

If you live in a state with a high percentage of uninsured drivers, adding this coverage to your policy is a wise decision. Even if it's not required in your state, driving without uninsured motorist coverage puts you at serious financial risk.

CSAA Auto Insurance: Understanding Motorhome Coverage

You may want to see also

Personal injury protection

PIP covers reasonable medical costs, including surgeries, medications, diagnostics (X-rays, CT scans, etc.), prosthetics, nursing care, physical therapy, and medical devices. It also covers lost wages due to injury and recovery, as well as replacement of necessary services normally provided by the injured party, such as childcare or household maintenance.

The amount of PIP insurance you need depends on your state's requirements and your personal financial situation. In Texas, for example, insurance companies are required to offer every driver at least $2,500 of PIP insurance, and you can typically increase your coverage up to $5,000 or $10,000. It is recommended to have enough PIP coverage to protect yourself and your loved ones from serious medical bills in the event of an accident.

PIP is distinct from liability insurance, which kicks in when the insured party is at fault for an accident that harms someone else. Liability insurance pays for someone else's costs when the insured party causes a crash. PIP, on the other hand, covers your own expenses and those of your passengers, regardless of fault. It is also important to note that health insurance can sometimes cover additional medical expenses that exceed your PIP policy limits.

When and How to File a PIP Claim

In Texas, for example, personal injury protection only covers costs that occur within three years of an accident. It is recommended to report all expenses and injuries to your insurance provider as soon as you become aware of them. When filing a claim, be sure to include all relevant documentation, such as receipts, bills, and proof of income loss, to ensure your claim is processed quickly and accurately.

Auto Insurance Costs in LA: What to Expect

You may want to see also

Frequently asked questions

The minimum amount of auto insurance coverage you need is your state's required liability coverage. This allows you to pay for some, if not all, injuries and damages you're liable for in an accident. The most commonly required liability limits are $25,000 per person, $50,000 total per accident for bodily injury, and $25,000 per accident for property damage.

There are several types of auto insurance coverage, including liability coverage, comprehensive coverage, collision coverage, personal injury protection, medical payments coverage, and uninsured/underinsured motorist coverage.

The amount of auto insurance coverage you need depends on your state's requirements, the value of your car, and your income level. It's recommended to have enough liability coverage to protect your assets in case you're liable in an accident.