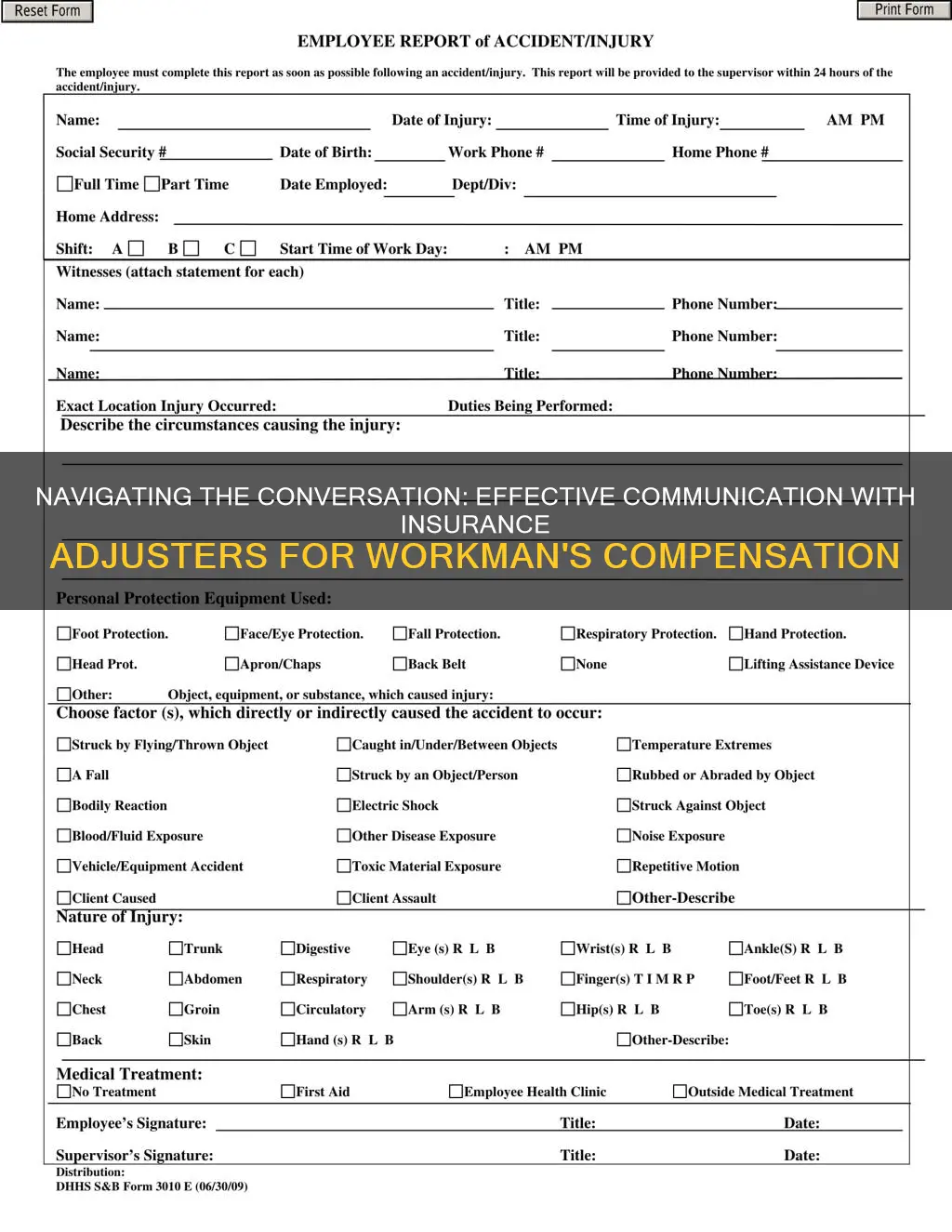

If you've been injured at work, you'll likely be contacted by an insurance adjuster, whose job is to assess your injury, determine its validity, and get you back to work if possible. They will want to know the details of how, when, and where the injury took place, and any other relevant information. It's important to be cautious when speaking to an insurance adjuster, as their primary goal is to minimise the amount of money the insurance company will have to pay. They will be looking for any indicators that you are being dishonest about your injuries or ways to take any statements you make out of context. Therefore, it is crucial that you are careful when speaking to them to ensure you do not inadvertently harm your claim.

| Characteristics | Values |

|---|---|

| Recorded statement | You are not obligated to provide a recorded statement. |

| Conversation | Avoid getting too comfortable and only discuss the basic facts of the accident. |

| Documents | Do not sign any documents before your attorney has reviewed them. |

| Family | You are not obligated to provide any information about your family. |

| Notes | Always take notes of every conversation with the insurance adjuster. |

| Doctors | Ask for a panel of physicians if you haven't seen a doctor yet. |

| Injuries | Be overly inclusive when describing your injuries. |

| Pre-existing conditions | Answer honestly about any pre-existing conditions. |

| Accident | Be very specific about how the accident occurred. |

| Attorney | Hire a skilled workers' compensation attorney as soon as possible. |

What You'll Learn

You are not obligated to provide a recorded statement

After an injury at work, you will usually be contacted by an insurance adjuster, who will ask you to provide a recorded statement. However, you are not obligated to provide a recorded statement to the adjuster, and doing so will not be in your favour. You have the right to decline this request politely.

Adjusters often ask for recorded statements to try to elicit information from you that can be used to poke holes in your claim. They will try to get you to admit to facts that prove you did not suffer an injury by accident arising from a specific employment risk. They may also ask about your criminal history, financial situation, or past accidents and injuries. This information can be used to deny or delay your claim or reduce any settlement offers.

If you do decide to give a recorded statement, be sure to tell the truth and carefully consider your answers. Many people get tripped up by rushing through and leaving out something important. It is recommended that you seek legal advice before proceeding with a recorded statement.

The Art of Damage Assessment: Unraveling the Insurance Adjuster's Process

You may want to see also

Do not get drawn into casual conversation

When dealing with an insurance adjuster, it is important to remember that they are not on your side. Their primary goal is to minimise the amount of money the insurance company will pay. To achieve this, they will try to get you to relax and engage in casual conversation so that you may inadvertently disclose details that could be used against your claim. Here are some tips to keep in mind when interacting with an insurance adjuster:

- Do not get drawn into casual conversation. Keep discussions strictly professional and related to the claim. Avoid discussing anything beyond the basic facts of the accident, such as the date, time, location, type of accident, and injuries sustained.

- Decline requests for a recorded statement. You are not obligated to provide one, and it could be used to elicit information that may jeopardise your claim.

- Do not sign any documents or forms, including medical authorisation forms, without first consulting with your attorney.

- Be cautious about disclosing personal or family information. You are not required to provide details about your family, finances, or work.

- Take notes during conversations with the adjuster. Note down their name, the insurance company they represent, and any other relevant details.

- Seek legal representation if necessary. A skilled attorney can guide you through the process and protect your rights.

Crafting a Strategic Response: Navigating the Insurance Adjuster's Queries

You may want to see also

Do not agree to anything without an attorney

After sustaining a workplace injury, you will likely be contacted by an insurance adjuster, who will want to assess your injury, determine its validity, and get you back to work if possible. While the adjuster may seem friendly, their primary goal is to minimise the amount of money the insurance company will pay. They are highly trained and have likely handled hundreds of similar cases.

Therefore, it is imperative that you do not agree to anything without an attorney. Here are some reasons why:

Recorded Statements

The adjuster will likely ask you to provide a recorded statement, but you are not obligated to do so. They will use this opportunity to ask leading questions and try to elicit information that can be used to poke holes in your claim or deny it altogether. For example, they may ask about your family, financial situation, or criminal history, which you are not required to disclose.

Medical Authorisation

The adjuster will often send you forms to sign, including a medical authorisation form. While you do need to provide the insurance company with a certain type of medical authorisation when requested, you do not need to sign a blank form. Only sign forms that designate the specific medical providers who have treated your injury.

Pre-existing Conditions

If you have a pre-existing condition, the insurance company will likely try to blame your injury on that. They may also deny or delay approval for expensive medical treatments. An attorney can help you prove that your injury is work-related and put pressure on the insurance company to approve necessary treatments.

Settlement Offers

The adjuster may offer you a quick, lowball settlement, taking advantage of your financial situation and desperation for cash flow. They may also use high-pressure tactics, such as threatening to withdraw an offer if you don't accept it immediately. An attorney can help you determine if the settlement offer is fair and ensure you get the maximum benefits you deserve.

Communication Issues

You may experience poor communication with the adjuster, such as unanswered calls or emails. This could be a deliberate stalling tactic to sap your energy and make you less likely to fight back. An attorney can help you navigate this situation and ensure your case stays on track.

Third-Party Claims

If someone other than your employer contributed to your injury, you may be able to file a workers' compensation lawsuit outside of the workers' compensation system. For example, if a negligent driver hit you while you were driving for work. An attorney can advise you on your options and represent your best interests.

In conclusion, while it is not always necessary to hire an attorney for a workers' compensation claim, doing so can significantly improve your chances of receiving a fair settlement. An attorney can guide you through the complex claims process, protect your rights, and ensure you don't inadvertently harm your own claim.

Understanding the Art of Calculating Insurance Adjustments: A Comprehensive Guide

You may want to see also

Do not answer questions about your family

When dealing with an insurance adjuster, it is important to remember that they are not your friend. Their primary goal is to minimise the amount of money the insurance company will pay out. They will use various tricks to get you to accept a low settlement offer or deny your claim. One of their tactics is to ask you questions about your family and financial situation. Remember that you are not obligated to answer these questions or provide any information about your family.

- To Assess Your Financial Situation: Insurance adjusters may ask about your family to determine if you are in a financially stable position. If they find out that you are desperate for money, they may use this information to offer a low settlement amount, knowing that you are more likely to accept it. By not disclosing information about your family, you protect yourself from such tactics.

- To Pressure You: Insurance adjusters may try to pressure you by threatening to interview your family members and disclose information that you do not want to be revealed. They may also try to intimidate you by threatening to report your legal status or tax history. It is important to remain calm and not give in to these threats.

- To Find Pre-existing Conditions: Insurance adjusters are looking for any reason to reduce or deny your claim. By asking about your family's medical history, they may try to link your injury to a pre-existing condition. Be clear and insistent that your injury is work-related and seek legal advice if needed.

- To Assess Your Credibility: Insurance adjusters may ask about your family to assess your credibility and reliability as a witness. They may try to get you to admit to facts that contradict your claim or previous statements. It is important to stick to the facts and not offer additional information about your family.

- To Create a Friendly Environment: Insurance adjusters may engage in casual conversation about your family to relax you and make you feel comfortable. This is a tactic to get you to disclose more information than you normally would. Remember their goal and do not get too comfortable or casual during these conversations.

Remember, when dealing with insurance adjusters, always seek legal advice if you are unsure. Do not give recorded statements, limit the personal information you provide, and do not feel pressured to accept a settlement offer immediately.

Pursuing a Career as an Insurance Adjuster in Delaware: A Comprehensive Guide

You may want to see also

Be specific about how the accident occurred

When speaking to an insurance adjuster, it is important to be very specific about how the accident occurred. This is because the adjuster will be looking for any indicators that you are being dishonest about your injuries or ways to take any statements out of context. They will use this information to try to reduce the value of your worker's compensation claim.

- Stick to the facts: Only provide factual information about the accident, such as the date, time, location, and type of accident. Do not elaborate or provide too many details, as this may give the adjuster ammunition to deny your claim.

- Be clear and concise: When describing the accident, use clear and concise language that is easy for the adjuster to understand. Avoid using vague or confusing terms.

- Provide relevant details: Include any relevant details that may impact your claim, such as the specific body parts that were injured and any witnesses to the accident.

- Be consistent: Make sure that your description of the accident is consistent with any previous statements you have made, such as to your employer or medical professionals. Inconsistencies may raise red flags for the adjuster.

- Avoid speculation: If you do not remember certain details about the accident, do not speculate or guess. It is better to say that you do not know or do not remember than to provide incorrect information.

- Seek legal advice: Consider consulting with a worker's compensation attorney before speaking to the adjuster. An attorney can advise you on what to say and help protect your rights.

The Driver's Right to Remain Silent: Navigating Conversations with Insurance Adjusters

You may want to see also

Frequently asked questions

No, you are not obligated to provide a recorded statement and doing so may harm your claim as adjusters are trained to ask leading questions and get you to lower your guard.

Always stick to the facts and refrain from speculating or providing opinions. Only answer the question that is being directly asked and keep the discussion restricted to the accident details and resulting injury and symptoms.

Ask them for specifics about what they need and carefully examine any medical authorization form before signing. You can always rescind a medical release, and it is better to let a workers' compensation attorney handle this for you.

Do not feel pressured to accept an unfair settlement. Take your time to get a fair deal and double-check the math.

Be polite and persistent. Keep asking, and follow up in writing as often as necessary. Do not hesitate to get an attorney involved.