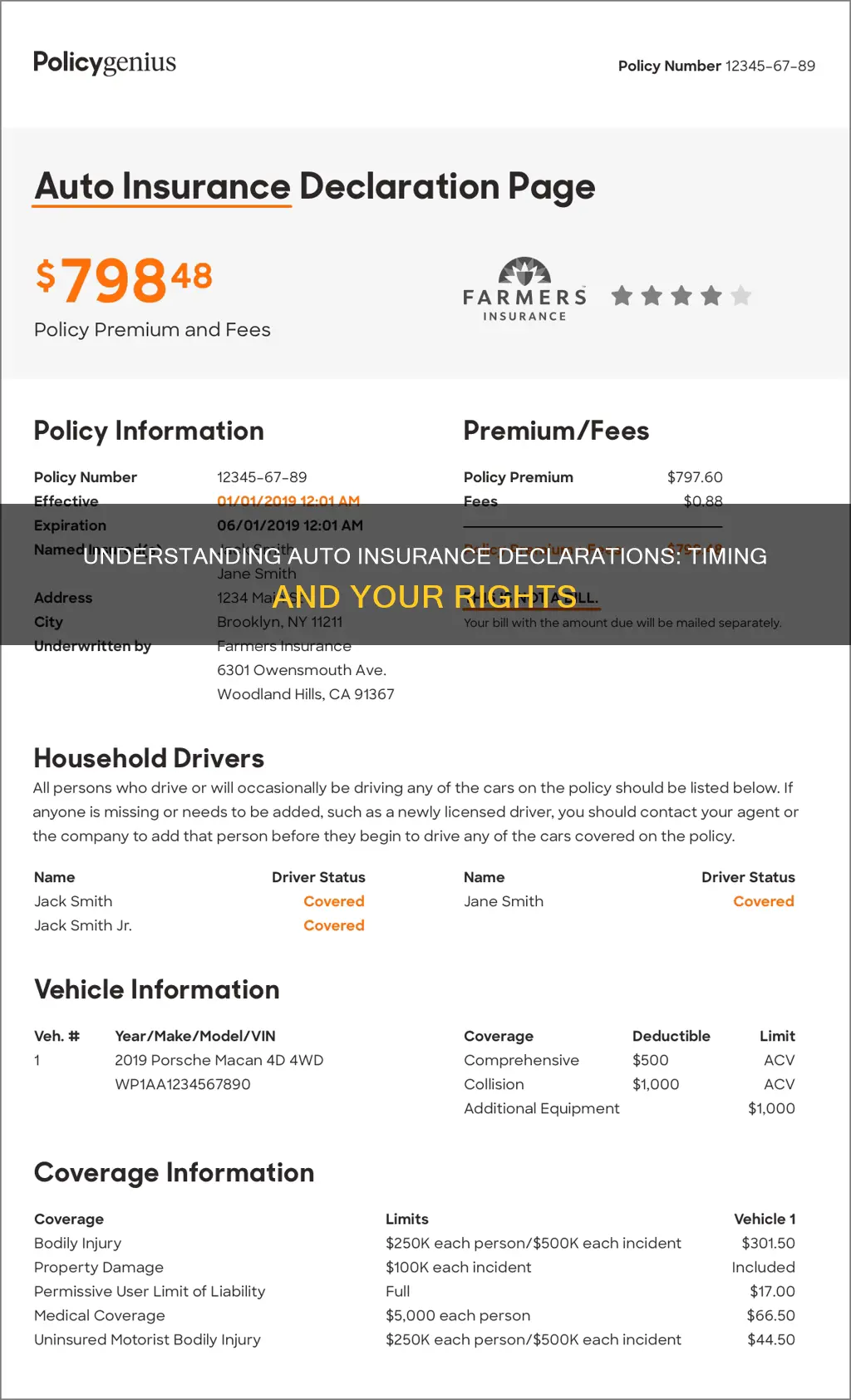

An auto insurance declaration page, also known as a dec page, is a summary of your auto policy in one or two pages. It provides important information related to your policy, such as when coverage starts and ends, what cars are covered, the types of coverage you're paying for, and their limits and deductibles. After purchasing a car insurance policy, your insurer will typically send you an insurance declaration page via email, fax, or regular mail. If you buy car insurance online, you may be able to print the declaration page from the insurer's website. It is important to review the declaration page carefully to ensure all the information is accurate and to keep it on hand for future reference or when filing a claim.

| Characteristics | Values |

|---|---|

| Purpose | Summarises key aspects of your car insurance policy |

| Format | A one- or two-page document |

| Content | Policy number, effective date, expiration date, agent's name and contact information, insured drivers, covered vehicles, types of coverage, coverage limits, deductibles, premium, discounts, lender information |

| Receipt | Sent by the insurance company via email, fax, regular mail, or online portal upon purchase or renewal of a policy |

| Use | Quick reference to your policy, understanding your coverage, comparing quotes from other insurers, filing a claim |

| Proof of insurance | Not typically used as proof of insurance; a physical or digital insurance card is usually required |

What You'll Learn

When to expect to receive your auto insurance declaration

An auto insurance declaration page is a summary of your auto policy, usually one or two pages long. It provides a quick reference to your policy and can be used to understand your coverage. It is not, however, proof of insurance. For that, you will need to keep an auto insurance ID card in your vehicle or on your phone.

Your insurance company will typically send you a declaration page via email, fax, or regular mail as soon as you buy your policy. Many insurers also allow you to access your declaration page online or through their mobile app. You can also request a copy from your insurer or agent if you need an extra one.

The declaration page will include the following information:

- Policy number

- Policy effective date

- Agent information (if you have an agent)

- Policyholder details (name, address, and phone number)

- Covered drivers

- Vehicle details (year, make, model, vehicle identification number, and average mileage)

- Coverage details (types of coverage, coverage limits, deductibles, premiums, and policy add-ons)

- Policy period

- Loss payee (any party with a vested interest in the vehicle, such as a lender)

- Discounts

You should review your declaration page carefully as soon as you receive it to ensure that all the information is accurate. If you find any errors, contact your insurance company immediately to have them corrected.

Best Auto Insurance Options: Top Policies for Your Car

You may want to see also

What to do if you don't receive your auto insurance declaration

An auto insurance declaration page is a summary of your auto policy, usually one or two pages long. It provides important information related to your policy, such as:

- When coverage starts and ends

- What cars are covered

- The types of coverage you're paying for, and their limits and deductibles

- A breakdown of how much you pay for coverage and any discounts you qualify for

Most insurance companies will mail or email your declaration page upon signing up for a new policy or renewing an existing one. You may also be able to find your declaration page by logging into the insurance company's website or mobile app and navigating to the documents section.

If you don't receive your auto insurance declaration, follow these steps:

Step 1: Contact the Insurance Company

Five days after you expect to receive your declaration page, try to contact the insurance company via email or phone. Ask any questions you may have about the necessary paperwork and confirm that they have all the right information to process the declaration. If you still haven't received your declaration after 30 days, reach out to the company again to confirm that they have the correct contact information and policy details.

Step 2: Contact Your Agent

If you have an insurance agent, they can help you resolve the issue. They may be able to provide you with a copy of your declaration page or assist in correcting any errors in your policy information.

Step 3: Review Your Policy Information

Double-check the details of your policy to ensure that the information is correct and up-to-date. This includes your name, address, phone number, vehicle information, coverage types, and coverage limits. If you find any discrepancies, contact your insurance company to update your policy information.

Step 4: Request a New Declaration Page

If you have confirmed that your policy information is correct and still haven't received your declaration page, contact your insurance company to request a new one. They should be able to send you a copy via mail or email.

Step 5: Seek Alternative Options

If you continue to experience issues receiving your auto insurance declaration, you may need to consider alternative options. This could include switching to a different insurance provider or seeking assistance from a third party, such as a lawyer or a government agency that handles consumer protection.

It is important to keep a close eye on your policy details and be proactive in resolving any issues. By following these steps, you can ensure that you receive the auto insurance declaration page you need and have accurate and up-to-date information about your policy.

Total Loss Vehicle: Insurance Release Timing

You may want to see also

How to use your auto insurance declaration

An auto insurance declaration page is a summary of your auto policy, usually in one or two pages. It is a very useful document that you should keep easily accessible, and it can be used in the following ways:

- When you first buy your policy, you should refer to the declaration page to check that all the information is correct.

- It can be used as a quick reference to remind you of what coverage you have.

- It is useful when shopping around for a new policy, as it lists all your coverage and costs, so you can easily compare quotes from other insurance companies.

- You will need it when you need to file a claim.

- It can be used to confirm insured names, coverage types, limits, and deductibles.

- It can help you understand what damages should be covered and what limits will apply, so you can decide whether to file a claim.

- It is useful when you want to renew your policy, as you can review and assess your coverage to see if you need to make any changes.

Your auto insurance declaration page should be sent to you by your insurer when you purchase your policy or make changes to an existing policy. You can usually access it through the insurer's website or mobile app, and you can also request a copy from your insurer if needed.

The Ultimate Guide to Becoming an Auto Damage Appraiser

You may want to see also

What to do if your auto insurance declaration contains errors

An auto insurance declaration page is a summary of your auto policy, usually in one or two pages. It is a crucial document that contains important information about your policy, such as the policy number, the date coverage starts and ends, the types of coverage, and the vehicles and drivers covered. It is typically sent to you by your insurance company via email, fax, or regular mail when you buy or renew your policy.

If you find any errors on your auto insurance declaration page, here are some steps you can take:

Contact your insurance company:

Get in touch with your insurance company as soon as possible. Inform them about the errors you have identified on your declaration page. They may ask for specific details about the inaccuracies to understand the issue better.

Provide correct information:

Be prepared to provide accurate information to your insurance company. For instance, if your name or address is misspelled, confirm the correct spelling and address. If there are errors regarding the covered vehicles or drivers, provide the correct details, including vehicle make, model, year, and vehicle identification number (VIN).

Request an updated declaration page:

After providing the correct information, ask your insurance company to issue an updated declaration page. They will make the necessary corrections and send you a revised version. Review the updated declaration page thoroughly to ensure that all the changes have been accurately reflected.

Understand the impact on coverage:

Errors on your declaration page may affect your insurance coverage. For example, if a covered vehicle or driver is missing from the declaration, it could impact your ability to make a claim. Discuss any concerns about coverage with your insurance company. They will advise you on how the corrections may impact your policy and what steps you need to take to ensure adequate protection.

Consider reviewing other policy documents:

Errors on your declaration page may indicate similar mistakes in other policy documents. Request to review your entire policy to ensure consistency and accuracy across all documents. This will help prevent further issues or misunderstandings regarding your coverage.

Keep a record of communication:

Maintain a record of your interactions with the insurance company, including any emails, letters, or phone calls. Document the dates and content of your conversations. This record can be helpful if there are future disputes or if you need to refer back to the details of your discussions.

It is important to review your auto insurance declaration page carefully and address any errors promptly. This will ensure that you have an accurate understanding of your coverage and can make informed decisions regarding your policy.

Phoenix's Top Auto Insurance Companies: Small but Mighty

You may want to see also

How to access your auto insurance declaration online

An auto insurance declaration page is a summary of your auto policy, usually one or two pages long. It provides important information about your policy, such as the types of coverage, coverage limits, covered drivers and vehicles, and the premium you pay. It is a useful document to refer to if you need to understand what your policy covers or when you need to file a claim. You may also need it when buying a new policy or renewing an existing one.

Visit the insurance company's website

Go to the website of your insurance company. You can usually find this information on your insurance card or by searching for the company name online.

Log in to your account

Most insurance companies will require you to create an account to access your policy information. Log in to your account using your credentials. If you don't have an account, you may need to create one by providing some personal information and your policy number.

Navigate to the policy documents section

Once you are logged in, look for a section called "Policy Documents," "My Accounts," or something similar. This section may be found under your account settings or a specific tab for auto insurance.

Select the relevant auto policy

If you have multiple policies with the same company, select the auto insurance policy for which you need the declaration page. You may be able to view all your policies in one place.

Locate and access the declaration page

Under the policy documents or policy details section, you should see the declaration page listed as "Declaration Page," "Dec Page," or "Insurance Declaration Page." Click on the link to view or download the document.

Contact customer support if needed

If you are unable to find the declaration page or are having issues accessing your account, you can contact the insurance company's customer support for assistance. Many companies provide a phone number or online chat feature to help you with any issues.

It is important to note that the process may vary slightly depending on the insurance company. Some common insurance companies and their processes are outlined below:

- State Farm: Log in to your online account at www.statefarm.com. Navigate to the "My Accounts" section, select your auto policy, and click on "View Policy Documents" to find your declaration page.

- GEICO: Log in to your GEICO account at www.geico.com. Go to the "Policy Documents" section, choose your auto policy, and then download or view the declaration page.

- Progressive: Visit www.progressive.com and sign in to your account. Click on the auto policy you wish to access, select the "Documents" tab, and then view or download the declaration page.

- Allstate: Log in to your Allstate account at www.allstate.com. Select the auto policy you need, click on the "Policy Details" tab, and find the declaration page under the "Policy Documents" section.

- Nationwide: Log in to your Nationwide account at www.nationwide.com. Go to the "Account" section, select the auto policy, and access the declaration page under the "Documents" tab.

Remember that you can always contact your insurance agent, broker, or customer service for assistance if you are unable to locate the declaration page or have any other issues. They will be able to provide you with guidance or a digital/physical copy of the document.

Leasing a Vehicle: Is Insurance Included?

You may want to see also

Frequently asked questions

Your auto insurance declaration will be sent to you via email, fax, or regular mail as soon as you buy your policy.

You may be able to download your policy documents from your insurance company's online portal or mobile app. You could also contact your agent for a new copy.

An auto insurance declaration includes the policy number, the date coverage goes into effect, and the expiration date. It also lists the names of all insured drivers and their details, as well as the vehicles covered under the policy.

No, your auto insurance declaration should not be used as proof of insurance. You should carry a physical insurance card in your vehicle or a digital insurance card to show to law enforcement if you get pulled over.