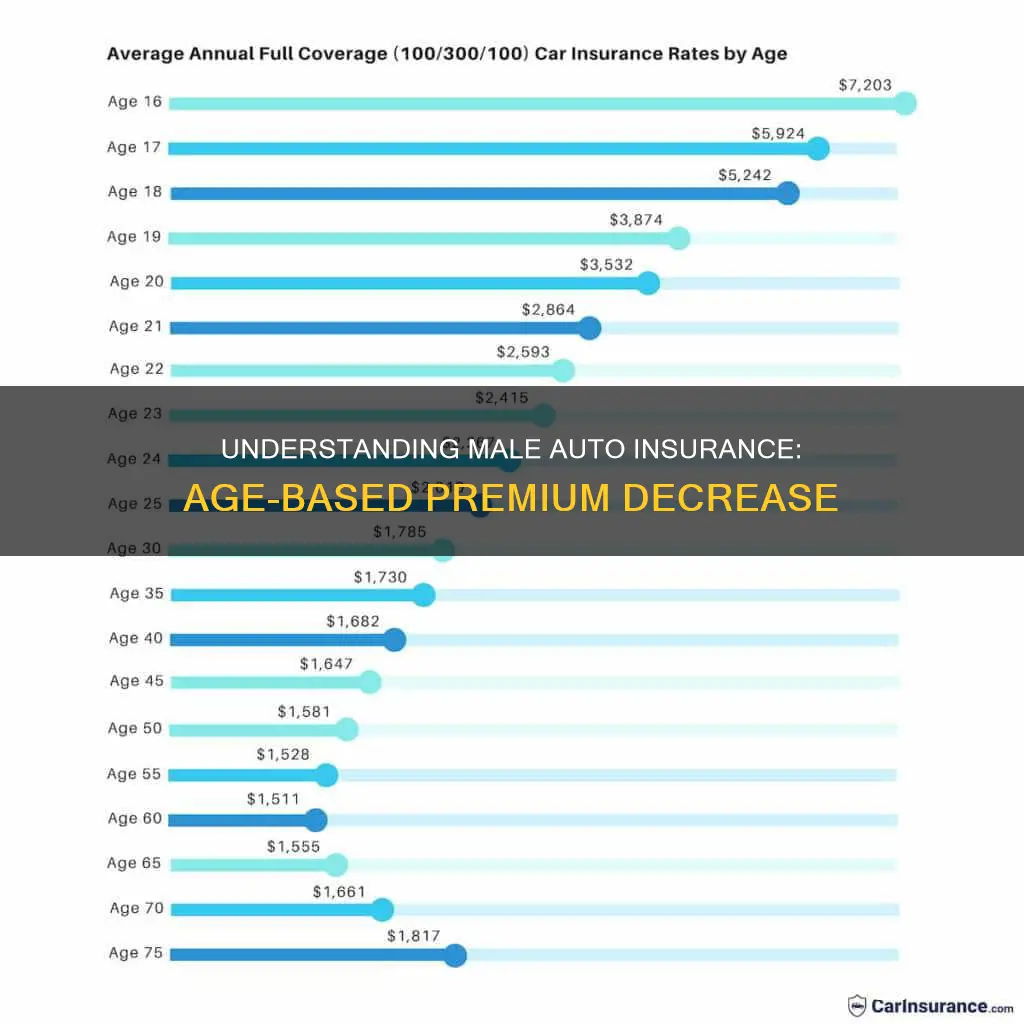

Men's auto insurance premiums decrease as they age, with the most significant drops occurring at ages 19 and 21. The cost of auto insurance is highest for teenage drivers and then gradually decreases as they get older, levelling off between the ages of 35 and 55. This is because younger drivers are more likely to get into car accidents and commit traffic violations than older drivers, so they are considered higher-risk and charged higher rates. Men also tend to pay more for car insurance than women, especially at younger ages, due to their higher likelihood of exhibiting unsafe driving behaviours. However, the difference in premiums between genders narrows as drivers age.

| Characteristics | Values |

|---|---|

| Age | Car insurance rates decrease with age, with the most significant drops at age 19 (25% decrease in premiums) and age 21 (20% decrease). Rates continue to decline in a driver's twenties and stabilise around age 30-34. |

| Gender | Men pay more than women for car insurance, especially at younger ages. The difference is less significant as drivers age. |

| Driving Record | Drivers with a history of at-fault accidents, speeding tickets, and other violations will pay higher premiums. Drivers with a clean record will see their rates decrease over time. |

| Credit History | People with poor credit history pay more for insurance as they are statistically more likely to file claims. |

| Location | Drivers in areas with high rates of theft or vandalism pay more for insurance. |

| Insurance History | Drivers with a history of not paying premiums or periods without insurance will pay more. |

| Vehicle Type | Older cars are generally cheaper to insure than newer cars. |

| Loyalty | Staying with the same insurance company can lead to loyalty discounts over time. |

What You'll Learn

Premiums decrease with age, especially after 19 and 21st birthdays

Car insurance premiums are calculated based on several factors, including age, gender, vehicle type, ZIP code, and driving history. While insurance rates for men and women converge around the age of 32, men typically pay more than women, especially at younger ages. This is because younger drivers are seen by auto insurance companies as riskier to insure due to their overall inexperience behind the wheel.

The cost of car insurance decreases with age, as at-fault accidents and traffic violations fall off the driver's record. The most significant drops in insurance rates for young men occur at ages 19 and 21, with a 16% and 17% decrease in premiums, respectively. The average price of car insurance for a 19-year-old is $4,453, while it drops to $3,207 for a 25-year-old. This decrease in insurance rates continues as drivers gain more experience and mature, with rates stabilising around age 30 to 34.

Young male drivers can take advantage of various strategies and discounts to reduce their car insurance rates. Staying on their parents' insurance policy, if possible, can result in significant savings. Additionally, maintaining a clean driving record and improving their credit score can positively impact their insurance rates. Shopping around for insurance providers and comparing quotes can also help young men find the best rates and discounts suited to their circumstances.

Does Your Personal Auto Insurance Cover You When Renting a U-Haul?

You may want to see also

Male drivers under 25 pay more than females of the same age

In addition, men are more likely to engage in risky driving behavior, such as speeding and driving under the influence, which leads to more accidents and more expensive claims. In 2013, 69% of traffic fatalities in Canada were men, and male drivers are also more likely to be charged with impaired driving.

The discrepancy in insurance rates between young male and female drivers is largest among drivers under 25. The difference in premium between genders narrows as drivers age, and by the time they turn 25, the discrepancy in price is minimal.

There are several ways that young male drivers can keep their insurance premiums as low as possible. These include taking driver training, avoiding traffic violations, and using telematics to prove they are safe drivers. Young men can also save money on their car insurance by driving safer vehicles, increasing their deductibles, or switching to a pay-per-mile plan if they don't drive frequently.

Direct Auto Insurance: Affordable Coverage?

You may want to see also

Premiums decrease after three years of safe driving

Car insurance premiums typically decrease after three years of safe driving. This is because most driving infractions and at-fault accidents will fall off your insurance record after three years, and insurance companies will consider you a lower risk to insure. The exact timeline depends on the type of infraction and the state's laws, but generally, you can expect to see your rates go down if you've maintained a clean driving record.

The cost of car insurance is based on several factors, including age, driving experience, and gender. Younger drivers, usually those under 25, tend to pay higher insurance premiums because they are considered higher-risk. As drivers gain more experience and age, their insurance rates usually decrease. For male drivers, insurance rates typically start to go down in their mid-twenties and reach a stable low throughout middle age. Female drivers also tend to pay higher insurance premiums when they are younger but will see their rates decrease as they enter their mid-twenties.

In addition to age and driving experience, insurance companies also consider an individual's credit history, ZIP code, and driving record when determining insurance rates. Maintaining a good credit score, living in a low-crime area, and keeping a clean driving record can all help lower insurance premiums.

It's worth noting that insurance rates may not decrease significantly at the age of 25, as some sources suggest. Instead, the decrease in insurance rates usually happens gradually over time as drivers gain more experience and maintain a clean driving record. Additionally, insurance rates can vary depending on the insurance company, so it's essential to shop around and compare rates from different providers.

Auto Insurance: Exploring Australia's Unique Requirements

You may want to see also

Premiums are lower for married couples

Car insurance premiums are generally lower for married couples than for single drivers. This is because insurers perceive married people as more stable and responsible, and therefore less likely to drive recklessly or file a claim. According to a rate analysis by CarInsurance.com, married couples pay on average 4% to 12% less for car insurance than single drivers.

There are several reasons why insurance companies view married people as lower risk. Firstly, they are considered more mature and reliable, especially if they are young. Secondly, statistics show that married drivers are involved in fewer accidents than single people and have a lower risk of insurance claims. A study by the National Institute of Health (NIH) found that drivers who had never been married had twice the risk of accident-related injury than married drivers.

In addition, married couples are more likely to own a home and qualify for multi-driver and multi-policy discounts. They are also assumed to drive less often than single people as they share driving responsibilities.

However, it's important to note that if one spouse has a poor driving record or a poor credit history, this could negatively affect the insurance premium for the couple. In this case, it may be worth considering separate policies or a named-driver exclusion, which states that the spouse with the poor driving record won't be covered when driving their partner's car.

Auto Accident Insurance: Damage, Claims, and You

You may want to see also

Premiums are lower for those with higher education qualifications

Education level and car insurance premiums

Those with higher education qualifications, such as a bachelor's degree, master's degree, or Ph.D., are statistically less likely to file insurance claims, which translates to lower insurance premiums. This is because people with higher education are more likely to have higher earnings, which means they can afford to pay higher premiums and are therefore considered lower-risk by insurance companies.

The impact of education level on insurance premiums

The level of education attained can have a significant impact on insurance premiums, with those holding higher qualifications often paying lower premiums than those with only a high school diploma. This is because insurance companies view individuals with higher education as more financially stable and responsible, leading to lower premiums.

The relationship between education and insurance premiums

The relationship between education level and insurance premiums is complex and multifaceted. While education level is a factor in determining insurance rates, it is not the only consideration. Other factors, such as driving history, credit score, and geographic location, also play a significant role in determining insurance premiums.

The influence of education on insurance rates over time

The impact of education level on insurance premiums may change over time as an individual's circumstances evolve. For example, a person with a higher education qualification may initially receive lower insurance premiums due to their perceived lower risk. However, if they accumulate driving infractions or their credit score decreases, their insurance premiums may increase despite their higher education level.

The role of education in insurance risk assessment

Insurance companies consider a multitude of factors when assessing risk and setting premiums. Education level is one component of this assessment, but it is not the sole determinant. Insurance companies also take into account factors such as age, gender, marital status, vehicle type, and driving history when calculating insurance rates.

The benefits of higher education in insurance risk mitigation

Higher education qualifications can signal to insurance companies that an individual possesses certain desirable traits, such as responsibility, financial stability, and maturity. These traits can lead to lower insurance premiums as the individual is perceived as a lower-risk driver. Additionally, higher education may lead to increased earnings, which can result in a higher capacity to pay premiums and a reduced need for insurance coverage, further mitigating risk for insurance companies.

Gap Insurance: Nissan Lease Protection

You may want to see also

Frequently asked questions

Men's auto insurance decreases as they get older, with the most significant drops occurring when they turn 19 and 21. Rates continue to lower until they turn 30 and tend to remain roughly the same until they reach their 50s or 60s.

Insurance companies consider younger drivers to be high-risk due to their inexperience and tendency to be involved in more accidents. As drivers age and gain more experience, they are seen as less risky and therefore receive lower rates.

Yes, in addition to age, factors such as driving experience, driving history, marital status, education level, career, credit score, and location can also impact the cost of auto insurance for men.

Men can lower their auto insurance rates by improving their driving record, taking a defensive driving course, seeking out discounts, boosting their credit score, and shopping around for quotes from different providers.

Yes, GEICO is often mentioned as one of the most affordable insurance companies for young male drivers, offering discounts for good students and participation in driver safety programs.