Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their families. One specific type of life insurance, known as OpM (Old-Age and Survivors Insurance), offers unique benefits and coverage options tailored to different life stages. Understanding when and how OpM life insurance is available is essential for anyone seeking long-term financial protection. This paragraph will explore the availability of OpM life insurance, its key features, and the factors that determine eligibility, ensuring readers gain a comprehensive understanding of this valuable insurance option.

What You'll Learn

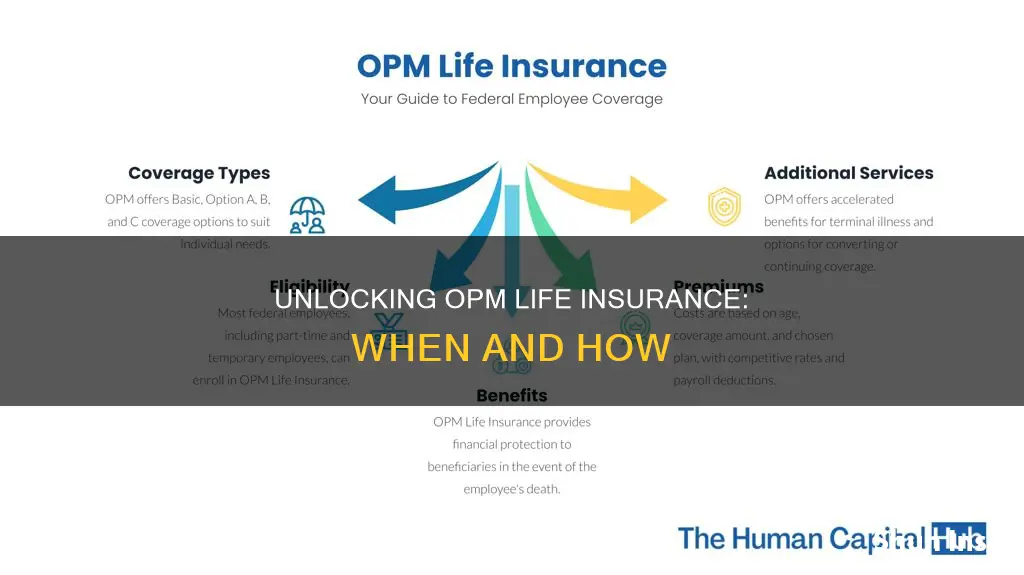

- Eligibility: OPM life insurance is available to federal employees and their families

- Coverage Options: It offers term life and permanent life insurance plans

- Enrollment Periods: Employees can enroll during open enrollment or special enrollment periods

- Benefits: Coverage begins upon qualification for federal employment

- Cost: Premiums are deducted from paychecks, making it convenient and affordable

Eligibility: OPM life insurance is available to federal employees and their families

OPM (Office of Personnel Management) life insurance is a valuable benefit for federal employees and their families, offering financial protection and peace of mind. This insurance is specifically designed to provide coverage for federal workers and their dependents, ensuring that their loved ones are taken care of in the event of the employee's passing.

Eligibility for OPM life insurance is straightforward and primarily based on employment status. It is available to all federal employees, including those who work full-time, part-time, or on a temporary basis. Whether you are a career civil servant, a military member, or a temporary employee, you are eligible to participate in this program. The insurance coverage is also extended to the family members of these federal employees, ensuring that their loved ones are protected even if the primary breadwinner is not.

To be eligible, you must be a current federal employee and have completed a specific period of service. The OPM typically requires a minimum of one year of federal service for eligibility. This ensures that the insurance provider can assess the employee's reliability and commitment to the role. Additionally, the insurance coverage is available to employees in various positions, including those in the executive, legislative, and judicial branches of the federal government.

For family members, eligibility is based on their relationship to the federal employee. Spouses, children, and dependent parents of federal employees are typically eligible for coverage. The insurance can provide financial support to cover various expenses, such as funeral costs, outstanding debts, and living expenses for the family. It is important to note that the specific eligibility criteria and coverage details may vary, so it is advisable to review the OPM's official guidelines and consult with a benefits specialist for personalized advice.

In summary, OPM life insurance is a valuable benefit that provides financial security for federal employees and their families. With eligibility based on employment status and a minimum period of federal service, this insurance ensures that federal workers and their dependents are protected. Understanding the eligibility requirements and coverage options is essential to make the most of this valuable benefit.

Life Insurance and FAFSA: What You Need to Know

You may want to see also

Coverage Options: It offers term life and permanent life insurance plans

When it comes to life insurance, the OPM (Office of Personnel Management) offers a range of coverage options to suit different needs. One of the primary options available is term life insurance, which provides coverage for a specific period, typically 10, 20, or 30 years. This type of policy is ideal for individuals who want to ensure their loved ones are financially protected during a particular stage of life, such as when they are raising a family or paying off a mortgage. During this term, the policy will pay out a death benefit if the insured individual passes away, providing financial security and peace of mind.

Term life insurance is often more affordable compared to permanent life insurance, making it an attractive choice for those seeking comprehensive coverage without a long-term financial commitment. It is a straightforward and cost-effective way to secure financial protection for a defined period.

In addition to term life insurance, OPM also provides permanent life insurance plans. These policies offer lifelong coverage and are designed to provide financial security for the entire duration of the insured individual's life. Permanent life insurance includes various types, such as whole life, universal life, and variable life insurance.

Whole life insurance, for instance, guarantees a death benefit and accumulates cash value over time, which can be borrowed against or withdrawn. Universal life insurance offers flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change. Variable life insurance, on the other hand, provides investment options, allowing the policy's cash value to grow based on market performance.

OPM's permanent life insurance plans are suitable for individuals who want long-term financial protection and the potential for cash value accumulation. These policies can be valuable for estate planning, business ownership, or providing for long-term financial goals. It is essential to carefully consider the different types of permanent life insurance and choose the one that aligns best with your financial objectives and risk tolerance.

Understanding Group Life Insurance: A Comprehensive Guide for TCS Employees

You may want to see also

Enrollment Periods: Employees can enroll during open enrollment or special enrollment periods

Life insurance offered by the Office of Personnel Management (OPM) provides a valuable benefit for federal employees, offering financial security and peace of mind. Understanding the enrollment periods is crucial for employees to take advantage of this benefit effectively.

Open enrollment periods are a standard time frame when employees can enroll in various benefits, including life insurance. These periods typically occur annually and provide a comprehensive opportunity for new hires and existing employees to review and update their coverage options. During open enrollment, employees can select the appropriate life insurance plan that suits their needs and can make any necessary changes to their coverage. It is recommended that employees carefully consider their choices during this period to ensure they have adequate protection for themselves and their families.

In addition to open enrollment, OPM offers special enrollment periods, which provide flexibility for employees to make changes to their life insurance coverage outside the regular open enrollment window. These special periods are often triggered by specific life events, such as marriage, the birth of a child, or a change in employment status. For instance, if an employee gets married, they may have the option to enroll in additional life insurance coverage for their spouse during a special enrollment period. Similarly, if an employee experiences a significant life change, such as a job transfer or retirement, they can take advantage of these special periods to adjust their insurance plans accordingly.

It is essential to stay informed about the specific dates and eligibility criteria for both open and special enrollment periods. OPM typically communicates these dates to employees through official channels, such as emails or notices on the agency's website. Employees should mark these dates on their calendars and be prepared to review and update their life insurance coverage accordingly.

By understanding the enrollment periods, federal employees can ensure they have the appropriate life insurance coverage to protect themselves and their loved ones. Taking advantage of open and special enrollment opportunities allows employees to make informed decisions and maintain a comprehensive benefits package throughout their federal career.

Life Insurance Post-Bariatric Surgery: What You Need to Know

You may want to see also

Benefits: Coverage begins upon qualification for federal employment

When it comes to life insurance through the Office of Personnel Management (OPM), one of the key benefits is that coverage begins upon qualification for federal employment. This means that if you are hired by a federal agency, you automatically become eligible for life insurance benefits, providing financial security for you and your loved ones. This is a significant advantage, as it ensures that you and your family are protected from the moment you start your federal career.

The OPM offers two types of life insurance plans: the Basic Life Insurance Program and the Federal Employees' Group Life Insurance (FEGLI) Program. The Basic Life Insurance Program provides a standard level of coverage, while the FEGLI Program offers more comprehensive options with higher death benefits. Both plans are designed to provide financial protection in the event of your death, ensuring that your family receives the financial support they need during a difficult time.

Upon qualification for federal employment, you will be automatically enrolled in the FEGLI Program, which offers a range of coverage options. These options typically include basic, optional, and additional coverage. Basic coverage is mandatory and provides a standard level of protection. Optional coverage allows you to increase your benefit amount, and additional coverage lets you further customize your policy to meet your specific needs. The OPM provides detailed information about these options, ensuring that you can make informed decisions about your life insurance coverage.

It's important to note that the OPM's life insurance program is highly regarded for its comprehensive benefits and competitive rates. The coverage is designed to provide peace of mind, knowing that your family will be financially secure if something happens to you. Additionally, the program's flexibility allows you to adjust your coverage as your circumstances change, ensuring that you always have the protection you need.

In summary, the OPM's life insurance program offers a unique advantage by providing coverage that starts immediately upon qualification for federal employment. This ensures that you and your family are protected from the moment you begin your federal career. With a range of coverage options and competitive rates, the OPM's program is a valuable benefit for federal employees, offering financial security and peace of mind.

Life Insurance: A Must-Have for Small Business Owners?

You may want to see also

Cost: Premiums are deducted from paychecks, making it convenient and affordable

The convenience and affordability of OPM (Office of Personnel Management) life insurance are significant advantages that make it an attractive option for many federal employees. One of the key benefits is the automatic enrollment process, where premiums are conveniently deducted directly from your paycheck. This streamlined approach ensures that you don't have to remember to pay for insurance, and it also means you can secure coverage without any additional effort. By having the premiums automatically withdrawn, OPM life insurance becomes a seamless part of your financial routine, providing peace of mind without disrupting your budget.

The cost-effectiveness of this program is particularly appealing. Since the premiums are taken out of your paycheck, you don't have to worry about setting aside money each month for insurance. This automatic deduction simplifies the process and ensures that you consistently have the coverage you need. Additionally, the fact that it is a group policy often results in lower rates compared to individual plans, making it an economical choice for federal employees.

OPM life insurance offers a competitive premium structure, which is a significant factor in its affordability. The rates are typically lower than those of private insurance companies, especially for the basic level of coverage. This cost-efficiency is further enhanced by the fact that the premiums are standardized for all enrollees, ensuring that everyone pays the same rate, regardless of their age or health status. This standardization contributes to the overall accessibility and budget-friendliness of the plan.

The automatic payroll deduction system also provides a sense of security and reliability. You can trust that your premiums will be paid on time, and you won't have to worry about missing a payment, which could potentially lead to a lapse in coverage. This convenience is especially valuable for those with busy schedules or those who prefer a hassle-free approach to managing their insurance needs.

In summary, the cost-effectiveness of OPM life insurance is a major draw for federal employees. The automatic deduction of premiums from paychecks ensures convenience and affordability, making it a practical and attractive option for those seeking reliable life insurance coverage without the complexity of individual policy management. This streamlined approach to insurance provides a valuable benefit to federal workers, offering both financial security and peace of mind.

Life Insurance in the Philippines: Abroad Options Explored

You may want to see also

Frequently asked questions

OPM life insurance is available to federal employees and their families through the Federal Employees' Group Life Insurance (FEGLI) program. This insurance is offered as part of the comprehensive benefits package provided by the federal government. It is accessible to employees who are enrolled in the FEGLI program, which is mandatory for most federal workers.

Eligibility for OPM life insurance is primarily based on your employment status and the duration of your federal service. As a federal employee, you are automatically enrolled in the FEGLI program, and the insurance coverage is provided at no cost to you. The amount of coverage you receive depends on your pay grade and the number of years you have been employed.

Yes, OPM life insurance remains available even after you leave your federal employment. The insurance coverage continues for a period of time, typically one year, after your employment ends. During this period, you can continue to pay the premiums and maintain your coverage. After the initial year, you may have the option to convert your coverage to an individual policy, depending on the terms and conditions of the OPM insurance program.