Verifying your auto insurance coverage is a necessary step to ensure you're protected and compliant. Whether you're borrowing a car, dealing with a divorce, or driving for business, it's essential to confirm that the vehicle is insured. Here are the steps you can take to verify auto insurance coverage:

Firstly, collect the relevant information, including basic contact details, the vehicle identification number (VIN), license plate number, and driver's license number. This information is crucial for the next steps. Secondly, you can verify coverage through various reputable sources. Contacting the insurance company directly is an option, where you can inquire about the active insurance policy and confirm coverage details. Alternatively, you may reach out to your local Department of Motor Vehicles (DMV) and request insurance information. However, the DMV may require proof of why you need this information, such as a police report of a collision involving the vehicle in question. Finally, in the event of an accident, you can contact the police, who can take down insurance information and verify coverage for you. They can also assist in cases where the other driver is uncooperative or leaves the scene without providing their insurance details.

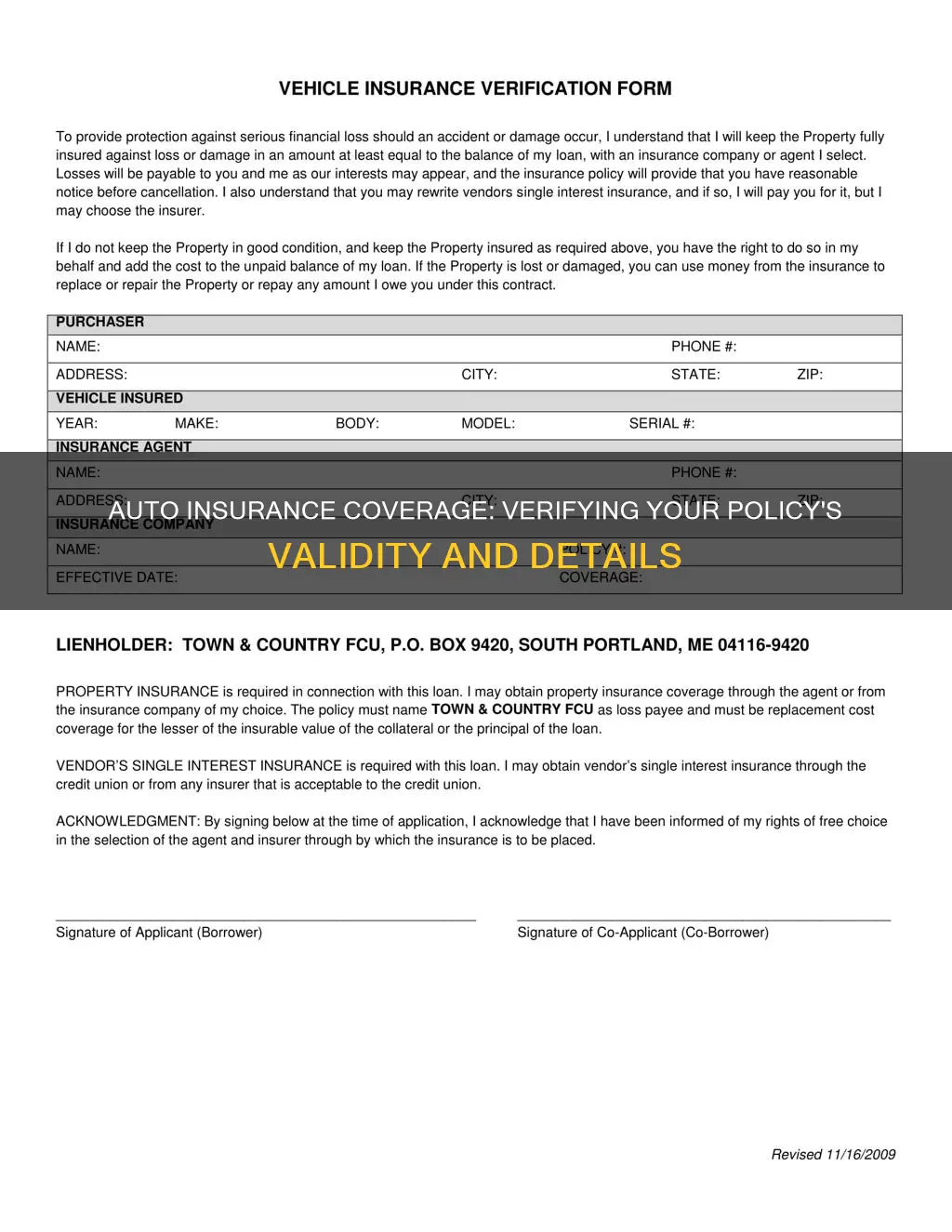

| Characteristics | Values |

|---|---|

| Verifying auto insurance coverage | Check the insurance card |

| Contact the insurance company directly | |

| Utilize online verification tools | |

| Collaborate with the vehicle owner | |

| Check state databases | |

| Look for insurance stickers or tags | |

| Request a Certificate of Insurance | |

| Verify through the DMV | |

| Monitor your mailbox | |

| Confirm coverage periods |

What You'll Learn

Check the insurance card

Checking the insurance card is the most straightforward way to verify auto insurance coverage. The insurance card is typically provided by the vehicle owner and includes essential information such as the insurance provider's policy number, coverage details, and contact information. It is important to ensure that the card is current and to cross-check the information provided. This method allows for quick verification without having to contact any external sources.

However, it is always a good idea to cross-reference the information on the insurance card with other sources to ensure its accuracy. This can be done by contacting the insurance company directly, using online verification tools, or checking with the local Department of Motor Vehicles (DMV). Verifying auto insurance coverage is crucial, especially when lending or borrowing a vehicle, to avoid any misunderstandings and ensure compliance with legal requirements.

In some regions, vehicles may also be required to display insurance stickers or tags on the license plate or windshield, providing a visual confirmation of insurance coverage. While this doesn't provide detailed coverage information, it serves as an additional indicator that the vehicle is insured.

It is worth noting that insurance information is not public record, and one cannot simply request it without a valid reason, such as being involved in a collision with the vehicle in question. Therefore, it is essential to have the necessary information, such as the vehicle identification number (VIN), license plate number, and driver's license number, when verifying auto insurance coverage through official channels.

Understanding Third-Party Auto Insurance: What You Need to Know

You may want to see also

Contact the insurance company directly

Contacting the insurance company directly is a straightforward way to verify auto insurance coverage. Here are some detailed steps to help you through the process:

Collect the Necessary Information

Before reaching out, ensure you have the relevant details about the car insurance policy in question. This typically includes basic contact information, such as the name of the policyholder, their address, and phone number. Additionally, gather information specific to the vehicle, including the Vehicle Identification Number (VIN), license plate number, and the driver's license number. Having this information readily available will streamline the verification process.

Contact the Insurance Company

With the required information in hand, you can now get in touch with the insurance company. Most insurance providers have multiple contact options, including phone, email, and online chat. It is recommended to call the insurance company directly, as this often provides the quickest response. When contacting them, provide the details you have gathered, and they will be able to confirm whether the policy is active and provide other relevant coverage information.

Online Account Access

If you are the policyholder, another option is to log in to your online account with the insurance company. Most insurance providers have online portals or mobile apps that allow customers to access their policy information. By logging in to your account, you can verify your coverage details, including the effective and expiration dates of your policy. This method is convenient if you need to quickly confirm your own insurance coverage.

Benefits of Contacting the Insurance Company

Contacting the insurance company directly is a reliable way to verify auto insurance coverage. By doing so, you can obtain accurate and up-to-date information about the policy. This method is particularly useful if you are looking to confirm coverage for another person's vehicle or if you have doubts about the validity of their insurance card. Additionally, contacting the insurance company directly can provide peace of mind and protect you from potential legal and financial risks associated with uninsured drivers.

Case Study: Sarah's Experience

To illustrate the process, consider the example of Sarah, who lent her car to a friend but wanted to ensure her friend had active insurance coverage. Before lending her car, Sarah collected her friend's insurance policy number and the name of the insurer. She then contacted her friend's insurance company directly, providing them with the necessary details. By taking this proactive step, Sarah was able to verify the coverage and feel confident about lending her car.

Younger Drivers: Higher Risk, Higher Auto Insurance Premiums

You may want to see also

Utilise online verification tools

When verifying auto insurance coverage, it is important to utilise online verification tools. Many insurance carriers have online portals or mobile apps that allow customers to log in and access their auto insurance policy documents, proof of coverage, and contact information. This is often the quickest and most convenient way to verify your insurance coverage.

In addition to insurance company websites and apps, several other online tools and resources can be used to verify auto insurance coverage. For example, the Department of Motor Vehicles (DMV) in some states, such as Virginia and Washington, D.C., offers online verification services. You can contact your local DMV to inquire about their specific process, as they may require certain information, such as the vehicle's license plate number, Vehicle Identification Number (VIN), and owner's information.

Some states also have their own insurance verification databases that are accessible by the DMV and law enforcement. For instance, Illinois has implemented a policy to verify car insurance coverage twice a year. Therefore, checking with your state's Secretary of State can provide proof of insurance coverage for a specific period.

Online comparison tools are also available to help you find the best rates and coverage options from different insurance providers. These tools allow you to compare quotes and coverage levels across multiple companies, ensuring that you get the most suitable plan for your needs.

By leveraging these online verification tools, you can efficiently and effectively confirm your auto insurance coverage, ensuring compliance with legal requirements and peace of mind while on the road.

Full Auto Insurance Coverage: Michigan's Unique Requirements Explained

You may want to see also

Collaborate with the vehicle owner

Collaborating with the vehicle owner is a straightforward way to verify auto insurance coverage. Open communication is vital when lending or borrowing a vehicle to avoid any misunderstandings about insurance status. Here are some steps to take when collaborating with the vehicle owner:

Request Insurance Information:

Ask the vehicle owner for their insurance details, including the name of their insurance company, policy number, and coverage specifics. It is essential to ensure that the insurance policy is current and covers the period you need.

Cross-Check Information:

Verify the information provided by the vehicle owner. You can do this by contacting the insurance company directly using the contact information on their website or through previous correspondences. Alternatively, you can utilize online verification tools by inputting the vehicle's VIN and other relevant details to confirm the insurance coverage.

Understand Coverage Details:

Ask the vehicle owner about the specific coverages included in their policy. For example, confirm whether they have liability coverage, collision coverage, or any additional protections. This information is crucial, especially if you plan to borrow the vehicle or if you are involved in an accident.

Obtain a Certificate of Insurance:

If you need comprehensive information about the insurance policy, you can request a Certificate of Insurance directly from the vehicle owner's insurance company. This document provides a summary of the policy, including coverage limits and other important details.

Maintain Open Communication:

Keep the lines of communication open with the vehicle owner. If you have any questions or concerns about the insurance coverage, don't hesitate to ask. It is better to clarify all the details beforehand to avoid any surprises or misunderstandings later on.

Remember that verifying auto insurance coverage is essential for responsible vehicle ownership and can provide financial protection in case of accidents, theft, or other unforeseen incidents. By collaborating with the vehicle owner, you can ensure that you have all the necessary information and peace of mind.

Phone-Friendly: States Allowing Digital Auto Insurance ID Cards

You may want to see also

Check state databases

When verifying auto insurance coverage, it is important to check state databases. While there is no national database in the US for checking vehicle insurance coverage, many states have their own insurance verification databases. These databases are accessible by the Department of Motor Vehicles (DMV) and law enforcement.

To check a vehicle's insurance status through the DMV, you will need to contact your local DMV using their website, phone numbers, or email addresses. Be prepared to provide the vehicle's license plate number, Vehicle Identification Number (VIN), and owner's name. The DMV can confirm if a vehicle is insured, but they may not provide detailed policy information.

In addition to the DMV, you can also check with your state's Secretary of State for proof of car insurance coverage. For example, Illinois has implemented a policy of verifying car insurance coverage twice a year. Therefore, checking with the Secretary of State can be helpful if you are seeking coverage details for a specific period.

It is important to note that when requesting insurance information from the DMV or Secretary of State, you may need to provide a valid reason for your request, such as being involved in a collision with another vehicle. You may also be required to submit a police report and other relevant documents.

Strategies to Reduce Auto Insurance Premiems Post-DUI

You may want to see also

Frequently asked questions

To verify car insurance coverage, you will need to collect the necessary information, such as the driver's details and insurance policy number, and then contact the insurance company, log in to your insurance account, or reach out to the DMV.

Collect the driver's information, vehicle details, insurance policy number, and the name of the insurance company.

Yes, you can verify your own car insurance coverage by contacting your insurance company or logging in to your online account.

To check another driver's car insurance coverage, you can contact their insurance company, use online verification tools, or contact the police or DMV for assistance.