A car insurance lapse is a period of time when you own a car but don’t have car insurance coverage. This could be due to a missed payment or because you were dropped by your insurance company. Driving without insurance is illegal in most states and can lead to serious consequences such as fines, penalties, and higher premiums. It is important to address a lapse in coverage as soon as possible to avoid these issues. If your policy has lapsed, you should contact your insurance company to see if it can be reinstated. If not, you will need to purchase a new policy.

| Characteristics | Values |

|---|---|

| Definition of a lapse in car insurance | Any amount of time the policy becomes inactive |

| Reasons for a lapse in car insurance | Missed premium payment(s) or policy cancellation by the insurance company |

| Consequences of a lapse in car insurance | Higher auto insurance premiums, driver's license suspension, tickets, fines, penalties, loss of driving privileges, possible jail time, having to pay for any accident damages out of pocket |

| Grace period for car insurance lapse | Varies by company and state, typically between 1 day and 30 days |

| Actions to take after a car insurance lapse | Contact insurance company, try to get old policy reinstated, shop for a new policy if necessary, stop driving the car |

| How to avoid a car insurance lapse | Pay premiums on time, set up automatic payments, opt for paperless billing and text notifications, monitor communications from the insurance provider |

What You'll Learn

What to do if your car insurance has lapsed

A car insurance lapse can have serious consequences, including fines, penalties, higher premiums, suspension of your license and registration, and even jail time. If your car insurance has lapsed, it's important to take immediate action to rectify the situation. Here are the steps you should take:

Understand the reason for the lapse:

Contact your insurance company to find out why your coverage has lapsed. It could be due to a missed payment, policy cancellation, or some other issue.

Try to get your old policy reinstated:

If the lapse is due to a missed payment, ask your insurance company if you can get your policy reinstated. In some cases, they may be willing to reinstate your policy, especially if it hasn't been too long since the missed payment. You may have to pay a reinstatement fee, and your rates might increase.

Shop around for a new policy:

If your insurance company is unwilling to reinstate your policy, you may need to switch to a different insurance provider. Compare plans from different insurers based on the features offered and premium rates. It's important to get a new policy as soon as possible, as driving without insurance is illegal in most states and can result in serious penalties.

Maintain continuous coverage:

Once you have secured a new policy, make sure to maintain continuous coverage to avoid future lapses. Set up automatic payments or opt for paperless billing and text notifications to help you stay on top of your payments.

Be aware of grace periods:

Most insurance companies offer a grace period after a missed payment, which can range from a few days to a few weeks. During this time, you can make the payment and get your policy reinstated without any lapse in coverage. However, be aware that not all companies offer grace periods, and the length of the grace period varies, so don't delay in taking action.

Understand the consequences:

If you continue to drive without insurance, you are at significant financial risk. In the event of an accident, you will be responsible for all damages and repairs, which can be extremely costly. Additionally, driving without insurance can result in hefty fines, suspension of your license and registration, and even jail time, depending on your state's laws and the number of offenses.

Full Coverage Auto Insurance: What's Really Covered?

You may want to see also

How to reinstate your policy

A car insurance lapse can have serious consequences, so it's important to get your policy reinstated as soon as possible. Here are the steps you can take to reinstate your policy:

Contact Your Insurance Company

Get in touch with your insurance provider to understand the reason for the lapse. This could be due to a missed payment, policy cancellation, or another issue. Ask them if your policy can be reinstated and what the next steps are. Some companies may be willing to reinstate your policy, especially if the lapse was due to a missed payment and it hasn't been too long.

Understand the Grace Period

Find out if your insurance company offers a grace period. A grace period is the time between your payment due date and the date your policy officially lapses. Grace periods can vary from one day to a few weeks and may give you some time to make payments and avoid a lapse.

Make the Necessary Payments

If your policy lapsed due to a missed payment, make the necessary payments as soon as possible. You may also need to pay a reinstatement fee to get your policy back on track. Contact your insurance company to understand their specific policies and procedures.

Provide Any Required Documentation

In some cases, your insurance company may require additional documentation to reinstate your policy. This could include a proof-of-no-loss form or a no-loss statement, which confirms that there were no accidents or damages during the lapse.

Shop Around if Necessary

If your insurance company is unwilling to reinstate your policy, you may need to consider switching to a new provider. Shop around and compare quotes from different insurers to find the best option for your needs and budget.

Remember, driving without valid insurance can result in significant penalties and fines, and it's important to address a lapse as soon as possible to minimize the impact on your coverage and driving record.

Switching State Farm Auto Insurance: A Smooth State Change

You may want to see also

What are the consequences of a lapse in car insurance

A lapse in car insurance coverage can have several negative consequences, and it's important to understand the risks involved. Here are some detailed explanations of the potential outcomes:

Financial Risk and Liability

Not having valid car insurance puts you at significant financial risk. If you cause an accident that results in injuries or property damage, you will be personally liable for the expenses. This includes medical bills for anyone injured, as well as repairs or replacement costs for damaged vehicles. The financial consequences of an accident can be life-changing, and you may even face legal action that could impact your future income.

Increased Insurance Premiums

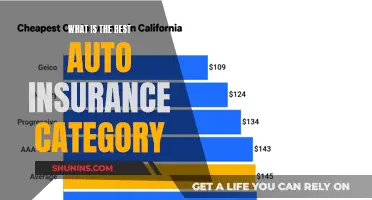

Allowing your car insurance to lapse, even for a short period, can lead to higher insurance premiums. Insurance companies view clients with lapsed policies as higher-risk, and you may be deemed less insurable. The longer the lapse in coverage, the higher your future insurance rates are likely to be. Some insurance companies may even refuse to offer you a new policy, forcing you to seek coverage from low-rated insurers.

License Suspension, Fines, and Penalties

In many states, driving without valid insurance is illegal and can result in license suspension, fines, or other penalties. For example, in New York, drivers can lose their license and vehicle registration for a year, and they must pay a substantial fee to reinstate their license. Additionally, you may be required to carry an SR-22, which is an added expense on your next auto policy, further increasing your costs.

Difficulty in Obtaining Future Insurance

A lapse in car insurance coverage can make it more challenging to obtain insurance in the future. Insurance companies may view you as a high-risk driver, even if you have a good driving record. This could lead to higher premiums or difficulties in finding an insurer willing to offer you a policy. Some companies have specific requirements for drivers who haven't maintained continuous coverage, such as a minimum period of continuous coverage before they will provide a policy.

Repossession

If you have a loan or lease on your vehicle, a lapse in insurance coverage could result in repossession. Lenders typically require comprehensive and collision coverage as part of the loan or lease agreement. Failing to maintain the required insurance coverage gives them the right to repossess the vehicle to protect their investment.

In summary, allowing your car insurance to lapse, even for a short period, can have significant consequences. It's essential to maintain continuous coverage to avoid these risks and ensure you are protected financially and legally while driving.

U.S. Military Auto Insurance: USAA Eligibility

You may want to see also

How to avoid a car insurance lapse

A car insurance lapse can have serious consequences, from fines to a suspended license or even repossession of your vehicle. Luckily, there are several ways to avoid a lapse in coverage.

Firstly, it's important to keep up-to-date with your payments. Most insurance companies offer a grace period of around 10-20 days, but it's best not to rely on this to avoid a lapse. Setting up automatic payments can help you stay on track and may even earn you a discount with some providers.

If you're struggling to make payments, get in touch with your insurance company as soon as possible. They may be able to offer you a different payment plan or find other ways to reduce your premiums.

It's also worth shopping around for the best deal. Different insurance companies have different requirements and eligibility criteria, so you may be able to find a cheaper option that still meets your needs. However, be aware that some companies won't sell a policy to drivers who haven't maintained continuous coverage for a certain duration.

Finally, keep your driving record as clean as possible. Insurance companies consider drivers with accidents or violations to be higher risk and may increase your premiums or even drop your coverage.

Texas Auto Insurance: Understanding the Mandatory Liability Coverage

You may want to see also

What to do if you no longer need car insurance

If you no longer need car insurance, you can cancel your policy. However, it's important to keep in mind that if you get behind the wheel again, you might have to pay an increased rate. This is because insurance companies may consider you a riskier driver than those who keep active policies.

If you're not driving, you won't need auto insurance. Here are some reasons why you might not need car insurance:

- You're travelling out of the country

- You plan to rely on other modes of transportation, such as biking or public transport

- You don't plan on driving and will only be a passenger in other people's cars

If you decide to cancel your car insurance, there are a few steps you should take:

- Contact your insurance company to inform them of your decision and confirm the date your coverage will end.

- Ask about any cancellation fees or penalties that may apply.

- Find out if you are eligible for a refund if you have paid for coverage beyond the cancellation date.

- Get written confirmation of the cancellation from your insurance company.

- If you're switching to a new insurance company, make sure you have secured a new policy before cancelling your current one.

It's important to weigh your options carefully before cancelling your car insurance. Consider the possibility that you may need to drive again in the future and the potential impact on your insurance rates.

Century Auto Insurance: Exploring Turo Coverage

You may want to see also

Frequently asked questions

Contact your insurance company to see if your policy can be reinstated. If not, shop around for a new policy.

You may be fined, have your license suspended, or even face jail time, depending on the state and the length of the lapse.

A lapse can last anywhere from one day to 180 days or more.

A grace period is the time between your payment due date and your policy officially lapsing. This can range from one day to a few weeks.