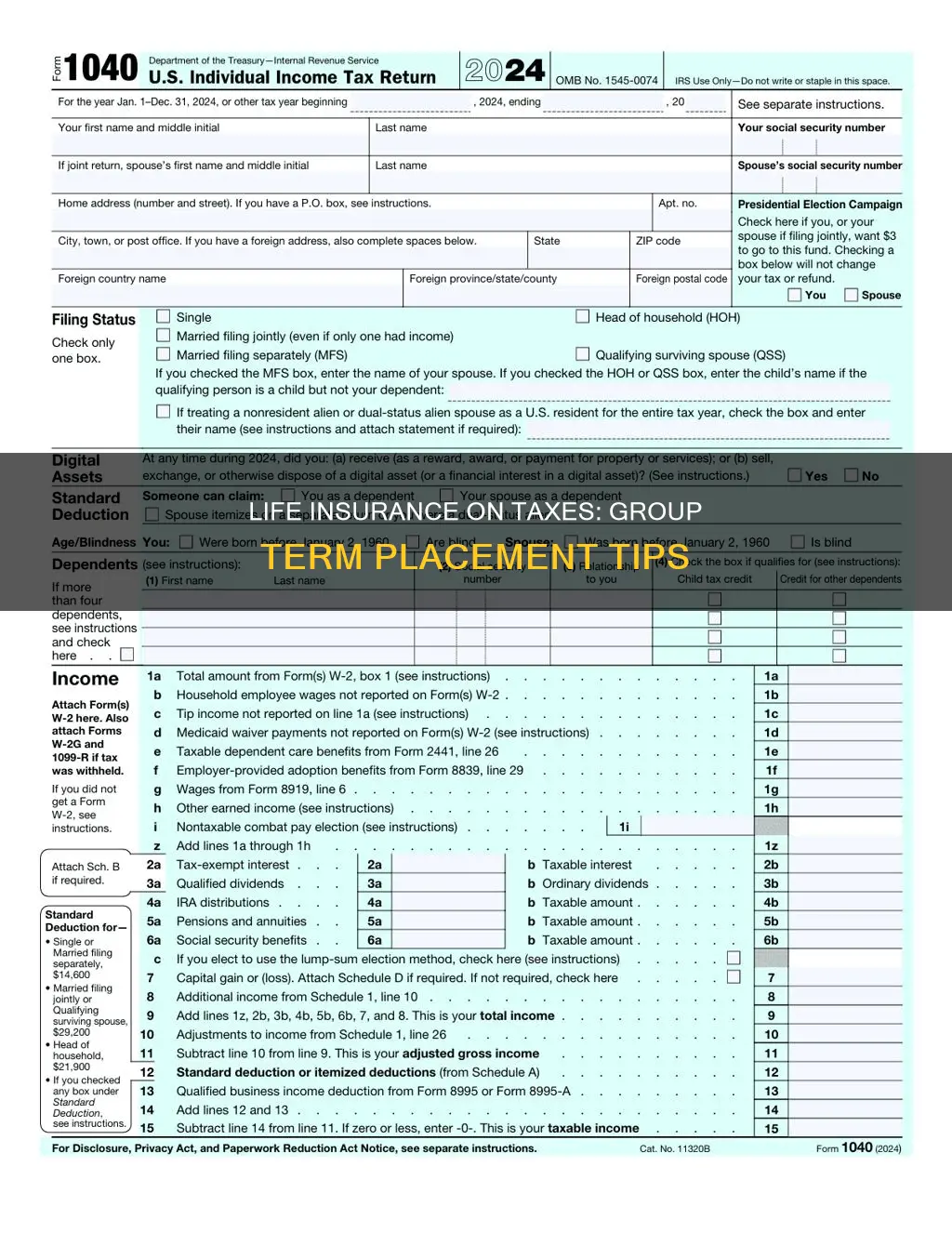

When it comes to filing group term life insurance on your 1040, it's important to understand the specific rules and regulations. Group term life insurance is a type of coverage provided by an employer or organization, and it's crucial to know how to properly report and claim this benefit on your tax return. This paragraph will guide you through the process of identifying and reporting group term life insurance on your 1040, ensuring you comply with tax laws and maximize any potential tax benefits.

What You'll Learn

- Tax Deductions: Group term life insurance premiums may be tax-deductible

- Form 1099-R: Report proceeds from group term life insurance on this form

- Schedule A: Claim deductions for group term life insurance premiums on Schedule A

- State Taxes: State tax laws vary; consult a tax professional for guidance

- Business Expenses: If the insurance is for a business, it may be a deductible expense

Tax Deductions: Group term life insurance premiums may be tax-deductible

When it comes to tax deductions, understanding the intricacies of your tax return can be a complex task, especially when it involves group term life insurance. Group term life insurance premiums can indeed be tax-deductible, but the process of claiming this deduction requires careful consideration. Here's a detailed guide to help you navigate this aspect of your tax return.

For individuals, group term life insurance premiums are generally not tax-deductible as a personal expense. However, there are specific circumstances where this can be beneficial. Firstly, if you are self-employed or a small business owner, you may be able to deduct the cost of group term life insurance as a business expense. This is because it can be considered a necessary cost to protect your business and its employees. When filling out your 1040, you would typically report this deduction under the 'Business Expenses' or 'Other Deductions' section, depending on your tax preparation software or method.

Secondly, if you are a high-income earner, group term life insurance premiums might be tax-deductible as a miscellaneous itemized deduction. This category includes expenses that are over 2% of your adjusted gross income (AGI) and are directly related to your job. For example, if your AGI is $150,000 and you pay $3,000 in group term life insurance premiums, you can deduct the excess amount over $3,000 (2% of $150,000) as a miscellaneous deduction. It's important to note that this deduction is subject to certain limitations and may not be available to everyone.

To claim this deduction, you'll need to provide detailed documentation. This includes proof of payment for the insurance premiums and any relevant forms or statements from the insurance provider. Additionally, you may need to complete a separate schedule or form to explain the nature of the deduction and its connection to your employment or business.

In summary, while group term life insurance premiums are generally not tax-deductible for personal insurance, they can be claimed as a business expense or a miscellaneous deduction in specific scenarios. Understanding the tax laws and keeping thorough records are essential to ensure you maximize your tax benefits while staying compliant with the IRS regulations. Always consult a tax professional or accountant to ensure you are taking the correct approach for your individual circumstances.

Group Life Insurance: A Compulsory Cover in Nigeria?

You may want to see also

Form 1099-R: Report proceeds from group term life insurance on this form

When it comes to reporting proceeds from group term life insurance on Form 1099-R, it's important to understand the specific guidelines provided by the IRS. This form is used to report distributions from retirement plans, including group term life insurance policies that are part of certain retirement plans. Here's a detailed guide on how to handle this situation:

Understanding Form 1099-R

Form 1099-R is a crucial document for individuals who have received distributions from retirement plans. It provides a summary of the distribution, including the type of plan, the date of distribution, and the amount received. When it comes to group term life insurance, the proceeds from this policy can be reported on this form if the insurance is part of a qualified retirement plan.

Reporting Group Term Life Insurance Proceeds

If you have received proceeds from a group term life insurance policy as part of your retirement plan, you should report these amounts on Form 1099-R. The proceeds from the insurance policy are considered a distribution from the retirement plan and must be included in your income for tax purposes. The form will typically show the box to be checked for "Distribution from a qualified retirement plan" or a similar category.

Box 1a and Box 1b

On Form 1099-R, you'll find two important boxes: Box 1a and Box 1b. Box 1a reports the total amount of distributions received during the tax year, while Box 1b specifies the amount that is considered taxable income. When reporting group term life insurance proceeds, you should include the entire amount received in Box 1a and the taxable portion in Box 1b. It's essential to accurately report these amounts to ensure compliance with tax regulations.

Additional Information

Along with the distribution amount, Form 1099-R may also include other relevant details such as the plan type, employer identification number, and the date of distribution. These details provide a comprehensive overview of the distribution, making it easier for taxpayers to understand and report the proceeds correctly.

Remember, when dealing with tax forms, accuracy is crucial. Ensure that you have all the necessary information and carefully follow the instructions provided by the IRS. If you have any doubts or require further clarification, consulting a tax professional or referring to the IRS guidelines is recommended to ensure proper reporting of your group term life insurance proceeds.

Life Insurance: AD&D Coverage and Benefits

You may want to see also

Schedule A: Claim deductions for group term life insurance premiums on Schedule A

When it comes to filing taxes, understanding how to properly report and claim deductions for group term life insurance premiums is essential. If you have group term life insurance provided through your employer or a qualified plan, you may be able to claim a deduction for the premiums on your tax return, specifically on Schedule A of Form 1040. This can help reduce your taxable income and potentially lower your tax liability.

To claim this deduction, you need to provide specific information on Schedule A. Start by filling out the relevant sections, including the type of insurance and the amount of the premium. You'll need to provide details such as the name of the insurance company, the policy number, and the total annual premium cost. It's important to be accurate and provide all the necessary information to ensure a smooth tax filing process.

In the 'Health Insurance Premiums' section of Schedule A, you will find a line specifically for 'Health, Disability, and Life Insurance Premiums.' Here, you can list the amount you paid for group term life insurance premiums during the tax year. Make sure to include the total amount paid, even if it was split between you and your employer or plan sponsor. This ensures that you claim the full deduction if you are eligible.

When completing this section, it's crucial to have the necessary documentation. Keep records of the premiums paid, such as pay stubs, insurance statements, or any other relevant documents. These records will support your claim and help avoid any potential issues during tax audits. Additionally, if you have any questions or uncertainties, consulting a tax professional can provide guidance tailored to your specific situation.

Remember, the rules and regulations regarding tax deductions can be complex, and it's essential to stay informed and accurate. By properly claiming your group term life insurance premiums on Schedule A, you can take advantage of this potential tax benefit and ensure a more efficient tax filing process.

Life Insurance Annuity: What Happens When It Matures?

You may want to see also

State Taxes: State tax laws vary; consult a tax professional for guidance

When it comes to reporting group term life insurance on your tax return, it's important to understand that state tax laws can vary significantly. This means that the specific treatment of group term life insurance may differ depending on your state of residence or the state where the insurance was issued. As such, consulting a tax professional who is familiar with the tax laws in your jurisdiction is highly recommended to ensure accurate compliance.

In general, group term life insurance is typically considered a form of group health insurance. When filing your federal tax return (Form 1040), you generally report the value of group health insurance premiums as a deduction on Schedule A (Itemized Deductions) if you itemize your deductions. However, the rules can get more complex when it comes to state taxes.

Some states may allow you to deduct the cost of group term life insurance premiums as a medical expense, which can be beneficial if you have itemized deductions. Others may require you to include the value of the insurance benefits received as taxable income. For instance, if you receive a lump-sum payment from the insurance company upon the death of a covered individual, this payment may be considered taxable income in some states.

To navigate these variations, it's crucial to seek personalized advice. A tax professional can provide tailored guidance based on your specific circumstances, including the state you reside in and the terms of your group term life insurance policy. They can help you determine the correct method for reporting the insurance on your state and federal tax returns, ensuring that you take advantage of any available deductions or exclusions while adhering to the relevant tax laws.

Remember, tax laws are intricate and can change frequently, so staying informed and seeking professional advice is essential. By doing so, you can ensure that your tax affairs are in order and that you are taking full advantage of any tax benefits related to your group term life insurance policy.

Life Insurance: Cashing in While Still Alive?

You may want to see also

Business Expenses: If the insurance is for a business, it may be a deductible expense

When it comes to tax deductions for business expenses, group term life insurance can be a valuable consideration for business owners. This type of insurance provides coverage for a group of individuals, typically employees, and can be an essential part of a comprehensive benefits package. If you are a business owner, it's important to understand how this insurance can be treated for tax purposes.

For tax purposes, group term life insurance can be considered a deductible business expense. This means that the cost of providing this insurance to your employees can be claimed as an expense on your business tax return. The key factor here is that the insurance is provided for the benefit of your business operations and its employees. By offering group term life insurance, you are providing a valuable benefit that can help attract and retain talent, which is crucial for the success of your business.

To claim this expense, you will need to provide documentation that supports the cost of the insurance. This typically includes proof of payment for the premiums and any other associated fees. It's important to keep detailed records and ensure that the insurance is specifically for the business and not for personal use. The IRS has specific guidelines for what qualifies as a deductible business expense, and group term life insurance generally meets these criteria when provided for employees.

When preparing your tax return, you can include the cost of group term life insurance as a deduction under the category of "Health and Welfare Benefits." This category is designed to cover expenses related to providing health and welfare benefits to employees, and group life insurance often falls under this heading. It's recommended to consult with an accountant or tax advisor to ensure you are claiming the correct amount and adhering to all relevant tax regulations.

In summary, if you are a business owner offering group term life insurance to your employees, it can be a valuable tax deduction. By providing this insurance, you are not only showing your commitment to employee well-being but also potentially reducing your business's taxable income. Remember to maintain proper documentation and seek professional advice to ensure compliance with tax laws.

Life Insurance: Impacting College Dreams and Realities

You may want to see also

Frequently asked questions

Group term life insurance premiums are typically not reported as income on your 1040 tax return. However, if you are self-employed or a business owner, you may need to consider the tax implications of the insurance. You can claim a deduction for the premiums paid, which can be found on Schedule C (Profit or Loss from Business) or Schedule SE (Self-Employment Tax).

As an employee, you generally cannot deduct the cost of group term life insurance premiums. This type of insurance is often provided by employers as a benefit to their employees, and the premiums are typically paid through payroll deductions. However, if you have a flexible spending account (FSA) or a health savings account (HSA), you might be able to use those funds to pay for qualified medical expenses, including insurance premiums.

If you have both a group term life insurance policy through your employer and a personal policy, you should report the group policy's benefits and premiums accordingly. The group policy's benefits may be exempt from income tax, but you should still report the premiums paid for it. Any additional personal insurance policies you own should be reported separately, and their premiums may be deductible, depending on your individual circumstances.

Yes, there can be tax advantages to having group term life insurance, especially if you are self-employed or a business owner. As mentioned earlier, you can deduct the premiums paid for this type of insurance. Additionally, if you itemize your deductions, you may be able to claim a deduction for the death benefit received from the policy, which can provide a tax-free financial safety net for your beneficiaries.