When it comes to group term life insurance on a W2, it's important to understand the placement and implications. Group term life insurance is a type of coverage provided by employers to their employees, offering financial protection in the event of the insured's death. The W2 form, an employee's annual wage and tax statement, plays a crucial role in reporting and managing this insurance. This paragraph will explore the various considerations and options for placing group term life insurance on a W2, ensuring employees receive the necessary coverage while also being aware of the tax implications and benefits.

What You'll Learn

- Tax Implications: Understand how group life insurance affects your taxes and deductions

- W-2 Reporting: Learn how to report group life insurance benefits on your W-2 form

- Employer Deductions: Explore employer tax deductions for group life insurance premiums

- Employee Contributions: Discover if employees can contribute to group life insurance

- Beneficiary Designations: Guide on how to update beneficiary info for group life insurance

Tax Implications: Understand how group life insurance affects your taxes and deductions

When it comes to group term life insurance, understanding its tax implications is crucial for both employers and employees. Group life insurance, which provides coverage to a group of individuals, can have significant tax considerations that impact the overall cost and benefits of the policy. Here's a breakdown of how group life insurance affects your taxes and deductions:

Employer's Perspective:

Employers who offer group life insurance as a benefit to their employees should be aware of the tax rules surrounding this arrangement. Firstly, the cost of group life insurance premiums is typically considered a business expense and can be deducted as a payroll deduction. This means that the employer can reduce their taxable income by the amount spent on group life insurance premiums. However, there are certain limitations and rules to follow. The Internal Revenue Service (IRS) has specific guidelines regarding the maximum amount that can be deducted, and it may vary based on the type of coverage and the number of employees. It's essential to stay updated with the latest IRS regulations to ensure compliance.

Employee Deductions:

For employees, group life insurance can provide valuable tax benefits. Premiums paid by the employer for group life insurance coverage are generally not taxable income for the employee. This means that the employee does not have to report the value of this coverage as income on their tax return. Additionally, if an employee pays for their own group life insurance policy, the premiums may be tax-deductible as a medical expense, provided the total medical expenses exceed a certain threshold. It's important to note that the IRS has specific rules regarding the maximum amount that can be deducted for medical expenses, and group life insurance premiums must meet these criteria to be considered a valid deduction.

Taxable Benefits:

While group life insurance premiums themselves are often not taxable, any additional benefits or cash values associated with the policy may be subject to taxation. For instance, if the group life insurance policy includes a cash value component, any dividends or interest earned on that cash value could be taxable income for the employee. It's crucial to understand the specific terms of the group life insurance policy to determine if any taxable benefits are included.

Reporting on W-2 Forms:

When it comes to reporting group life insurance on W-2 forms, employers must accurately reflect the total group life insurance premiums paid on behalf of their employees. This information is crucial for employees to understand their overall compensation and benefits. However, it's essential to note that the W-2 form does not typically include the value of group life insurance coverage itself but rather the premiums paid by the employer. Employees should consult their W-2 form and any accompanying documentation to ensure they have a clear understanding of their taxable benefits and deductions related to group life insurance.

In summary, group term life insurance offers valuable tax advantages for both employers and employees. Employers can deduct a portion of the premiums as business expenses, while employees can benefit from tax-free coverage and potential deductions for personal premiums. Understanding the specific tax rules and staying informed about IRS guidelines is essential to ensure compliance and maximize the benefits of group life insurance.

Life Insurance Without Beneficiaries: What You Need to Know

You may want to see also

W-2 Reporting: Learn how to report group life insurance benefits on your W-2 form

When it comes to reporting group life insurance benefits on your W-2 form, it's important to understand the specific guidelines and requirements set by the Internal Revenue Service (IRS). Group life insurance is a common benefit provided by employers to their employees, offering financial protection in the event of the employee's death. Here's a step-by-step guide to help you navigate the W-2 reporting process for these benefits.

Understanding the Basics:

Group life insurance is typically provided as a voluntary benefit, meaning employees can choose to participate or not. The employer pays the premium for this insurance, and the coverage amount is usually a fixed sum. It's essential to recognize that group life insurance is different from individual life insurance policies, and the reporting process varies accordingly.

W-2 Reporting Requirements:

According to the IRS, group life insurance benefits are generally not taxable to the employee. However, there are specific rules regarding the reporting of these benefits on your W-2 form. Here's how to approach it:

- Box 12 (Wages and Taxable Earnings): You should not include the group life insurance benefits in Box 12 of your W-2 form. This box is typically used to report wages, salaries, and other taxable earnings. Since the insurance benefits are not considered taxable income, they do not belong in this section.

- Box 14 (Total Social Security and Medicare Taxes Withheld): Similarly, you should not report group life insurance benefits in Box 14. This box is used to show the total amount of Social Security and Medicare taxes withheld from your wages. As the benefits are not taxable, they should not be included here either.

- Box 17 (Total Contributions to Dependent Care and Adoption Accounts): This box is for reporting contributions made by the employer to dependent care or adoption assistance accounts. Group life insurance benefits do not fall under this category, so there is no need to include them here.

Additional Considerations:

- It's crucial to review your W-2 form carefully to ensure accuracy. Any incorrect reporting of benefits could lead to tax-related issues.

- If you have any doubts or concerns, consult a tax professional or your employer's HR department for guidance specific to your situation.

- Remember, the IRS provides detailed instructions and forms (such as Form W-2) to help employees understand their tax obligations.

By following these guidelines, you can ensure that your group life insurance benefits are reported correctly on your W-2 form, maintaining compliance with tax regulations.

Life Insurance: Recession-Proofing Your Finances and Future

You may want to see also

Employer Deductions: Explore employer tax deductions for group life insurance premiums

When it comes to employer tax deductions for group life insurance premiums, it's important to understand the rules and regulations set by the IRS. Group life insurance is a valuable benefit that employers often provide to their employees, offering financial protection in the event of the employee's death. As an employer, you may be wondering how to handle the tax implications of providing this coverage.

According to the IRS, group life insurance premiums paid by an employer for its employees are generally tax-deductible business expenses. This deduction is available to both for-profit and not-for-profit organizations. The key is to ensure that the insurance is provided as a group plan and is not tailored to a specific individual. If the insurance is customized for an individual, it may not qualify for the tax deduction.

To claim the deduction, employers need to provide specific documentation. This includes a written statement from the insurance company confirming the group nature of the policy and the total premiums paid. Additionally, employers should keep records of the employees covered under the plan and the corresponding premium payments. These records will be essential when filing the necessary tax forms.

It's worth noting that there are certain limitations and restrictions. The deduction is typically limited to the amount of the premium that the employer pays on behalf of each employee. If the employer also contributes to the employee's individual life insurance policy, only the group policy premium is eligible for deduction. Furthermore, the IRS has specific guidelines regarding the types of employees who qualify for this deduction, generally excluding independent contractors and leased employees.

In summary, employers can take advantage of tax deductions for group life insurance premiums, provided the insurance is offered as a group plan and not tailored to individuals. By adhering to the IRS guidelines and maintaining proper documentation, employers can ensure that they maximize their tax benefits while providing a valuable benefit to their employees.

Senior Life Insurance: Making Money Off the Elderly

You may want to see also

Employee Contributions: Discover if employees can contribute to group life insurance

Employee contributions to group life insurance plans are a topic that often sparks curiosity among employees and employers alike. It's important to understand the intricacies of these contributions to ensure compliance with tax regulations and to maximize the benefits for employees. Here's a detailed breakdown of how and why employees might contribute to their group life insurance:

Understanding Group Life Insurance:

Group life insurance is a type of coverage provided by an employer to their employees. It offers financial protection to the employees' designated beneficiaries in the event of the employee's death. This type of insurance is typically more affordable for employers to offer compared to individual policies due to the collective risk pooling.

Employee Contributions: A Common Practice:

Many employers allow employees to contribute to the group life insurance plan, and this practice has several advantages. Firstly, it empowers employees to take an active role in their financial well-being. By contributing, employees can ensure that the coverage provided by the employer is tailored to their specific needs, potentially offering more comprehensive protection. Additionally, contributing to group life insurance can be a tax-efficient way to build wealth, as contributions are often made pre-tax, reducing the employee's taxable income.

How It Works:

When an employee contributes to the group life insurance, they typically do so through payroll deductions. This means that a portion of their salary or wages is automatically set aside for the insurance premium. The employer then matches these contributions, often up to a certain percentage, further enhancing the overall coverage. This arrangement allows employees to build a substantial insurance benefit over time without significantly impacting their take-home pay.

Tax Implications:

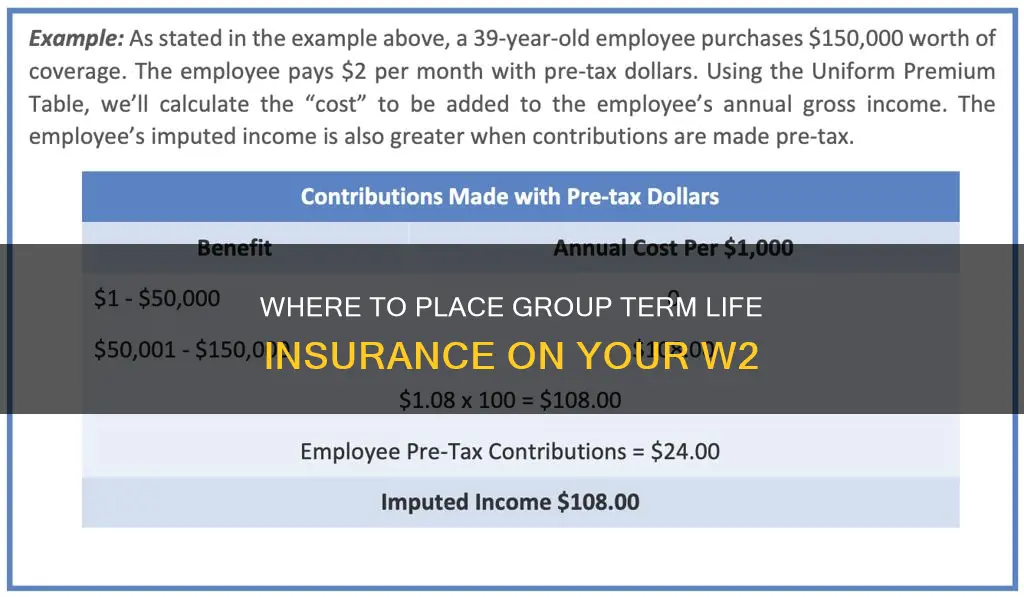

It's essential to understand the tax treatment of these contributions. In many jurisdictions, group life insurance premiums paid by an employer are considered a taxable benefit to the employee. However, the contributions made by employees themselves are often tax-deductible. This means that employees can reduce their taxable income by the amount they contribute, providing a financial incentive to participate. Employers should ensure that they comply with tax regulations regarding the reporting of these contributions on employees' W2 forms.

Maximizing Benefits:

Encouraging employee contributions to group life insurance can lead to several advantages. Firstly, it can result in a more personalized insurance plan, as employees can choose the level of coverage that aligns with their specific needs. Secondly, it fosters a sense of financial responsibility and ownership among employees, potentially improving their overall financial well-being. Employers can also consider offering incentives, such as matching contributions or additional benefits, to encourage participation and engagement.

In summary, allowing and encouraging employee contributions to group life insurance plans can be a mutually beneficial practice. It empowers employees to take control of their financial security while also providing employers with a way to offer comprehensive benefits. Understanding the tax implications and ensuring compliance with regulations is crucial for both parties to fully realize the advantages of this arrangement.

Breaking Free: Navigating HDFC Life Insurance Maze

You may want to see also

Beneficiary Designations: Guide on how to update beneficiary info for group life insurance

When it comes to group life insurance, understanding how to update your beneficiary information is crucial to ensure your loved ones are protected in the event of your passing. This process is often overlooked, but it's an essential part of your financial planning. Here's a comprehensive guide to help you navigate the process of updating beneficiary designations for your group term life insurance policy.

Understanding Beneficiary Designations:

Beneficiary designations are instructions you provide to the insurance company, specifying who should receive the death benefit payout when you pass away. This is a critical aspect of your insurance policy, as it determines how your insurance proceeds are distributed. It's essential to regularly review and update these designations to reflect any changes in your personal or family circumstances.

Accessing Your Group Life Insurance Policy:

To update beneficiary information, you'll need to access your group life insurance policy documents. These documents are typically provided by your employer or the insurance provider. If you don't have access to the physical documents, contact your HR department or the insurance company's customer service to request a copy of your policy.

Steps to Update Beneficiary Information:

- Locate the Beneficiary Form: Look for a beneficiary designation form within your policy documents. This form will have fields for you to input the names, relationships, and contact information of your chosen beneficiaries.

- Identify Current Beneficiaries: Before making changes, identify the current beneficiaries listed on your policy. This information is usually available in your policy summary or through the insurance company.

- Update Beneficiary Details: Carefully review the beneficiary form and make the necessary changes. You can add new beneficiaries, remove existing ones, or change the order of distribution. Ensure that you provide accurate and up-to-date contact information for each beneficiary.

- Submit the Updated Form: After completing the form, submit it to the insurance company according to their instructions. This might involve sending it via email, mail, or through an online portal, depending on the insurance provider's procedures.

Important Considerations:

- Multiple Beneficiaries: You can name multiple beneficiaries, which can be useful for distributing the death benefit among family members or charitable organizations.

- Sequence of Beneficiaries: You can specify a sequence or order in which the beneficiaries should receive the payout. This ensures that if one beneficiary cannot accept the benefit, the next in line will receive it.

- Legal Considerations: In some cases, you may need to provide legal documentation to support any changes, especially if beneficiaries are added or removed.

- Regular Review: Life events like marriages, births, or deaths can trigger the need to update your beneficiary information. It's a good practice to review and update your designations at least once a year or whenever significant life changes occur.

Remember, keeping your beneficiary information current is a vital step in ensuring that your loved ones receive the financial support they need during a difficult time. By following these steps, you can take control of your group life insurance and provide peace of mind for your beneficiaries.

Understanding Cash Value Life Insurance in Canada

You may want to see also

Frequently asked questions

Group term life insurance is typically not listed on the W2 form. The W2 form is used to report wages, salaries, tips, and other compensation paid to employees during the tax year. It does not include details about insurance benefits or other fringe benefits provided by an employer.

Group term life insurance benefits are generally not taxable income. However, if you are a participant in a group term life insurance plan, you should report any taxable payments or reimbursements received from the plan. These amounts may be included in box 1 of your W2 form or on a separate statement provided by the employer.

In most cases, the premiums for group term life insurance are paid by the employer and are not taxable to the employee. As a result, you typically cannot claim a deduction for these premiums on your personal tax return. However, if you are paying for the insurance yourself, you may be able to deduct the premiums as a medical expense, depending on your individual circumstances and the tax laws in your jurisdiction.