Liberty Mutual is the fifth-largest property and casualty insurer in the US, offering a range of insurance products, including auto insurance. The company provides standard minimum- and full-coverage car insurance, with several add-on options, such as accident forgiveness, new car replacement, and original parts replacement. Liberty Mutual also offers a range of discounts, including for military service members, good students, and safe drivers.

In terms of customer satisfaction, Liberty Mutual has received mixed reviews. While some customers report positive experiences with the company's claims handling and customer service, others have noted slow follow-up on claim processing and issues with policy renewal. The company has also received below-average scores in J.D. Power's Auto Claims Satisfaction Study. However, Liberty Mutual's mobile app has received positive reviews, with ratings of 4.8 out of 5 on the App Store and 4.6 out of 5 on Google Play.

| Characteristics | Values |

|---|---|

| Industry standing | Ranked 6th largest auto insurer |

| Customer experience | Below average |

| Cost and discounts | Offers a wide range of discounts |

| Ranked below average in J.D. Power's 2023 U.S. Auto Claims Satisfaction Study | |

| Ranked above average in J.D. Power's 2023 U.S. Insurance Digital Experience Study |

What You'll Learn

- Liberty Mutual's ranking in the J.D. Power U.S. Auto Claims Satisfaction Study

- Liberty Mutual's ranking in the J.D. Power U.S. Insurance Digital Experience Study

- Liberty Mutual's ranking in the J.D. Power U.S. Auto Insurance Study

- Liberty Mutual's National Association of Insurance Commissioners (NAIC) scores for auto insurance

- Liberty Mutual's AM Best rating

Liberty Mutual's ranking in the J.D. Power U.S. Auto Claims Satisfaction Study

Liberty Mutual ranked below average in the J.D. Power U.S. Auto Claims Satisfaction Study, scoring 866 out of 1,000. This score is slightly below the study average of 878, indicating room for improvement in claims handling. Liberty Mutual's score in the J.D. Power 2023 U.S. Auto Insurance Study was also below average across all regions where it was assessed.

In the J.D. Power 2024 Auto Insurance Shopping Study, Liberty Mutual ranked 16th out of 17 companies for overall customer satisfaction.

Auto Insurance Claims: USAA Rates After an Incident

You may want to see also

Liberty Mutual's ranking in the J.D. Power U.S. Insurance Digital Experience Study

In the 2024 Auto Insurance Shopping Study, Liberty Mutual ranked 16th out of 17 companies for overall customer satisfaction. Similarly, in the 2023 U.S. Auto Insurance Study, Liberty Mutual was ranked below average in all regions where it was assessed.

In the 2022 J.D. Power U.S. Insurance Digital Experience Study, Liberty Mutual received an overall score of 78.7 out of 100 for overall value and 77.1 out of 100 for online experience. These scores were above the average scores of 77.3 for overall value and 75.3 for online experience.

Auto Insurance and AARP: What's the Minimum Age?

You may want to see also

Liberty Mutual's ranking in the J.D. Power U.S. Auto Insurance Study

Liberty Mutual ranked below average in the J.D. Power U.S. Auto Insurance Study, receiving a score of 642 out of 1,000 in 2024. This is a decrease from its 2023 score of 865 out of 1,000, which was already below the industry average of 877. Liberty Mutual also ranked below average in the J.D. Power U.S. Auto Claims Satisfaction Study, receiving a score of 866 out of 1,000 in 2023, which was slightly below the industry average of 878.

Liberty Mutual's performance in the J.D. Power studies indicates that the company has room for improvement in customer satisfaction and claims handling. The company's scores suggest that customers may experience longer wait times and less effective claims processing. However, it's important to consider other factors when evaluating Liberty Mutual's service quality, such as the complexity of claims and individual customer experiences, which can vary.

Liberty Mutual offers a range of insurance products, including auto, home, renters, and life insurance. The company provides several discounts and add-on coverage options, contributing to its position as the sixth-largest global property and casualty insurer as of 2024.

Auto Insurance Refunds: Which Companies are Giving Back?

You may want to see also

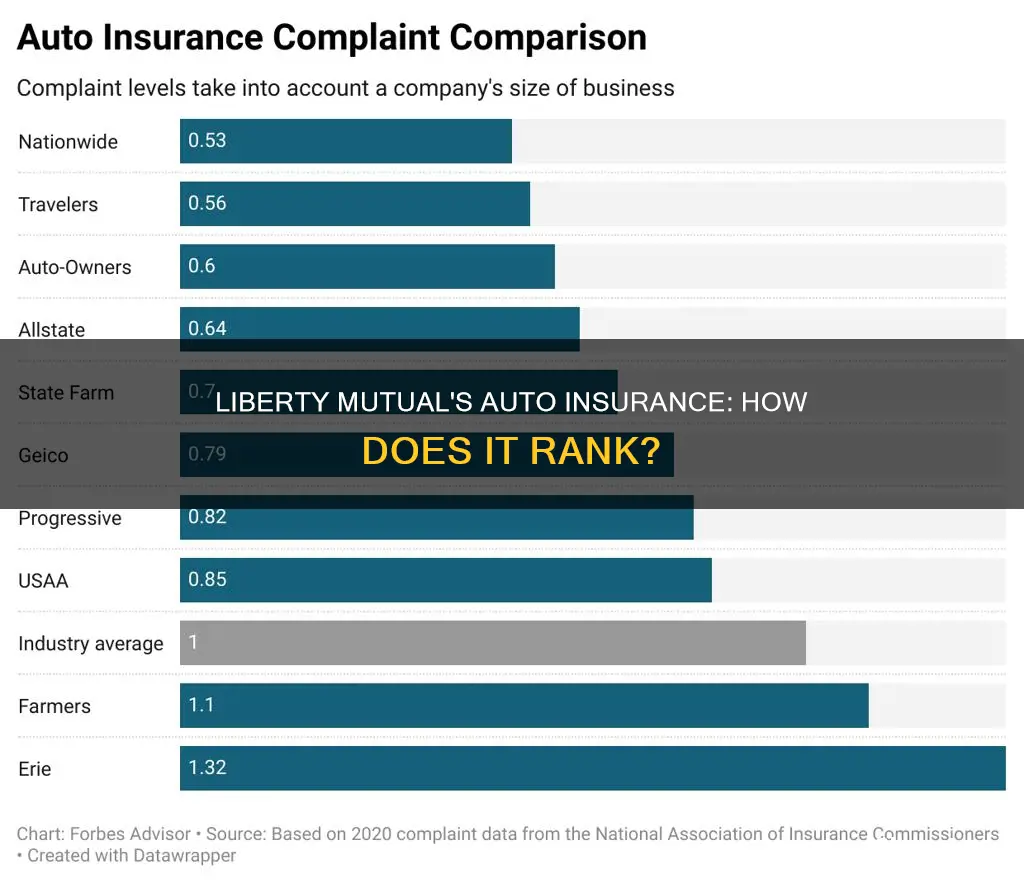

Liberty Mutual's National Association of Insurance Commissioners (NAIC) scores for auto insurance

The NAIC scores are based on complaints to state regulators relative to a company's size, according to three years' worth of data. Liberty Mutual's auto insurance offerings receive varied feedback according to third-party customer satisfaction ratings. While the company shows promising performance in the J.D. Power 2023 U.S. Insurance Digital Experience Study, it ranks below average in the 2023 U.S. Auto Insurance Study across all regions where it was assessed. Furthermore, in the J.D. Power U.S. Auto Claims Satisfaction Study, Liberty Mutual scored 866 out of 1,000, slightly below the study average of 878, indicating room for improvement in claims handling.

Switching Auto Insurance: DMV Notification and Your Options

You may want to see also

Liberty Mutual's AM Best rating

Liberty Mutual has a B++ financial strength rating from AM Best, indicating its ability to pay out claims to customers. This is a positive indicator of the company's financial health and stability, which is an important consideration when choosing an insurance provider.

In addition to its AM Best rating, Liberty Mutual has received ratings from other reputable agencies. For example, it has an A- rating from the Better Business Bureau (BBB) and a score of 2.26 from the National Association of Insurance Commissioners (NAIC) Complaint Index. These ratings provide insights into the company's customer service, complaint handling, and overall standing in the industry.

When considering Liberty Mutual or any other insurance company, it is always a good idea to review their financial ratings and assess their financial stability. This information can help you make an informed decision and ensure that the company is likely to fulfil its obligations to its policyholders.

SSNs and Auto Insurance: A Smart Combination?

You may want to see also

Frequently asked questions

Liberty Mutual is the sixth-largest auto insurer in the United States based on direct premiums written.

Liberty Mutual has received mixed to negative reviews when it comes to customer satisfaction. The company scored slightly below average in J.D. Power's 2023 Claims Satisfaction Study and Insurance Shopping Study. However, it scored slightly above average in J.D. Power's Digital Experience Study, indicating that customers have a more positive experience with its digital tools and online services.

Liberty Mutual has an A rating from AM Best, indicating strong financial stability and the ability to pay out claims.

Liberty Mutual offers standard auto insurance policies and a range of optional add-on coverages, including accident forgiveness, new car replacement, better car replacement, and original parts replacement.