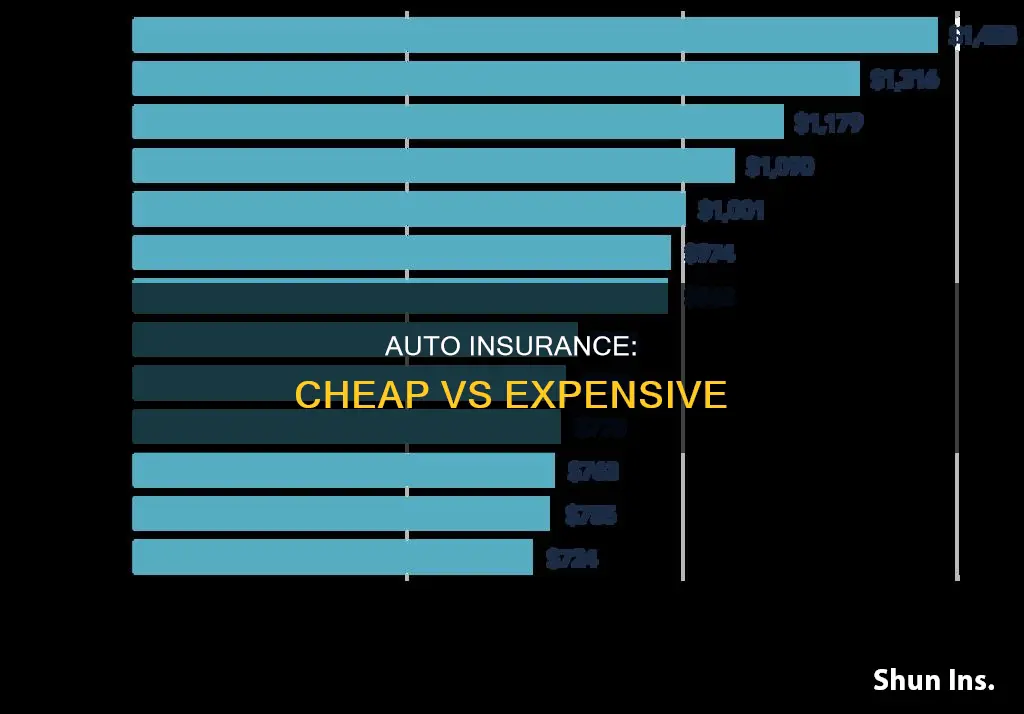

The cost of auto insurance varies depending on a range of factors, including age, driving history, location, and credit score. In general, younger drivers pay more for car insurance than older drivers, and those with a history of accidents, speeding tickets, or DUIs will also face higher premiums. The type of coverage also affects the cost, with minimum liability coverage typically being cheaper than full coverage. When looking for cheap car insurance, it is recommended to compare quotes from multiple companies, as rates can vary significantly between providers. Additionally, taking advantage of discounts offered by insurance companies, such as good student discounts or safe driver discounts, can help lower premiums. Shopping around and comparing rates is the best way to find affordable car insurance that meets an individual's specific needs and budget.

| Characteristics | Values |

|---|---|

| Cheapest car insurance in Florida | Geico |

| Cheapest car insurance in Texas | GEICO |

| Cheapest car insurance in the U.S. | State Farm |

What You'll Learn

Cheapest car insurance for young drivers

Car insurance for young drivers can be expensive. Young and inexperienced drivers are considered liabilities for insurance companies and are therefore charged higher rates than older, more experienced drivers. However, there are ways to find cheaper insurance.

Cheapest Car Insurance Companies for Young Drivers

USAA, State Farm, and GEICO are consistently the cheapest car insurance companies for young drivers. These companies offer some of the lowest rates for young drivers in their 20s.

Ways to Get Cheaper Car Insurance as a Young Driver

- Reduce your coverage limits: Lowering your car insurance coverage will decrease the cost of your insurance, but it will also leave your car and finances less protected. You will likely be required to carry bodily injury liability coverage and property damage liability insurance. Collision coverage, comprehensive coverage, uninsured motorist coverage, and medical payments coverage (MedPay) are usually optional.

- Increase your auto insurance deductible: Choosing a higher deductible on your policy will lower your insurance premium, but it means you'll pay more out of pocket if you file a claim.

- Bundle your insurance policies: If you rent an apartment or own a house, consider bundling your auto and renters or homeowners insurance policies with a single company. Many companies offer a multi-policy discount, and it's more convenient to manage your bills.

- Raise your credit score: In most states, auto insurance providers use policyholders' credit scores to determine their rates. Improving your credit score can help you get lower insurance rates, as well as lower interest rates on loans and lines of credit.

- Compare car insurance quotes: Getting free quotes from multiple providers is the best way to ensure you're getting the cheapest car insurance.

- Enroll in a telematics insurance program: With telematics insurance, your auto insurance provider tracks your driving habits through a mobile app or similar tool. If you drive safely and don't put many miles on your car, you may be able to earn a discount on your premium.

Car Insurance Discounts for Young Drivers

Taking a defensive driving course and maintaining good grades can also help lower your insurance rates as a young driver. Many insurance companies offer good student discounts, and some offer discounts for taking a defensive driving course.

Cheapest Car Insurance by State

The cheapest car insurance company for young drivers will vary depending on your state. Here are the cheapest companies for 21-year-olds and 25-year-olds in each state:

Cheapest Car Insurance for 21-Year-Olds by State

- Full coverage: Travelers, Geico, USAA, Farmers Mutual of Nebraska, American Farmers & Ranchers

- Minimum coverage: Travelers, Geico, USAA, Farmers Mutual of Nebraska, American Farmers & Ranchers

Cheapest Car Insurance for 25-Year-Olds by State

- Full coverage: Travelers, Geico, USAA, Southern Farm Bureau, Farmers Mutual of Nebraska

- Minimum coverage: CSAA Insurance (AAA), District of Columbia, Kentucky Farm Bureau, Southern Farm Bureau, Farmers Mutual of Nebraska

Hyundai Lease Insurance Requirements

You may want to see also

Cheapest car insurance for seniors

Car insurance rates tend to increase for drivers in their senior years, but there are still ways to find affordable coverage. The best option for you will depend on your age, location, driving record, and other factors. Here are some of the cheapest car insurance options for seniors:

USAA

USAA offers affordable full-coverage insurance for military-affiliated seniors, with an average annual rate of $1,158 or $97 per month. It also has the cheapest rates for 65-year-old and 75-year-old drivers. However, USAA insurance is only available to military members, veterans, and their families.

Geico

For non-military members, Geico is a good option, with an average annual rate of $1,342 or $112 per month. Geico also offers specific insurance for drivers over 50 through its Prime Time program, which guarantees policy renewal.

State Farm

State Farm is a good choice for seniors looking for ease of use, as it has an easy-to-use website and highly-rated mobile apps. It also offers a range of discounts and extras, including travel expense coverage.

Nationwide

Nationwide is the cheapest option for drivers in their 60s, with rates as low as $77 per month. It also offers usage-based insurance, which can provide significant savings for seniors who don't drive as much.

Progressive

Progressive is a good option for high-risk drivers, as it offers relatively affordable rates and its SnapShot program, which provides usage-based coverage.

Other Options

Other insurance companies that offer competitive rates for seniors include Erie, American Family, The Hartford, Farmers, and Allstate. Additionally, local providers may have cheaper rates, so it's worth comparing quotes from multiple companies to find the best deal.

Ways to Save on Car Insurance

- Take a defensive driving course: Many insurance companies offer discounts for completing an approved course.

- Review your driving status: If you're no longer commuting to work, updating your status to pleasure driving can lower your rates.

- Consider pay-per-mile insurance: If you don't drive much, you can save money by paying based on your mileage rather than a flat rate.

- Avoid tickets and accidents: Maintaining a clean driving record can help keep your rates low.

- Shop around: Compare quotes from multiple companies to find the best rate for your needs.

Insurance Claims: Recovered Vehicle

You may want to see also

Cheapest car insurance for drivers with a poor credit score

Overview

Drivers with a poor credit score tend to pay more for car insurance than those with a good credit score. This is because a poor credit score is associated with a higher likelihood of filing insurance claims, which makes them a higher-risk customer. However, the impact of a poor credit score on insurance costs can vary across different companies, so it is always a good idea to compare quotes from different insurers.

Cheapest Car Insurance Companies for Poor Credit

According to various sources, the cheapest car insurance companies for drivers with poor credit include:

- GEICO

- Nationwide

- USAA

- American Family

- Travelers

- Dairyland

- Direct Auto

- Progressive

- Farm Bureau

- Root Insurance

- Dillo Insurance

- CURE Insurance

No-Credit-Check Insurance Companies

Some insurance companies do not use credit scores as a factor in setting car insurance rates. These companies are rare, and mostly operate at a local level. Examples include:

- Dillo (Texas)

- CURE Auto Insurance (New Jersey and Pennsylvania)

- Root Insurance

Tips for Lowering Insurance Rates

If you have a poor credit score, there are several ways to lower your insurance rates:

- Compare quotes from multiple insurance companies

- Take advantage of discounts

- Increase your deductibles

- Improve your credit score by making timely payments and keeping your credit utilisation low

Auto Insurance: Shop and Save

You may want to see also

Cheapest car insurance for drivers with a DUI

If you have a DUI on your record, you can expect your car insurance rates to go up. The increase will vary depending on your location, insurance company, and other factors. However, there are still some insurance providers that offer cheaper rates for drivers with a DUI. Here are some of the cheapest options:

USAA

USAA offers some of the lowest rates for drivers with a DUI. According to Forbes Advisor, the average annual rate for a driver with a DUI is $2,751. USAA also has competitive rates for young drivers, seniors, and drivers with accidents or speeding tickets on their record. However, USAA insurance is only available to military members, veterans, and their families.

Progressive

Progressive is another insurance company that offers relatively low rates for drivers with a DUI. The average annual rate after a DUI is around $2,776, which is a 29% increase from their average rates for good drivers. Progressive also offers accident forgiveness and a vanishing deductible option. They are available in 48 states and are the second-largest auto insurer in the US.

State Farm

State Farm is the largest auto insurer in the US and offers affordable rates for drivers with a DUI. Their average annual rate for full coverage after a DUI is $1,231, which is significantly cheaper than the national average. State Farm also has a wide range of discounts that can help lower your rates even further. They are available in 48 states and Washington, D.C.

American Family

American Family has better-than-average rates for drivers with a DUI and receives very few complaints compared to other insurance companies. They offer a range of optional coverage types, including accident forgiveness, vanishing deductible, and new car replacement. However, American Family is only available in 19 states.

Auto-Owners

Auto-Owners Insurance has competitive rates for drivers with a DUI and receives high ratings for its claims process and low level of complaints. They offer accident forgiveness, diminishing deductibles, and new car replacement coverage. However, they do not offer SR-22 insurance filings, which may be required after a DUI.

Erie

Erie Insurance offers slightly below-average rates for drivers with a DUI and has excellent scores from collision repair professionals. They also have competitive rates for drivers with accidents or speeding tickets on their record. However, Erie is only available in 12 states and does not offer SR-22 filings.

It's important to note that insurance rates can vary based on individual factors such as age, gender, location, and driving history. It's always a good idea to shop around and compare quotes from multiple insurance companies to find the best rate for your specific situation. Additionally, there are ways to lower your car insurance costs after a DUI, such as improving your driving record, bundling policies, and raising your deductible.

CSL Auto Insurance: Understanding Combined Single Limit

You may want to see also

Cheapest car insurance for drivers with a ticket or accident

If you have a bad driving record, it's still possible to get car insurance from good companies, but your rates will likely be more expensive. The best way to find the cheapest car insurance is to compare quotes from multiple companies.

Cheapest car insurance for drivers with speeding tickets

State Farm has the cheapest rates for drivers with speeding tickets, with an average rate of $125 per month for full coverage. That's $95 per month cheaper than average.

Cheapest car insurance for drivers with accidents

State Farm also has the best and cheapest full coverage car insurance for drivers with accidents on their record, regardless of age. The company has a strong national presence with competitive offerings.

Cheapest car insurance for drivers with a DUI

Progressive has the cheapest rates for drivers with a DUI on their record.

Cheapest car insurance for drivers with multiple incidents

The General is a good nonstandard car insurance company for drivers with multiple incidents on their record.

Auto Insurance: How Much is Enough?

You may want to see also

Frequently asked questions

Geico has the cheapest car insurance in Florida, with an average annual rate of $1,710 for full coverage.

The cheapest major car insurance company in Texas is GEICO.

State Farm has the cheapest car insurance for most drivers, at $50 per month for liability coverage and $124 for full coverage.

USAA has the cheapest rates overall at $34 per month. But only military members, veterans or their families can qualify for USAA.