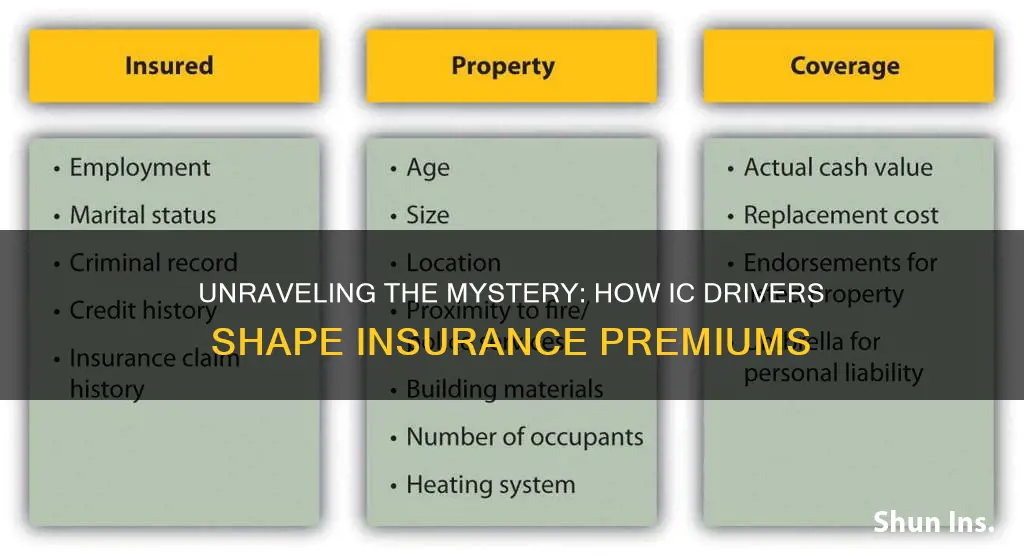

Insurance companies use various factors to determine the cost of insurance policies, and understanding these drivers is crucial for both consumers and providers. The 'which drives IC insurance pricing differenator' refers to the unique elements that influence the pricing of insurance products, particularly in the context of insurance companies (ICs). These differenators can vary widely and may include factors such as age, gender, location, driving record, vehicle type, coverage options, and even the time of year. Each of these elements plays a significant role in determining the final insurance premium, making it essential to recognize and analyze these drivers to ensure fair and competitive pricing in the insurance market.

What You'll Learn

- Market Demand: Insurance companies analyze customer needs and preferences to set competitive prices

- Risk Assessment: Underwriters evaluate risks associated with ICs to determine premium rates

- Regulatory Compliance: Insurance providers must adhere to legal requirements, impacting pricing strategies

- Competitive Analysis: Comparing prices with rivals helps set unique and attractive IC insurance rates

- Technology Impact: Advanced tech can influence pricing by improving risk management and efficiency

Market Demand: Insurance companies analyze customer needs and preferences to set competitive prices

Insurance companies play a crucial role in the market by understanding and catering to the diverse needs of their customers. When it comes to setting prices for insurance products, especially in the context of 'Which drives IC insurance pricing differentiator', market demand analysis is a key driver. This process involves a deep dive into customer preferences, behaviors, and pain points to ensure that the insurance offerings are not only competitive but also aligned with the target audience's expectations.

The first step in this analysis is identifying the target market and understanding the demographics, psychographics, and behavioral patterns of potential and existing customers. For instance, when designing an insurance product for drivers, companies might consider factors such as age, gender, driving experience, vehicle type, and usage patterns. Younger drivers, for instance, may require more comprehensive coverage due to their lack of experience, while frequent mileage could impact premium costs. By segmenting the market in this manner, insurers can tailor their products to specific customer groups.

Once the target market is defined, insurance providers can gather and analyze data to understand customer needs and preferences. This includes studying claims data, customer feedback, and market trends. For example, if a significant number of claims are related to specific types of accidents or vehicle issues, the insurance company can adjust their pricing and coverage accordingly. Additionally, customer feedback can highlight areas where the competition excels, allowing insurers to identify gaps in their offerings and set competitive prices.

Market demand analysis also involves keeping an eye on industry trends and regulatory changes that might impact insurance pricing. For instance, technological advancements in the automotive sector, such as the rise of electric vehicles or autonomous driving, could influence insurance pricing and coverage. Insurance companies must stay abreast of these trends to ensure their pricing strategies remain relevant and competitive.

By thoroughly understanding market demand, insurance companies can set prices that are not only profitable but also attractive to customers. This approach ensures that the insurance product meets the specific needs and preferences of the target audience, thereby driving customer satisfaction and loyalty. Ultimately, this detailed analysis of market demand is a critical differentiator in the insurance industry, allowing companies to stand out in a crowded market.

Best Vehicle Insurance in Mexico

You may want to see also

Risk Assessment: Underwriters evaluate risks associated with ICs to determine premium rates

Underwriters play a critical role in the insurance industry, especially when it comes to determining the pricing of insurance policies for integrated circuits (ICs). The process of risk assessment is a key component of their work, as it involves a thorough evaluation of the potential risks associated with insuring these complex electronic components. This assessment is crucial because ICs are often at the heart of many modern technologies, and their failure or malfunction can lead to significant financial losses for manufacturers and users alike.

When assessing the risks, underwriters consider various factors that could impact the insurance pricing. One of the primary differentiators in IC insurance pricing is the technology and application of the IC itself. Different types of ICs, such as microprocessors, memory chips, or sensors, may have unique failure modes and potential risks. For instance, a microprocessor might be at risk due to manufacturing defects, while a sensor could fail due to environmental factors. Understanding these specific risks is essential for accurate pricing.

Underwriters also examine the manufacturing process and supply chain of the ICs. The complexity and precision required in manufacturing can introduce various risks. These may include process variations, material quality issues, or even external factors like natural disasters that could disrupt production. By analyzing these aspects, underwriters can assess the likelihood and impact of potential failures, which directly influences the premium rates.

Another critical aspect of risk assessment is the end-use of the ICs. The application and environment in which the ICs operate can significantly affect their performance and longevity. For example, ICs used in automotive systems might face different risks compared to those in consumer electronics. Underwriters need to consider factors like operating temperatures, vibration, and the overall reliability of the end product to determine the appropriate insurance coverage and premiums.

Furthermore, underwriters often study historical data and industry trends to identify patterns and potential risks. This includes analyzing failure rates, product recalls, and industry-specific challenges. By doing so, they can make more informed decisions regarding premium rates, ensuring that the insurance policies are adequately priced to cover potential losses while also being competitive in the market. This comprehensive risk assessment approach is vital for the successful pricing and management of IC insurance policies.

Allstate's Auto Insurance: Losing to Competitors?

You may want to see also

Regulatory Compliance: Insurance providers must adhere to legal requirements, impacting pricing strategies

Insurance pricing is a complex process that is heavily influenced by various factors, and regulatory compliance plays a critical role in shaping these strategies. Insurance providers operate within a highly regulated environment, and legal requirements can significantly impact their pricing models. These regulations are designed to protect consumers, ensure fair practices, and maintain market stability, and insurance companies must navigate this landscape carefully to remain compliant.

One of the primary legal considerations for insurance providers is the need to adhere to insurance regulations set by financial authorities and government bodies. These regulations often dictate the minimum standards and guidelines that insurance companies must follow. For instance, insurance providers might be required to offer specific coverage options, maintain certain capital reserves, or provide detailed policy documentation. Compliance with these regulations is essential to avoid legal consequences and maintain a positive reputation. When setting prices, insurance providers must consider the costs associated with meeting these regulatory obligations. This includes the expenses related to compliance officers, legal advice, and the implementation of necessary systems and processes. As a result, regulatory compliance can directly influence the overall cost structure of an insurance company, which, in turn, affects the pricing of their products.

Additionally, insurance providers must stay updated with changing legislation and industry standards. Regulatory bodies frequently introduce new rules or amend existing ones, and insurance companies need to adapt their pricing strategies accordingly. For example, a change in the regulatory framework might require insurers to offer more comprehensive coverage, which could increase operational costs. To maintain profitability, insurance providers may need to adjust their pricing to account for these additional expenses, ensuring that the premium reflects the new regulatory requirements. This dynamic nature of regulatory compliance means that insurance pricing must be flexible and responsive to legal changes.

Furthermore, insurance providers must also consider consumer protection regulations when setting prices. These regulations aim to safeguard the interests of policyholders and ensure fair treatment. Insurance companies are often required to provide transparent pricing, disclose potential risks, and offer clear terms and conditions. Compliance with these regulations may involve extensive documentation and communication, which can impact the overall cost of providing insurance. As a result, insurance providers might need to allocate resources to ensure compliance, which could influence the final price of their products.

In summary, regulatory compliance is a critical aspect of insurance pricing strategies. Insurance providers must navigate a complex legal landscape, ensuring they meet the necessary standards and regulations while also maintaining profitability. The dynamic nature of legal requirements means that insurance companies need to be agile in their approach, adapting pricing models to reflect any changes in the regulatory environment. By understanding and addressing these legal obligations, insurance providers can develop pricing strategies that are both compliant and competitive in the market.

Understanding Auto Insurance: PIP 60 and You

You may want to see also

Competitive Analysis: Comparing prices with rivals helps set unique and attractive IC insurance rates

In the realm of insurance, competitive analysis is a powerful tool for driving IC (Insurance Company) pricing differentiation. By comparing your rates with those of your rivals, you can gain valuable insights into the market dynamics and position your IC insurance offerings effectively. This process involves a thorough examination of competitors' pricing strategies, allowing you to identify gaps, strengths, and weaknesses in your own pricing structure.

When conducting a competitive analysis, start by gathering data on rival ICs' insurance rates for similar products or services. This data should include various coverage options, deductibles, and policy terms. By analyzing this information, you can identify trends and patterns in pricing strategies. For instance, you might discover that certain competitors offer more comprehensive coverage at a higher price point, while others provide basic coverage at a lower rate. This analysis will help you understand the market's perception of value and the factors that influence customers' purchasing decisions.

The next step is to evaluate your IC's unique selling points and how they impact pricing. Consider the following: Do you offer specialized coverage options that your competitors lack? Are your policies tailored to specific customer segments or industries? Perhaps your IC has a strong brand reputation or a unique value proposition that justifies a premium price. By identifying these differentiators, you can strategically set your prices to reflect the added value you provide.

For instance, if your IC specializes in providing comprehensive coverage for rare and exotic car collections, you can position your rates accordingly. Customers seeking such specialized insurance are likely to be willing to pay a higher premium for the peace of mind and expertise your IC offers. Similarly, if your IC has a strong digital presence and provides online policy management tools, you can highlight this convenience in your pricing strategy.

Additionally, competitive analysis allows you to identify pricing gaps in the market. If you notice that your competitors' rates are significantly lower, it might indicate an opportunity to offer more competitive pricing without compromising profitability. Conversely, if your rates are consistently higher, you can explore ways to enhance your offerings or communicate the value proposition more effectively.

In summary, comparing prices with rivals is a crucial aspect of setting unique and attractive IC insurance rates. It enables you to understand the market, identify your strengths and weaknesses, and position your IC effectively. By leveraging competitive analysis, you can make informed decisions about pricing strategies, ensuring that your IC insurance offerings remain competitive and appealing to customers.

Understanding Auto Insurance: The Underwriting Process Explained

You may want to see also

Technology Impact: Advanced tech can influence pricing by improving risk management and efficiency

The integration of advanced technology in the insurance industry has significantly impacted pricing strategies, particularly in the context of risk management and operational efficiency. One of the key drivers of this change is the utilization of data analytics and machine learning algorithms. These technologies enable insurers to analyze vast amounts of data, including historical claims, customer behavior, and environmental factors, to identify patterns and trends that were previously difficult to discern. By employing predictive analytics, insurers can now more accurately assess risk, which is a critical component in determining insurance premiums. For instance, advanced algorithms can predict the likelihood of certain events, such as natural disasters or accidents, allowing insurers to set prices that reflect the true risk exposure. This precision in risk assessment leads to more competitive pricing, as insurers can offer tailored policies that better match the specific needs and risks of their customers.

Moreover, technology has improved the efficiency of insurance operations, which in turn influences pricing. Automation and digital processes streamline various back-office functions, reducing the time and resources required for policy administration, claims processing, and customer service. As a result, insurers can lower operational costs, which can be passed on to customers in the form of more competitive rates. For example, automated claims processing systems can quickly verify and settle claims, reducing the time between an incident and the payout, which not only improves customer satisfaction but also minimizes the potential for fraud. This efficiency also enables insurers to offer a wider range of products and services, further enhancing their competitive advantage in the market.

Advanced technology also plays a pivotal role in enhancing risk management capabilities. Remote sensing and satellite imagery, for instance, provide insurers with real-time data on environmental conditions, such as weather patterns, terrain changes, and natural disasters. This information is invaluable for assessing the risk associated with various types of insurance, especially property and liability coverage. By incorporating this data into their risk models, insurers can make more informed decisions about pricing, ensuring that premiums reflect the unique risks associated with specific locations or activities. Additionally, the use of drones for aerial inspections can provide detailed information about the condition of properties, allowing insurers to make more accurate assessments and pricing decisions.

The impact of technology on insurance pricing is further evident in the development of usage-based insurance (UBI) models. UBI programs utilize telematics and other sensors to collect data on how drivers actually use their vehicles. This data-driven approach allows insurers to offer personalized pricing based on individual driving habits, vehicle usage, and even time of day. By reducing the reliance on traditional demographics and instead focusing on actual risk factors, insurers can provide more tailored and competitive rates. This not only benefits customers by offering them more affordable insurance but also encourages safer driving behaviors, as drivers are more likely to be aware of the direct correlation between their actions and insurance costs.

In summary, advanced technology is a powerful differentiator in insurance pricing, primarily through its ability to enhance risk management and operational efficiency. The use of data analytics, machine learning, and various sensing technologies enables insurers to make more accurate risk assessments, leading to competitive pricing. Additionally, automation and digital processes streamline operations, reducing costs and allowing for a broader range of offerings. As the insurance industry continues to embrace technological advancements, we can expect further innovations in pricing strategies, ultimately benefiting both insurers and their customers.

Auto Insurance and Bankruptcy: What's the Link?

You may want to see also

Frequently asked questions

The IC pricing differentiator is a term used in the insurance industry to describe the unique factors or variables that influence the cost of insurance premiums for a specific product or service. It highlights the aspects that set one insurance product apart from others in terms of pricing.

This differentiator plays a crucial role in determining insurance premiums. It helps insurers assess the risk associated with a particular product or service and set prices accordingly. By considering unique factors, insurers can offer tailored coverage options and competitive rates to attract customers.

For instance, in the auto insurance industry, the age and driving experience of the policyholder can be a significant differentiator. Younger drivers often face higher premiums due to their lack of experience, while older, more experienced drivers may benefit from lower rates. This example demonstrates how personal characteristics can influence insurance pricing.

Customers who comprehend the pricing differentiators can make informed decisions when choosing insurance plans. It allows them to compare policies, identify potential savings, and select coverage that aligns with their specific needs and budget. Understanding these factors empowers individuals to become more engaged and proactive in managing their insurance expenses.

Insurers should strive for transparency by clearly communicating the factors that influence pricing. Providing detailed explanations and justifications for premium rates can build trust with customers. Regularly reviewing and updating pricing models to reflect changing market conditions and customer preferences is also essential to maintaining fairness and competitiveness.