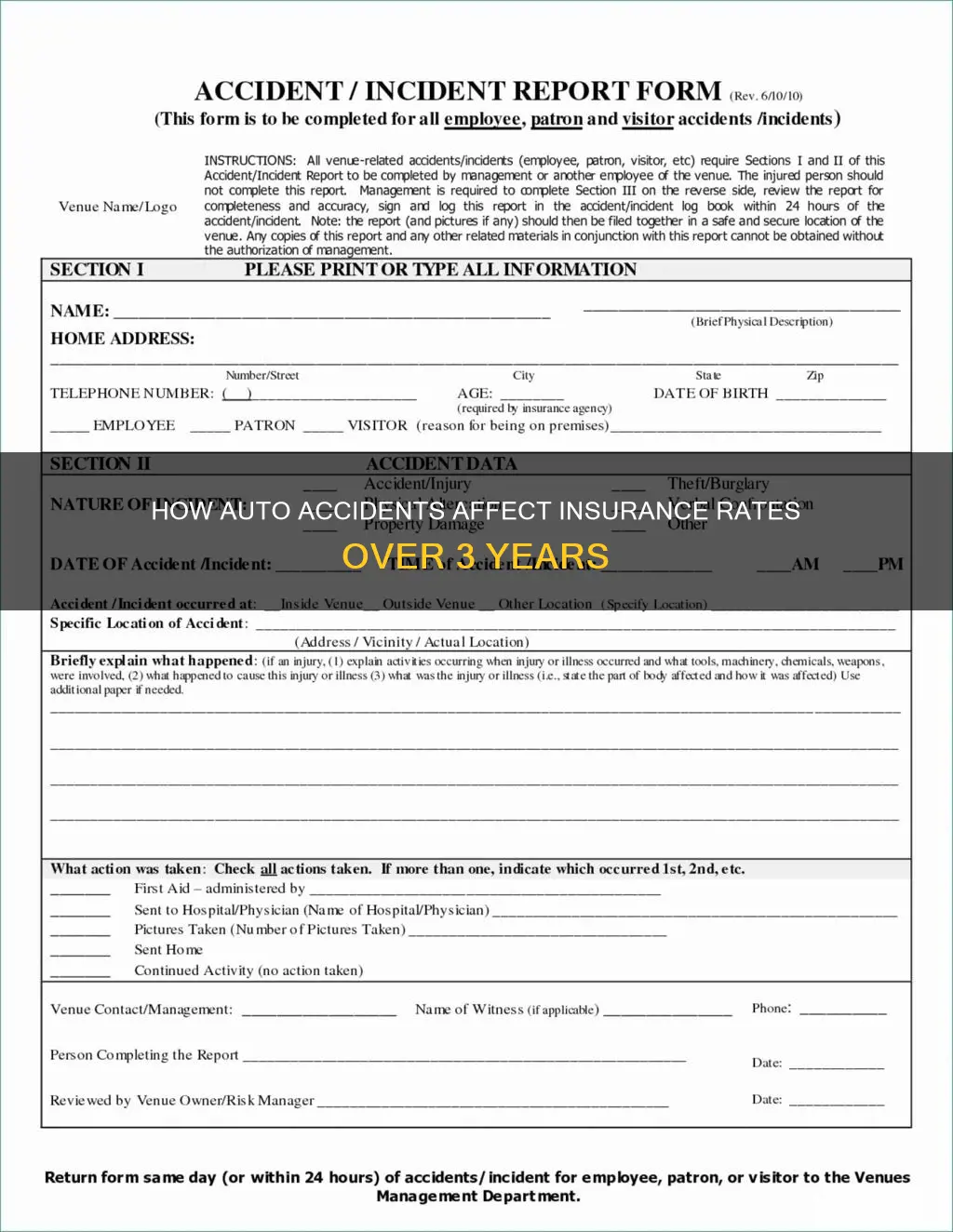

When it comes to car insurance, accidents generally stay on your record for three to five years. However, some notable insurance companies, including Progressive and State Farm, only look back on three years of driving history. This is because most states only require insurers to use the most recent three years of a driver's history when setting rates. For instance, California and Virginia require insurers to use the previous three years of a driver's history when determining rates. In addition, insurers believe that a driver's risk level changes relatively slowly, and some events, like accidents and violations, may fall off a driver's record after three years in certain states.

| Characteristics | Values |

|---|---|

| Number of years insurance companies look back | 3 years |

| Insurance companies that look back 3 years | Progressive, State Farm |

| Companies that look back more than 3 years | Allstate, Nationwide, American Family, Liberty Mutual, Geico, Erie, Amica, USAA |

| Effect on insurance rates | 45% increase on average |

| High-risk factors | History of tickets, at-fault accidents, new driver, bad credit, DUI/DWI convictions, SR-22 or FR-44 form, Multiple insurance claims in the last 3 years |

| High-risk driver status duration | 3 years |

What You'll Learn

- Progressive and State Farm are two insurance companies that look back 3 years

- Accidents and violations may fall off a driver's record after 3 years

- Insurance companies use your driving record to set rates

- DUIs can remain on your record for up to 10 years

- Insurance companies calculate risk in different ways

Progressive and State Farm are two insurance companies that look back 3 years

When shopping for car insurance, it's important to know how much your driving history will factor into your rate. Accidents and violations can affect your insurance premiums, and some insurers will look back further than others. Progressive and State Farm are two notable car insurance companies that only look back on three years of a customer's driving record to check for claims on an insurance policy or minor moving violations.

Progressive is known for its competitive rates and several available discounts. The company was established in 2001 and offers a charitable giving program called Name Your Cause, which allows each employee to recommend a charity to receive a monetary gift from The Progressive Insurance Foundation. Progressive also provides educational opportunities for students to learn more about financial literacy and safe driving.

State Farm is one of the largest car insurance companies in the country, offering great rates and coverage options, as well as several discounts.

While Progressive and State Farm only look back on three years of driving history, it's worth noting that some auto insurance companies will investigate records dating back five to ten years for major violations and claims when making underwriting decisions. Additionally, state laws can impact how far back insurance providers can look, with some states requiring companies to disregard driving record information older than three years, and others allowing them to look back up to ten years.

It's always a good idea to shop around and compare rates from different car insurance companies to secure the best deals, as every auto insurance provider calculates risk in its own way.

Understanding Maryland Auto Insurance Liabilities Coverage

You may want to see also

Accidents and violations may fall off a driver's record after 3 years

Accidents and violations may fall off a driver's record after three years, but this depends on the state and insurance company in question. For example, the states of Virginia and Washington require that auto insurance companies disregard driving-record information that is more than three years old. On the other hand, states like Massachusetts and California allow insurance companies to look back up to ten years.

Most car insurance companies keep claims records for three to five years. Progressive, for instance, keeps claims on record for five years but only uses the information to influence rates for three of those years. Some companies may look back even further for major violations and claims.

If you have a DUI or several driving violations, a car insurance company may look back as far as ten years. Accidents can last up to three years on your driving record, but DUIs and DWIs can remain for up to ten years.

Your driving record correlates to risk. A clean driving record indicates that you are less likely to file an insurance claim, whereas traffic violations indicate a higher chance of filing a claim. Most driving infractions impact car insurance rates. For example, DUIs increase insurance rates by 72% on average.

Auto Rental Companies in Scotland: US CDW Insurance Valid?

You may want to see also

Insurance companies use your driving record to set rates

When you're shopping for car insurance, it's important to know that insurance companies will use your driving record to set your rates. This means that they will look at your driving history, including any accidents, violations, or claims, to assess how likely you are to file an insurance claim in the future. A clean driving record with no accidents, tickets, or claims is considered low risk and will generally result in lower insurance rates. On the other hand, a driving record with accidents, traffic violations, or DUIs is considered high risk and will lead to higher insurance rates.

Most insurance companies typically look back at the previous three to five years of your driving record when setting rates. This "look-back" period can vary depending on state regulations and the insurance company itself. For example, some states like Virginia and Washington limit insurance companies to only considering driving record information from the past three years, while others like Massachusetts and California allow companies to look back up to ten years. Additionally, insurance companies may place more weight on certain types of violations or accidents when determining your risk level. For instance, DUIs and DWIs are considered serious offenses and can remain on your driving record for up to ten years in some states.

It's worth noting that insurance companies use different methods to obtain your driving record information. They often use your driver's license number to retrieve this data from the Department of Motor Vehicles (DMV) or similar government agencies. Additionally, some insurance companies may use telematics or data-sharing partnerships with automakers to track and collect real-time driving behavior data, such as speeding, hard braking, or phone usage while driving. This data is then used to create a risk profile and set your insurance rates accordingly.

While having a less-than-perfect driving record may result in higher insurance rates, it's important to remember that not all insurance companies weigh driving records equally. It's always a good idea to shop around and compare rates from different insurance providers, as some may be more lenient or offer better rates for drivers with accidents or violations on their records. Additionally, you can take steps to improve your driving record over time by driving carefully, taking defensive driving classes, or signing up for usage-based insurance programs that reward good driving behavior.

U-Turn: Understanding USAA's Extended Payment Plan for Auto Insurance

You may want to see also

DUIs can remain on your record for up to 10 years

When it comes to auto insurance, companies will typically look back at your driving record over the past few years to assess your risk level and calculate your insurance rates. While some insurers only review the past two to three years, others may go back as far as ten years. Progressive and State Farm are two notable companies that tend to look back three years when determining insurance rates.

Now, regarding your question about DUIs, it's important to note that they can have a significant impact on your driving record and insurance rates. In most states, a DUI conviction will remain on your driving record for up to ten years. This period typically starts from the date of your arrest, not the conviction date. During this time, auto insurance companies can access this information and may modify your insurance policy, often resulting in increased premiums.

It's worth mentioning that while a DUI may no longer be held against you on your driving record after ten years, it doesn't disappear from your record entirely. Law enforcement and certain employers will still be able to view it. If you wish to remove a DUI from your criminal record, you may need to explore legal options such as expungement or record sealing, depending on the state and specific circumstances.

Fiesta Auto Insurance: Is It Affordable?

You may want to see also

Insurance companies calculate risk in different ways

When it comes to determining insurance premiums, insurance companies employ various methods to calculate risk. While some insurers only review a driver's record from the past three years, others may delve into a driver's entire driving history. Progressive and State Farm are two notable companies that typically only look back three years. The main reasons for this three-year limit are state requirements, the belief that a driver's risk level changes slowly, and the fact that some events fall off a driver's record after three years in certain states.

State laws play a crucial role in determining how far back insurance companies can look. For instance, Virginia and Washington mandate that auto insurance providers disregard driving record information beyond three years, while California and Massachusetts allow companies to examine records spanning up to ten years.

The calculation of insurance premiums takes into account numerous factors, including age, driving experience, occupation, vehicle type, location, security, and driving history. Younger drivers, for example, tend to face higher premiums due to their lack of experience and the higher likelihood of accidents. Similarly, those with riskier occupations, such as delivery drivers, often pay more for insurance. The type of vehicle also matters, with more expensive or powerful cars leading to higher premiums.

Insurers also consider the security of the vehicle, with alarms and immobilisers helping to reduce costs. Additionally, factors like annual mileage, claims history, and no-claims bonuses influence the cost of insurance.

It's worth noting that insurance companies use credit scores and history to determine premiums. An insurance score predicts the likelihood of a customer filing an insurance claim, and it is based on factors such as outstanding debt, credit history length, payment history, and available credit. Even with a flawless driving record, a low insurance score can result in higher premiums.

Ultimately, each insurance company calculates risk in its own way, and it's essential for consumers to shop around and compare rates to find the best deal.

Financed Vehicle: Essential Insurance Coverage

You may want to see also

Frequently asked questions

Progressive and State Farm are two notable car insurance companies that only look back on three years of a customer's driving record to check for claims on an insurance policy or minor moving violations.

No, insurance companies also consider violations such as DUIs when determining rates.

Insurance rates typically increase by 45% after an at-fault accident. However, rates can increase by as much as 72% after a DUI.

Accidents generally stay on your record for three to five years. However, this may vary depending on the state and the severity of the accident.