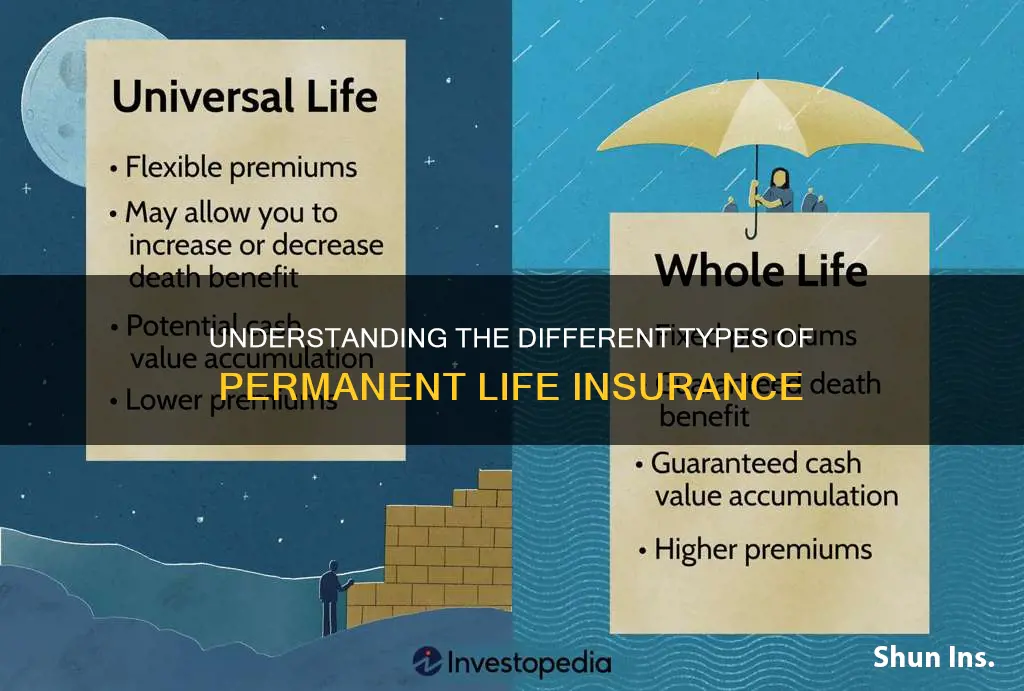

Permanent life insurance, also known as whole life insurance, is a type of long-term coverage that provides coverage for the entire life of the insured individual. It offers a range of benefits, including a guaranteed death benefit, a cash value account that grows tax-deferred, and the potential for dividends. There are several types of permanent life insurance, each with its own unique features and advantages. These include whole life insurance, universal life insurance, and variable universal life insurance. Understanding the different types of permanent life insurance can help individuals choose the best coverage to meet their financial goals and provide financial security for their loved ones.

What You'll Learn

- Whole Life Insurance: Provides lifelong coverage with a fixed death benefit and an accumulation of cash value

- Universal Life Insurance: Offers flexible premiums and death benefits, allowing policyholders to adjust coverage over time

- Term Life Insurance: Temporary coverage for a specified period, offering a fixed death benefit if the insured dies during the term

- Variable Universal Life Insurance: Combines universal life insurance with investment options, allowing for potential higher returns

- Final Expense Insurance: Designed to cover funeral and burial expenses, providing peace of mind for end-of-life costs

Whole Life Insurance: Provides lifelong coverage with a fixed death benefit and an accumulation of cash value

Whole life insurance is a type of permanent life insurance that offers a range of unique benefits. It is a long-term commitment, providing coverage for the entire life of the insured individual, hence the term "permanent." One of its key features is the guaranteed death benefit, which means that the insurance company will pay out a specified amount to the policyholder's beneficiaries upon the insured's death. This fixed death benefit is a significant advantage, offering financial security to the policyholder's family or designated recipients.

In addition to the death benefit, whole life insurance also includes an investment component. Over time, a portion of the premium payments goes into an accumulation of cash value. This cash value grows tax-deferred, allowing it to accumulate and build up a substantial amount. The policyholder can access this cash value through policy loans or surrender the policy for its full value. This feature makes whole life insurance a valuable financial tool, providing both insurance protection and a potential source of funds for various financial goals.

The cash value accumulation in whole life insurance is a key differentiator from other types of life insurance. It allows policyholders to build a substantial sum of money that can be used for various purposes. For example, the cash value can be borrowed against, providing a source of funds for major purchases, education expenses, or business ventures. Additionally, the cash value can be used to pay for future premiums, ensuring that the policy remains in force without the need for additional premium payments.

Another advantage of whole life insurance is its predictability. The death benefit and premium payments are fixed, providing a stable and consistent level of coverage. This predictability is particularly beneficial for long-term financial planning, as it allows individuals to budget and plan for the future with confidence. Moreover, the fixed nature of whole life insurance ensures that the policyholder's loved ones will receive the intended financial support, regardless of market fluctuations or changes in the insurance industry.

In summary, whole life insurance offers a comprehensive and reliable solution for permanent life coverage. With its guaranteed death benefit, accumulation of cash value, and fixed premium payments, it provides financial security and flexibility. Policyholders can benefit from the insurance protection while also building a valuable asset that can be utilized for various financial needs. This type of insurance is an excellent choice for those seeking long-term financial planning and a reliable source of coverage.

Understanding Term Life AD&D Insurance: A Comprehensive Guide

You may want to see also

Universal Life Insurance: Offers flexible premiums and death benefits, allowing policyholders to adjust coverage over time

Universal Life Insurance is a type of permanent life insurance that provides long-term financial security and offers a unique level of flexibility to policyholders. Unlike traditional term life insurance, which provides coverage for a specified period, universal life insurance is designed to remain in force for the entire life of the insured individual. This type of policy is particularly appealing to those seeking a more adaptable and personalized insurance solution.

One of the key advantages of universal life insurance is the flexibility it offers in terms of premium payments and death benefits. Policyholders have the autonomy to adjust their premiums, allowing them to customize their payments according to their financial situation and goals. This adaptability is especially beneficial for individuals who experience fluctuations in income or those who want to ensure their insurance coverage aligns with their changing needs over time. For instance, a policyholder might opt for lower premiums during their early working years and increase them later in life when their financial circumstances improve.

The death benefit, which is the amount paid out upon the insured's passing, is another aspect that can be tailored. Universal life insurance policies typically allow policyholders to increase or decrease the death benefit, providing a level of control that is not available in other types of permanent life insurance. This flexibility ensures that the coverage can be adjusted to match the insured's evolving needs and financial objectives.

Furthermore, universal life insurance policies often accumulate cash value, which can be borrowed against or withdrawn. This feature enables policyholders to access funds for various purposes, such as funding education, starting a business, or covering unexpected expenses. The cash value also grows tax-deferred, providing a potential source of financial security and wealth accumulation.

In summary, universal life insurance stands out among permanent life insurance options due to its flexibility in premium payments and death benefits. This adaptability empowers policyholders to make informed decisions about their insurance coverage, ensuring it remains relevant and valuable throughout their lives. With the ability to adjust and customize, universal life insurance provides a comprehensive and personalized approach to long-term financial protection.

Understanding Dependent Life Premier Insurance Coverage and Benefits

You may want to see also

Term Life Insurance: Temporary coverage for a specified period, offering a fixed death benefit if the insured dies during the term

Term life insurance is a type of life insurance that provides coverage for a specific period, often 10, 20, or 30 years. It is a straightforward and affordable way to secure financial protection for your loved ones during a defined period. This type of insurance is particularly useful for individuals who want to ensure their family's financial stability in the short to medium term, such as covering mortgage payments, children's education, or business startup costs.

The key feature of term life insurance is its temporary nature. Unlike permanent life insurance, which provides coverage for the entire life of the insured, term insurance is designed to meet specific needs for a limited time. When purchasing a term policy, you select a term length, and the insurance company guarantees a death benefit if the insured person passes away during that period. This benefit is paid out to the policy's designated beneficiaries, providing them with a financial safety net.

One of the advantages of term life insurance is its cost-effectiveness. Since the coverage is temporary, the premiums are generally lower compared to permanent life insurance. This makes it an attractive option for those who want to maximize their coverage without breaking the bank. Additionally, term life insurance is often easier to qualify for, as it doesn't require extensive medical exams or health history assessments, making it accessible to a broader range of individuals.

During the term, the insured individual's health and lifestyle can change, and if they become less insurable, the policy may not be renewed. However, many term life insurance policies offer the option to convert the term policy into a permanent one at the end of the term, ensuring long-term coverage if desired. This flexibility allows individuals to adapt their insurance needs as their circumstances change over time.

In summary, term life insurance provides a temporary safety net with a fixed death benefit, making it an excellent choice for short-term financial protection. Its affordability, accessibility, and flexibility make it a popular option for individuals seeking to secure their family's future during a specific period.

Evaluating a Life Insurance Business: Key Factors for Success

You may want to see also

Variable Universal Life Insurance: Combines universal life insurance with investment options, allowing for potential higher returns

Variable Universal Life Insurance is a type of permanent life insurance that offers a unique blend of insurance coverage and investment opportunities. It is designed to provide long-term financial security while also allowing policyholders to potentially grow their money through various investment options. This type of insurance is particularly appealing to those seeking a flexible and customizable approach to life insurance.

In a Variable Universal Life policy, the death benefit, which is the amount paid to the beneficiary upon the insured's passing, is linked to an investment account. This investment account can be customized to suit the policyholder's financial goals and risk tolerance. The policyholder can choose from a range of investment options, often including stocks, bonds, and mutual funds, which are managed by the insurance company. This investment aspect sets it apart from traditional universal life insurance, where the cash value accumulation is typically more limited.

One of the key advantages of Variable Universal Life is the potential for higher returns. The investment options provide an opportunity for the policy's cash value to grow, which can be used to increase the death benefit or taken as loans or withdrawals. This flexibility allows policyholders to adapt their insurance strategy as their financial situation changes. For example, during periods of market growth, the investment returns can boost the policy's value, providing a higher payout upon death or allowing for increased policy borrowing.

Additionally, this type of insurance offers a degree of flexibility in premium payments. Policyholders can typically adjust their monthly, annual, or even less frequent premium payments based on their financial circumstances. This adaptability is especially beneficial for those who may experience fluctuations in income or who want to ensure their insurance coverage remains adequate over time.

In summary, Variable Universal Life Insurance is a permanent life insurance option that combines the insurance aspect of universal life with the investment potential of variable policies. It provides policyholders with the opportunity to grow their money, adapt their insurance strategy, and make flexible premium payments, all while maintaining a long-term financial safety net. This type of insurance is well-suited for individuals who want to maximize their financial growth within the context of a comprehensive insurance plan.

Life Insurance: Optional Worth or Wasteful Expense?

You may want to see also

Final Expense Insurance: Designed to cover funeral and burial expenses, providing peace of mind for end-of-life costs

When considering permanent life insurance, it's important to understand the various types available, each serving a unique purpose. One such type is Final Expense Insurance, a specialized policy designed to provide financial coverage for end-of-life expenses. This insurance is a crucial aspect of financial planning, ensuring that your loved ones are not burdened with the financial strain of funeral and burial costs during a difficult time.

Final Expense Insurance is tailored to cover the specific and often unexpected costs associated with end-of-life arrangements. These expenses can include funeral services, burial or cremation costs, funeral home fees, and even the expenses related to obtaining a headstone or memorial. By having this insurance in place, individuals can ensure that their final wishes are respected and that their families can focus on grieving rather than financial worries.

The beauty of Final Expense Insurance lies in its simplicity and the peace of mind it offers. It is a straightforward policy that pays out a lump sum benefit upon the insured's death. This benefit is specifically designated to cover the aforementioned expenses, providing a financial safety net for the insured's beneficiaries. The process of claiming the benefit is typically straightforward, ensuring that the funds are available when needed most.

This type of insurance is particularly valuable for individuals who want to secure their loved ones' financial future without the complexity of traditional life insurance policies. It is often more affordable and accessible, making it an excellent option for those on a fixed income or with limited financial resources. Additionally, it can be a wise investment for those who wish to leave a financial legacy or contribute to their estate planning.

In summary, Final Expense Insurance is a dedicated financial tool designed to address the specific needs of covering funeral and burial expenses. It provides a sense of security and ensures that the end-of-life process is managed with dignity and respect. By considering this type of insurance, individuals can take a proactive approach to financial planning, leaving a lasting impact on their loved ones' lives.

Whole Life Insurance: Understanding Employee Benefits and Coverage

You may want to see also

Frequently asked questions

Permanent life insurance, also known as whole life insurance, offers lifelong coverage and a cash value component. It includes two main types: Traditional Whole Life and Universal Life. Traditional Whole Life has a fixed premium and death benefit, while Universal Life allows for flexible premium payments and potential investment options.

Whole life insurance provides coverage for the entire lifetime of the insured, ensuring a death benefit is paid out to beneficiaries regardless of when the policyholder passes away. It also accumulates cash value over time, which can be borrowed against or withdrawn. In contrast, term life insurance is designed for a specific period, offering coverage for a set duration, such as 10, 20, or 30 years.

Universal life insurance offers several advantages. It provides flexible premium payments, allowing policyholders to adjust their contributions based on their financial situation. Additionally, it has an investment component, where a portion of the premium goes into an investment account, potentially earning interest and growing the policy's cash value. This feature can be beneficial for those seeking long-term financial planning and investment opportunities.

Yes, many term life insurance policies offer conversion options. This means you can switch your term life coverage to a permanent life insurance policy, typically with the same insurer, without a medical examination. It provides an opportunity to enhance your coverage and ensure lifelong protection without the need for a new medical assessment.