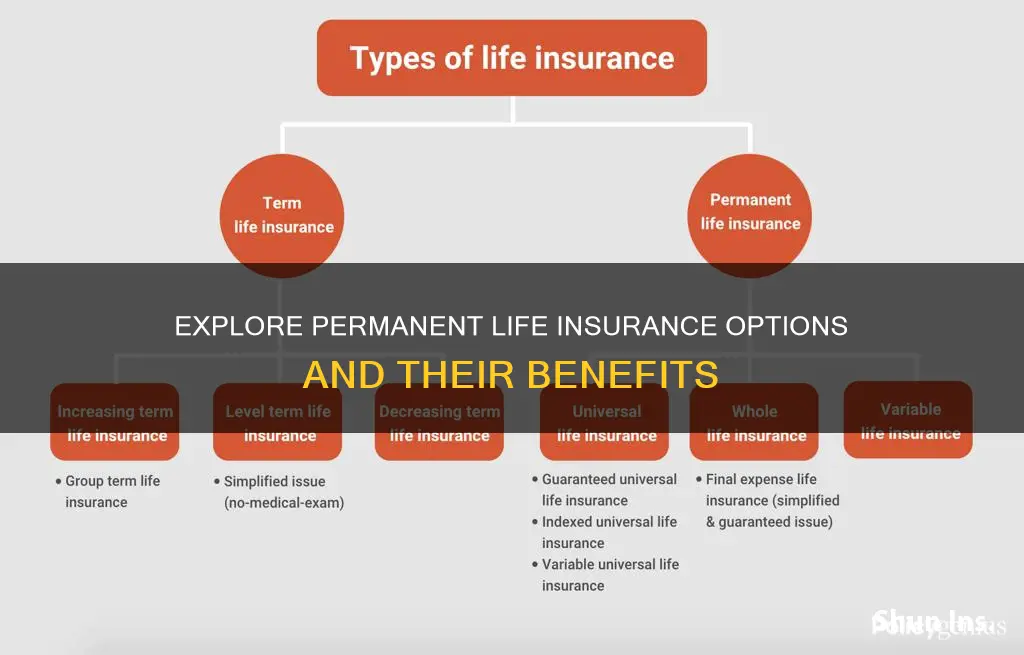

Permanent life insurance is a type of insurance policy that provides coverage for the full lifetime of the insured person. It is more expensive than term insurance but offers extra advantages such as a guaranteed minimum death benefit and the ability to accumulate cash value tax-deferred. The four types of permanent life insurance are universal life, whole life, variable universal life, and variable life. Each type offers varying levels of flexibility, investment options, and risk.

What You'll Learn

Whole Life Insurance

There are several types of whole life insurance policies, categorised by how premiums are paid. Level payment policies have premiums that remain unchanged throughout the duration of the policy. Single premium policies are paid for with a one-time large premium. Limited payment policies have a limited number of higher premium payments for a set number of years. Modified whole life insurance policies have lower premiums in the first few years and higher premiums in later years.

Life Insurance: Pyramid Scheme or Legit Business?

You may want to see also

Universal Life Insurance

Flexibility in Premium Payments

One of the key advantages of universal life insurance is its flexibility in premium payments. Policyholders can choose how much they pay and when they pay, as long as the cash value is sufficient to cover the policy's monthly fees. This adaptability makes it a good choice for those with fluctuating incomes or varying financial circumstances. However, it's important to monitor the cash value to ensure that the policy remains active and doesn't lapse.

Death Benefit Options

Cash Value and Savings

Investment Risks and Returns

Unlike whole life insurance, universal life insurance does not guarantee a fixed interest rate on the cash value. The interest rate is set by the insurer and can change frequently, although there is usually a minimum rate to protect against significant losses. If interest rates drop or investments underperform, the cash value may not grow as expected, and there is a risk of the policy lapsing if the cash value becomes insufficient.

Comparison with Other Types of Insurance

When compared with term life insurance, universal life insurance offers more flexibility in premium payments and provides a savings component that accumulates cash value. Term life insurance typically covers a set period and does not offer the same cash value benefits. On the other hand, whole life insurance offers fixed premiums and guaranteed death benefits, whereas universal life insurance provides adjustable premiums and a flexible death benefit.

Dialysis and Life Insurance: What's Covered and What's Not

You may want to see also

Variable Universal Life Insurance

The cash value of a VUL policy can be invested in a variety of subaccounts, including stock and bond accounts, along with a money market option. The growth of the cash value is tax-deferred, and policyholders can access these funds through withdrawals or loans. While the potential for higher returns exists due to exposure to market fluctuations, there is also the risk of substantial losses.

VUL insurance offers increased flexibility and growth potential compared to other life insurance options. It is suitable for those seeking permanent life insurance, comfortable with higher investment risk, and interested in self-managing their investments. However, it is important to carefully assess the risks and consider alternatives before purchasing a VUL policy due to its complexity and higher fees.

Login Credentials for SBI Life Insurance: A Step-by-Step Guide

You may want to see also

Indexed Universal Life Insurance

IUL insurance policies are more volatile than fixed universal life policies but are less risky than variable universal life insurance policies because they do not invest directly in equity positions. IUL policies usually cap returns but guarantee a minimum interest rate, typically offering a range of 8-12%. The interest rate will be variable, but there is a guaranteed minimum, regardless of market performance.

IUL policies have adjustable premiums, and the death benefit may also be flexible. The accumulated cash value can be used to lower or cover premiums without reducing the death benefit. The cash value in an IUL policy can be accessed at any time without penalty.

IUL insurance is a viable option for those seeking permanent life insurance with a cash component that earns interest, plus a tax-free death benefit for beneficiaries. This type of insurance is more expensive than term life insurance, but it offers permanent coverage. IUL insurance also offers flexible premiums, allowing policyholders to increase or decrease payments as needed. The cash value component grows tax-deferred, and the cash value can be used to pay insurance premiums, reducing or eliminating out-of-pocket premium payments.

Ohio National: Life Insurance Options in New York

You may want to see also

Adjustable Life Insurance

Three factors can be changed in an adjustable life insurance policy: the premium, cash value, and death benefit.

- Premiums: You can change the frequency and amount of premium payments as long as you pay the policy's minimum cost. You can lower your premium payments if you have adequate cash value in your policy.

- Cash value: You can increase the cash value by increasing your premium payments. You can also borrow against the cash value or use it to pay your premiums. However, if the cash value drops to zero, your policy might lapse.

- Death benefit: You can increase or decrease the death benefit amount. For example, you might increase it due to a life event like the birth of a child. Decreasing the death benefit usually only requires a request or written confirmation and doesn't require underwriting.

Advantages and Disadvantages

However, adjustable life insurance requires more management than policies with fixed premiums, such as whole life insurance. If you don't pay enough into your policy to cover the insurance costs, your future premiums will increase. Additionally, adjustable life insurance is more expensive than term life insurance, and the interest rates on the cash value account are typically modest.

Who is it for?

It is also an option for those caring for a person with disabilities, as it offers the ability to make adjustments to the policy if their situation changes. High-wealth individuals may also consider adjustable life insurance as part of a comprehensive financial portfolio to diversify their income and provide tax-deferred savings.

Marketing Term Life Insurance: Strategies for Success

You may want to see also

Frequently asked questions

Permanent life insurance is a type of insurance policy that never expires, so it will last the entire life of the policyholder, as long as the premiums are paid. It usually has basic components like the death benefit and some type of savings element.

The four types of permanent life insurance policies are universal life, whole life, variable universal life, and variable life.

Whole life insurance has fixed premium payments for the life of the policy, whereas universal life insurance provides the flexibility of varying the amount of premium payments. Whole life insurance also offers a guaranteed cash value growth, whereas the cash value growth potential of universal life insurance is weaker.