Term life insurance is a type of insurance that provides temporary coverage for a specific term. It is similar to renting an apartment, where you pay rent (premiums) for a certain period. This could be 10, 20, or 30 years, and if the insured passes away during this time, the policy pays out a death benefit to the beneficiaries. Term life insurance is generally the least expensive option and tends to be more affordable than permanent life insurance, but it becomes more expensive if you renew at an older age. It is a good option for those who want to protect their family in the event of their early death.

| Characteristics | Values |

|---|---|

| Coverage | Temporary coverage for a specific term |

| Cost | Least expensive type of life insurance |

| Renewal | Can be renewed for an additional term but at a higher premium |

| Premium | Premium is based on the policy's value and factors such as age, gender, and health |

| Payout | Payout only if the insured dies within the term |

| Types | Level-premium, Yearly renewable term, Annually renewable term, Level term, Adjustable life, Single premium whole life |

What You'll Learn

Term life insurance is temporary coverage for a specific term

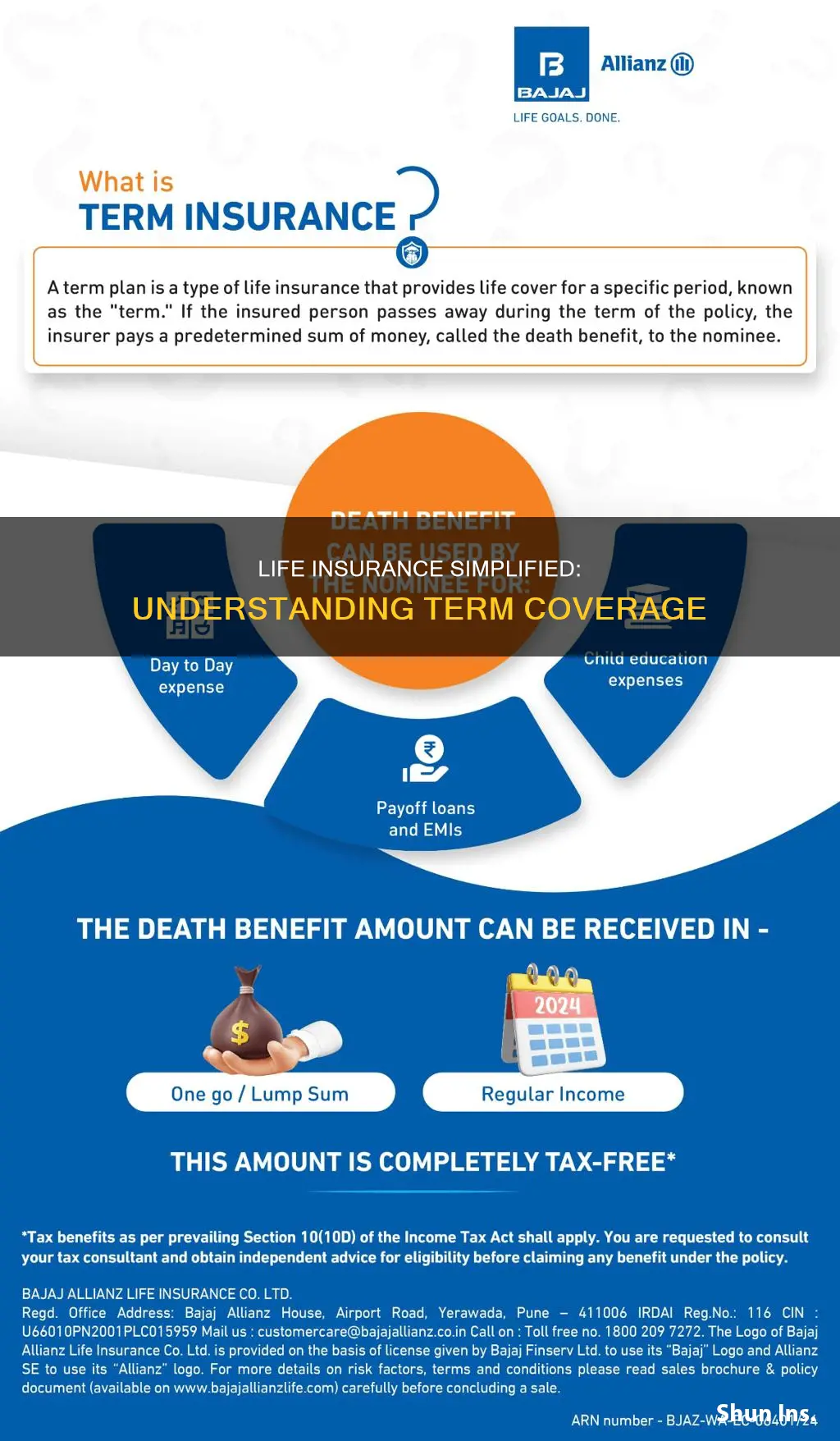

Term life insurance is a form of insurance that provides coverage for a specified period, often ranging from 10 to 30 years, though some companies offer terms of up to 40 years. It is designed to offer temporary protection, similar to renting an apartment, where you pay premiums for a certain duration known as the term. This means that if the insured person passes away during the term, their beneficiaries will receive a death benefit. However, if the insured person survives beyond the policy term and renews the policy, the premiums will be higher as they are based on the current age of the insured.

Term life insurance is often chosen by individuals who want to protect their families in the event of their early death. For example, a 30-year-old individual might opt for a 10-year term life insurance policy with a premium of $50 per month, ensuring that their beneficiary receives a payout if they pass away within the 10-year term. This type of insurance is particularly relevant for those who are starting their careers or expect to have children in the future, as it provides a cost-effective way to secure their family's financial future.

One of the key advantages of term life insurance is its affordability, especially when compared to permanent life insurance options. It is a good choice for those who cannot afford the higher premiums of permanent coverage but still want to ensure their loved ones are taken care of in the event of their untimely death. However, it is important to note that term life insurance does not offer lifelong protection like permanent insurance, and failing to renew the policy after the term expires can leave individuals unprotected.

Additionally, term life insurance policies may become more expensive if you decide to renew them, especially if you are renewing at an older age. This is because the insurance company will base the new premiums on your current age and the associated increased risk of mortality. In some cases, individuals diagnosed with a terminal illness during the first policy term may not be eligible to renew their term life insurance policy when it expires.

When considering term life insurance, it is essential to weigh the pros and cons according to your unique needs and circumstances. While it offers temporary coverage at a lower initial cost, the lack of permanent protection and potential for higher renewal premiums should be carefully considered. It is always advisable to compare different types of insurance policies and choose the one that best aligns with your financial goals and risk tolerance.

Term Life Insurance: Quick Approval Process Explained

You may want to see also

It is the least expensive type of life insurance

Term life insurance is the least expensive type of life insurance, especially when compared to permanent life insurance. It is a form of temporary coverage for a specific term, often ranging from 10 to 30 years, with some companies offering terms of up to 40 years. The longer the term, the more expensive the policy will be. For example, a 30-year term life insurance policy will have a fixed premium for the duration of the policy, which is more affordable than a permanent life insurance policy over the same period.

The affordability of term life insurance makes it an attractive option for those seeking to protect their loved ones in the event of their early death. For example, a 30-year-old individual can purchase a 10-year, $500,000 term life insurance policy with a premium of $50 per month. If the insured person passes away within the term, the policy will pay out the sum to the designated beneficiary. However, if the insured person survives the term, the beneficiary will not receive any benefit, and the policy will need to be renewed at a higher premium based on the current age of the policyholder.

The premium for term life insurance is determined by the insurance company based on the policy's value, or payout amount, and factors such as the age, gender, and health of the insured individual. The insurance company's business expenses, investment earnings, and mortality rates for each age also influence the premium rates. In some cases, a medical exam, driving record, current medications, smoking status, occupation, hobbies, and family history may be considered when determining the premium.

While term life insurance is the most affordable option initially, it is important to note that the premiums increase with each renewal as the insured individual ages. This is because the actuaries must account for the increasing costs of insurance over time. On the other hand, permanent life insurance, such as whole life and universal life, offers coverage for an entire lifetime as long as the premiums are paid and may provide better long-term value despite higher initial costs.

In conclusion, term life insurance is the least expensive type of life insurance when compared to permanent options, making it a viable choice for those seeking temporary coverage. However, the premiums increase with each renewal, and permanent life insurance may offer better long-term value depending on individual circumstances.

Life Insurance: When to Stop Paying Premiums

You may want to see also

It is similar to car insurance

Term life insurance is a type of life insurance that offers coverage for a set period of time, or term. It is somewhat similar to car insurance in that it is statistically unlikely that you will need it, and premiums are lost money if you don't. However, if the worst happens, your family will receive the benefits.

Term life insurance is usually the most affordable type of life insurance because it only lasts for a specific number of years, usually 10 to 30 years. Depending on the insurance company, it may be possible to turn term life into whole life insurance. You can purchase term life policies that last 10, 15, 20 years, or more, and you can usually renew them for an additional term. The best term life insurance companies have low prices, easy application processes, flexible policy features, and good customer service.

When you buy a term life insurance policy, the insurance company determines the premium based on the policy's value (the payout amount) and factors such as age, gender, and health. Other considerations affecting rates include the company's business expenses, how much it earns from its investments, and mortality rates for each age. In some cases, a medical exam may be required. The insurance company may also inquire about your driving record, current medications, smoking status, occupation, hobbies, family history, and similar information.

Term life insurance is a good option for people who cannot afford or will not pay the much higher monthly premiums associated with whole life insurance. It is a relatively inexpensive way to provide a lump sum to your dependents if something happens to you. It can be a good option if you are young and healthy and support a family.

Disabled Veterans: Free Life Insurance for 100% Rating?

You may want to see also

Term life insurance can be converted to whole life insurance

Term life insurance is a type of insurance that covers you for a specific period, such as 10, 15, 20, or 30 years. If you die within that time frame, your beneficiary will receive a payout. However, if you live past the policy's expiration date, your beneficiary will not receive any benefits. Term life insurance is ideal when you have significant obligations with a defined end date, such as paying off a mortgage or funding your children's college education.

The ability to convert term life insurance to whole life insurance provides flexibility as your life circumstances change. For example, if you initially chose term life insurance due to budget constraints but now have a higher income, converting to whole life insurance ensures lifelong coverage without worrying about renewal or expiration dates. Additionally, whole life insurance offers the potential for cash value accumulation, which can be advantageous for long-term financial goals.

When considering a conversion, it is essential to be mindful of the conversion window specified in your term life insurance policy. The option to convert is typically available for a limited time, and the deadline can vary depending on the insurance company. In most cases, you can convert without undergoing an additional medical examination or answering health-related questions, which means your current health status will not affect your eligibility for the new coverage.

To initiate the conversion process, you should first determine whether your term policy includes a conversion option and confirm the deadline for making the change. Next, discuss the available permanent life insurance options and associated costs with your insurance company. You may then need to fill out a life insurance conversion application, choose the desired coverage amount, and decide on your preferred billing frequency for the premiums. Finally, provide the necessary bank account information if you plan to set up automatic withdrawals.

Life Insurance and Section 8 Housing: What's the Verdict?

You may want to see also

It is like renting an apartment

Term life insurance is like renting an apartment in several ways. Firstly, just as you pay rent for a certain period, with term life insurance, you pay premiums for a specific term, which could be 10, 20, or 30 years. This is similar to a rental agreement, where you commit to paying rent for a fixed duration, such as a one-year lease.

Secondly, term life insurance provides temporary coverage, much like renting an apartment. When you rent, you occupy the space for a limited time and do not own the property. Similarly, with term life insurance, you are covered for a set period, after which the policy expires. This is in contrast to permanent life insurance, which lasts your entire life as long as you continue paying premiums, akin to buying and owning a home.

Another similarity is that term life insurance is often more affordable initially, like renting an apartment. Renting is usually more cost-effective in the short term compared to buying a home, which typically requires a substantial down payment and higher monthly mortgage payments. Similarly, term life insurance is generally cheaper than permanent life insurance when you first purchase it. However, if you renew your term life insurance at an older age, the premiums increase, just as rent prices can rise over time.

Additionally, term life insurance provides peace of mind and protection during the specified term, similar to how renting an apartment offers security and shelter for a fixed period. If you pass away during the term of your policy, your beneficiaries will receive a death benefit, ensuring their financial well-being. This is analogous to how renting an apartment provides a safe and stable living environment for the duration of your lease.

Lastly, both term life insurance and renting an apartment offer flexibility. With term life insurance, you can choose the duration of coverage that suits your needs, such as 10, 15, or 20 years. Similarly, when renting, you can decide on the length of your lease, whether it's month-to-month or a longer-term rental agreement. This flexibility allows you to adapt to changing circumstances and choose the option that best fits your current situation.

Free Life Insurance: Banks Offering $1000 Coverage

You may want to see also

Frequently asked questions

Term life insurance is a type of insurance that offers temporary coverage for a specific term. It is similar to renting an apartment, where you pay rent (premiums) for a certain period (the term). This could be 10, 20, or 30 years, and the insurance company determines the premium based on factors such as age, gender, and health.

Term life insurance is generally the least expensive option when considering the amount of coverage you can get for your premium dollars. It is a good option for those who want to protect their family in the event of their early death, as the policy will pay out a death benefit to the beneficiaries.

Term life insurance is temporary coverage with a set expiration date, whereas permanent life insurance (such as whole life and universal life) lasts your entire life as long as premiums are paid. Term life insurance is more affordable initially but becomes more expensive if you renew at an older age.