When it comes to life insurance, choosing the right smart score is crucial for ensuring you have adequate coverage. The smart score is a rating system that evaluates your risk profile based on various factors such as age, health, lifestyle, and financial situation. Understanding these factors and how they impact your smart score can help you make an informed decision about the type and amount of life insurance you need. This guide will explore the different smart scores available and provide insights into how to select the most appropriate one for your individual circumstances.

What You'll Learn

- Understanding SmartScore: How it impacts life insurance rates

- Factors Affecting SmartScore: Age, health, lifestyle, and more

- SmartScore and Policy Types: Term vs. permanent life insurance

- SmartScore Benefits: Lower premiums, better coverage options

- SmartScore Improvement Tips: Healthy habits, financial management

Understanding SmartScore: How it impacts life insurance rates

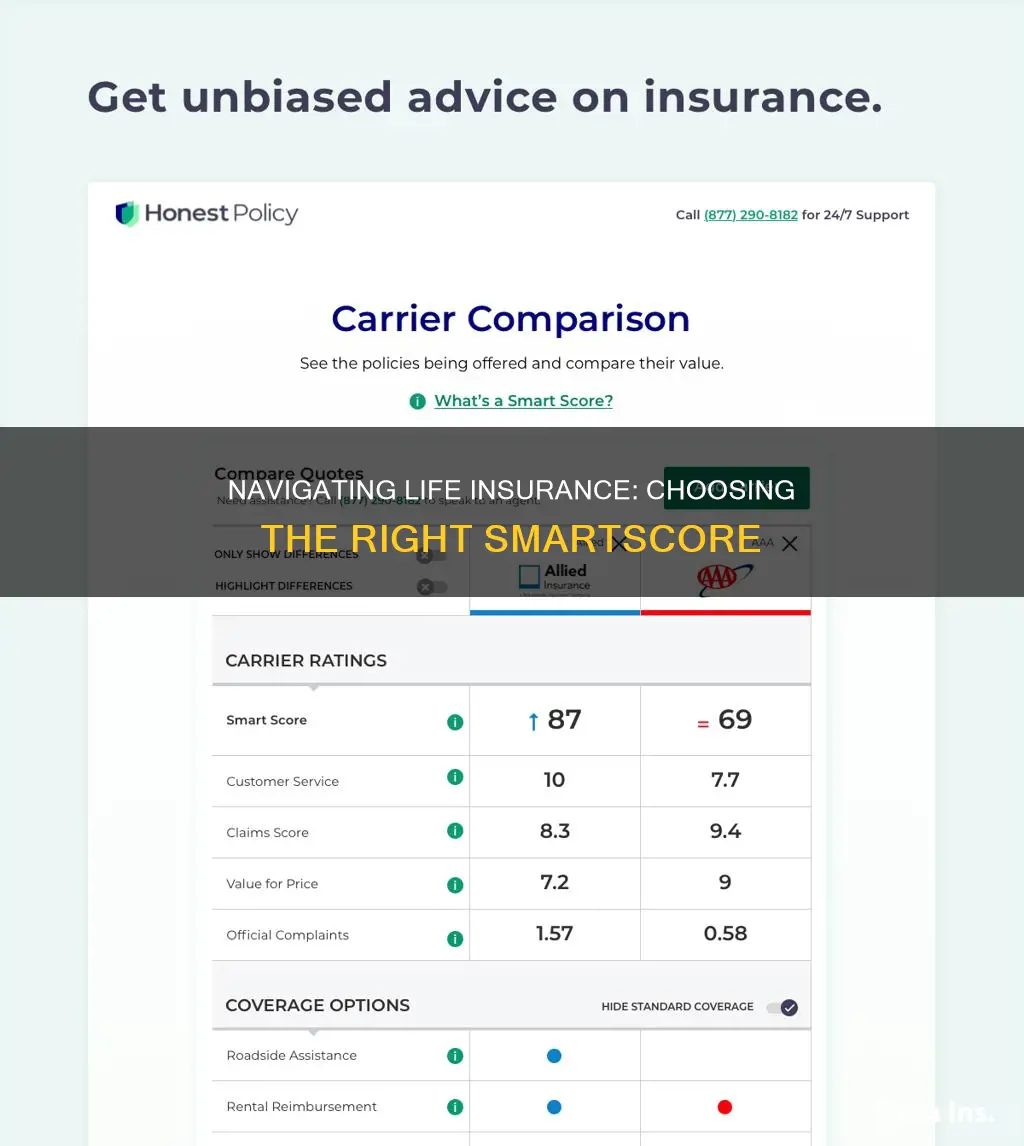

The concept of SmartScore is an innovative tool used by insurance companies to assess the risk associated with potential policyholders. When it comes to life insurance, this score can significantly influence the premium rates you'll be offered. Understanding how SmartScore works and its impact on your life insurance rates is crucial for making informed financial decisions.

SmartScore is a numerical representation of an individual's financial health and behavior, calculated based on various data points. These data points often include credit history, income, employment status, and even lifestyle choices. The score is designed to predict the likelihood of a policyholder making insurance claims, especially in the context of life insurance, where the risk of death or terminal illness is a primary concern. A higher SmartScore indicates a lower risk profile, suggesting that the individual is less likely to require insurance payouts.

Insurance companies use this score to determine the likelihood of a policyholder filing a claim, which directly affects the premium rates. A higher SmartScore often results in lower insurance premiums, as the insurer perceives the individual as a better risk. For instance, a person with a high SmartScore might be offered more competitive rates for term life insurance or a reduced premium for a whole life policy. Conversely, a lower SmartScore could lead to higher premiums, as the insurer may consider the individual as a higher-risk candidate.

It's important to note that SmartScore is just one factor among many that insurance companies consider when setting rates. Other factors, such as age, health, and lifestyle, also play a significant role. However, a good SmartScore can certainly improve your chances of securing favorable life insurance terms. Understanding and improving your SmartScore can be a strategic move, potentially saving you a substantial amount of money on life insurance premiums over time.

In summary, SmartScore is a powerful tool that insurance companies use to assess risk and set rates. By understanding how this score impacts your life insurance rates, you can take steps to potentially lower your premiums and secure more affordable coverage. Regularly reviewing and improving your financial habits can contribute to a higher SmartScore, ultimately benefiting your life insurance journey.

Understanding Tricaqre: Primary or Secondary Insurance Coverage?

You may want to see also

Factors Affecting SmartScore: Age, health, lifestyle, and more

When it comes to life insurance, understanding the factors that influence your SmartScore is crucial. This score is a critical component in determining your eligibility and the cost of your insurance policy. Here's a breakdown of how age, health, and lifestyle choices can impact your SmartScore:

Age: Age is a significant factor in life insurance calculations. Younger individuals typically have a higher SmartScore because they are considered less risky by insurance providers. As you age, your SmartScore may decrease due to the increased likelihood of health issues and potential long-term care needs. This is why younger people often secure lower premiums for life insurance policies.

Health and Medical History: Your health plays a pivotal role in determining your SmartScore. Insurance companies will review your medical records, including any pre-existing conditions, chronic illnesses, or recent health scares. Conditions like diabetes, heart disease, or cancer can significantly impact your score. For instance, a person with a history of smoking or obesity may face higher insurance premiums due to the associated health risks. In contrast, maintaining a healthy lifestyle with regular exercise and a balanced diet can positively influence your SmartScore.

Lifestyle Choices: Lifestyle factors are another critical aspect of SmartScore assessment. Insurance providers consider habits such as smoking, alcohol consumption, drug use, and even occupation. For example, smokers are often assigned a lower SmartScore due to the well-documented health risks associated with smoking. Similarly, high-risk occupations like construction or emergency services may result in a lower score. On the other hand, non-smokers and individuals with sedentary jobs might enjoy better insurance rates.

Additionally, your credit score and financial history can also contribute to your overall SmartScore. A good credit history indicates financial responsibility, which can positively impact your insurance rates. It's essential to maintain a healthy lifestyle and manage any existing health conditions to potentially improve your SmartScore and secure more favorable life insurance terms.

Life Insurance: Adaptable Options for a Changing World

You may want to see also

SmartScore and Policy Types: Term vs. permanent life insurance

When it comes to life insurance, understanding the different policy types and how they relate to your SmartScore is crucial for making informed decisions. SmartScore, a numerical representation of your financial health, can significantly impact the type of life insurance you qualify for and the rates you receive. Here's a breakdown of how SmartScore influences your choice between term and permanent life insurance.

Term Life Insurance:

Term life insurance is a straightforward and cost-effective solution for a specific period, typically 10, 20, or 30 years. It provides coverage during the agreed-upon term, offering a death benefit if the insured individual passes away during that time. SmartScore plays a vital role in determining your eligibility and premium rates for term life insurance. A higher SmartScore indicates a more favorable financial profile, making you a more attractive candidate for insurers. As a result, you may secure lower premiums, making term life insurance an affordable option for those seeking temporary coverage. This type of policy is ideal for individuals who want coverage for a defined period, such as covering mortgage payments or providing financial security for their family during a specific life stage.

Permanent Life Insurance:

In contrast, permanent life insurance offers lifelong coverage and includes a cash value component that grows over time. This policy type is more complex and often comes with higher premiums. SmartScore is still a critical factor in assessing your eligibility, but it also considers the long-term financial commitment associated with permanent life insurance. Insurers may require a higher SmartScore to ensure you can afford the ongoing premiums, especially as the policy's cash value grows. Permanent life insurance is suitable for those seeking long-term financial security and the potential for tax-advantaged savings. It provides a death benefit and a guaranteed cash value accumulation, making it a comprehensive solution for long-term financial planning.

SmartScore and Policy Selection:

The decision between term and permanent life insurance should consider your financial goals, risk tolerance, and long-term plans. A higher SmartScore can open doors to more favorable terms and lower rates, making both policy types more accessible. However, it's essential to evaluate your financial situation and future commitments. If you have a stable income and a defined period of coverage needed, term life insurance might be the more practical choice. On the other hand, if you seek lifelong coverage and the potential for long-term savings, permanent life insurance could be more suitable, despite the higher initial costs.

In summary, SmartScore is a powerful tool that influences your life insurance options. It determines your eligibility and premium rates, especially when choosing between term and permanent life insurance. Understanding your SmartScore and its implications can help you make a well-informed decision, ensuring you have the right coverage to meet your financial needs.

Usaa Life Insurance: Is It Worth the Hype?

You may want to see also

SmartScore Benefits: Lower premiums, better coverage options

Understanding your SmartScore can significantly impact your life insurance experience, offering both financial benefits and improved coverage options. This unique numerical rating, generated by insurance companies, is a comprehensive assessment of your health and lifestyle factors. Here's how it can benefit you:

Lower Premiums: One of the most direct advantages of a high SmartScore is reduced life insurance premiums. Insurance companies use this score to evaluate your risk profile. A higher SmartScore indicates a lower likelihood of developing health issues, making you a more attractive candidate for insurance providers. As a result, you can expect to pay less for your life insurance policy, potentially saving a substantial amount over the policy's duration. This is particularly beneficial for long-term financial planning, allowing you to allocate those savings to other important aspects of your life.

Better Coverage Options: A high SmartScore not only leads to lower premiums but also opens doors to more comprehensive coverage options. Insurance companies often provide customized plans based on your SmartScore. This means you can access tailored coverage that suits your specific needs. For instance, a higher score might allow you to opt for a larger death benefit, ensuring your loved ones receive the financial support they need in your absence. Additionally, with a favorable SmartScore, you may be eligible for additional benefits like critical illness coverage or accidental death insurance, enhancing the overall value of your policy.

The SmartScore system encourages individuals to take a proactive approach to their health and lifestyle choices. By maintaining a high score, you not only benefit from financial savings but also gain access to a wider range of insurance products. This can be particularly advantageous when planning for the long term, ensuring that your life insurance policy aligns with your evolving needs and goals.

In summary, the SmartScore is a powerful tool that can simplify the life insurance process, making it more accessible and affordable. It empowers individuals to take control of their financial well-being and provides insurance companies with a comprehensive view of their clients' health, ultimately leading to more favorable terms and conditions.

Life Insurance Proceeds: Minnesota's Tax Laws Explained

You may want to see also

SmartScore Improvement Tips: Healthy habits, financial management

Improving your SmartScore can significantly impact your life insurance application process. SmartScore is a unique metric that insurance companies use to assess an individual's likelihood of making timely payments on their insurance premiums. A higher SmartScore indicates a more financially responsible individual, which can lead to better insurance rates and terms. Here are some tips to enhance your SmartScore and potentially secure more favorable life insurance coverage:

Healthy Habits:

- Maintain a Healthy Lifestyle: Insurance companies often consider health factors when calculating SmartScore. Adopting a healthy lifestyle can positively impact your score. Regular exercise, a balanced diet, and managing any existing health conditions can contribute to a better overall health profile. Aim for a consistent routine that includes physical activity and a nutritious diet to showcase your commitment to well-being.

- Monitor Your Health: Keep track of your health metrics such as blood pressure, cholesterol levels, and blood sugar. Regular check-ups with healthcare professionals can provide valuable data. Insurance providers may review this information to assess your health risk and, consequently, your SmartScore.

- Avoid Smoking and Excessive Alcohol Consumption: These habits can negatively affect your health and, in turn, your SmartScore. Insurance companies may view smokers or excessive drinkers as higher-risk individuals, potentially leading to higher insurance premiums. Quitting smoking and moderating alcohol intake can significantly improve your health and SmartScore.

Financial Management:

- Build a Solid Credit History: A good credit score is essential for a high SmartScore. Ensure you pay bills on time, maintain a low credit utilization ratio, and regularly review your credit report for any discrepancies. A strong credit history demonstrates financial responsibility and can make a positive impression on insurance companies.

- Manage Debt Effectively: High debt levels can impact your financial health and, consequently, your SmartScore. Work on reducing debt, especially credit card debt, as it can be a significant factor in the scoring model. Creating a debt repayment plan and sticking to it will showcase your ability to manage finances effectively.

- Practice Consistent Financial Planning: Regularly review and update your financial plans. This includes budgeting, saving, and investing. A well-structured financial plan indicates a disciplined approach to money management, which is highly valued by insurance providers. Consider consulting a financial advisor to create a comprehensive strategy.

- Avoid Frequent Credit Applications: Multiple credit applications in a short period can negatively affect your credit score and, by extension, your SmartScore. Be mindful of credit inquiries and only apply for credit when necessary. This demonstrates financial stability and responsibility.

By implementing these healthy habits and financial management practices, you can significantly improve your SmartScore. Remember, insurance companies are interested in individuals who demonstrate a commitment to their well-being and financial stability. Taking proactive steps in these areas will not only benefit your life insurance application but also contribute to a healthier and more secure financial future.

Life Insurance Benefits: Taxable in New Jersey?

You may want to see also

Frequently asked questions

A smart score is a numerical representation of an individual's risk profile, which helps insurance companies assess the likelihood of a policyholder making claims. It considers various factors like age, health, lifestyle, and financial information to provide a comprehensive view of the applicant's overall health and potential longevity.

The calculation of a smart score involves analyzing multiple data points. These may include medical history, family medical history, lifestyle choices (such as smoking, alcohol consumption, and exercise habits), occupation, financial stability, and other relevant factors. The insurance company uses advanced algorithms and statistical models to process this data and assign a score.

Yes, there are several ways to potentially improve your smart score and secure more favorable life insurance rates. These include maintaining a healthy lifestyle by quitting smoking, reducing alcohol consumption, exercising regularly, and managing any pre-existing health conditions. Additionally, improving your credit score, maintaining a stable income, and having a healthy body mass index (BMI) can also positively impact your smart score.

No, the smart score is just one aspect of the assessment process. Insurance companies also consider other factors such as age, gender, family medical history, occupation, hobbies, and the type of coverage requested. A higher smart score can make you a more attractive candidate, but it doesn't guarantee approval or the best rates.

It is recommended to review your smart score and life insurance policy periodically, especially if there are significant changes in your lifestyle, health, or financial situation. Life events like getting married, having children, or experiencing major health changes can impact your risk profile and, consequently, your insurance rates. Regular reviews ensure that your policy remains appropriate and cost-effective.