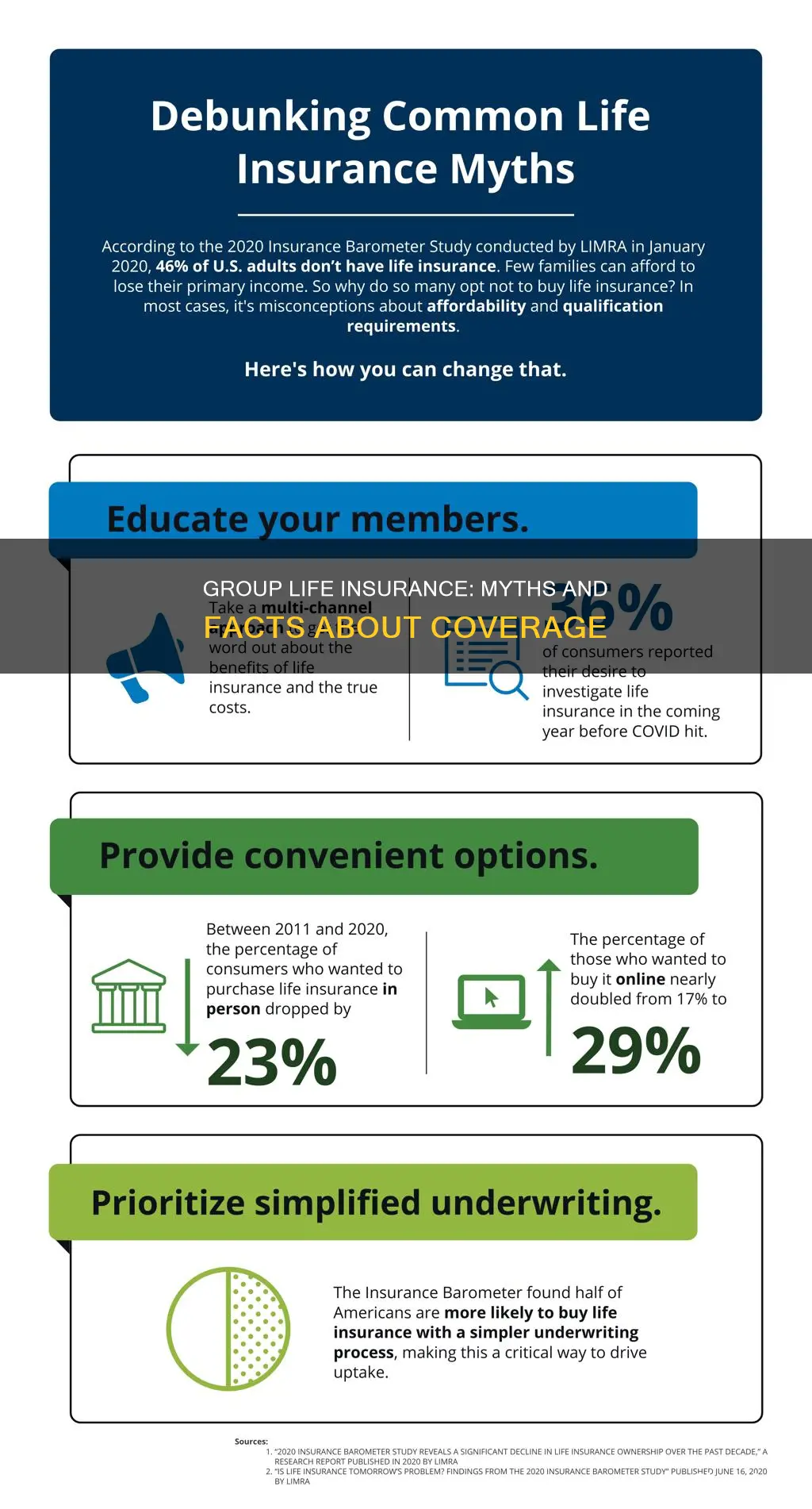

Group life insurance is a type of insurance offered by employers or large-scale entities to their workers or members. It is typically inexpensive and sometimes even free for employees, as the cost is lower than individual policies due to the larger number of people covered. Group life insurance policies do not require individuals to undergo medical examinations, making them more accessible. However, the coverage amount is usually basic and limited, and it is recommended that employees supplement it with individual policies. While group life insurance is a valuable perk, it is not a comprehensive solution for all insurance needs.

Now, let's delve into the incorrect statement about group life insurance. One statement that stands out as incorrect is, Each participant requires evidence of insurability. This statement contradicts the nature of group life insurance, where individuals are not required to provide proof of their insurability. Instead, group life insurance is often based on the understanding that a large group of people will be covered, and the risk is spread across the entire group. Therefore, this particular statement is incorrect, as group life insurance does not necessitate evidence of insurability from each participant.

| Characteristics | Values |

|---|---|

| Requirement to prove insurability on the part of the participants | Not required |

| Participants receive a Certificate of Insurance as their proof of insurance | True |

| Minimum number of participants required to underwrite the plan | True |

| The cost of the plan is determined by the average age of the group | False |

What You'll Learn

Group life insurance is not determined by the ratio of men to women in the group

Group life insurance is a common benefit offered by employers or large-scale entities to their workers or members. It is a single contract for life insurance coverage that extends to a group of people, and it is often provided as part of a larger benefits package. While there are certain requirements that must be met to qualify for group life insurance, it is generally accessible and affordable for those who are eligible.

One common misconception about group life insurance is that the cost of coverage is based on the ratio of men to women in the group. However, this is not the case. The cost of group life insurance is typically determined by factors such as the age and health status of the group members, the benefit amount, and the risk profile of the group as a whole. Group life insurance is designed to provide financial protection to the insured individuals and their beneficiaries in the event of death, and the pricing is based on the overall risk assessment of the group, not the gender ratio.

Group life insurance policies are often attractive to employees because they are usually inexpensive or even free, as many members pay into the group policy. Additionally, group life insurance does not require individuals to undergo a medical examination or individual underwriting, making it more accessible than individual policies. It is important to note that the coverage provided by group life insurance is typically basic and may not meet the needs of all policyholders. As a result, it is often recommended that individuals supplement their group life insurance with a separate individual policy to ensure adequate coverage.

While group life insurance can provide valuable financial protection, it is important to understand its limitations. The coverage is usually only valid for as long as an individual remains a part of the group, and the employer or organization typically controls the policy. This means that if an individual leaves the group or the organization terminates the policy, their coverage will end. However, in some cases, former employees may have the option to continue their coverage at the individual level, although this may come with higher premiums.

In conclusion, group life insurance is a valuable benefit offered by employers or large-scale entities that can provide financial protection for individuals and their beneficiaries in the event of death. The cost of coverage is not based on the ratio of men to women in the group, but rather on factors such as age, health status, benefit amount, and group risk profile. It is important for individuals to understand the specifics of their group life insurance coverage and to consider supplementing it with additional individual coverage if needed.

MetLife Insurance: Accidental Death Coverage and Exclusions

You may want to see also

It does not require a medical exam

Group life insurance is offered by an employer or another large-scale entity, such as an association or labor organization, to its workers or members. It is a common and fairly inexpensive benefit, and may even be free for certain employees. Group life insurance is typically term life insurance, which is renewable each year, rather than whole life insurance, which is permanent. Whole life insurance is more expensive and has higher premiums and death benefits.

Group life insurance does not require a medical exam or individual underwriting, which means that it is easy to qualify for coverage. This is in contrast to individual policies, which often require a medical exam. A medical exam for life insurance is similar to an annual physical and includes an examination by a medical professional, as well as questions about an individual's medical history and lifestyle.

The lack of a medical exam for group life insurance means that the insurance company is taking on more risk, as they have less information about the health of the group members. This means that group life insurance policies tend to have lower coverage amounts and higher premiums than individual policies. Group life insurance coverage is also not portable, meaning that it ends when a member leaves the group, although the former member may be able to continue coverage at an individual level.

Group life insurance is a good option for those who are unable to qualify for an individual policy due to health issues, as well as those who want a hassle-free way to get coverage quickly. It can also be a good value-for-money option for those who want basic coverage. However, it is important to note that group life insurance may not fulfill the needs of all policyholders due to its limited coverage. Therefore, it is recommended that group life insurance be supplemented with a separate individual policy.

Life Insurance Agents: How Are They Paid?

You may want to see also

The group sponsor receives a certificate of insurance

Group life insurance is a type of insurance coverage provided by an employer or large-scale entity, such as an association or labour organisation, to its workers or members. It is typically offered as part of a larger benefits package and can be inexpensive or even free for employees, as many members pay into the group policy.

The group sponsor, such as an employer or organisation, purchases a master policy to cover a group of individuals. In doing so, the group sponsor receives a certificate of insurance, which outlines the coverage details for the individuals within the group. This certificate serves as proof of insurance for the group members.

The certificate of insurance is an important document that summarises the coverage terms and explains the rights of the employees or group members under the policy. It is a key component of group life insurance, providing clarity and assurance to both the group sponsor and the insured individuals.

The certificate of insurance typically includes essential information such as the names of the insured individuals, the effective date and duration of the coverage, the benefits provided, any exclusions or limitations, and the process for filing claims. It may also outline the process for adding or removing members from the group policy and the steps to take if an individual leaves the company or organisation.

Additionally, the certificate of insurance may include details about the group sponsor's responsibilities, such as premium payment obligations and the process for renewing or cancelling the policy. It may also specify the rights of the group sponsor, such as their ability to make changes to the coverage or adjust the terms of the policy.

In summary, the group sponsor receiving a certificate of insurance is a fundamental aspect of group life insurance. This certificate serves as proof of insurance for the group members and outlines the coverage details, rights, and responsibilities of all parties involved. It is an important document that provides transparency and protection for both the group sponsor and the insured individuals.

Life Insurance and Schizophrenia: What's the Verdict?

You may want to see also

It can be converted to an individual term insurance policy

Group life insurance is a type of insurance that is offered by an employer or another large-scale entity, such as an association or labor organization, to its workers or members. It is usually inexpensive and may even be free for certain employees. Group life insurance is a single contract for insurance coverage that extends to a group of people.

Group life insurance policies are generally not portable, meaning that once a member leaves the group, their coverage ends. However, in some cases, group life insurance can be converted into an individual term insurance policy. This is especially important for employees with medical conditions that would make it difficult for them to secure coverage on their own.

When an individual leaves their employer or organization, their group life insurance coverage typically terminates. However, in certain cases, they may have the option to convert their group coverage into an individual policy. This is known as a "conversion privilege." This option allows employees to continue their life insurance coverage without undergoing medical underwriting, which may be challenging for those with health issues.

The process of converting group life insurance to an individual policy is straightforward. Almost all company life insurance policies provide a grace period, typically 31 days from the date of release from the company, to transfer the group life insurance policy to an individual policy. It is important to note that the premiums may change, as the individual will no longer receive contributions from their employer and will no longer be part of an insurance pool.

Additionally, the converted individual policy may have higher premiums than the original group policy. This is because the individual policy is no longer subsidized by the employer and the individual is now purchasing coverage on their own. Nevertheless, the ability to convert group life insurance to an individual policy can be beneficial, especially for those who may struggle to obtain coverage due to health reasons.

Get Life Insurance Fast for an SBA Loan

You may want to see also

It is not true that each participant requires evidence of insurability

Group life insurance is a single contract for life insurance coverage that extends to a group of people. It is offered by an employer or another large-scale entity, such as an association or labor organization, to its workers or members. It is a common employee benefit that provides a death benefit to the insured's beneficiaries if they die while part of the organization.

Group life insurance policies are generally inexpensive and may even be free for certain employees. They are also easy to qualify for, as they do not require a medical examination or individual underwriting. This means that, unlike with individual policies, each participant in a group life insurance policy does not need to provide evidence of insurability.

Evidence of insurability (EOI) is a critical tool for insurers to assess the risk of insuring an individual. It involves providing a detailed medical history and lifestyle habits and occasionally undergoing a thorough health examination. The information from the EOI helps determine insurance premium rates, coverage limits, and eligibility.

While group life insurance policies do not require individuals to provide evidence of insurability, there are some exceptions. For example, if an employee opts for additional coverage beyond the guaranteed issue amount, they may need to submit an EOI. This is known as a "guaranteed issue" amount, which is a base amount of coverage offered without requiring proof of insurability.

In summary, it is generally true that each participant in a group life insurance policy does not need to provide evidence of insurability. However, there may be cases where individuals need to submit an EOI if they opt for additional coverage beyond the guaranteed issue amount.

Term Life Insurance: Waiting Periods and You

You may want to see also

Frequently asked questions

No, group life insurance policies do not require a medical exam, making the premiums more affordable for members.

Group life insurance is typically inexpensive and may even be free for members, as the cost is spread across a large group.

Yes, group life insurance can often be converted to an individual policy when a member leaves the group, although this will result in higher premiums.

Group life insurance is an employee benefit that provides financial support to the families of employees in the event of their death while employed by the organization.

Group life insurance is a single contract that covers a group of people, typically employees of a company or members of an organization. The employer or organization purchases the policy and retains the master contract.