When it comes to life insurance, the beneficiary designation is a crucial aspect that determines who receives the payout upon the insured's death. In many cases, the default beneficiary is the spouse or partner. However, there are specific types of life insurance policies that require the consent of the beneficiary, especially if they are not a spouse or a close family member. These policies often involve complex legal considerations and may require the beneficiary to provide written consent or attend a meeting to confirm their willingness to accept the benefits. Understanding these requirements is essential for individuals to ensure their loved ones receive the intended financial support.

What You'll Learn

- Legal Requirements: Insurance companies must obtain consent from the named beneficiary for certain actions

- Policy Changes: Modification of beneficiaries or coverage often needs the beneficiary's approval

- Payout Distribution: The beneficiary's consent is crucial for how and when funds are distributed

- Beneficiary Updates: Regularly reviewing and updating beneficiaries is essential and requires their consent

- Dispute Resolution: In case of disputes, the beneficiary's consent may be required for legal proceedings

Legal Requirements: Insurance companies must obtain consent from the named beneficiary for certain actions

When it comes to life insurance, the concept of a beneficiary is crucial, and the legal requirements surrounding their consent are essential for insurance companies to navigate. The consent of the named beneficiary is a critical aspect of the policy's administration, especially in certain scenarios. Here's an overview of the legal obligations and the importance of obtaining consent:

Policy Changes and Updates: Insurance companies often need to make changes to the policy, such as modifying the beneficiary's name, address, or the amount of coverage. In such cases, the insurance provider must obtain the consent of the named beneficiary. This ensures that the beneficiary is aware of any changes and has the opportunity to review and agree to the updates. For instance, if a policyholder decides to add a new beneficiary or change the primary beneficiary, the insurance company is legally obligated to notify and obtain consent from the individual named in the policy. This process protects the rights of the beneficiary and allows for transparency in policy management.

Surrender or Lapse of Policy: If a policyholder wishes to surrender the policy or it lapses due to non-payment of premiums, the insurance company must inform the named beneficiary. The beneficiary's consent is not always required in these cases, but it is still a best practice to keep them informed. However, in some jurisdictions, the insurance company may need explicit consent from the beneficiary to proceed with the surrender or lapse, especially if it results in a financial loss for the beneficiary.

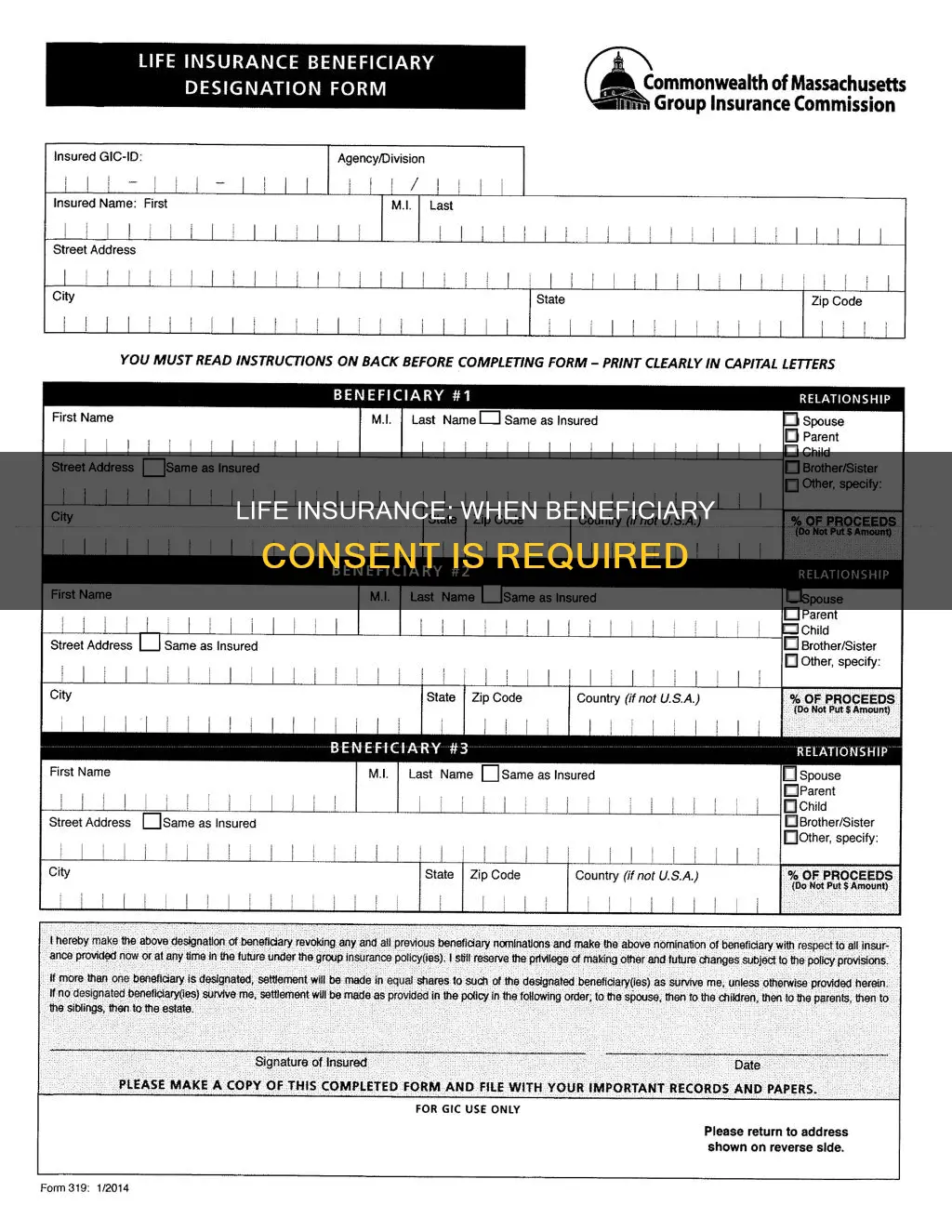

Beneficiary Designations: The process of naming a beneficiary is a fundamental aspect of life insurance. When a policyholder designates a beneficiary, the insurance company must ensure that the beneficiary is aware of their status. This awareness is crucial for the beneficiary's understanding of their rights and obligations. In some jurisdictions, the insurance company may be required to provide a copy of the policy or a summary of its terms to the named beneficiary, especially if the policy is a complex or high-value one.

Legal Challenges and Disputes: Failure to obtain consent in the required scenarios can lead to legal challenges and disputes. If an insurance company makes changes to the policy without the beneficiary's consent, it may face legal consequences. For example, if a policyholder passes away, and the insurance company proceeds with a payout without notifying the beneficiary, it could result in a legal dispute. Obtaining consent ensures that the policy remains valid and enforceable, protecting both the insurance company and the beneficiary's interests.

In summary, insurance companies must adhere to legal requirements that mandate obtaining consent from the named beneficiary for various actions. These requirements ensure transparency, protect the beneficiary's rights, and maintain the integrity of the policy. By following these guidelines, insurance providers can navigate the complexities of beneficiary management and ensure a smooth policy administration process.

Voya: A Comprehensive Mutual Life Insurance Option?

You may want to see also

Policy Changes: Modification of beneficiaries or coverage often needs the beneficiary's approval

When it comes to life insurance policies, the concept of beneficiaries is crucial, as they are the individuals who will receive the death benefit upon the insured person's passing. The process of modifying or changing these beneficiaries often requires the consent of the beneficiary themselves, which is an essential aspect of policy management. This requirement ensures that the beneficiary's interests and preferences are considered, providing a layer of protection and transparency.

In many cases, life insurance policies allow the insured individual to name primary and secondary beneficiaries. The primary beneficiary is the first in line to receive the payout, while the secondary beneficiary steps in if the primary is unable or unwilling to accept the benefit. Modifying these beneficiary designations typically necessitates the consent of the intended new beneficiary. For instance, if the insured wants to add a spouse as a primary beneficiary, the spouse's agreement is necessary to ensure they are comfortable with the change. This consent requirement helps prevent potential disputes and ensures that the beneficiary is aware of and agrees to the new arrangement.

The need for beneficiary consent becomes even more critical when considering changes to the coverage amount or type. Life insurance policies often offer various coverage options, such as term life, whole life, or universal life. If the insured wishes to increase or decrease the coverage amount, they must obtain the consent of the current beneficiary(ies). This is to ensure that the beneficiary is aware of the financial impact of the change and can provide informed consent. Similarly, altering the type of coverage, such as converting from term life to permanent life insurance, requires the beneficiary's approval to ensure they understand the implications.

Furthermore, life insurance policies may also include provisions for beneficiary reviews and updates. Over time, circumstances can change, and beneficiaries might no longer be the best choice. In such cases, the insured person can initiate a review process, which often requires the consent of the existing beneficiary(ies). This could involve removing a beneficiary, adding a new one, or making other adjustments to the policy. By requiring consent, the insurance company ensures that the beneficiary's current wishes and preferences are respected.

In summary, modifying life insurance policies, especially those related to beneficiaries and coverage, often demands the beneficiary's approval. This process is designed to protect the interests of the beneficiary and ensure that any changes are made with their knowledge and consent. It is a crucial aspect of policy management, promoting transparency and preventing potential conflicts that could arise without proper consent. Understanding these requirements is essential for both the insured and beneficiaries to maintain a smooth and efficient insurance administration process.

Understanding PA's Tax on Employer-Provided Group Term Life Insurance

You may want to see also

Payout Distribution: The beneficiary's consent is crucial for how and when funds are distributed

The distribution of life insurance proceeds is a critical process that often hinges on the beneficiary's consent. When an individual purchases a life insurance policy, they typically name one or more beneficiaries who will receive the death benefit upon their passing. However, the specific payout distribution process can vary significantly depending on the type of beneficiary and the insurance company's policies.

In many cases, the primary beneficiary, often a spouse or a close family member, has the authority to decide how the funds are distributed. This individual's consent is crucial as they are typically the first point of contact for the insurance company and can provide the necessary documentation and information to initiate the payout process. For instance, if the primary beneficiary is a spouse, they may have the right to choose between a lump-sum payment or regular installments, ensuring the funds are utilized according to their wishes.

On the other hand, secondary beneficiaries, such as children or other relatives, might have different considerations. In some policies, the insurance company may require the consent of the primary beneficiary before distributing any funds to secondary beneficiaries. This is to ensure that the primary beneficiary's rights are respected and that the distribution aligns with their intentions. For example, if the primary beneficiary is a parent, they may need to consent to the distribution of funds to their children, especially if the policy specifies that minors require a guardian's consent for financial transactions.

The process of obtaining beneficiary consent can vary. Some insurance companies may provide a simple consent form that needs to be signed and returned, while others might require a more comprehensive process, including legal documentation and proof of identity. It is essential for beneficiaries to understand their rights and the insurance company's requirements to ensure a smooth and timely payout process.

In summary, the beneficiary's consent is a critical aspect of life insurance payout distribution. It ensures that the insurance company can verify the beneficiary's identity and intentions, allowing for a fair and efficient process. Whether it's a primary or secondary beneficiary, their consent is essential to navigate the complexities of distributing the death benefit and providing financial security to the intended recipients.

Sun Life Insurance: Acupuncture Coverage and Benefits Explained

You may want to see also

Beneficiary Updates: Regularly reviewing and updating beneficiaries is essential and requires their consent

Regularly reviewing and updating beneficiaries is a crucial aspect of maintaining an effective life insurance policy. This process ensures that your beneficiaries are up-to-date and accurately reflect your current wishes, especially in the event of your passing. It is essential to keep this information current for several reasons. Firstly, life is inherently unpredictable, and personal relationships can change over time. What was once a close relationship may evolve, and individuals may move in and out of each other's lives. By regularly reviewing beneficiaries, you can ensure that your insurance policy aligns with your current relationships and preferences.

Secondly, life events such as marriages, births, or even the passing of a loved one can significantly impact your beneficiary choices. For instance, if you have a new spouse, they should be included as a beneficiary to ensure a smooth distribution of your insurance proceeds. Similarly, the birth of a child might prompt you to add them to your policy, ensuring their financial security. These life events often require legal documentation and consent from the individuals involved, making the process of updating beneficiaries a necessary and respectful step.

The process of updating beneficiaries typically involves contacting your insurance provider and providing them with the necessary information. This may include the full legal names, addresses, and relationships of the individuals you wish to name as beneficiaries. In some cases, you might need to obtain consent from the proposed beneficiaries, especially if they are not immediate family members. This consent ensures that the individuals are aware of their role and agree to be named as such. It is a legal and ethical practice that respects the individuals' rights and ensures a smooth transition of benefits.

It is worth noting that different types of life insurance policies may have specific requirements regarding beneficiary updates. For instance, some policies might allow for changes without the need for consent, while others may mandate it. Understanding the terms of your policy is crucial to ensure compliance and avoid any potential issues. Always consult your insurance provider or a financial advisor to clarify any doubts and ensure that your beneficiary information is accurate and up-to-date.

In summary, regularly reviewing and updating beneficiaries is a vital practice that demonstrates your commitment to effective estate planning. It ensures that your life insurance policy remains relevant and beneficial to your intended recipients. By involving the beneficiaries in the process and adhering to the legal requirements, you can maintain a positive and respectful relationship with those who hold a significant place in your life. Remember, life insurance is a powerful tool to provide financial security, and keeping it current is an essential part of that process.

Canceling Royal London Life Insurance: A Step-by-Step Guide

You may want to see also

Dispute Resolution: In case of disputes, the beneficiary's consent may be required for legal proceedings

In the context of life insurance, the concept of beneficiary consent is crucial, especially when it comes to dispute resolution and legal proceedings. When a life insurance policy involves a beneficiary, the process of claiming the benefits and resolving any disputes can be complex and may require the consent of the intended recipient. This is particularly relevant in cases where the policyholder's death is disputed or when there are multiple beneficiaries with conflicting interests.

The requirement for beneficiary consent in legal proceedings is a critical aspect of ensuring fair and transparent processes. When a dispute arises, such as a disagreement over the validity of the policy, the identity of the rightful beneficiary, or the distribution of benefits, the court or legal authorities may need to involve the intended recipient. Their consent is essential to validate the claims and ensure that the legal process respects the wishes of the deceased and the beneficiaries.

For instance, in a scenario where a life insurance policy has multiple beneficiaries, and there is a dispute regarding the distribution of the proceeds, the consent of all beneficiaries may be necessary. This ensures that the legal process considers the interests of all parties involved and prevents any single beneficiary from making unilateral decisions that could impact others. Obtaining consent from the beneficiaries can help prevent potential conflicts and provide a more harmonious resolution.

In some cases, the consent of the beneficiary may be required to initiate legal proceedings at all. This is especially true when the dispute involves the interpretation of the policy terms or the validity of the beneficiary's claim. The insurance company or the legal team representing the estate may need to gather statements or affidavits from the beneficiaries to establish their consent and cooperation in the legal process.

It is important for insurance companies and legal professionals to understand the legal implications of beneficiary consent. By requiring the consent of the intended recipient, the legal system aims to protect the rights of all parties involved and ensure that the dispute resolution process is fair and just. This practice also encourages open communication and cooperation between the beneficiaries, the insurance company, and the legal representatives, fostering a more efficient and amicable resolution to any disputes that may arise.

Life Insurance: Your Ultimate Financial Safety Net

You may want to see also

Frequently asked questions

The consent of the beneficiary is typically required when the policyholder names a new beneficiary or changes the existing one. This process ensures that the policyholder's wishes are honored and provides a layer of protection for the beneficiary's interests.

Yes, there are exceptions. In some cases, if the policyholder has been declared mentally incompetent or has passed away without leaving a valid will, the insurance company may automatically pay the death benefit to the primary beneficiary listed in the policy. Additionally, if the policyholder has a joint policy with a spouse, the consent of the other spouse might not be necessary for changes related to the joint policy.

The process usually involves the policyholder providing written notice to the insurance company, stating the desired changes and the reasons for them. The insurance company will then notify the current beneficiary(ies) and obtain their consent, often requiring a signed document. This ensures that all parties are aware of and agree to the changes, providing a clear understanding of the beneficiary's rights and the policy's terms.