Aflac Term Life Insurance offers a comprehensive and affordable solution for individuals seeking financial protection and peace of mind. With its competitive rates and customizable coverage options, this insurance policy ensures that your loved ones are financially secure in the event of your untimely passing. Whether you're a young professional starting a family or an established business owner, Aflac's term life insurance provides a safety net, allowing you to focus on what matters most while knowing your family's financial future is protected.

What You'll Learn

- Affordability: AFLAC term life insurance offers affordable coverage for individuals seeking cost-effective protection

- Flexibility: Policies can be tailored to individual needs, providing flexibility in coverage duration and amount

- Financial Security: Term life insurance ensures financial security for loved ones in the event of the insured's death

- No Lapse Coverage: AFLAC guarantees coverage for the entire term, even if premiums are missed

- Peace of Mind: With AFLAC, individuals can have peace of mind knowing their loved ones are protected

Affordability: AFLAC term life insurance offers affordable coverage for individuals seeking cost-effective protection

When it comes to life insurance, finding an affordable option that provides adequate coverage can be a challenging task. This is where AFLAC term life insurance comes into play, offering a cost-effective solution for those in need of financial protection. With its competitive pricing, AFLAC ensures that individuals can secure their loved ones' futures without breaking the bank.

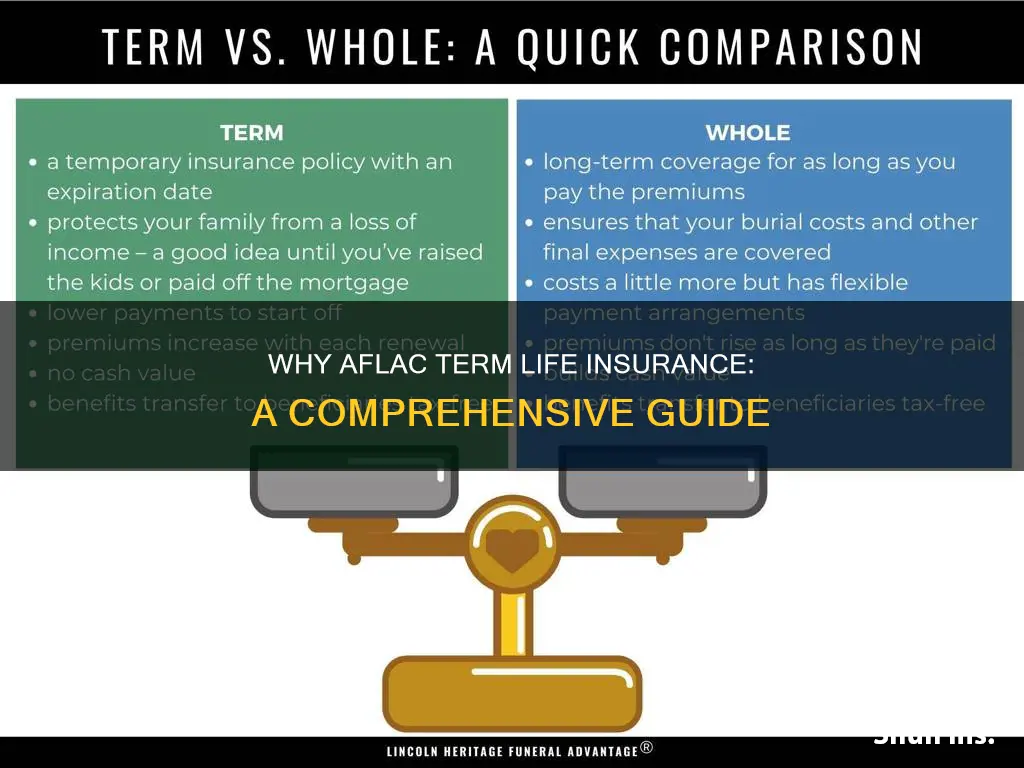

One of the key advantages of AFLAC term life insurance is its affordability. This type of policy is designed to provide coverage for a specific period, typically 10, 15, or 20 years. During this term, the insurance company guarantees a death benefit if the insured individual passes away. The beauty of AFLAC's approach lies in its ability to offer this valuable coverage at a lower cost compared to permanent life insurance policies. By focusing on a defined term, AFLAC can provide affordable premiums, making it an attractive choice for those seeking short-term financial security.

For individuals who want to protect their families or businesses without incurring substantial expenses, AFLAC's term life insurance is an ideal solution. The affordability factor allows policyholders to allocate their financial resources more efficiently, ensuring that the coverage meets their specific needs. Whether it's providing financial support for children's education, covering mortgage payments, or securing business continuity, AFLAC's term policy offers a flexible and cost-efficient approach.

Furthermore, AFLAC's term life insurance is designed to be straightforward and easy to understand. The policy terms are transparent, ensuring that policyholders know exactly what they are paying for and what they are entitled to. This clarity in pricing and coverage empowers individuals to make informed decisions about their insurance needs, allowing them to choose the most suitable term length and coverage amount.

In summary, AFLAC term life insurance stands out for its affordability and ability to provide cost-effective coverage. By offering competitive premiums and a defined term, AFLAC ensures that individuals can secure their financial future without straining their budgets. This makes AFLAC an excellent choice for those seeking short-term protection without compromising on the quality of coverage. With AFLAC, individuals can find peace of mind knowing their loved ones are protected, all while managing their finances effectively.

Best Life Insurance in India: Top 5 Plans Compared

You may want to see also

Flexibility: Policies can be tailored to individual needs, providing flexibility in coverage duration and amount

When it comes to life insurance, flexibility is a key advantage, especially with Aflac Term Life Insurance. This type of insurance offers a customizable approach, allowing individuals to design policies that perfectly fit their unique circumstances and requirements. One of the primary benefits of this flexibility is the ability to adjust the coverage duration and amount according to personal needs.

For instance, individuals can choose the term length that aligns with their specific goals. Whether it's a short-term coverage for a specific period, like covering a mortgage or a child's education, or a longer-term policy to ensure financial security for an extended period, Aflac allows for this customization. This flexibility ensures that the insurance policy is not a one-size-fits-all solution but rather a tailored financial tool.

The coverage amount can also be tailored to individual circumstances. This means that policyholders can determine the financial benefit they wish to provide to their beneficiaries. For example, someone with a large family and significant financial responsibilities might opt for a higher coverage amount to ensure their family's long-term financial stability. Conversely, a younger individual with fewer financial commitments might choose a lower coverage amount, keeping the policy more affordable.

Moreover, the flexibility in Aflac Term Life Insurance extends to adjustments over time. As an individual's life changes, their insurance needs may evolve. This policy type allows for easy modifications, ensuring that the coverage remains relevant and appropriate. For instance, if a policyholder's income increases, they can adjust the coverage amount to match their new financial situation without having to start the entire process from scratch.

In summary, Aflac Term Life Insurance provides a level of flexibility that empowers individuals to take control of their financial security. By customizing coverage duration and amount, policyholders can ensure that their insurance is a perfect fit for their current and future needs, offering peace of mind and tailored protection. This adaptability is a significant advantage, making Aflac Term Life Insurance a versatile and attractive option for those seeking personalized insurance solutions.

BrightHouse Life Insurance: Is It Worth the Cost?

You may want to see also

Financial Security: Term life insurance ensures financial security for loved ones in the event of the insured's death

Term life insurance is a powerful tool for providing financial security and peace of mind, especially for those with loved ones who depend on their income. It offers a straightforward and effective way to protect your family's financial future in the event of your untimely passing. When you purchase a term life insurance policy, you're essentially making a promise to your beneficiaries that you will provide them with a steady income stream if something happens to you. This promise is a form of financial security that can help cover essential expenses and maintain the standard of living your family is accustomed to.

The beauty of term life insurance lies in its simplicity and affordability. It provides coverage for a specific period, often 10, 20, or 30 years, during which the insured pays a fixed premium. This structured approach ensures that the cost of insurance is predictable and manageable, making it an excellent choice for those who want to provide long-term financial protection without breaking the bank. By locking in a premium rate for the term, you can rest assured that your loved ones will have the financial support they need when it matters most.

In the event of your death, the term life insurance policy will pay out a death benefit to your designated beneficiaries. This financial payout can be used to cover various expenses, such as mortgage payments, education costs, daily living expenses, and even funeral arrangements. Knowing that your family has this financial safety net can provide immense comfort and allow them to focus on healing and moving forward during a difficult time. It ensures that your loved ones won't have to make difficult financial decisions or rely on other sources of income to maintain their lifestyle.

One of the key advantages of term life insurance is its flexibility. You can choose the amount of coverage that aligns with your family's needs and your ability to pay. This customization ensures that the policy provides the right level of financial security without being overly burdensome. Additionally, term life insurance is often more affordable than permanent life insurance, making it an attractive option for those seeking comprehensive coverage without a long-term financial commitment.

In summary, term life insurance is an essential component of a comprehensive financial plan, especially for those with dependents. It offers a simple, affordable, and effective way to ensure financial security for your loved ones when it matters most. By providing a guaranteed income stream in the event of your death, term life insurance empowers you to take control of your family's financial future and give them the peace of mind that comes with knowing they are protected.

Exploring Life Insurance: Uncertainty About My Father's Policy

You may want to see also

No Lapse Coverage: AFLAC guarantees coverage for the entire term, even if premiums are missed

When considering term life insurance, one of the key advantages of choosing AFLAC is its commitment to providing "No Lapse Coverage." This unique feature ensures that your life insurance policy remains in force for the entire term, even if you miss premium payments. It's a significant benefit that sets AFLAC apart from many other insurance providers.

In the world of insurance, it's not uncommon for policies to lapse if premiums are not paid on time. This can result in a loss of coverage when it's needed most. However, with AFLAC's No Lapse Coverage, you can rest assured that your policy will continue to provide financial protection for your loved ones, regardless of any missed payments. This guarantee is particularly valuable for individuals who may have a history of financial difficulties or those who want to ensure their coverage remains uninterrupted.

The concept is straightforward: if you become disabled and unable to pay your premiums, AFLAC will step in and cover the payments for you. This means your policy will remain active, and your beneficiaries will still receive the death benefit as specified in your plan. It's a safety net that provides peace of mind, knowing that your insurance coverage won't be compromised due to unforeseen circumstances.

This feature is especially beneficial for those who have a history of financial challenges or are concerned about potential future difficulties. By offering No Lapse Coverage, AFLAC ensures that individuals can maintain their insurance protection without the fear of losing it due to missed payments. It's a valuable guarantee that can provide long-term financial security for your family.

In summary, AFLAC's No Lapse Coverage is a distinctive and attractive feature of their term life insurance policies. It ensures that your coverage remains in force throughout the entire term, providing financial security and peace of mind. This guarantee is a powerful incentive for individuals to consider AFLAC when exploring their life insurance options.

Life Insurance & POA: Can a POA Request Information?

You may want to see also

Peace of Mind: With AFLAC, individuals can have peace of mind knowing their loved ones are protected

When it comes to safeguarding your family's future, having peace of mind is invaluable. AFLAC term life insurance offers a comprehensive solution to ensure that your loved ones are financially protected, even in your absence. This insurance provides a safety net, allowing you to focus on what matters most: your family's well-being.

The primary benefit of AFLAC term life insurance is its ability to provide financial security for your dependents. In the event of your passing, the policy ensures that your family receives a lump sum payment, which can be used to cover essential expenses such as mortgage payments, education costs, and daily living expenses. This financial cushion enables your loved ones to maintain their standard of living and achieve their long-term goals without the added stress of financial uncertainty.

With AFLAC, you can customize the policy to fit your specific needs. You have the flexibility to choose the coverage amount and duration that best align with your family's requirements. Whether you opt for a longer-term policy to cover your children's education or a shorter-term plan to bridge the gap until your mortgage is paid off, AFLAC provides tailored solutions. This customization ensures that your loved ones are protected in the way that best suits your family's unique circumstances.

Furthermore, AFLAC's term life insurance is known for its simplicity and ease of understanding. Unlike some other insurance products, AFLAC policies are straightforward, with clear terms and conditions. This transparency allows you to make informed decisions about your coverage, ensuring that you fully comprehend the benefits and protections you're providing for your family.

In summary, AFLAC term life insurance offers peace of mind by providing a reliable financial safety net for your loved ones. With customizable coverage and transparent policies, AFLAC empowers individuals to take control of their family's future, knowing that they are prepared for life's unexpected twists and turns. This insurance is a valuable tool for anyone seeking to protect their family's financial well-being.

Death Row Families: Insurance Payouts After Execution

You may want to see also

Frequently asked questions

Aflac Term Life Insurance provides financial protection for your loved ones in the event of your passing. It offers a straightforward and affordable way to secure a death benefit, ensuring your family can maintain their standard of living and cover essential expenses during a difficult time.

This insurance policy offers a fixed term of coverage, typically 10, 15, or 20 years. During this period, if the insured individual passes away, the policy pays out a predetermined death benefit to the designated beneficiaries. The policy can be renewed at the end of the term, but it's essential to review the terms and conditions for any changes or limitations.

Aflac Term Life Insurance offers several advantages, including competitive rates, customizable coverage options, and the ability to build cash value over time. It provides peace of mind, knowing that your family's financial security is protected. Additionally, Aflac is known for its efficient claims process, ensuring that beneficiaries receive the death benefit promptly.

Absolutely! Aflac offers flexibility in tailoring the policy to your specific needs. You can choose the term length, death benefit amount, and even add optional riders or riders for additional coverage. This customization ensures that the policy aligns with your financial goals and provides the necessary protection for your loved ones.