Auto insurance companies use credit-based insurance scores to assess how risky a customer is and to determine their insurance premiums. These scores are based on consumer credit reports and are used to predict the likelihood of a customer filing insurance claims. While the use of credit-based insurance scores is controversial and banned in some US states, it is a common practice among auto insurance providers.

What You'll Learn

- Credit scores indicate how risky a driver is to insure

- Drivers with poor credit are statistically more likely to file claims

- Credit-based insurance scores are used to calculate rates

- Insurance companies use soft credit pulls to check credit history

- Credit scores are not the only factor in determining insurance rates

Credit scores indicate how risky a driver is to insure

Credit scores are a key factor in determining how risky a driver is to insure. A person's credit score is used by insurance companies to assess the risk they present. Historical data from the Federal Trade Commission shows that drivers with poor credit file more claims than those with excellent credit, and these claims are more expensive for the insurer. Thus, drivers with lower credit scores are considered higher-risk and are often subject to higher premiums.

Insurance companies use a credit-based insurance score to determine how likely someone is to file insurance claims that cost the company more than it collects in premiums. This score is calculated from information on a person's credit reports, including payment history, credit mix, and credit history length. A person's insurance payment history and the age of their credit history are also considered.

While credit scores are a significant factor, insurance companies also take into account other criteria when setting rates, such as driving record, location, age, gender, marital status, vehicle type, and insurance type. Additionally, insurance companies usually conduct soft credit checks, which do not negatively impact a person's credit score.

It is important to note that not all states allow insurance companies to use credit scores when determining insurance rates. Some states, such as California, Hawaii, Massachusetts, and Michigan, prohibit insurance carriers from conducting credit checks altogether. In other states, like Maryland, Utah, and Oregon, insurance companies cannot use credit scores as a basis for cancelling or refusing to renew an existing policy.

Understanding Auto Insurance Deductibles: Total Loss and Its Implications

You may want to see also

Drivers with poor credit are statistically more likely to file claims

Drivers with poor credit are statistically more likely to file insurance claims. This is supported by data from the Federal Trade Commission (FTC) and the American Property Casualty Insurance Association. As a result, insurance companies consider drivers with low credit scores as high-risk and charge them higher premiums to compensate for potential claims.

Insurers use a credit-based insurance score to set prices, which is different from a regular credit score. This insurance score is based on payment history, credit history length, and pursuit of new lines of credit. A driver's insurance score is used to predict how likely they are to file an insurance claim.

The higher premiums charged to drivers with poor credit can significantly impact their insurance costs. On average, drivers with poor credit pay around $1,270 more per year for auto coverage than those with good credit. In some states, such as Michigan, the difference is even more pronounced, with motorists with good credit paying around $5,571 per year less than those with poor credit.

Improving credit scores can help drivers reduce their insurance costs. Paying bills on time, paying off credit cards, and keeping credit card balances under 30% of the card limit are some ways to improve credit scores and potentially lower insurance premiums.

Auto Insurance Without Credit Checks: Where to Find It

You may want to see also

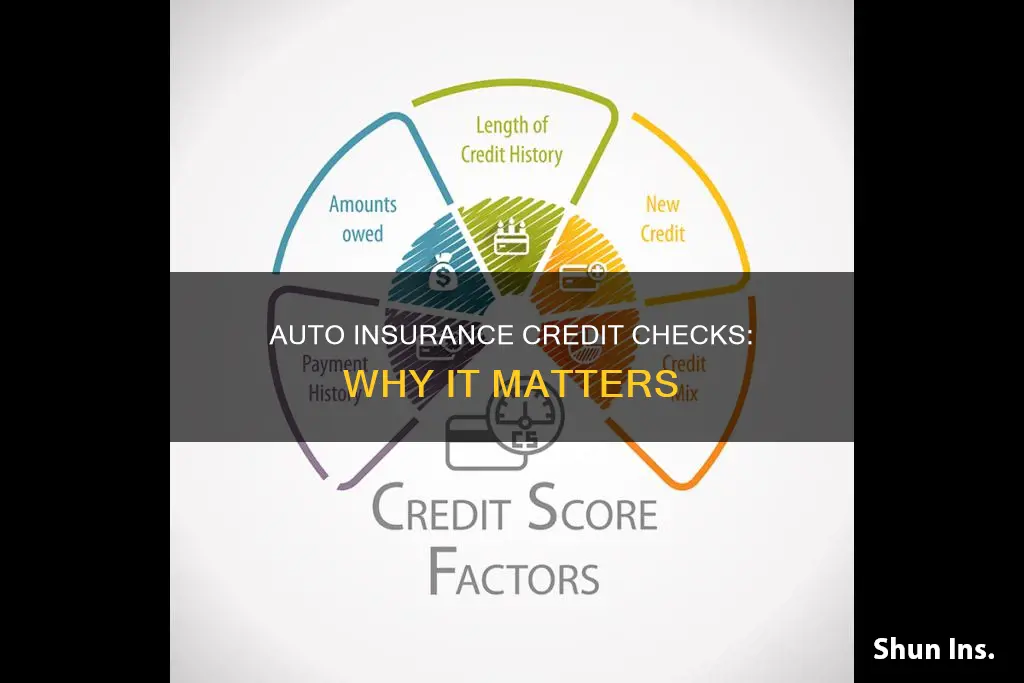

Credit-based insurance scores are used to calculate rates

Credit-based insurance scores are used by auto insurance companies to calculate rates. These scores are different from typical credit scores, such as the FICO score, and are used to predict the likelihood of a driver filing an insurance claim. While it is controversial, and banned in some US states, it is a common practice for auto insurance companies to use credit-based insurance scores when setting rates.

Credit-based insurance scores are calculated using five main factors:

- Payment history (40%) — How well an individual has made payments on their outstanding debt in the past.

- Outstanding debt (30%) — How much debt an individual currently has.

- Length of credit history (15%) — How long an individual has had a line of credit.

- Pursuit of new credit (10%) — Whether an individual has applied for new lines of credit recently.

- Credit mix (5%) — The types of credit an individual has (e.g. credit card, mortgage, auto loans, etc.).

It's important to note that a credit-based insurance score is not the only factor used to determine auto insurance rates. Other factors include an individual's driving history, the type of car they drive, their location, and their insurance claims history. Additionally, auto insurance companies usually conduct soft credit checks, which do not negatively impact an individual's credit score.

Redlining Practice: Auto Insurance Policy Discrimination

You may want to see also

Insurance companies use soft credit pulls to check credit history

When you request an auto insurance quote, insurance companies will often conduct a soft credit pull, or soft credit inquiry, to determine the risk of insuring you. This is a snapshot of your credit report that helps them to assess your creditworthiness.

A soft credit pull can occur when you haven't applied for credit but are being screened for preapproval financing offers or background checks. It can be initiated by you or the company. Soft credit pulls are also used by employers for employment verification and by credit card companies to see if you qualify for certain credit card offers.

Soft credit pulls do not impact your credit score. They are not attached to a specific application for credit and are only visible to you on your credit report. They are useful for understanding how your credit score is reported and can be viewed as part of your free credit report.

A hard credit pull, on the other hand, occurs when you officially apply for credit, such as a loan or credit card, and can harm your credit score for a few months. It stays on your credit report for about two years.

Insurance companies use soft credit pulls to check your credit history and determine your credit-based insurance score, which is a rating factor used to calculate your premium. This is because drivers with poor credit are statistically more likely to file claims and are therefore considered higher risk to insure.

Understanding Auto Insurance Deductibles: Smaller Deductibles, Bigger Benefits

You may want to see also

Credit scores are not the only factor in determining insurance rates

In most states, insurance companies are allowed to factor in credit history when determining rates, but it is not the only criterion. Some of the other factors that insurance companies take into account include:

- Deductibles: The amount you pay before your insurance covers a claim. A higher deductible typically results in lower insurance rates.

- Coverage limits: The maximum amount that the insurance company will pay per claim. Higher limits generally lead to higher premiums.

- Types of coverage: Policies with more coverage types, such as liability, collision, and comprehensive coverage, come with higher rates.

- Location: Where you live can impact auto and homeowners' rates as crime rates, weather conditions, and local traffic patterns can influence the likelihood of accidents or damage.

- Specific characteristics: The type of vehicle you drive, the type of roof on your home, and other specific factors can affect your rates.

- Claims history: Your history of filing insurance claims can also impact your rates. LexisNexis, for example, creates reports with auto and homeowners insurance claim histories.

- Demographics: Factors such as age, gender, marital status, and ZIP code can also influence insurance rates.

Additionally, insurance companies use different formulas to calculate credit-based insurance scores, and these scores are not solely based on your credit score. Common factors that are considered include outstanding debt, credit history length, credit mix, and payment history.

It's important to note that some states have stricter limits or prohibit the use of credit scores in setting insurance rates. For example, California, Hawaii, Massachusetts, and Michigan have regulations in place that limit or outlaw the use of credit scores in determining insurance premiums.

Auto Insurance: Understanding the Mandatory Coverage Basics

You may want to see also

Frequently asked questions

Historical data shows that drivers with poor credit file more claims than those with excellent credit, and these claims are more expensive for the insurer. Checking credit scores helps insurance companies assess the risk of insuring a driver.

No. Some companies, such as CURE, Dillo, and Empower, do not check credit scores. Additionally, there are several states that do not allow insurance companies to check credit scores, including California, Hawaii, Massachusetts, and Michigan.

A higher credit score generally leads to lower insurance rates. A poor credit score can make securing affordable insurance rates more difficult. The difference in average insurance rates between the lowest and highest levels of credit is over $1,500 per year.

Checking your credit-based insurance score is not as straightforward as checking a regular credit score. You can ask an insurance agent for access to your score, or you can get an insurance quote, which may provide you with an adverse action notice that includes your credit-based insurance score.

There are several ways to improve your credit score:

- Make timely payments on loans and credit cards.

- Pay down debts and keep credit card balances low.

- Use a mix of revolving credit and installment loans.

- Avoid applying for new credit frequently, as this results in hard inquiries that can hurt your score.