Whole life insurance is a type of permanent life insurance that offers lifelong coverage. It is designed to always pay out as long as premium payments are up to date and the policy hasn't lapsed. Whole life insurance policies are ideal for high earners seeking tax-deferred saving options and permanent coverage needs, such as a dependent with a disability. Whole life insurance may be a worthwhile investment at any age, depending on one's current situation and long-term financial goals.

What You'll Learn

Whole life insurance offers lifelong coverage

Whole life insurance is a powerful financial tool for you and your family. It offers lifelong coverage, also known as permanent coverage, which means that as long as you're current on premium payments, your policy won't lapse. Whole life insurance policies are designed to always pay out, providing a guaranteed death benefit to your loved ones. This makes it an ideal option for those seeking to provide for their family or other dependents in the long term.

Whole life insurance policies are more expensive than term life insurance, with premiums that are fixed but higher due to the investment feature and longer coverage period. However, the premium payments remain level throughout the policy, which can make them more affordable in the long run. Additionally, the cost of insuring you increases over time, so the amount of your premiums that goes towards building the policy's cash value will decrease.

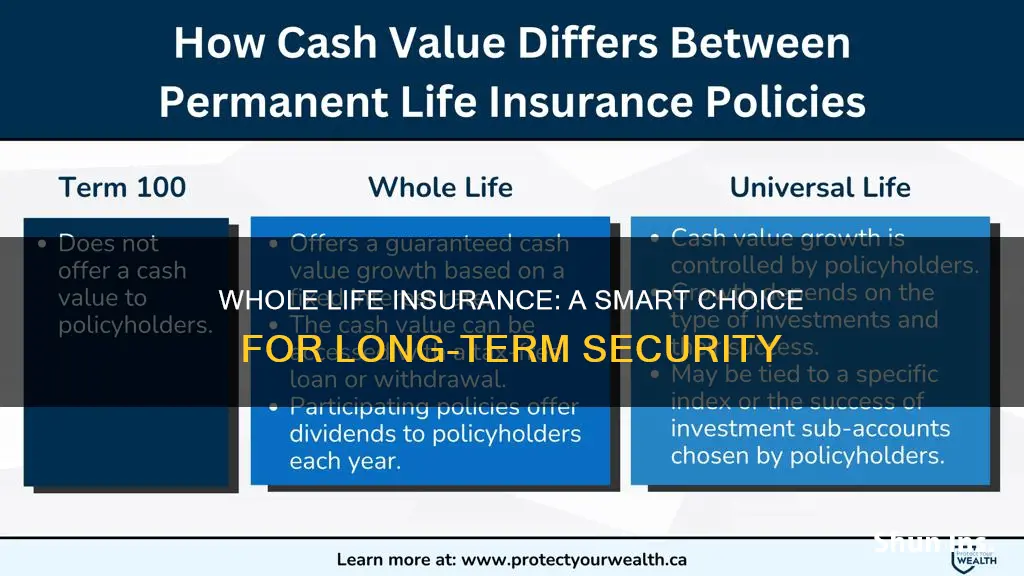

Whole life insurance policies offer guaranteed cash value growth, which builds at a steady, dependable pace. This cash value can be used to pay for big-ticket items, such as a new home or starting a business. It can also be used to supplement your income during retirement, providing financial security for you and your family. The cash value grows on a tax-deferred basis, and the longer you keep your policy, the more your cash value will continue to grow.

Whole life insurance is a good option for those with permanent coverage needs, such as a dependent with a disability, or specific estate planning needs. It may also be suitable for high-net-worth individuals who have maxed out their tax-advantaged accounts and are looking for additional tax-sheltered benefits. By purchasing a policy from a mutual company, policyholders may be eligible to receive dividends, further increasing the death benefit and cash value accumulation.

Senior Life Insurance: What's the Catch?

You may want to see also

It's a good way to build assets

Whole life insurance is a good way to build assets. It is a powerful financial tool for you and your family. Whole life insurance offers a death benefit that can keep your family financially secure if you pass away. It also has a cash value component that accumulates over time. This cash value can be used to pay for big-ticket items like a new home or starting a business. Upon retirement, it can be used to supplement income.

Whole life insurance is a form of "forced savings" that offers guaranteed returns. The cash value grows at a fixed rate, so you know exactly how much cash value you will have over time. This predictability can be less stressful than other investment options. The longer you hold the policy, the more cash value you can build up.

Whole life insurance also has tax advantages. The growth of the cash value is tax-deferred, and the death benefit is usually tax-free for the beneficiaries. Additionally, you may be eligible to receive dividends, which can be used to purchase additional coverage or taken as cash.

Whole life insurance may be a good choice for those who want a safe, guaranteed way to build assets over time. It provides financial protection for your family and can help you achieve your long-term financial goals. However, it is important to note that whole life insurance may not be the best option for those seeking higher returns or short-term liquidity.

Life Insurance: Their Doctors, Your Health

You may want to see also

It's a fail-proof way to provide for your family

Whole life insurance is a powerful financial tool for you and your family. It is a fail-proof way to provide for your family, especially if you are the primary breadwinner. In the unfortunate event of your passing, a whole life insurance policy can provide financial security to your loved ones by replacing your "human capital". This means that your family will continue to receive an income, even after your death, allowing them to maintain their standard of living and focus on healing.

Whole life insurance offers a guaranteed death benefit, ensuring that your loved ones will receive a payout, as long as the policy is in force. This benefit is typically tax-free, providing an additional financial advantage to your beneficiaries. The death benefit is guaranteed and insulated from financial market performance, giving you financial confidence.

Whole life insurance also includes a savings component, known as the cash value, which accumulates over time. This cash value can be accessed through loans or withdrawals and can be used for various purposes, such as supplementing retirement income, purchasing a home, or starting a business. The cash value grows at a steady, dependable pace, allowing it to complement your fixed-income investments. By planning your term length wisely, you may be able to avoid high fees and maximize the cash value for your loved ones.

Furthermore, whole life insurance provides lifelong coverage, ensuring that you are protected for your entire life, unlike term life insurance, which only covers a specific number of years. Whole life insurance premiums are typically fixed for life and do not increase or decrease, providing stability and predictability. This type of insurance is particularly beneficial for those who require lifelong coverage or want to build financial assets for their families.

Overall, whole life insurance is a reliable and comprehensive way to provide for your family, offering both financial security and the potential for wealth accumulation through its guaranteed death benefit and savings component. By choosing whole life insurance, you can have peace of mind knowing that your family will be taken care of, no matter what the future holds.

Life Insurance: Me Bank's Guide to Peace of Mind

You may want to see also

It's a useful financial tool for high-net-worth individuals

Whole life insurance is a useful financial tool for high-net-worth individuals as it offers a way to build and preserve wealth for future generations. It provides a guaranteed death benefit, which is a tax-free income for beneficiaries, ensuring financial security for surviving family members. This is especially beneficial for high-net-worth individuals who wish to leave an inheritance without burdening their heirs with additional tax liabilities.

Whole life insurance also offers a cash value component, which accumulates over time. This cash value grows tax-deferred, providing a tax-advantaged growth opportunity. The funds can be used to diversify investment portfolios, hedge against market volatility, or fund retirement. Additionally, the cash value can be accessed through policy loans or withdrawals, providing liquidity for other financial needs.

High-net-worth individuals often face significant estate tax liabilities. Whole life insurance can help offset these taxes by providing liquidity to pay estate taxes without forcing the sale of assets. This allows wealthy families to maintain control over their wealth and pass it on intact to their heirs. The cash value and death benefit of whole life insurance policies are also protected from creditors in some jurisdictions, safeguarding assets from potential legal claims or financial risks.

Furthermore, whole life insurance can facilitate charitable giving by allowing wealthy families to designate charities as beneficiaries, ensuring a portion of their wealth is used for philanthropic purposes. While whole life insurance has higher premiums than term life insurance, it offers permanent coverage and is a good option for individuals with lifelong financial dependents.

Overall, whole life insurance provides high-net-worth individuals with a comprehensive financial tool that offers both death benefits and cash value accumulation, helping to build and preserve wealth for future generations while also providing tax advantages and estate planning benefits.

Hispanics and Life Insurance: What You Need to Know

You may want to see also

It's a good option for those with permanent coverage needs

Whole life insurance is a good option for those with permanent coverage needs. It is a type of permanent life insurance that offers lifelong coverage, unlike term life insurance, which only covers a set period. Whole life insurance policies are designed to always pay out as long as premium payments are up to date and the policy hasn't lapsed. This makes it a good option for those who want to ensure their dependents are taken care of financially, even after they're gone.

Whole life insurance is also a good option for those who want to build financial assets. The cash value of a whole life policy grows over time, and this growth is guaranteed and tax-deferred. This means that the longer the policy is held, the more the cash value will increase. Policyholders can borrow against the cash value of their policies, which can be useful in financial emergencies. Additionally, the death benefit provided by whole life insurance is also tax-free, making it a tax-efficient way to provide for loved ones.

Whole life insurance may be particularly attractive to high-net-worth individuals who have already maxed out their tax-advantaged accounts and are looking for additional tax-sheltering benefits. The guaranteed cash value growth of whole life insurance can complement fixed-income investments in their portfolio. Acquiring a whole life insurance policy when one is young and healthy can also result in lower premium payments, making it a more affordable option in the long run.

However, it is important to note that whole life insurance is typically more expensive than term life insurance and may not be the best fit for those with more limited financial resources. It is important to consider one's budget and long-term financial goals when deciding whether whole life insurance is the right choice for their permanent coverage needs.

Life Insurance Proceeds: Taxable in North Carolina?

You may want to see also

Frequently asked questions

Whole life insurance offers lifelong coverage, guaranteed cash value growth, and a death benefit that is typically tax-free. It is a good option for those who want to build financial assets and require permanent coverage, such as those with permanent dependents or specific estate planning needs.

Term life insurance is the most popular form of life insurance due to its lower premiums. However, term life insurance only covers you for a specified period, whereas whole life insurance provides permanent coverage for as long as you pay the premiums. Whole life insurance premiums are fixed and tend to be higher than term life insurance, but they can be worth it in the long run as you won't face increasing costs as you get older or your health deteriorates.

Whole life insurance policies have a cash value component that grows over time. This cash value can be used to pay for big-ticket items, supplement your income during retirement, or be left to your loved ones as an income tax-free asset. The cash value also allows you to take out loans against your policy, providing financial flexibility.

The cash value growth in a whole life insurance policy is tax-deferred, meaning you don't pay taxes on the interest earned as long as the funds remain in the policy. Additionally, the death benefit paid to beneficiaries is generally not taxable, providing a tax-efficient way to leave money to your loved ones.