Zurich Life Insurance offers a comprehensive range of life insurance products tailored to meet diverse financial needs. Whether you're looking to secure your family's future, plan for retirement, or protect your assets, Zurich provides flexible and customizable solutions. With a strong reputation for reliability and customer satisfaction, Zurich Life Insurance is a trusted choice for individuals and businesses seeking reliable and long-term financial protection. Their products are designed to offer peace of mind, ensuring that your loved ones and your financial goals are well-protected.

What You'll Learn

- Financial Security: Zurich offers comprehensive coverage for a secure future

- Customized Plans: Tailored policies to meet individual needs and goals

- Expert Guidance: Access to experienced advisors for informed decision-making

- Global Reach: International coverage for worldwide protection and support

- Customer Satisfaction: High customer satisfaction ratings for reliable service

Financial Security: Zurich offers comprehensive coverage for a secure future

Zurich Life Insurance is a renowned provider of financial security solutions, offering a wide range of products designed to protect individuals and families from life's uncertainties. With a strong focus on comprehensive coverage, Zurich ensures that its customers can build a secure future, providing peace of mind and financial stability. Here's why choosing Zurich for your insurance needs can be a wise decision:

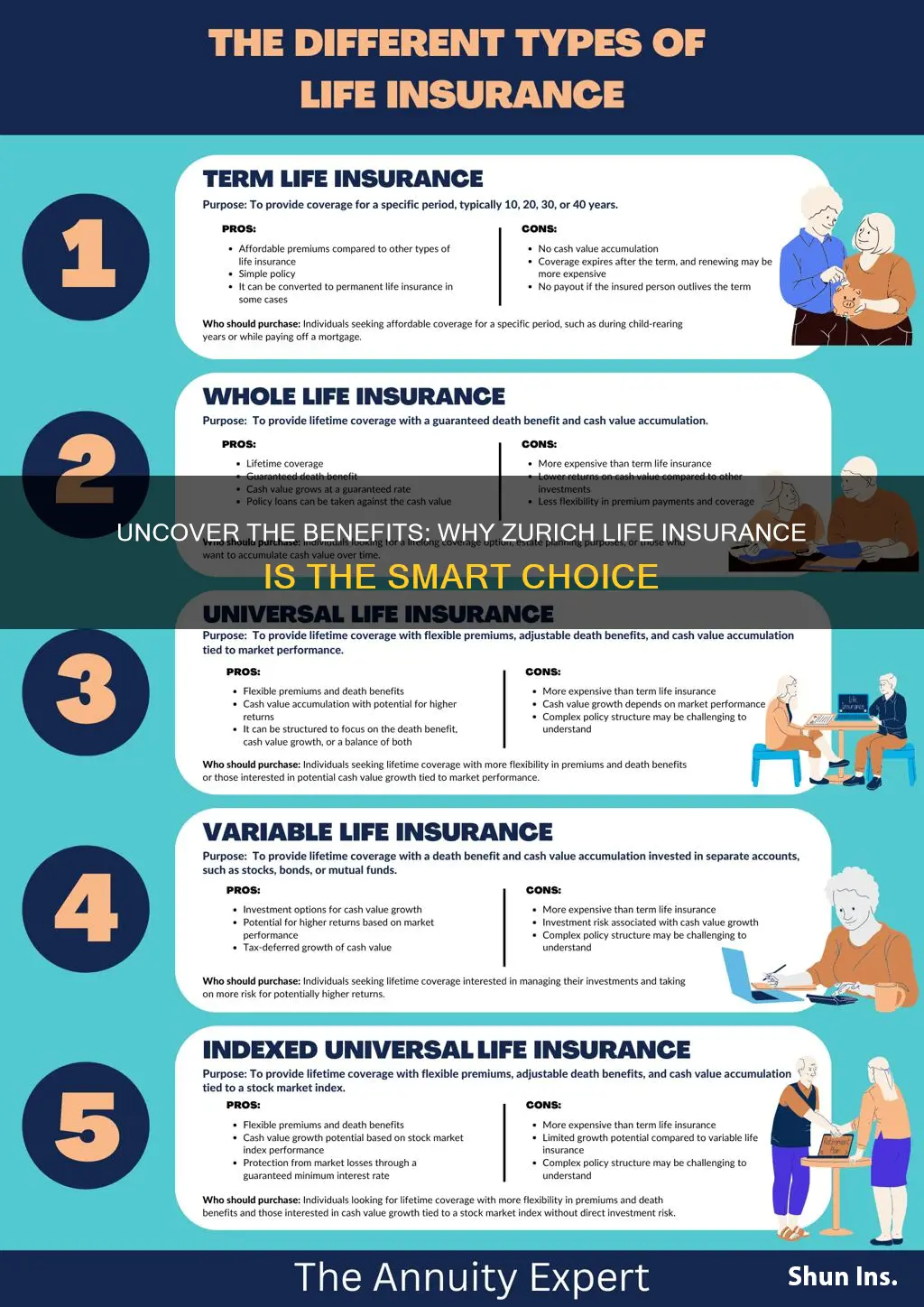

Comprehensive Protection: Zurich understands that financial security is a multifaceted concept. They offer a diverse portfolio of insurance products to cater to various needs. From term life insurance, which provides coverage for a specified period, to permanent life insurance, offering lifelong protection, Zurich ensures that individuals can find the right fit for their unique circumstances. Additionally, they provide critical illness insurance, disability insurance, and income protection, ensuring that policyholders are covered for a wide range of potential risks.

Tailored Solutions: One of the key strengths of Zurich is its ability to offer customized solutions. They recognize that every individual and family has distinct financial goals and requirements. By providing personalized advice and a range of options, Zurich helps customers design policies that align with their specific needs. Whether it's ensuring financial support for loved ones, covering educational expenses, or planning for retirement, Zurich's comprehensive coverage can be tailored to fit the unique financial security requirements of each client.

Financial Stability and Reputation: Zurich Life Insurance has a strong financial reputation, backed by its solid financial position. As a well-established company, Zurich has a long history of providing reliable and consistent service. Their financial stability ensures that policyholders can trust that their insurance provider will be there to fulfill their obligations, even in challenging economic times. This level of assurance is crucial when choosing an insurance company, as it guarantees that your financial security is in capable hands.

Expert Guidance: Choosing the right insurance policy can be complex, and Zurich recognizes the importance of expert guidance. Their team of experienced professionals is dedicated to educating and assisting customers throughout the decision-making process. These experts provide valuable insights, helping individuals understand the various coverage options and how they can best meet their financial goals. With Zurich, you receive personalized advice, ensuring that your choice of insurance is well-informed and aligned with your long-term financial security.

By offering comprehensive coverage, tailored solutions, and a strong financial foundation, Zurich Life Insurance empowers individuals to take control of their financial future. With their extensive range of products and expert guidance, Zurich ensures that customers can make informed decisions, providing a solid foundation for a secure and prosperous life. Choosing Zurich means selecting a partner committed to your financial well-being.

Canceling Knights of Columbus Life Insurance: A Step-by-Step Guide

You may want to see also

Customized Plans: Tailored policies to meet individual needs and goals

When it comes to life insurance, having a policy that is tailored to your specific needs and goals is essential. This is where Zurich Life Insurance shines, offering a range of customized plans that provide comprehensive coverage and peace of mind. Whether you're a young professional starting your career or a family looking to secure their future, Zurich understands that everyone's circumstances and aspirations are unique.

The key to choosing the right life insurance is recognizing that a one-size-fits-all approach rarely meets individual requirements. Zurich Life Insurance excels in this aspect by offering personalized plans. These plans are designed to cater to various life stages and financial goals. For instance, a young couple starting a family might opt for a term life insurance policy, providing coverage for a specific period, such as until the children are financially independent. On the other hand, an entrepreneur with a growing business might require a more permanent policy to ensure the financial stability of their enterprise in the long term.

Customized plans from Zurich offer flexibility and adaptability. These policies can be tailored to include various benefits, such as death benefit, critical illness coverage, disability income protection, and more. For example, a policyholder might choose to increase the death benefit to cover a substantial mortgage or to provide a substantial financial cushion for their loved ones. Additionally, optional add-ons like critical illness insurance can be incorporated to offer financial support in case of a serious health condition, ensuring that policyholders can focus on recovery without the added stress of financial burdens.

The process of creating a customized plan is straightforward and involves a detailed discussion with a Zurich advisor. During this consultation, you'll be guided through various factors that influence your insurance needs, such as your age, health, lifestyle, and financial goals. By understanding these aspects, Zurich can design a policy that not only meets your current requirements but also adapts as your life circumstances change over time. This level of personalization ensures that your life insurance remains relevant and effective throughout your journey.

In summary, Zurich Life Insurance's strength lies in its ability to offer customized plans that are tailored to individual needs. This approach ensures that policyholders receive the most appropriate and comprehensive coverage, providing financial security and peace of mind. With Zurich, you can trust that your life insurance is designed with your unique circumstances and goals in mind, allowing you to focus on what matters most in life.

Hepatitis A: Life Insurance Options and Availability

You may want to see also

Expert Guidance: Access to experienced advisors for informed decision-making

Choosing the right life insurance provider is a significant decision, and having access to experienced advisors can be a game-changer in ensuring you make an informed choice. When you opt for Zurich Life Insurance, you gain a valuable resource in the form of their team of seasoned professionals. These advisors are not just knowledgeable; they are also dedicated to understanding your unique needs and providing tailored solutions.

The advisors at Zurich Life Insurance are equipped with extensive industry knowledge and a deep understanding of various insurance products. They can guide you through the complex world of life insurance, helping you navigate the myriad of options available. Whether you're a young professional starting to think about long-term financial planning or an individual with specific needs, these advisors will take the time to listen and offer personalized advice. Their expertise lies in assessing your current situation, future goals, and risk factors to recommend the most suitable coverage.

One of the key advantages of having access to these experts is the ability to make well-informed decisions. They provide clarity on various insurance terms, benefits, and potential pitfalls, ensuring you fully understand your choices. For instance, they can explain the difference between term life insurance and permanent life insurance, helping you decide which type of coverage aligns with your objectives. Moreover, they can assist in evaluating the impact of various policy features, such as riders and optional benefits, on your overall insurance package.

The advisors' role extends beyond just providing information. They offer a comprehensive service that includes assessing your financial situation, discussing your family's needs, and considering your long-term goals. By taking a holistic approach, they can help you make decisions that are not only financially sound but also emotionally comfortable. This level of personalized guidance is a testament to Zurich Life Insurance's commitment to customer satisfaction and financial well-being.

In summary, opting for Zurich Life Insurance means gaining access to a network of experienced advisors who are dedicated to helping you make the best decisions for your future. Their expertise, combined with a personalized approach, ensures that you receive tailored advice, making the process of choosing life insurance both efficient and effective. With their guidance, you can navigate the complexities of insurance with confidence, knowing that your interests are well-represented.

Unveiling Teachers' Life Insurance: A Comprehensive Guide to Benefits

You may want to see also

Global Reach: International coverage for worldwide protection and support

Zurich Life Insurance offers a remarkable global reach, providing international coverage that ensures your protection and support wherever your life takes you. With a presence in over 55 countries, this insurance company has a truly global footprint, allowing them to offer comprehensive solutions to a diverse range of clients. Whether you're an expat, a frequent traveler, or someone with an international lifestyle, Zurich's international coverage is designed to meet your unique needs.

The company's global reach means that you can access the same high-quality insurance products and services across different countries. This consistency in coverage is a key advantage, ensuring that your protection remains seamless as you move between nations. For instance, if you're relocating to a new country, Zurich's international coverage can provide the necessary support, including life insurance, critical illness cover, and disability income protection, tailored to your new location. This level of continuity is especially valuable for those with an international career or a dynamic lifestyle.

Zurich's international network of offices and representatives further enhances their global reach. This network enables efficient claims handling, policy administration, and customer support, regardless of your location. In the event of an emergency or a claim, you can rely on Zurich's expertise and assistance, ensuring a swift and efficient resolution. The company's commitment to providing a seamless experience across borders is a testament to its dedication to customer satisfaction.

Moreover, Zurich's international coverage offers a sense of security and peace of mind. Knowing that you are protected globally can reduce the stress associated with international travel or relocation. Whether it's medical expenses, travel disruptions, or life-changing events, Zurich's comprehensive policies provide the financial support you need during challenging times. This level of protection is particularly important for individuals and families who value the security that comes with knowing they are covered, no matter where their journey takes them.

In summary, Zurich Life Insurance's global reach is a significant advantage for those seeking international coverage. With their extensive network and commitment to providing consistent, high-quality services, Zurich ensures that your protection and support are not limited by geographical boundaries. This level of global reach is a key reason why choosing Zurich Life Insurance can be a wise decision for anyone with an international lifestyle or aspirations.

Term Life Insurance: Filling Out Forms for Your Employer

You may want to see also

Customer Satisfaction: High customer satisfaction ratings for reliable service

Zurich Life Insurance has consistently earned high customer satisfaction ratings, which is a testament to its commitment to providing reliable and exceptional service. This is a crucial aspect to consider when choosing an insurance provider, as it directly impacts the overall experience and peace of mind customers can expect.

The company's dedication to customer satisfaction is evident in its various initiatives and strategies. They have implemented a comprehensive feedback system, allowing customers to rate their experiences and provide valuable insights. By actively listening to their customers, Zurich Life Insurance can identify areas for improvement and make necessary adjustments to enhance their services. This feedback loop ensures that the company remains responsive to the needs and expectations of its clients.

Furthermore, Zurich Life Insurance's commitment to reliability is reflected in its consistent performance in customer satisfaction surveys. Independent research and ratings consistently rank them highly, often receiving top scores for their prompt and efficient service, knowledgeable staff, and effective claim processing. These high ratings are a result of their focus on building strong relationships with customers, understanding their unique needs, and providing tailored solutions.

A satisfied customer base is a powerful indicator of a company's success and trustworthiness. Zurich Life Insurance's ability to consistently deliver reliable service has fostered a loyal customer following. This loyalty is further strengthened by the company's commitment to transparency and fair practices, ensuring that customers feel valued and respected.

In summary, choosing Zurich Life Insurance means opting for a provider with a proven track record of high customer satisfaction. Their reliable service, responsive nature, and dedication to customer needs make them a preferred choice for those seeking peace of mind and a trusted insurance partner.

NAFLD: High-Risk Life Insurance and Your Health

You may want to see also

Frequently asked questions

Zurich Life Insurance offers a comprehensive range of life insurance products tailored to individual needs. They provide competitive pricing, flexible coverage options, and a strong financial backing, ensuring policyholders' interests are protected.

Zurich has a global presence and a long-standing reputation for reliability. They offer personalized services, including expert advice and regular policy reviews, ensuring your insurance plan adapts to your changing circumstances. Their financial stability and customer-centric approach make them a trusted choice.

A A: Zurich prides itself on delivering exceptional customer service. They offer 24/7 support, quick claim processing, and a dedicated team of professionals to guide you through the insurance journey. Their commitment to customer satisfaction is a key differentiator.

Absolutely! Zurich provides long-term financial solutions, including term life insurance and permanent life insurance plans. Their products offer flexibility, allowing you to build a secure financial future for yourself and your loved ones. Zurich's expertise in risk management and financial planning makes them a reliable partner.

Yes, Zurich offers additional benefits like critical illness coverage, disability insurance, and retirement planning options. They also provide access to a network of healthcare professionals, ensuring you receive the best support during challenging times. These extra features enhance the overall value of their insurance policies.