Many insurance companies, including Globe Life Insurance, have policies that terminate when the insured individual reaches a certain age, often 90. This practice is due to the increased risk associated with longevity. As individuals age, the likelihood of developing health issues or facing other life challenges increases, making it more challenging for insurance companies to provide coverage. Additionally, older individuals may have accumulated significant assets, and the insurance company may consider it less risky to terminate the policy to avoid potential financial losses. Understanding these factors can help individuals make informed decisions about their insurance coverage and plan accordingly.

What You'll Learn

- Age-Related Policy Limits: Insurance companies often cap coverage at a certain age to manage risk

- Medical History: Advanced age may trigger higher premiums or policy termination

- Financial Strategy: Planning for long-term care becomes crucial as you approach 90

- Market Trends: Industry practices may change, affecting policy renewals

- Legal Compliance: Regulatory changes could impact insurance offerings for older individuals

Age-Related Policy Limits: Insurance companies often cap coverage at a certain age to manage risk

Age-related policy limits are a common practice in the insurance industry, and they can significantly impact life insurance policies. When it comes to Globe Life Insurance, it is essential to understand why coverage may end at a specific age, typically 90. This practice is not unique to Globe Life and is a strategic decision made by insurance companies worldwide to manage risk effectively.

As individuals age, the risk of certain health issues and mortality increases. Insurance providers often assess this risk and may choose to limit coverage to manage potential financial liabilities. By setting an age cap, companies can ensure that their policies remain financially viable and protect themselves from excessive payouts. For instance, at age 90, the risk of a policyholder's passing may be considered too high for the insurer to bear, especially if the policy offers long-term coverage. This decision is based on statistical data and risk analysis, allowing insurance companies to maintain a balanced approach to their business model.

The age of 90 is a critical threshold because it represents a point where the likelihood of outliving the policy's term becomes significantly higher. After this age, individuals may be advised to consider alternative insurance options or review their current policies to ensure adequate coverage. It is a standard practice to encourage policyholders to reassess their insurance needs as they age, allowing them to make informed decisions about their financial security.

Furthermore, age-related policy limits are a way for insurance providers to attract a diverse range of customers. By offering different coverage options, companies can cater to various demographics, ensuring that individuals can find a policy that suits their specific needs and budget. This approach allows Globe Life Insurance and other similar companies to maintain a comprehensive portfolio of products while managing risk effectively.

In summary, the practice of capping coverage at a certain age is a strategic decision made by insurance companies to manage risk and maintain financial stability. Globe Life Insurance's policy ending at age 90 is a common industry practice, ensuring that the company can provide coverage for a broad range of individuals while mitigating potential financial risks associated with longevity. Understanding these age-related limits is crucial for policyholders to make informed choices regarding their insurance coverage.

Life Insurance Certificate: Understanding Your Policy Proof

You may want to see also

Medical History: Advanced age may trigger higher premiums or policy termination

As individuals age, especially beyond a certain threshold, insurance companies often reevaluate their risk assessments. When it comes to life insurance, advanced age can significantly impact policy terms and costs. For those approaching or exceeding the age of 90, insurance providers may consider this a high-risk demographic, leading to potential changes in their insurance offerings.

Medical history plays a crucial role in this context. Insurance companies typically require detailed medical information to assess the risk associated with insuring an individual. Advanced age often coincides with an increased likelihood of health issues, chronic conditions, and a higher overall medical risk. This can result in higher premiums or even the termination of existing policies. For instance, if a policyholder's health deteriorates significantly, the insurance company may choose to reassess the policy, potentially leading to higher rates or the need for additional medical exams.

The insurance industry's approach to advanced age is often cautious due to the potential long-term financial implications. As individuals age, the likelihood of requiring extensive medical care and treatment increases. This higher risk is reflected in the insurance rates, which may become more expensive as the policyholder gets closer to the age of 90. In some cases, insurance companies might even refuse to extend coverage to individuals in this age group, citing the increased potential for long-term care needs and associated costs.

It is essential for individuals to be aware of these potential changes and to review their insurance policies regularly. Understanding the impact of age and medical history on insurance coverage can help policyholders make informed decisions and potentially find alternative solutions to ensure their financial security. Consulting with insurance advisors or experts can provide valuable insights into managing insurance risks and costs associated with advanced age.

Group Life Insurance: Taxable Benefits in Canada?

You may want to see also

Financial Strategy: Planning for long-term care becomes crucial as you approach 90

As individuals approach their 90s, the importance of financial planning, especially for long-term care, becomes increasingly critical. This is a life stage where many people may face significant health challenges and the need for specialized care, which can be financially demanding. The traditional approach to insurance, such as term life insurance, often ends at age 90, leaving individuals without the coverage they might need during this vulnerable period. Understanding this transition is essential for making informed financial decisions.

Long-term care insurance is a specialized type of coverage designed to assist with the costs associated with chronic illnesses, disabilities, and other conditions that require ongoing support. It can cover a range of services, from in-home care to nursing home expenses. When considering long-term care, it's crucial to assess personal health, family history, and the likelihood of future care needs. This proactive approach ensures that individuals are prepared for potential financial burdens.

One effective strategy is to review and potentially adjust insurance policies to include long-term care benefits. Many insurance companies offer conversion options, allowing term life insurance policies to be converted into a permanent policy with long-term care coverage. This ensures that individuals maintain a safety net as they age, providing peace of mind and financial security. Additionally, consulting with financial advisors can help create a comprehensive plan tailored to individual circumstances.

Another aspect to consider is the potential impact of age-related health issues on long-term care costs. As people live longer, the risk of developing chronic conditions increases. Planning for these potential expenses is essential, and it may involve setting aside dedicated savings or exploring specialized insurance products designed for the elderly. By taking a proactive approach, individuals can better manage the financial implications of long-term care.

In summary, approaching 90 is a significant life milestone that highlights the need for comprehensive financial planning, particularly regarding long-term care. Understanding the limitations of traditional insurance and exploring specialized options can provide individuals with the necessary tools to navigate this challenging phase with financial confidence. It is a crucial step towards ensuring a secure and comfortable future, even in the face of potential health-related expenses.

Life Insurance Mistakes: 5 Things to Avoid

You may want to see also

Market Trends: Industry practices may change, affecting policy renewals

The insurance industry is dynamic, and market trends often drive changes in policy offerings and renewal processes. One significant trend that has emerged is the evolution of insurance policies, particularly in the realm of life insurance. As the industry adapts to changing demographics and customer preferences, it's crucial to understand how these shifts impact policy renewals, especially regarding the age-based termination of certain policies.

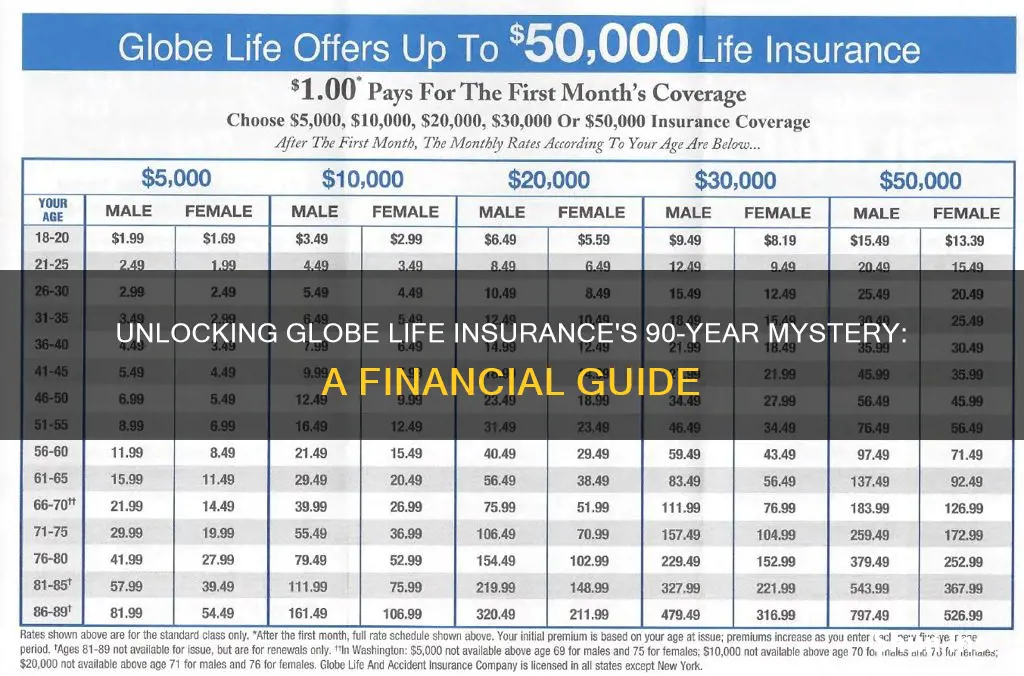

In the past, many life insurance companies, including Globe Life Insurance, offered policies with a specific age limit for coverage. For instance, a policy might provide coverage until the insured individual turned 90. This approach was based on historical data and assumptions about life expectancy and health trends. However, market trends indicate a shift towards more personalized and flexible insurance solutions.

One of the primary reasons for this change is the increasing longevity of individuals. With advancements in healthcare and improved living standards, people are living longer and healthier lives. As a result, insurance companies are reevaluating their policies to accommodate this demographic shift. Instead of a blanket termination at a certain age, insurers are now more inclined to offer extended coverage or provide options for policyholders to continue their insurance beyond the traditional age limits.

This trend towards personalized insurance is driven by customer demand for tailored solutions. Policyholders are becoming more aware of their insurance needs and are seeking products that align with their specific circumstances. For example, an individual with a family and financial responsibilities might prefer a policy that provides long-term coverage, ensuring their loved ones are protected even after they reach the traditional age limit.

As a result, the insurance industry is witnessing a transformation in policy renewals. Instead of a one-size-fits-all approach, insurers are now more likely to offer policy renewals that consider individual circumstances. This may include the option to extend coverage, adjust premiums based on changing health conditions, or provide alternative insurance products that better suit the policyholder's needs. By adapting to market trends, insurance companies can maintain their relevance and provide valuable coverage to a diverse range of customers.

Whole Life Insurance: Joint Policies' Value Increase Explained

You may want to see also

Legal Compliance: Regulatory changes could impact insurance offerings for older individuals

The insurance industry is subject to various regulations and laws that govern the products and services it can offer. These regulations are designed to protect consumers and ensure fair practices, but they can also significantly impact the availability and cost of insurance for older individuals. As such, it is essential to understand how regulatory changes might affect the insurance offerings available to this demographic.

One of the primary areas of regulatory focus is the protection of consumers' rights and the prevention of unfair or deceptive practices. Insurance companies are required to adhere to strict guidelines when selling policies, especially to vulnerable populations like the elderly. For instance, regulations may mandate that insurers provide clear and transparent information about policy terms, coverage limits, and potential exclusions. This ensures that older individuals are fully informed about their insurance products and can make well-informed decisions.

Regulatory changes can also influence the types of insurance available to older adults. In response to market demands and consumer needs, insurance providers might introduce new products or modify existing ones. For example, with an aging population, there is a growing demand for long-term care insurance, which can help cover the costs associated with extended healthcare needs. However, regulatory bodies may need to approve and set guidelines for such products to ensure they meet the necessary standards and protect consumers.

Additionally, the insurance industry is subject to age-based regulations that directly impact older individuals. These rules often dictate the maximum age at which one can purchase certain types of insurance, such as life insurance. For instance, some insurers may offer reduced-benefit life insurance policies for those over a certain age, or they might not provide coverage at all. This is a direct result of regulatory changes aimed at managing risk and ensuring the financial stability of insurance companies. As a result, older adults may find themselves with limited options or higher premiums when seeking insurance coverage.

Staying informed about regulatory changes is crucial for both insurance providers and older consumers. As regulations evolve, insurance companies must adapt their offerings to comply with new standards. This may involve updating their product portfolios, providing additional benefits, or adjusting pricing structures. For older individuals, keeping abreast of these changes is essential to understanding their insurance rights and making informed choices. It is recommended that consumers regularly review their insurance policies and consult with financial advisors to ensure they have the appropriate coverage and are aware of any regulatory impacts on their insurance plans.

Leaving Minor Life Insurance Benefits: What You Need to Know

You may want to see also

Frequently asked questions

When you turn 90, your Globe Life Insurance policy will typically terminate. This is a standard practice for many insurance companies to ensure that the risk associated with insuring individuals at such an advanced age is managed. As longevity increases with age, the likelihood of making a claim also rises, making it a financial risk for the insurer.

Yes, there might be certain circumstances or policy options that could extend coverage beyond age 90. For instance, some policies offer a guaranteed period of coverage, ensuring benefits for a specific number of years, regardless of age. Additionally, riders or add-ons to the policy might provide extended benefits for an additional fee. It's essential to review your policy documents or consult with a Globe Life representative to understand the specific terms and conditions applicable to your situation.

If you wish to maintain insurance coverage beyond age 90, you may need to explore alternative options. This could include applying for a new policy with a different insurer that offers coverage for older individuals. Factors like health status, lifestyle, and family medical history may be considered during the underwriting process. It's advisable to start exploring these options well in advance to ensure you find suitable coverage.