AARP, the American Association of Retired Persons, is a well-known organization that provides various benefits and services to its members. However, one area where AARP does not offer life insurance is a topic of interest and discussion. The decision not to provide life insurance to its members can be attributed to several factors. Firstly, AARP's primary focus is on advocating for and supporting the needs of retirees, and they have established a comprehensive range of services, including healthcare, financial planning, and social engagement. Offering life insurance might be seen as an additional service that could potentially divert resources from their core mission. Secondly, AARP members often have access to other insurance options through their employers, Medicare, or other sources, making life insurance less of a priority for them. Lastly, the organization's financial model and revenue streams are primarily derived from membership fees, sponsorships, and partnerships, which may not align with the traditional insurance business model. Understanding these reasons can provide insight into AARP's strategic choices and the services they prioritize for their members.

| Characteristics | Values |

|---|---|

| AARP's Focus | AARP primarily serves older adults and focuses on providing benefits and services tailored to their needs, such as healthcare, travel, and financial planning. |

| Market Niche | Life insurance is a highly competitive market, and AARP believes it can offer more specialized and tailored products to its members through partnerships with insurance companies. |

| Member Benefits | AARP offers a range of benefits, including discounts, travel services, and advocacy, which are often more appealing to its members compared to a standard life insurance policy. |

| Customization | AARP aims to provide personalized insurance solutions, and offering life insurance directly may limit the ability to cater to individual needs and preferences. |

| Member Experience | AARP prioritizes member satisfaction and convenience, and offering life insurance directly might not align with their current service model and infrastructure. |

| Strategic Partnerships | By partnering with insurance providers, AARP can leverage their expertise and offer a wider range of insurance products, including life insurance, to members. |

| Regulatory Considerations | Insurance regulations and compliance can be complex, and AARP may choose to work with regulated insurance companies to ensure member protection and legal compliance. |

| Member Feedback | AARP conducts regular member surveys and feedback sessions, and offering life insurance directly might not be a top priority based on current member preferences. |

| Market Trends | The insurance industry is evolving, and AARP may be exploring alternative ways to provide insurance benefits, such as through technology-driven platforms or collaborative models. |

| Financial Considerations | Offering life insurance directly may involve significant financial investments and operational costs, which AARP might prefer to manage through partnerships. |

What You'll Learn

- Cost and Value: AARP's focus on cost-effective services may not align with life insurance, which can be expensive

- Member Needs: AARP members may prefer other financial products, making life insurance less appealing

- Competitive Market: The life insurance market is highly competitive, with many options available to AARP members

- Strategic Partnerships: AARP might partner with other insurance providers, offering alternative coverage instead of life insurance

- Regulatory Considerations: Insurance regulations and compliance may limit AARP's ability to offer comprehensive life insurance options

Cost and Value: AARP's focus on cost-effective services may not align with life insurance, which can be expensive

The American Association of Retired Persons (AARP) is a well-known organization that provides a range of services and benefits to its members, primarily focusing on advocacy, social services, and cost-effective solutions for the elderly population. One of the key reasons why AARP does not offer life insurance to its members is the inherent cost and value proposition associated with this type of insurance.

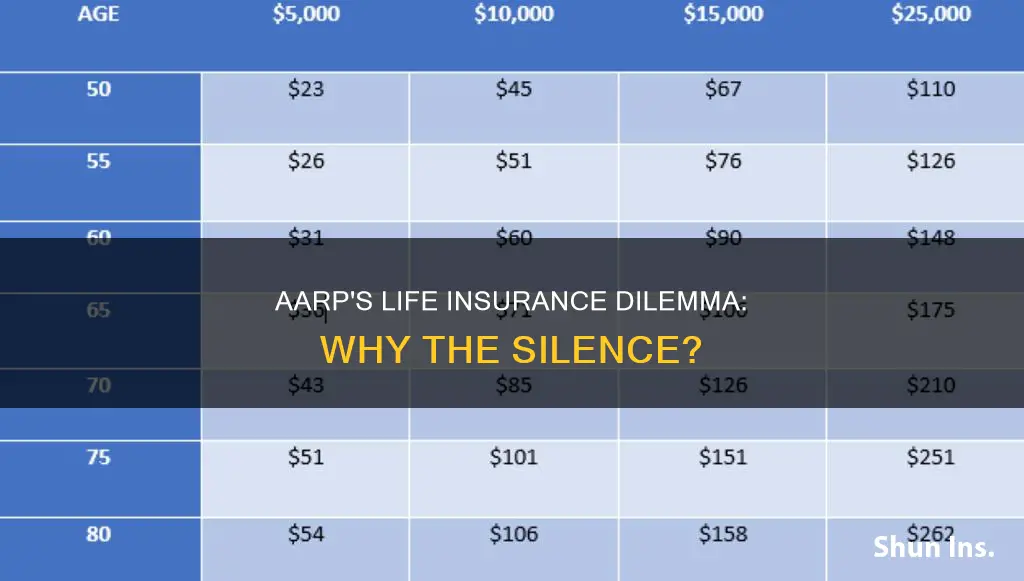

Life insurance, particularly term life insurance, can be a valuable financial tool for individuals and families, providing a financial safety net in the event of the insured's death. However, it is also a relatively expensive product, especially for older individuals who may have higher health risks. AARP, being an organization dedicated to cost-effective solutions, might view the offering of life insurance as a potential financial burden for its members. The primary goal of AARP is to provide affordable and accessible services, and life insurance, with its varying coverage options and potential long-term commitments, may not align with this mission.

The cost of life insurance can vary significantly based on factors such as age, health, lifestyle, and the amount of coverage desired. For older adults, who are often the primary target audience for AARP's services, the premiums can be prohibitively expensive. AARP's focus on cost-effectiveness may lead them to prioritize other financial services or benefits that offer more immediate and tangible value to their members. For instance, they might provide retirement planning advice, investment guidance, or discounts on various products and services, which can be more cost-efficient and relevant to the needs of their elderly members.

Additionally, AARP's role as an advocate for older adults may influence their decision not to offer life insurance. They might believe that their members' needs are better served by advocating for affordable healthcare, retirement planning, and other social security benefits. By focusing on these areas, AARP can provide comprehensive support to its members, ensuring they have access to essential services without incurring significant financial burdens.

In summary, the cost and value considerations play a crucial role in AARP's decision not to offer life insurance. While life insurance can be a valuable financial product, it may not align with AARP's mission of providing cost-effective and accessible services to its members. AARP's focus on advocacy and cost-efficiency leads them to prioritize other financial services and benefits that better serve the needs of the elderly population.

Whole Life Insurance: Two Major Drawbacks

You may want to see also

Member Needs: AARP members may prefer other financial products, making life insurance less appealing

AARP members, a large and influential group of older adults, often have diverse financial needs and preferences that may not align with the traditional life insurance offerings. This is a critical aspect to consider when understanding why AARP might choose not to provide life insurance as a core benefit to its members. Here's an analysis of the member needs that could influence this decision:

Many AARP members are at an age where they are already covered by various insurance policies, including life insurance, through their employers or previous affiliations. For instance, many retirees have life insurance policies linked to their pensions or previous jobs, which could still provide coverage for their remaining years. This existing coverage might be sufficient for their needs, making the purchase of additional life insurance less appealing.

The financial priorities of AARP members may also play a significant role. With retirement savings and other financial goals in mind, members might prefer to allocate their resources to other financial products that better suit their current and future needs. For example, they may opt for long-term care insurance, which is a more pressing concern for many older adults, or they might focus on investing in their retirement portfolios.

AARP members often seek comprehensive financial solutions that address multiple aspects of their financial well-being. They may prefer a more holistic approach to financial planning, which includes retirement planning, healthcare costs, and other essential benefits. Life insurance, while important, might not be the primary focus when members are considering a wide range of financial products that can provide more immediate and tangible benefits.

Additionally, the preferences of AARP members can vary widely. Some members might be more inclined to take on additional financial risks, while others may prefer a more conservative approach. This diversity in preferences means that a one-size-fits-all insurance product might not cater to everyone's needs, making it challenging for AARP to offer a comprehensive life insurance policy that appeals to all its members.

In summary, understanding the financial landscape and priorities of AARP members is crucial in determining their insurance preferences. By recognizing that members may already have adequate life insurance coverage, have specific financial goals, and prefer a diverse range of financial products, AARP can tailor its offerings to better serve its members' needs. This approach ensures that AARP provides valuable benefits that resonate with its membership, even if life insurance is not one of them.

Understanding the Basics: What is Standard Life Insurance?

You may want to see also

Competitive Market: The life insurance market is highly competitive, with many options available to AARP members

The life insurance market is a highly competitive space, offering a wide range of options to consumers, including AARP members. This competition is driven by the desire to cater to diverse needs and preferences, ensuring that individuals can find a policy that suits their specific requirements. With numerous insurance providers vying for attention, AARP members have the advantage of a robust marketplace where they can explore various life insurance products.

When it comes to life insurance, AARP members have a plethora of choices. They can opt for term life insurance, which provides coverage for a specified period, offering a cost-effective solution for those seeking temporary protection. Alternatively, whole life insurance, a permanent policy, guarantees coverage for the entire life of the insured, making it a reliable long-term option. Additionally, universal life insurance offers flexibility, allowing policyholders to adjust their coverage and premiums over time. This variety ensures that AARP members can find a policy that aligns with their financial goals and risk tolerance.

The competition among life insurance companies encourages innovation and customization. Providers strive to offer unique features and benefits to attract customers. Some companies provide additional riders or options to enhance coverage, such as accelerated death benefits or critical illness riders. Others may focus on providing competitive rates, especially for individuals with specific health conditions or lifestyles. This competitive environment empowers AARP members to compare policies, ensuring they receive the best value for their premium payments.

Furthermore, the availability of multiple insurance providers allows AARP members to leverage their collective bargaining power. By having a large and engaged membership, AARP can negotiate favorable terms with insurance companies on behalf of its members. This negotiation power can result in exclusive offers, discounts, or customized plans tailored to the needs of AARP members, making life insurance more accessible and affordable.

In summary, the life insurance market's competitiveness provides AARP members with a wealth of options and benefits. The variety of policies, coupled with the drive for innovation and customization, ensures that individuals can find the right coverage. Additionally, the competitive environment and AARP's negotiating power further enhance the member experience, making life insurance a more accessible and attractive option for this demographic.

Comcast's Life Insurance Offering: What You Need to Know

You may want to see also

Strategic Partnerships: AARP might partner with other insurance providers, offering alternative coverage instead of life insurance

AARP, a well-known organization for its advocacy and support for older adults, has been a trusted resource for various benefits and services. However, one area where AARP's offerings might be limited is life insurance. There are several reasons why AARP may choose not to provide life insurance directly to its members, and instead, focus on strategic partnerships to offer alternative coverage.

Firstly, AARP's primary mission is to empower and support its members in various aspects of life, particularly as they age. By partnering with insurance companies, AARP can provide a range of financial protection products without directly offering life insurance. This approach allows them to maintain their focus on advocacy and member services while still providing valuable benefits. For instance, AARP could collaborate with insurance providers to offer critical illness insurance, disability insurance, or long-term care insurance, which are essential coverage options for older adults. These alternative coverage options can provide financial security and peace of mind to AARP members, ensuring they are protected against various life circumstances.

Strategic partnerships can also allow AARP to offer more tailored and specialized insurance products. By collaborating with insurance providers, AARP can negotiate customized plans that cater to the unique needs of its members. This could include coverage options specifically designed for seniors, addressing their health concerns and financial goals. For example, AARP might partner with an insurance company to create a comprehensive health insurance plan with additional benefits for pre-existing conditions, which are often a challenge for older adults. This partnership approach ensures that AARP members receive relevant and valuable insurance solutions.

Furthermore, AARP's focus on alternative coverage can provide members with a more holistic benefits package. Instead of solely offering life insurance, AARP can bundle various insurance products together, creating a comprehensive financial protection plan. This strategy might include health insurance, retirement planning, and other essential coverage options. By doing so, AARP can provide members with a one-stop solution for their insurance needs, making it more convenient and appealing to join and utilize their services.

In summary, AARP's decision not to offer life insurance directly can be strategically justified. By forming partnerships with insurance providers, AARP can expand its offerings to include alternative coverage options that are highly relevant to its members. This approach ensures that AARP remains focused on its core mission while still providing valuable financial protection and security to its members. Through these strategic alliances, AARP can create a comprehensive benefits package, enhancing its reputation as a trusted advocate for older adults.

Big Lou Life Insurance: Legit or Scam?

You may want to see also

Regulatory Considerations: Insurance regulations and compliance may limit AARP's ability to offer comprehensive life insurance options

The decision of AARP, a prominent organization serving the interests of older adults, not to offer life insurance to its members is a complex one, and regulatory considerations play a significant role in this choice. Insurance regulations are stringent and designed to protect consumers, which can present challenges for organizations like AARP when attempting to provide comprehensive insurance solutions. One of the primary concerns is the complexity of regulatory compliance, especially in the life insurance sector. Insurance companies and providers must adhere to a myriad of rules and guidelines set by regulatory bodies, which can vary across different regions and countries. These regulations often dictate the types of insurance products that can be offered, the coverage amounts, and the eligibility criteria for policyholders. AARP, as a non-profit organization, might face challenges in navigating these intricate regulatory frameworks to ensure compliance while still providing competitive and comprehensive life insurance options to its members.

Additionally, the insurance industry is highly regulated to prevent fraudulent activities and protect consumers from unfair practices. This includes strict oversight of premium rates, policy terms, and claims processes. For AARP, offering life insurance would require meticulous attention to these regulatory details to ensure transparency and fairness in their insurance offerings. The organization would need to carefully structure policies, set appropriate premiums, and establish efficient claims procedures, all while adhering to the ever-changing regulatory landscape. This level of compliance can be a significant hurdle, especially for a large-scale organization like AARP, which may have limited resources dedicated to insurance operations.

Another aspect of regulatory considerations is the potential impact on AARP's mission and services. AARP's primary focus is on advocacy and providing benefits to its members, particularly in retirement planning and healthcare. Offering life insurance might divert attention and resources from these core services, potentially diluting the organization's primary objectives. Regulatory bodies often require insurance providers to demonstrate a clear public benefit, which could be challenging for AARP to articulate in the context of life insurance, especially when compared to their existing services.

Furthermore, the insurance industry is subject to frequent changes in regulations, which can make it difficult for organizations to keep up with the evolving compliance requirements. AARP would need to stay abreast of these changes to ensure their insurance offerings remain compliant, a task that can be resource-intensive. This is particularly true if AARP decides to offer a wide range of life insurance products, each with its own set of regulatory considerations. As a result, the organization might opt for a more limited insurance offering to simplify compliance and focus on their core strengths.

In summary, regulatory considerations are a critical factor in AARP's decision not to offer life insurance. The complexity of insurance regulations, the need for stringent compliance, and the potential impact on AARP's primary mission all contribute to this choice. While AARP can provide valuable services to its members in other areas, the insurance industry's regulatory environment presents significant challenges that may limit their ability to offer comprehensive life insurance options. Understanding these regulatory constraints is essential for members and stakeholders to grasp the full context of AARP's insurance offerings (or lack thereof).

Life Insurance Benefits: Understanding Post-Quitting Coverage

You may want to see also

Frequently asked questions

AARP, the American Association of Retired Persons, is a non-profit organization that primarily focuses on providing various benefits and resources to its members, particularly in the areas of healthcare, financial planning, and advocacy. While AARP offers a range of insurance products, including auto, home, and Medicare supplement insurance, life insurance is not currently part of their core offerings. The decision to not provide life insurance is strategic, as AARP aims to cater to the diverse needs of its members, and they believe that other insurance providers can better address the specific requirements of life insurance, which often involves more complex medical underwriting and risk assessment.

Term life insurance is a popular choice for individuals seeking affordable coverage for a specific period, typically 10, 20, or 30 years. AARP's current insurance portfolio does not include term life insurance because the organization prioritizes comprehensive benefits that cater to the retirement and healthcare needs of its members. Term life insurance is generally more suitable for those seeking temporary coverage, often during the working years, to provide financial security for their families. AARP's focus is on long-term financial planning and healthcare solutions, which may not align with the primary purpose of term life insurance.

AARP regularly reviews its product offerings and services to ensure they meet the evolving needs of its members. While there are no immediate plans to introduce life insurance, the organization remains open to exploring new insurance products that can benefit its members. AARP's insurance offerings are designed to complement their existing services, and any future additions would be made with the goal of enhancing the overall member experience and providing comprehensive financial solutions.

Yes, AARP members have the flexibility to choose and purchase life insurance from other reputable insurance companies. AARP's insurance marketplace provides a platform for members to explore and compare various insurance products, including life insurance, from different providers. This approach empowers members to make informed decisions based on their specific needs and preferences, ensuring they can find the right coverage options that align with their financial goals and risk tolerance.

AARP's insurance products are designed to cater to the unique needs of retirees and older adults. Their current offerings include Medicare supplement insurance, which helps cover gaps in original Medicare coverage, and various types of insurance for homes, autos, and other assets. These products provide financial protection and peace of mind, ensuring that members can manage potential risks and unexpected events. AARP's focus on comprehensive benefits and member-centric services sets them apart, allowing them to address the specific challenges and concerns of their target demographic.