Life insurance is a financial product designed to provide financial security and peace of mind to individuals and their families. The term life in life insurance refers to the coverage provided for the insured individual's life, not their death. This type of insurance offers a safety net for loved ones by providing a financial benefit upon the insured's passing, ensuring that their dependents can maintain their standard of living and cover essential expenses. It is a way to protect against the financial impact of losing a primary income earner and to provide for the future well-being of one's family. The term life signifies the ongoing protection and support it offers throughout an individual's life, rather than focusing on the unfortunate event of death.

| Characteristics | Values |

|---|---|

| Definition | Life insurance is a financial protection tool that provides a monetary benefit to the beneficiaries upon the insured individual's death. |

| Purpose | The primary purpose is to provide financial security and support to the family or dependents of the insured person in the event of their passing. |

| Term | "Life" refers to the duration of the insurance policy, which typically lasts for a specific period, such as 10, 20, or 30 years, or even for the entire lifetime of the insured. |

| Contrast with Death Insurance | The term "life" is used instead of "death" because the insurance policy is designed to provide coverage and benefits during the insured's lifetime, not just at the time of death. |

| Benefits | It offers financial stability, covers expenses like mortgage payments, education costs, or daily living expenses, and ensures the family's financial well-being. |

| Risk Assessment | Insurers assess the risk of insuring an individual based on factors like age, health, lifestyle, and medical history to determine premium rates. |

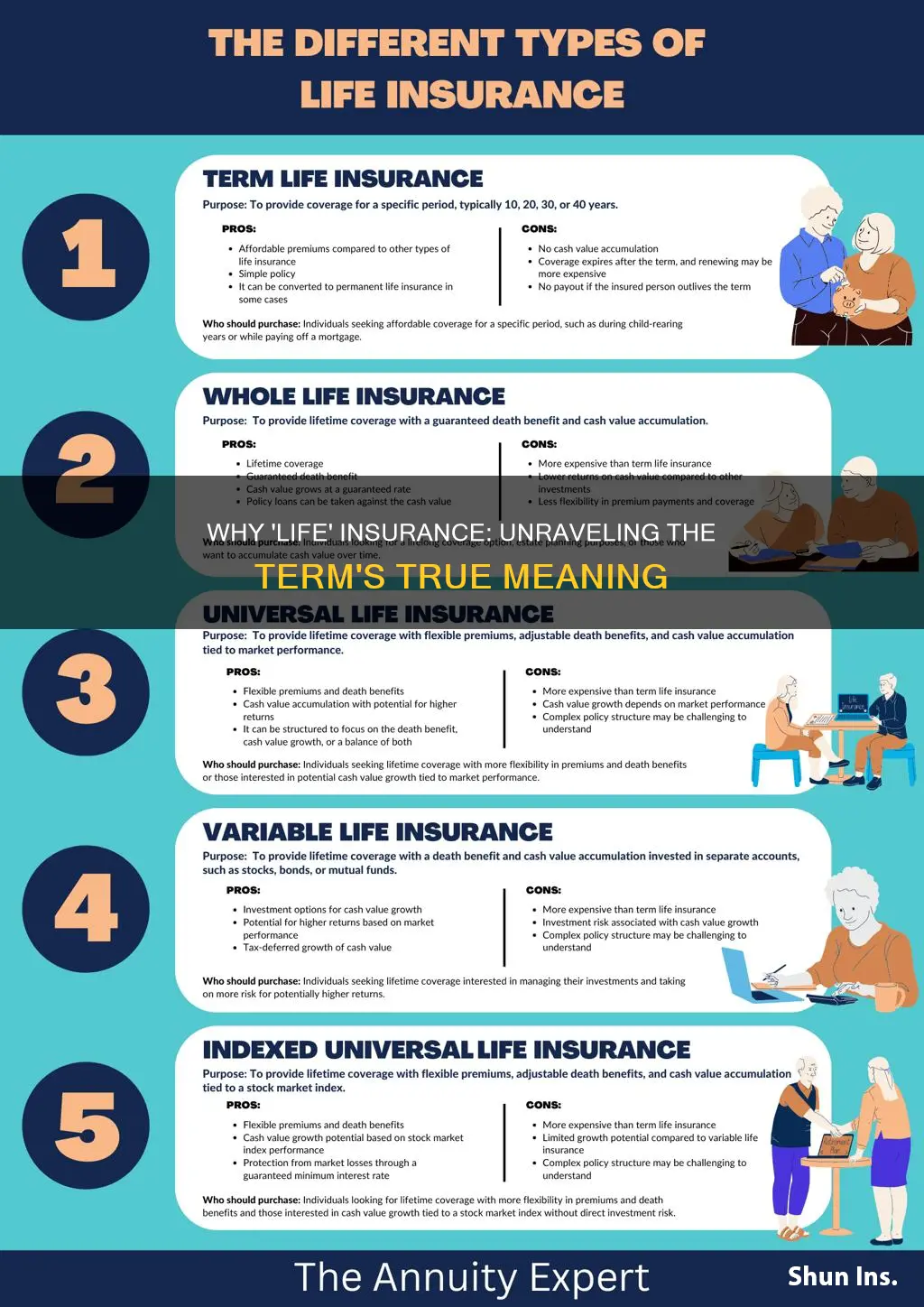

| Policy Types | There are various types, including term life, whole life, universal life, and variable life, each with different features and benefits. |

| Tax Advantages | In many countries, life insurance policies provide tax benefits, allowing policyholders to build cash value over time, which can be tax-deferred. |

| Legacy Planning | It is a valuable tool for estate planning, helping to ensure that beneficiaries receive financial support and that assets are distributed according to the insured's wishes. |

| Peace of Mind | Having life insurance can provide individuals and their families with peace of mind, knowing that financial obligations will be met in the event of the insured's passing. |

What You'll Learn

- Financial Security: Life insurance provides financial protection for beneficiaries in the event of the insured's death

- Long-Term Planning: It offers a way to plan for the future, ensuring financial stability for loved ones

- Peace of Mind: Knowing you have coverage can bring peace of mind and reduce financial stress

- Legacy Building: Life insurance can help create a legacy by providing financial support to family

- Legal and Emotional Benefits: It offers legal and emotional support, ensuring proper distribution of assets and closure for loved ones

Financial Security: Life insurance provides financial protection for beneficiaries in the event of the insured's death

Life insurance is a financial product designed to provide a safety net for individuals and their loved ones, offering a unique and essential service. The term "life insurance" is a fitting description, as it emphasizes the core purpose of the policy: to ensure financial security and stability for the beneficiaries in the unfortunate event of the insured's death. This is a critical distinction from other insurance types, which often focus on compensating for losses or damages.

When an individual purchases life insurance, they are essentially making a promise to their beneficiaries that, should they pass away, a financial safety net will be provided. This promise is what gives life insurance its name. The policy ensures that the beneficiaries receive a predetermined sum of money, which can be used to cover various expenses and provide for their future needs. This financial protection is a powerful tool, offering peace of mind and a sense of security to both the insured and their loved ones.

The concept of life insurance revolves around the idea of long-term financial planning and risk management. It allows individuals to secure their family's future by providing a financial cushion during challenging times. For example, if a primary earner in a family were to die, the remaining family members could use the life insurance payout to cover essential expenses like mortgage payments, utility bills, and daily living costs, ensuring that the family's standard of living is maintained. This financial security can be a lifeline for beneficiaries, especially when dealing with the emotional aftermath of a loved one's passing.

Moreover, life insurance policies often come with various riders and options that further enhance the financial protection aspect. These may include options to increase the death benefit, convert the policy to a different type of insurance, or provide additional coverage for specific risks. By offering these customizable features, life insurance companies empower individuals to tailor their policies to their unique needs, ensuring that the financial security provided is comprehensive and aligned with their personal circumstances.

In summary, the term "life insurance" accurately reflects the primary function of this financial product. It is a commitment to financial security and a promise that, in the event of the insured's death, the beneficiaries will receive a substantial sum to cover their expenses and secure their future. This unique aspect of life insurance sets it apart from other insurance types and highlights its importance in providing peace of mind and financial stability to individuals and their families.

Understanding Thai Life Insurance: A Comprehensive Guide

You may want to see also

Long-Term Planning: It offers a way to plan for the future, ensuring financial stability for loved ones

Long-term planning is a crucial aspect of financial management, and life insurance plays a pivotal role in this context. It provides a means to secure the financial future of your loved ones, offering a safety net that can significantly impact their lives. The concept of life insurance is often associated with the idea of providing for those who depend on you, ensuring their well-being even after your passing. This long-term strategy is not just about the insurance itself but the peace of mind it offers.

When you consider the long-term implications, life insurance becomes a powerful tool to secure your family's financial future. It allows you to plan for various life events and unexpected circumstances. For instance, it can provide financial support for your children's education, ensuring they have the resources to pursue their dreams. Additionally, it can cover mortgage payments or rent, keeping the roof over your loved ones' heads, even if you're no longer there to provide for them. This level of financial security is a cornerstone of long-term planning, giving you the confidence to face life's challenges.

The beauty of life insurance in long-term planning lies in its ability to adapt to changing needs. As your family's circumstances evolve, so can the insurance policy. For example, you might start with a basic plan to cover immediate expenses and then gradually increase the coverage as your family's financial goals expand. This flexibility ensures that your long-term planning remains relevant and effective throughout your life's journey.

Moreover, life insurance encourages a proactive approach to financial management. It prompts individuals to assess their current financial situation, identify potential risks, and make informed decisions. By doing so, you can tailor your long-term strategy to fit your unique circumstances, ensuring that your loved ones are protected in the way that makes the most sense for your family. This proactive mindset is a valuable skill, as it not only secures your family's future but also empowers you to take control of your financial destiny.

In summary, long-term planning with life insurance is about more than just financial security; it's about providing peace of mind and a sense of control. It allows you to shape a future where your loved ones are protected, even in your absence. By embracing this long-term strategy, you can ensure that your family's financial stability is a priority, fostering a secure and prosperous future for those who matter most.

Life Insurance: Top Platforms for Application and Comparison

You may want to see also

Peace of Mind: Knowing you have coverage can bring peace of mind and reduce financial stress

The term "life insurance" is a powerful and reassuring phrase that encapsulates the very essence of its purpose. It is a financial safety net, a promise that provides security and peace of mind to individuals and their loved ones. When we refer to it as "life insurance," we emphasize the value of life and the importance of protecting it. This terminology is a stark contrast to "death insurance," which might evoke a sense of morbid curiosity or even fear. By calling it "life insurance," we shift the focus from the negative to the positive, ensuring that the primary intention is to safeguard the well-being of those we care about.

Having life insurance coverage offers a profound sense of security and tranquility. It allows individuals to rest easy, knowing that their families or beneficiaries will be financially protected in the event of their untimely demise. This peace of mind is invaluable, as it reduces the stress and anxiety associated with financial uncertainties. With coverage in place, individuals can focus on living their lives to the fullest, knowing that their loved ones will be taken care of should something happen. The financial security provided by life insurance enables families to maintain their standard of living, cover essential expenses, and even plan for the future, all while grieving the loss of a loved one.

The concept of "life insurance" also encourages a proactive approach to financial planning. It prompts individuals to consider their long-term goals and the well-being of their dependents. By evaluating one's life and the potential risks, people can make informed decisions about the type and amount of coverage needed. This process empowers individuals to take control of their financial future and ensures that their loved ones are protected, even in their absence. The act of choosing the right policy and understanding its benefits can be a satisfying and empowering experience, further enhancing the sense of peace and security.

Moreover, the term "life insurance" reflects the idea of long-term commitment and support. It symbolizes a bond that endures, providing stability and continuity during challenging times. This longevity is a stark contrast to the fleeting nature of "death insurance," which might imply a temporary solution. With life insurance, individuals can build a financial foundation that supports their loved ones over an extended period, allowing them to adapt to life's changing circumstances without the added burden of financial worry.

In summary, the phrase "life insurance" is a powerful and appropriate term that conveys the purpose and benefits of this essential financial tool. It provides peace of mind, reduces financial stress, and ensures that individuals can live their lives with the knowledge that their loved ones are protected. By understanding and appreciating the meaning behind this terminology, people can make informed decisions about their coverage, ultimately leading to a more secure and fulfilling future.

Unlocking Life Insurance: Borrowing Soon After Policy Initiation

You may want to see also

Legacy Building: Life insurance can help create a legacy by providing financial support to family

Life insurance is a powerful tool that can significantly impact an individual's legacy and the well-being of their loved ones. While the term "life insurance" might seem counterintuitive, given its association with mortality, it is a vital financial product that ensures security and peace of mind. This type of insurance is designed to provide financial protection and support to beneficiaries during the insured individual's lifetime, offering a safety net that can be a cornerstone of a family's legacy.

When an individual purchases life insurance, they essentially make a promise to their family that their financial obligations and goals will be met if something happens to them. This promise is a form of legacy building, as it ensures that the family's standard of living, education, and overall financial stability are maintained, even in the face of tragedy. The policyholder can choose to leave a substantial financial cushion for their spouse, children, or other dependents, allowing them to cover essential expenses, such as mortgage payments, education costs, or daily living expenses, without incurring significant debt.

The financial support provided by life insurance can be a lifeline for families, especially in the initial years after the insured individual's passing. It can help cover funeral and burial costs, which can be substantial, and provide immediate financial relief during a difficult time. Moreover, the proceeds from the policy can be used to pay off any existing debts, such as personal loans or credit card debt, ensuring that the family's credit remains intact and that they are not burdened with additional financial obligations.

Over time, the impact of life insurance on a family's legacy can be profound. The financial support it provides can enable beneficiaries to pursue their dreams and goals, whether it's starting a business, purchasing a home, or funding their children's education. It can also help maintain the family's standard of living, ensuring that the loss of a primary income earner does not lead to a significant decline in lifestyle. By providing this financial security, life insurance empowers families to build a legacy that goes beyond the insured individual's lifetime, creating a lasting impact on the lives of their loved ones.

In summary, life insurance is a critical component of legacy building, offering financial support and security to families when they need it most. It provides a safety net that allows individuals to leave a lasting, positive impact on their loved ones, ensuring their financial well-being and the fulfillment of their dreams. Understanding the role of life insurance in creating a legacy is essential for anyone looking to provide long-term financial security for their family.

Life Insurance: Extra Protection, Extra Peace of Mind

You may want to see also

Legal and Emotional Benefits: It offers legal and emotional support, ensuring proper distribution of assets and closure for loved ones

Life insurance is indeed a critical tool that provides both legal and emotional benefits, offering a sense of security and peace of mind to individuals and their loved ones. When someone purchases a life insurance policy, they are essentially making a commitment to their beneficiaries, ensuring that their financial affairs are in order should the worst happen. This commitment is legally binding, and it outlines the terms and conditions under which the insurance company will pay out a death benefit to the designated recipients. This legal framework is crucial as it provides a clear and structured way to manage one's affairs and ensures that the wishes of the policyholder are honored.

The legal aspect of life insurance is particularly important in estate planning. It allows individuals to specify how their assets should be distributed, which can include beneficiaries for life insurance proceeds, retirement accounts, and other holdings. By having a clear plan in place, individuals can ensure that their wealth is passed on according to their desires, providing financial security for their family or chosen recipients. This legal structure also helps to minimize potential disputes among beneficiaries, as the terms are explicitly defined in the policy.

Emotionally, life insurance plays a vital role in providing closure and support to the loved ones left behind. Knowing that there is a financial safety net in place can be immensely comforting during a difficult time. It allows beneficiaries to focus on grieving and healing without the added stress of financial worries. The insurance payout can help cover essential expenses, such as funeral costs, outstanding debts, or everyday living expenses, ensuring that the family's immediate needs are met. This emotional support is invaluable, as it enables the bereaved to navigate the challenging period of adjusting to life without their loved one.

Furthermore, life insurance can provide a sense of continuity and stability for the family. It ensures that the financial obligations and commitments of the deceased individual are honored, allowing the remaining family members to maintain their standard of living and long-term goals. This can be especially important for families with children, as it provides financial security for their future education, healthcare, and overall well-being. The emotional reassurance of knowing that the family's financial future is protected can be a powerful motivator for individuals to secure life insurance coverage.

In summary, life insurance serves as a powerful tool that offers both legal and emotional advantages. It provides a legal framework for asset distribution, ensuring that the policyholder's wishes are respected and minimizing potential conflicts. Emotionally, it offers peace of mind, financial security, and closure to beneficiaries, allowing them to grieve and move forward with their lives. By understanding and appreciating these benefits, individuals can make informed decisions about life insurance, providing a valuable layer of protection for themselves and their loved ones.

Joint First-to-Die: Understanding the Benefits and Drawbacks of This Life Insurance Option

You may want to see also

Frequently asked questions

The term "life insurance" is used because it provides financial protection and security for the insured individual's beneficiaries during their lifetime. It ensures that the policyholder's loved ones are financially supported in the event of the insured person's death. The focus is on the coverage and benefits provided for the living, hence the name "life insurance."

The term "life" in life insurance signifies the coverage period, which is the duration for which the policy provides financial protection. It is not limited to the moment of death but rather encompasses the entire life of the insured individual. The policy benefits are paid out upon the insured's death, but the insurance company also offers various riders and options to provide coverage for critical illnesses, disabilities, or other specific events during the policy term.

The term "insurance" refers to the act of providing financial protection and security against potential risks. In the case of life insurance, it involves assessing and managing the risk of the insured's death. The insurance company sets premiums based on statistical data and the insured's health and lifestyle factors to ensure that the policyholders and their beneficiaries are financially protected. This term emphasizes the role of the insurance provider in mitigating financial risks and offering peace of mind to policyholders.