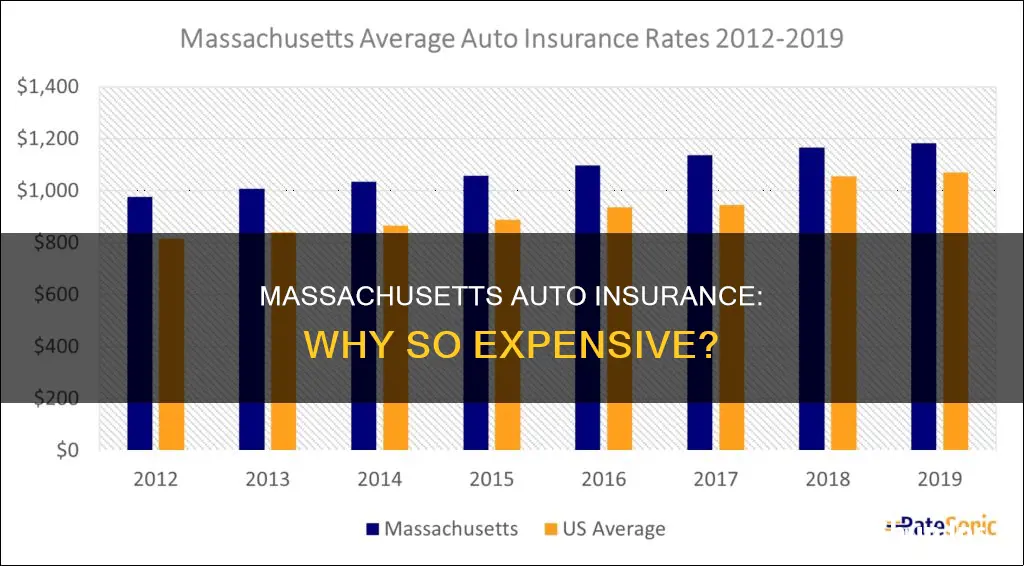

Massachusetts has some of the highest auto insurance costs in the country. This is due to a combination of factors, including the state's no-fault regulations, high car repair costs, mandatory coverages such as uninsured motorist protection, dense urban areas with high accident rates, and severe weather events leading to more claims.

The state's no-fault insurance rules mean that insurers must cover medical expenses and other losses, regardless of who caused the accident. This results in more claims and higher premiums. Additionally, Massachusetts requires several mandatory coverages, including uninsured motorist protection and personal injury protection, which further increase the overall cost of car insurance.

The high urban population density in cities like Boston also contributes to the high cost of auto insurance in Massachusetts. More accidents, theft, and vandalism occur in these densely populated areas, leading to increased claims and insurance rates.

Furthermore, the state has a high number of highways, resulting in a large number of drivers on the road and a higher likelihood of crashes. The combination of these factors makes auto insurance in Massachusetts more expensive than in many other states.

| Characteristics | Values |

|---|---|

| High population density | 92% of the state's residents live in urban areas |

| High accident rate | Accidents are more likely to happen in urban areas |

| High cost of living | Higher costs for medical care, auto repairs, and litigation |

| High number of claims | More property damage and bodily injury claims per vehicle than nearly every other state |

| High car repair costs | Vehicles today cost more to repair due to the added technology and features |

| Uninsured drivers | 4% of drivers lacked even minimum liability insurance in Massachusetts in 2019 |

| Mandatory coverages | Uninsured motorist coverage, personal injury protection, bodily injury to others, bodily injury caused by an uninsured auto, and damage to someone else's property |

What You'll Learn

Mandatory uninsured motorist insurance

Massachusetts requires drivers to have mandatory uninsured motorist insurance, which can affect insurance premiums. This type of insurance covers you, your passengers, and family members living with you for bodily injuries when hit by an uninsured driver or in a hit-and-run accident. It is important to note that uninsured motorist coverage does not protect against underinsured drivers, who have insufficient insurance to pay for injuries they cause. To protect against this, underinsured motorist coverage can be purchased separately.

In the event of an accident with an uninsured driver, it is recommended to exchange information with the other driver, take pictures of the scene, and file a police report. Contact your insurance carrier and open a claim as soon as possible.

The mandatory uninsured motorist insurance in Massachusetts is one of the factors that contribute to the state's high auto insurance costs. Other factors include the state's high population density, with most drivers living in urban areas where accidents are more likely to occur, and the higher cost of living, resulting in higher costs for medical care, auto repairs, and litigation.

Gap Insurance: What's Covered?

You may want to see also

No-fault state

Massachusetts is a "no-fault" state, which means that in the event of a car accident, your insurance will cover your medical bills and other losses, regardless of who caused the accident. This type of insurance is also known as "personal injury protection" or "PIP" coverage. This coverage extends to the owner of the vehicle, anyone with permission to drive the vehicle, any passengers in the vehicle, and any pedestrians injured by the vehicle.

In Massachusetts, drivers are required to have a minimum of $8,000 in PIP coverage, which can be used to pay for medical bills, up to 75% of lost income, and replacement services. It's important to note that PIP coverage does not include compensation for "pain and suffering" or other non-monetary damages resulting from the accident.

While Massachusetts is a no-fault state, there are situations where you can step outside of the no-fault system and pursue a claim against the at-fault driver. This can happen if the injured person incurs at least $2,000 in reasonable medical expenses, or if the injuries include permanent and serious disfigurement, fractured bones, or substantial loss of hearing or sight. In these cases, you can hold the at-fault driver responsible and pursue compensation for all categories of losses, including pain and suffering.

The no-fault system in Massachusetts is just one factor that contributes to the state's high auto insurance costs. Other factors include the state's high population density, especially in urban areas, which increases the likelihood of accidents, theft, and vandalism. Additionally, Massachusetts has a higher cost of living, which leads to higher costs for medical care, auto repairs, and litigation.

Auto Detailing Business: What's the Cost of Liability Insurance?

You may want to see also

High car repair costs

Massachusetts has some of the highest auto insurance costs in the country. One of the factors contributing to these high costs is the high cost of auto repairs in the state.

The cost of repairing a car is influenced by several factors, including mechanic wages, cost of living, household income, type of vehicle, road conditions, and weather. As Massachusetts has a higher cost of living than many other states, this will impact the cost of auto repairs.

In addition, Massachusetts has a high population density, with around 92% of its residents living in urban areas. This means there is a high demand for auto repair services, which can drive up costs.

The high cost of auto repairs in Massachusetts is reflected in the state's insurance premiums. The yearly average cost of car insurance in Massachusetts is $466 for minimum coverage and $1,737 for full coverage. While these rates are lower than the national average, they are still considered expensive for residents of the state.

Auto Insurance and Windshield Woes: What's Covered?

You may want to see also

High population density

Massachusetts is the third most densely populated state in the US, with 895 people per square mile. This high population density is a significant factor in the state's high auto insurance costs.

The state's population is heavily concentrated in urban areas, with 92% of residents living in cities. Most Bay Staters live within a 60-mile radius of the State House on Beacon Hill, in what is known as Greater Boston. This area includes the City of Boston, neighbouring towns and cities, the North Shore, South Shore, and most of southeastern and central Massachusetts.

With so many people living in close proximity, the chances of accidents, theft, and vandalism increase. This leads to more insurance claims, which in turn drives up insurance rates. The bottom line is that Massachusetts has more property damage and bodily injury claims per vehicle than nearly every other state.

The high population density in Massachusetts is a key factor in the state's high auto insurance costs, as it contributes to a higher number of claims.

Cosigning Auto Insurance: What You Need to Know

You may want to see also

Severe weather

Massachusetts has a higher frequency of severe weather events, which can result in costly property damage and repairs. The state is susceptible to severe weather conditions, including coastal storms and flooding, and high winds, which can cause extensive damage to vehicles, homes, and other structures, leading to increased insurance claims and, consequently, higher insurance rates.

The state's geographical location and climate contribute to its vulnerability to severe weather. Massachusetts experiences all four seasons, with cold, snowy winters and warm, humid summers. The coastal areas are particularly at risk of storms and flooding due to their proximity to the Atlantic Ocean.

In recent years, Massachusetts has witnessed an increase in the frequency and intensity of severe weather events. Climate change is a significant contributing factor, with rising sea levels and more unpredictable weather patterns exacerbating the problem. As a result, insurance companies have had to adjust their rates to account for the heightened risk and increased number of claims associated with severe weather.

The impact of severe weather on insurance rates is evident in the mandatory coverage requirements for Massachusetts drivers. The state mandates that drivers carry uninsured motorist coverage and personal injury protection, reflecting the higher likelihood of accidents and injuries during severe weather events.

Additionally, the high population density of Massachusetts, especially in urban areas, further increases the risk of weather-related damage. With more people and vehicles concentrated in these areas, the potential for accidents, injuries, and property damage is heightened. This density contributes to higher insurance rates as insurers anticipate more claims arising from severe weather events.

Quicksilver Credit Card Auto Rental Insurance: What's Covered?

You may want to see also

Frequently asked questions

Massachusetts is a no-fault state, which means that your own insurance pays for your medical expenses and some other losses, regardless of who caused the accident. This is managed through Personal Injury Protection (PIP) coverage. PIP covers up to $8,000 in medical expenses, lost income, and household services.

Some other reasons are the high cost of auto repairs, mandatory coverages such as uninsured motorist protection, dense urban areas leading to increased accidents, and severe weather causing more claims.

One of the best ways to lower your auto insurance rates in Massachusetts is to shop around and compare quotes from different insurers. You should also consider bundling your policies if you have home or other types of insurance. Increasing your deductible can also lower your monthly premiums.

The mandatory auto insurance coverages in Massachusetts include bodily injury to others, personal injury protection (PIP), bodily injury caused by an uninsured auto, and damage to someone else's property.