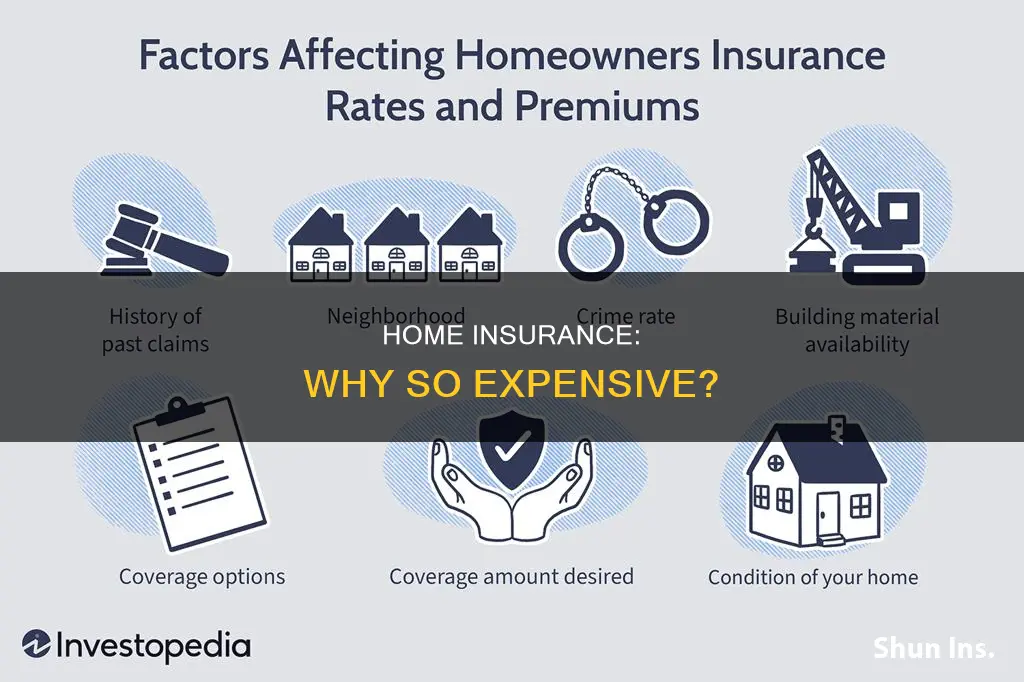

There are several factors that can cause house insurance to be high. Firstly, the increase in natural disasters, such as hurricanes, floods, droughts, and wildfires, has led to costly insurance claims, which have caused insurance rates to skyrocket. Additionally, the rising cost of building materials, supply chain issues, and labour shortages have also contributed to higher insurance rates. Furthermore, insurance companies take into account the location of the house, the age of the house, the crime rate in the area, the credit score of the homeowner, and the number of insurance claims made when determining insurance rates.

| Characteristics | Values |

|---|---|

| Natural disasters | Hurricanes, floods, droughts, wildfires, tornadoes, hail, and storms |

| Inflation | Increase in the cost of building materials, supply chain issues, and high labour costs |

| Location | High-risk states, high crime areas, flood zones, distance from fire stations, and distance from water |

| Credit score | Poor credit score |

| Insurance history | Previous claims, multiple insurance policies, and loyalty to insurance company |

| Home characteristics | Age of the home, type of roof, plumbing, HVAC, electrical systems, and unique features |

| Policy details | Low deductible, high coverage, and additional coverages |

What You'll Learn

Natural disasters and climate change

The impact of climate change on insurance rates is twofold. Firstly, insurers use past events to determine the risk of future damage and set premium prices. However, climate change has introduced new extremes, such as longer heatwaves, rising sea levels, higher winds, and more frequent and intense natural disasters. These new extremes pose a significant risk to properties, and insurers may struggle to accurately price policies to reflect this increased risk. As a result, insurers often choose to increase premiums across the board to offset the potential losses from these extreme events.

Additionally, climate change has altered traditional flood risk assessments. With every additional degree of heat, the atmosphere holds 4% more moisture, increasing the likelihood and severity of flooding. This was evident in Hurricane Harvey, which caused extensive flooding in Houston, Texas, in 2017. Many of the affected homes were outside the areas historically deemed most at risk, demonstrating how climate change can quickly render previous risk assessments obsolete.

The insurance industry is also facing challenges due to the concentration of risk in certain geographic areas. As specific regions become more susceptible to natural disasters, insurers struggle to balance their portfolios and spread risk effectively. This has led to some insurers excluding coverage for specific disasters, such as hurricanes, wind, and hail, in high-risk areas.

Furthermore, the physical impacts of climate change are systemic and have far-reaching consequences. A natural catastrophe can trigger a chain of events, including property damage, business interruption, ecosystem destruction, and humanitarian crises. These interconnected effects can lead to greater volatility and economic disruption, which the insurance industry must consider when assessing risk and setting premiums.

The increasing frequency and severity of natural disasters, coupled with the systemic impacts of climate change, have forced the insurance industry to adapt. Insurers must now offer innovative solutions and services to meet the evolving needs of their customers. While these changes may be necessary, they often result in higher premiums and deductibles for homeowners, especially those living in areas vulnerable to natural disasters.

The Intricacies of Reciprocal Insurance: Unraveling the Nature of Farmers Insurance Exchange

You may want to see also

Inflation and building costs

The construction industry has been facing rising costs due to a combination of factors, including high demand, inflation, supply chain disruptions, labour shortages, and the impact of the pandemic and the war in Ukraine. These factors have contributed to increased prices for materials and labour, with construction costs expected to rise by 14.1% in 2022. While inflation is expected to stabilise in 2023 and 2024, it will still impact the cost of building and rebuilding homes.

The cost of rebuilding a home is a significant component of home insurance premiums. When construction costs increase, insurance companies need to adjust their rates to cover the potential cost of rebuilding homes in the event of damage or destruction. This means that higher construction costs due to inflation are passed on to homeowners through higher insurance premiums.

Inflation can also affect the margins of contractors and suppliers, which in turn impacts construction costs. When construction volume increases rapidly, margins tend to increase as well. Overhead and profit margins rise in response to increased demand, and these costs are reflected in the final cost of construction projects. This further contributes to the increase in home insurance premiums.

In addition to inflation, the increase in severe weather events and natural disasters, such as hurricanes, wildfires, and tornadoes, has also contributed to higher home insurance rates. These events have caused billions of dollars in damage to insured properties, leading to higher payouts from insurance companies. As a result, insurance companies have been raising rates to cover the cost of these payouts and prepare for future climate-related disasters.

Farmers Insurance: Unraveling its Corporate Structure and Nature of Ownership

You may want to see also

Credit score

In most states, credit history and credit-based insurance scores are considered when determining insurance rates and eligibility. However, other factors such as location, home characteristics, and coverage amount may have a more significant impact on overall insurance costs.

While a strong credit score can lead to lower insurance rates, it is not the sole factor in determining insurance premiums. Insurance companies also take into account factors like the age of the home, the presence of safety features, and the frequency of insurance claims.

It is worth noting that some states, including California, Maryland, Michigan, Massachusetts, and Oregon, strictly regulate or prohibit the use of credit scores in determining home insurance rates.

To improve credit-based insurance scores, individuals should focus on paying their bills on time, reducing credit card balances, and avoiding excessive new credit applications.

Farmers Insurance Refunds: Policyholder Perks or Publicity Stunt?

You may want to see also

Crime rates

Insurance companies will also consider the proximity of your home to emergency services. For example, if you live just around the corner from a police station, officers could respond quickly to a break-in and thieves might decide to skip your house altogether. From the insurance company's perspective, your home is less risky to insure than one that is further away from emergency services.

In addition, the crime rate of your neighbourhood can impact your insurance rates even if you're not a victim of crime yourself. Insurance companies offer rates based on collective risk, so if you live in a high-crime area, your neighbours could file more claims, which will impact your rates.

To lower your premiums, you can make security improvements to your property, such as installing a security system, improving lighting in your yard, or trimming bushes to reduce potential hiding places for burglars.

Bed Bug Infestations: Understanding Insurance Coverage and Communicability

You may want to see also

Age of home

The age of a home is a significant factor in determining insurance premiums. Older homes tend to have more problems than newer homes, and the systems and materials that make up the home deteriorate over time, making the home more prone to property damage. As a result, insurance companies view older homes as higher-risk and charge higher premiums to offset the increased likelihood of claims being filed.

The age of a home's roof, plumbing, HVAC, and electrical systems can all impact insurance costs. For example, if your roof is around 10 to 15 years old, your insurance company may start raising your rates annually to offset the risk of you filing a claim due to water leaks or wind damage. Similarly, outdated electrical systems can pose a fire risk, leading to higher premiums.

To lower insurance costs for older homes, it is essential to stay up-to-date with maintenance and improvements. Replacing an old roof or water heater, for instance, can help reduce premiums. Additionally, installing impact-resistant roofing materials or fire and burglar alarms may lead to discounts.

It is worth noting that the age of a home is just one of several factors that influence insurance rates. Location, construction type, risk factors, and personal factors about the homeowner also play a role in determining insurance premiums.

Understanding Scheduled Roof Payments with Farmers Insurance

You may want to see also

Frequently asked questions

There are several factors that can contribute to high insurance rates, including:

- Location: If your house is located in an area with a high crime rate, history of natural disasters, or is far from a fire station, you may be subject to higher insurance rates.

- Home characteristics: Older homes, especially those with outdated electrical wiring, plumbing, or roofing, are considered higher risk and may have higher insurance premiums. Additionally, features such as pools, trampolines, or wood-burning stoves can increase premiums due to the added risk of accidents or damage.

- Market conditions: Inflation, supply chain issues, and skilled labor shortages have contributed to increased construction and repair costs, which are reflected in higher insurance rates.

- Claims history: Insurance companies may view you as a higher risk if you have a history of filing insurance claims, potentially leading to increased rates.

- Credit score: A poor credit score can indicate financial risk to insurance companies, resulting in higher insurance rates.

To reduce your insurance rates, consider the following strategies:

- Shop around: Compare rates from multiple insurance companies to find the best fit for your needs.

- Raise your deductible: Opting for a higher deductible can lower your premiums, but ensure you can afford the higher out-of-pocket expense in the event of a claim.

- Bundle policies: Consolidating your insurance needs with one company by bundling home and auto insurance, for example, can often lead to significant discounts.

- Improve your credit score: Paying bills on time and reducing debt can improve your credit score, which may lead to lower insurance rates.

- Install safety features: Adding security systems, fire alarms, or water sensors can make your home less risky to insure and may result in discounts.

In addition to the factors mentioned above, home insurance rates can be influenced by:

- Type of insurance policy: Different types of policies offer varying levels of coverage, benefits, and perils covered, which can impact the cost.

- Distance from water: Homes in high-risk flood zones may require additional flood insurance, increasing overall insurance costs.

- Dog breed: Certain dog breeds may be considered higher risk by insurance companies, leading to higher rates or even restrictions on coverage.

- Attractive nuisances: Features such as pools or trampolines that may be appealing but potentially dangerous, especially to children, can increase insurance costs.

Endorsements, or additional coverages, typically raise your insurance premium as you're getting more robust coverage. Common endorsements include flood insurance, earthquake insurance, umbrella policies, and sewer backup policies. While these endorsements increase your premium, they can provide valuable protection in the event of a covered loss.

The average cost of home insurance in the US is $1,687 per year for a policy with $250,000 in dwelling coverage. However, insurance rates can vary significantly depending on individual factors such as location, credit score, claims history, and home characteristics.