Millennials, born between the early 1980s and mid-1990s, have been the subject of much debate regarding their financial habits and attitudes towards insurance. Unlike previous generations, many millennials seem to have a different perspective on life insurance, often viewing it as an unnecessary expense. This shift in mindset can be attributed to several factors, including a general sense of invincibility, a preference for immediate gratification, and a growing reliance on technology and financial services that offer more flexibility and customization. This article explores the reasons behind this generational gap in attitudes towards life insurance and the implications for the insurance industry.

What You'll Learn

- Financial Independence: Millennials often prioritize financial freedom, making life insurance seem unnecessary

- Alternative Investments: They may prefer alternative investments like stocks, ETFs, or real estate

- Risk Aversion: Younger generations tend to be more risk-averse, seeing life insurance as a high-risk investment

- Digital Solutions: With digital banking and financial apps, millennials may feel they have adequate coverage

- Cost Sensitivity: Life insurance premiums can be seen as too expensive for their budget-conscious generation

Financial Independence: Millennials often prioritize financial freedom, making life insurance seem unnecessary

Millennials, a generation often associated with a strong sense of financial independence, have a unique perspective on life insurance that sets them apart from their predecessors. This generation, born between the early 1980s and the mid-1990s, has grown up in a rapidly changing economic landscape, marked by the dot-com boom and bust, the 2008 financial crisis, and the rise of the gig economy. These experiences have shaped their financial mindset, leading many to question the traditional role of life insurance.

Financial freedom is a cornerstone of millennial values. This generation, often burdened with student loans and the challenges of a competitive job market, has a heightened awareness of financial security. They are more likely to prioritize short-term financial goals, such as saving for a down payment on a home or investing in their retirement, over long-term commitments like life insurance. The idea of tying up their money in a policy that may not provide immediate benefits seems counterintuitive to their pursuit of financial independence.

In the digital age, millennials have access to a wealth of financial information and resources. They are more likely to turn to online platforms and financial advisors for guidance, allowing them to make informed decisions about their money. This generation is also more inclined to take control of their financial destiny, often choosing to invest in their own education and skills rather than relying on traditional financial products. Life insurance, with its long-term commitments and potential complexities, may not align with their desire for financial autonomy.

The concept of financial independence also extends to their personal lives. Millennials often value flexibility and the ability to adapt to changing circumstances. Life insurance, with its fixed premiums and long-term contracts, can feel restrictive in a generation that embraces change. They may prefer more adaptable financial strategies that can adjust to their evolving needs and goals.

However, it's important to note that while millennials may prioritize financial freedom, they still face unique challenges. The high cost of living, rising healthcare expenses, and the need for long-term financial security are all valid concerns. Balancing these factors with their desire for independence is a complex task. Some millennials may choose to opt for term life insurance or other alternative financial products that better align with their short-term goals and values. Ultimately, the decision to purchase life insurance is a personal one, and millennials, like any generation, will make choices that reflect their individual circumstances and priorities.

Whole Life Insurance: A Smart Financial Move?

You may want to see also

Alternative Investments: They may prefer alternative investments like stocks, ETFs, or real estate

Millennials, often portrayed as a generation with a unique set of preferences, have indeed shown a different approach when it comes to financial planning, including life insurance. While traditional insurance products have been a staple for older generations, millennials are increasingly opting for alternative investments, which offer a more dynamic and potentially lucrative way to secure their financial future. This shift in preference is not just a trend but a strategic move that reflects the generation's financial literacy and desire for control over their assets.

One of the primary reasons millennials are moving away from traditional life insurance is the perception that it is a passive and often underperforming investment. Many millennials are well-versed in the stock market and have a natural inclination towards more active and tangible assets. Stocks, for instance, offer a direct stake in a company's success, providing both the potential for significant returns and the ability to influence the company's direction. This level of engagement and the potential for higher returns make stocks an attractive alternative to traditional insurance.

Exchange-Traded Funds (ETFs) are another popular choice for this demographic. ETFs are a type of investment fund that trades on an exchange like a stock, providing diversification across various assets, sectors, or markets. Millennials appreciate the flexibility and low costs associated with ETFs, which can be easily bought and sold, allowing for quick adjustments to their investment strategy. This accessibility and the ability to diversify their portfolio without the high fees typically associated with mutual funds make ETFs a compelling alternative to life insurance.

Real estate is yet another investment avenue that has captured the interest of millennials. With the rise of crowdfunding platforms, it is now possible to invest in real estate projects without the need for substantial capital. This democratization of access to real estate investments allows millennials to build a diversified portfolio of properties, providing a steady income stream and the potential for long-term wealth appreciation. Unlike traditional life insurance, real estate offers a more tangible asset, providing a sense of security and control over a physical asset.

In summary, millennials' preference for alternative investments like stocks, ETFs, and real estate is a strategic response to their financial goals and risk tolerance. These investments offer a more active and engaging approach to wealth management, providing the potential for higher returns and a sense of ownership over their financial future. As millennials continue to shape the financial landscape, their choice to bypass traditional life insurance in favor of these alternative investments is a significant trend that financial advisors and insurance companies alike must consider.

Selling Life Insurance: Strategies for Success

You may want to see also

Risk Aversion: Younger generations tend to be more risk-averse, seeing life insurance as a high-risk investment

The concept of risk aversion is a key factor in understanding why younger generations, particularly millennials, may not see the value of traditional life insurance. This generation, often characterized by their cautious and calculated approach to financial decisions, tends to view life insurance as a high-risk investment with potential drawbacks.

Millennials, who came of age during a period of economic uncertainty and witnessed the financial crisis of 2008, have developed a heightened awareness of risk. They are more likely to prioritize immediate financial stability and flexibility over long-term commitments. Life insurance, with its long-term policies and potential financial obligations, can be seen as a risky venture for this generation. The idea of tying up their assets for decades or even a lifetime may seem counterintuitive to their desire for financial freedom and control.

This risk aversion is further fueled by the belief that life insurance policies can be complex and potentially costly. Millennials often prefer transparent and straightforward financial products. They are more inclined to invest in assets they can easily understand and manage, such as stocks, bonds, or real estate. The idea of entrusting their financial well-being to a complex insurance policy, with potential hidden fees and uncertain payouts, can be off-putting.

Additionally, the rise of alternative investment options and financial technologies (fintech) has given millennials more diverse ways to manage their money. They can now access a wide range of investment products and financial advice through online platforms, often with lower fees and more personalized services. This shift in financial behavior makes traditional life insurance seem less appealing, as millennials seek out alternatives that align with their values of transparency, accessibility, and control.

In summary, the risk aversion of younger generations, particularly millennials, plays a significant role in their perception of life insurance. They view it as a high-risk investment, preferring instead to take a more cautious approach to financial planning. This mindset, combined with the availability of alternative investment options, contributes to the lower adoption of traditional life insurance policies among millennials.

Life Insurance and Divorce: What You Need to Know

You may want to see also

Digital Solutions: With digital banking and financial apps, millennials may feel they have adequate coverage

Millennials, often portrayed as the generation detached from traditional financial products, have indeed shown a different approach to life insurance. While older generations may have relied on this coverage as a standard part of their financial planning, millennials seem to have a different perspective, especially when it comes to digital solutions.

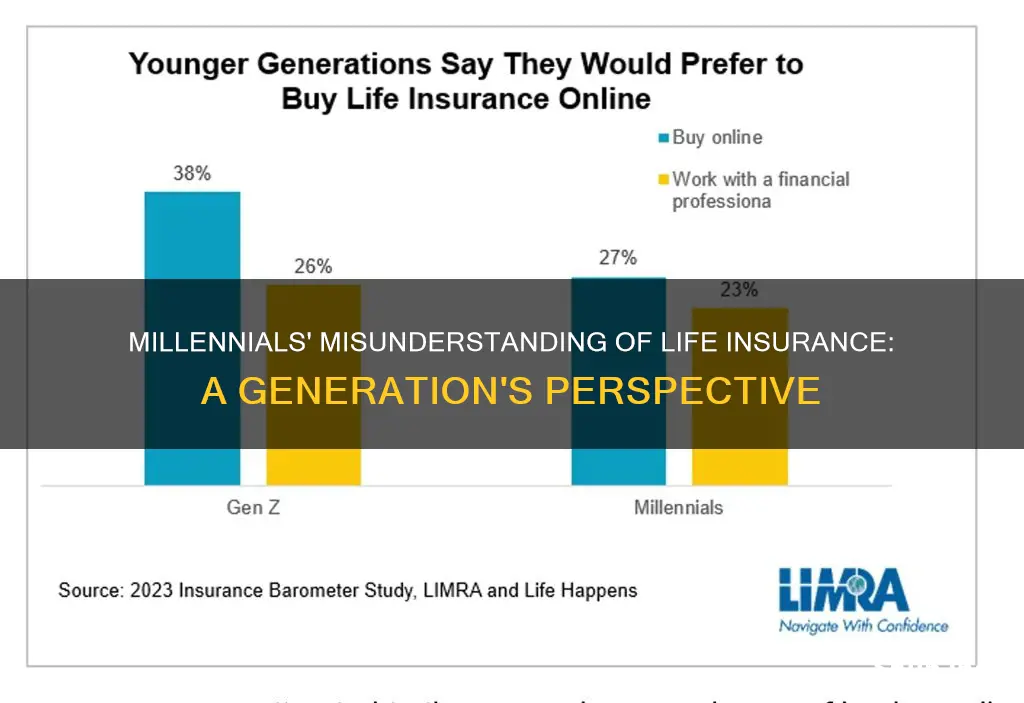

The rise of digital banking and financial apps has provided millennials with convenient access to various financial services, including insurance. With just a few taps on their smartphones, they can now compare policies, get quotes, and even purchase life insurance online. This accessibility and convenience have played a significant role in changing their perception of insurance. Many millennials believe that they can easily find and manage the coverage they need through these digital platforms, making traditional life insurance less appealing.

Online financial apps offer a personalized experience, allowing users to tailor their insurance plans according to their specific needs. Millennials, known for their tech-savviness, appreciate the ability to customize and control their financial decisions. They can now choose the level of coverage, select beneficiaries, and even opt for term life insurance, which is often more affordable and suitable for their current life stage. This level of customization and the ability to make informed choices have made digital insurance solutions an attractive option for this generation.

Furthermore, the transparency and simplicity provided by digital banking and financial apps are highly valued by millennials. They appreciate the clear communication and easy-to-understand language used in these platforms. Unlike traditional life insurance policies, which can be complex and filled with jargon, digital solutions present information in a straightforward manner. This transparency builds trust and encourages millennials to take control of their financial well-being.

In addition, the cost-effectiveness of digital insurance solutions cannot be overlooked. Millennials, often facing financial constraints as they start their careers, are drawn to affordable options. Digital apps often provide competitive rates, and with the ability to compare policies side by side, millennials can make informed choices. This accessibility and affordability further contribute to their preference for digital banking and financial services over traditional life insurance.

In conclusion, the digital revolution has significantly influenced millennials' attitude towards life insurance. With the convenience, customization, and transparency offered by digital banking and financial apps, they feel empowered to manage their financial needs. As a result, many millennials may perceive that they have adequate coverage through these digital solutions, making traditional life insurance a less prioritized aspect of their financial planning.

Life Insurance: When Family Can Contest Beneficiaries

You may want to see also

Cost Sensitivity: Life insurance premiums can be seen as too expensive for their budget-conscious generation

Millennials, often referred to as the 'budget-conscious generation', have a unique perspective on financial planning, and life insurance is an area where their views can be particularly divergent. One of the primary reasons millennials are less inclined to purchase life insurance is the perception of high costs. In an era where financial literacy and awareness of personal finances are paramount, millennials are more likely to scrutinize every dollar spent. Life insurance premiums, which can vary significantly depending on factors like age, health, and lifestyle, are often seen as an unnecessary expense. This generation, raised during the Great Recession, has a heightened awareness of financial risks and a tendency to prioritize short-term savings and investments over long-term financial products.

The cost sensitivity of millennials is deeply rooted in their financial mindset. They are more likely to opt for immediate gratification and short-term gains, such as investing in stocks or cryptocurrencies, rather than committing to long-term financial commitments like life insurance. Additionally, the rise of digital-first financial services has empowered millennials to take control of their finances, allowing them to compare prices and services with ease. This has further fueled their cost-consciousness, as they can quickly identify and avoid what they perceive as excessive fees or premiums.

In the context of life insurance, millennials might question the value proposition. They may argue that the benefits of life insurance, such as financial security for loved ones, are not immediately apparent or relevant to their current life stage. Many millennials are focused on building their careers, starting families, or pursuing entrepreneurial ventures, and they may believe that these goals can be achieved without the need for life insurance. This perception can lead to a reluctance to invest in a product that they don't fully understand or see as essential.

Furthermore, the digital age has provided millennials with alternative ways to plan for the future. They are more likely to explore affordable and accessible options like term life insurance or even opt-out of life insurance altogether. With the rise of online marketplaces and comparison platforms, they can easily compare different insurance providers and policies, further reinforcing their cost-sensitive behavior. This generation's preference for transparency and control over their finances has led to a more selective approach to insurance, where they demand value for money.

In conclusion, the high cost of life insurance premiums is a significant deterrent for millennials. Their budget-conscious nature, combined with a desire for financial control and transparency, makes them less inclined to commit to long-term insurance policies. However, it is essential to note that while cost sensitivity is a prevalent issue, it also presents an opportunity for insurance providers to adapt and offer more affordable, tailored solutions that resonate with this influential generation.

Life Insurance and Inheritance Tax in PA: What's the Deal?

You may want to see also

Frequently asked questions

Millennials, born between the early 1980s and mid-1990s, have grown up in a world where technology and instant access to information have shaped their perspectives. They tend to believe that they have more control over their financial future compared to previous generations. With a strong focus on personal financial management and a desire for financial independence, many millennials feel they can handle their finances without relying on traditional insurance products.

One misconception is that life insurance is only for the elderly or those with families to support. Millennials often assume that since they are young and single, they don't need life insurance. However, this perception overlooks the fact that life insurance can provide financial security in various life stages, including for individuals without dependents. Another myth is that life insurance is too expensive, but with the rise of digital-only insurance providers, millennials can now access affordable coverage tailored to their needs.

Despite their financial literacy and independence, millennials can still benefit from life insurance. It can provide financial protection in case of unexpected events, such as accidents or critical illnesses. Life insurance can also help with debt repayment, ensuring that any outstanding loans or mortgages are covered, thus providing peace of mind. Additionally, certain types of life insurance policies offer investment components, allowing millennials to grow their money over time.

Yes, major life events can significantly impact a millennial's view on life insurance. Getting married, starting a family, or purchasing a home are milestones that often prompt individuals to reevaluate their insurance needs. These events may lead millennials to recognize the importance of having financial protection for their loved ones. Moreover, as millennials progress in their careers and accumulate assets, they might realize the value of having a comprehensive insurance plan to safeguard their financial well-being.