Variable Universal Life (VUL) insurance is a type of life insurance that offers both a death benefit and an investment component. It provides flexibility in premium payments and investment options, allowing policyholders to customize their coverage and investment strategy. VUL insurance is an attractive option for those seeking a long-term financial plan that combines insurance protection with the potential for investment growth. This type of policy allows individuals to allocate a portion of their premium payments to various investment options, providing an opportunity to build wealth over time. Understanding the benefits and features of VUL insurance can help individuals make informed decisions about their financial security and long-term goals.

| Characteristics | Values |

|---|---|

| Flexibility | Allows policyholders to allocate premiums between fixed and variable components, providing investment options. |

| Potential for Higher Returns | Variable components offer the opportunity for investment growth, which can outpace traditional fixed-rate insurance products. |

| Customizable | Policyholders can adjust their investment strategy over time, tailoring the policy to their financial goals. |

| Tax Advantages | May offer tax-deferred growth on investment gains, similar to retirement accounts. |

| Death Benefit | Provides a death benefit, ensuring financial security for beneficiaries. |

| Long-Term Financial Planning | Suited for long-term financial goals, offering both insurance coverage and investment potential. |

| Market-Linked | Performance is tied to the stock market, which can be attractive for those seeking market-related returns. |

| Low Initial Costs | Often has lower initial costs compared to other types of life insurance. |

| Liquidity | Policyholders can access cash value through loans or withdrawals, providing financial flexibility. |

| Guaranteed Death Benefit | Some policies offer a guaranteed death benefit, ensuring a specified amount is paid out upon the insured's death. |

| No Fixed Premiums | Premiums are not fixed and can vary based on the policyholder's investment choices. |

| Risk Management | Offers a way to manage risk by diversifying investments across various asset classes. |

| Regular Reviews | Policies typically require regular reviews to ensure the policy remains aligned with the policyholder's financial objectives. |

| No Fixed Maturity Date | Unlike traditional term life insurance, it has no fixed maturity date, providing coverage for life. |

| Suitable for High-Net-Worth Individuals | Often preferred by those with substantial financial resources who seek investment opportunities within insurance. |

What You'll Learn

- Cost-Effectiveness: VUL offers lower premiums than traditional life insurance, making it a budget-friendly option

- Flexibility: Policyholders can adjust death benefits and premiums to fit their changing financial needs

- Tax Advantages: Tax-deferred growth of cash value, providing potential tax benefits over time

- Investment Options: VULs offer a range of investment choices, allowing for potential long-term growth

- Lifestyle Benefits: Provides financial security and peace of mind, adapting to various life stages

Cost-Effectiveness: VUL offers lower premiums than traditional life insurance, making it a budget-friendly option

Variable Universal Life (VUL) insurance is an attractive financial product for those seeking a cost-effective way to secure their loved ones' financial future. One of the key advantages of VUL is its cost-effectiveness, which is particularly appealing to budget-conscious individuals. When compared to traditional life insurance, VUL offers lower premiums, making it a more affordable option for those who want to maximize their coverage without breaking the bank.

The lower premiums of VUL can be attributed to the investment component of the policy. Unlike traditional life insurance, which primarily focuses on providing a death benefit, VUL combines insurance with an investment account. Policyholders can allocate a portion of their premium payments into various investment options, such as stocks, bonds, or mutual funds. This investment aspect allows VUL to offer more competitive rates because the insurance company doesn't need to set aside as much money for future payouts, as the investment returns can help fund the policy.

In traditional life insurance, the premiums are calculated based on the expected long-term costs of providing the death benefit, which includes administrative fees, investment returns, and other associated expenses. Since VUL incorporates investment, the insurance company can invest the policyholder's premiums and generate returns, reducing the overall cost of the policy. This investment strategy enables VUL to provide lower premiums, making it an attractive choice for those who want to optimize their insurance budget.

Additionally, VUL policies often offer flexibility in premium payments, allowing policyholders to adjust their contributions based on their financial situation. This adaptability further enhances the cost-effectiveness of VUL, as individuals can tailor their payments to their needs and budget constraints. Over time, this flexibility can result in significant savings compared to fixed-premium traditional life insurance policies.

In summary, the cost-effectiveness of VUL is a significant draw for those seeking affordable life insurance. By combining insurance with investment opportunities, VUL offers lower premiums, making it a budget-friendly option without compromising on coverage. This unique feature sets VUL apart from traditional life insurance, providing individuals with a more flexible and potentially more economical way to secure their family's financial future.

Farm Bureau Life Insurance: Is It Worth the Hype?

You may want to see also

Flexibility: Policyholders can adjust death benefits and premiums to fit their changing financial needs

Variable Universal Life Insurance offers a unique level of flexibility that sets it apart from traditional life insurance policies. One of its key advantages is the ability for policyholders to customize and adjust their coverage according to their evolving financial circumstances. This adaptability is particularly beneficial for individuals who want to ensure their insurance policy remains relevant and effective throughout their lifetime.

With Variable Universal Life, policyholders have the freedom to modify the death benefit, which is the amount paid out upon the insured's death. This feature allows individuals to increase or decrease the death benefit based on their current financial situation and goals. For instance, during periods of financial growth, a policyholder might choose to increase the death benefit to provide enhanced coverage for their family. Conversely, if financial conditions change and the need for coverage diminishes, the policyholder can opt to reduce the death benefit, thus lowering the overall cost of the policy. This flexibility ensures that the insurance policy remains aligned with the policyholder's changing needs and priorities.

Additionally, the policyholders can also adjust the premiums, which are the regular payments made to maintain the policy. The ability to customize premiums is advantageous as it allows individuals to manage their insurance costs effectively. If a policyholder experiences a financial surplus, they can choose to pay higher premiums, thereby increasing the cash value of the policy and potentially boosting their investment returns. Conversely, during times of financial constraint, lower premiums can be selected to ensure the policy remains affordable without compromising its essential coverage. This level of control empowers individuals to make informed decisions that align with their financial objectives.

The flexibility provided by Variable Universal Life Insurance is particularly appealing to those who value financial planning and adaptability. It allows individuals to make proactive adjustments to their insurance strategy, ensuring that their coverage remains adequate and relevant as their life circumstances evolve. Whether it's a result of career changes, family expansion, or shifts in financial goals, the ability to customize death benefits and premiums provides a sense of security and control over one's insurance portfolio.

In summary, Variable Universal Life Insurance stands out for its flexibility, enabling policyholders to tailor their death benefits and premiums to their specific needs. This adaptability ensures that the insurance policy remains a valuable asset throughout the policyholder's life, providing both financial protection and the freedom to make adjustments as required.

Fidelity Term Life Insurance: Is It Worth the Cost?

You may want to see also

Tax Advantages: Tax-deferred growth of cash value, providing potential tax benefits over time

Variable Universal Life (VUL) insurance offers a unique and powerful feature: tax-deferred growth of its cash value. This is a significant advantage for those seeking to maximize their long-term financial goals while enjoying potential tax benefits. Here's how it works and why it matters:

When you invest in a VUL policy, a portion of your premium payments goes towards building cash value, which grows tax-deferred. This means that the earnings on this cash value are not subject to annual income taxes, allowing your money to grow faster. Traditional investment vehicles, such as mutual funds or stocks, often have taxable gains that must be reported and taxed each year. In contrast, the cash value in a VUL policy compounds over time without incurring these annual tax liabilities. This tax-deferred growth can be particularly advantageous for long-term financial planning, as it allows your money to accumulate steadily without the immediate impact of taxes.

The tax advantages of VUL insurance become even more apparent when considering the potential for tax-free withdrawals. As the cash value grows, you can take out loans or withdrawals from the policy, and these amounts are typically tax-free, provided they are used for policy-related expenses or other qualified purposes. This flexibility enables policyholders to access their funds when needed without triggering a tax liability, which is a unique benefit compared to other investment options.

Over time, the tax-deferred nature of VUL insurance can result in substantial savings. The power of compounding, combined with the absence of annual taxes, allows the cash value to grow significantly. This growth can provide a substantial financial cushion for various life goals, such as retirement, education funding, or other financial milestones. Additionally, the tax-efficient nature of VUL policies can make them an attractive component of a comprehensive financial strategy, especially for those seeking to optimize their long-term wealth accumulation.

In summary, the tax-deferred growth of cash value in Variable Universal Life insurance is a powerful feature that can provide substantial long-term benefits. By avoiding annual income taxes on earnings and allowing tax-free withdrawals, VUL policies offer a unique and advantageous way to build wealth and achieve financial goals. Understanding these tax advantages is essential for anyone considering VUL as part of their financial plan.

Generate Life Insurance Leads in India: Strategies for Success

You may want to see also

Investment Options: VULs offer a range of investment choices, allowing for potential long-term growth

Variable Universal Life (VUL) insurance is a type of life insurance that offers a unique combination of insurance protection and investment opportunities. One of its key advantages is the flexibility it provides in terms of investment options, which can significantly impact an individual's financial goals and long-term wealth accumulation.

VULs offer policyholders a diverse range of investment choices, typically including various mutual funds, index funds, and even stocks. This variety allows investors to tailor their investment strategy according to their risk tolerance and financial objectives. For instance, those seeking more conservative investments might opt for bond funds or money market accounts, while those with a higher risk appetite could choose to invest in equity funds or individual stocks. This flexibility is particularly beneficial for long-term growth, as it enables investors to adapt their strategy as market conditions evolve.

The investment options within a VUL policy can be customized to fit the investor's needs. Policyholders can allocate their premiums across different investment accounts, allowing them to build a diversified portfolio. This diversification is a critical strategy for managing risk and maximizing returns over the long term. By spreading investments across various asset classes, individuals can potentially benefit from the growth of different sectors and minimize the impact of any single investment's poor performance.

Moreover, the investment accounts within a VUL often offer tax advantages. Contributions to these accounts are typically made with after-tax dollars, and the earnings can grow tax-deferred until they are withdrawn. This feature encourages long-term investment, as the compound interest can accumulate without the immediate burden of taxes. When the policyholder eventually takes distributions, the tax treatment may vary depending on the specific circumstances, but it often provides a more favorable tax situation compared to traditional investment accounts.

In summary, the investment options available through VULs provide individuals with a powerful tool for building wealth over time. The ability to choose from a range of investment vehicles, customize allocation strategies, and benefit from tax advantages makes VULs an attractive choice for those seeking both insurance protection and the potential for long-term financial growth. This flexibility and control over investment decisions can be a significant factor in achieving one's financial goals.

Birth Certificates: Vital for Life Insurance Policies?

You may want to see also

Lifestyle Benefits: Provides financial security and peace of mind, adapting to various life stages

Variable Universal Life Insurance (VUL) offers a unique and flexible approach to financial security, providing individuals with a sense of peace and adaptability as they navigate through different life stages. One of its primary lifestyle benefits is the ability to provide financial security, ensuring that individuals and their families are protected against unforeseen circumstances. This type of insurance is designed to adapt to various life stages, offering a dynamic and personalized solution.

As life progresses, VUL policies can be adjusted to meet changing needs. For instance, during the early years of a career, the policy can be structured to provide a solid foundation of coverage, ensuring that the individual is protected in case of unexpected events. As the individual's financial situation improves, the policy can be modified to increase the death benefit, providing enhanced financial security for a growing family or business. This adaptability is a key advantage, allowing policyholders to make the most of their insurance without feeling constrained by a one-size-fits-all approach.

The flexibility of VUL allows for regular adjustments, ensuring that the policy remains relevant and effective over time. Policyholders can choose to increase or decrease the death benefit, adjust the investment allocation, or even take out loans against the cash value. This level of customization ensures that the insurance policy evolves with the individual's changing circumstances, providing a sense of control and financial confidence.

Moreover, VUL offers a unique investment component, allowing policyholders to allocate a portion of their premiums into various investment options. This feature provides an opportunity to potentially grow the policy's cash value, which can be used for various purposes, such as funding education, starting a business, or planning for retirement. The investment aspect of VUL provides a dual benefit: financial security and the potential for wealth accumulation, making it a comprehensive financial tool.

In summary, Variable Universal Life Insurance offers a lifestyle benefit that is both secure and adaptable. It provides individuals with the means to protect their loved ones and themselves while also offering the flexibility to adjust as life progresses. With its combination of insurance coverage and investment opportunities, VUL empowers individuals to take control of their financial future, ensuring peace of mind and a sense of security for various life stages.

Life Insurance and THC: Can It Cause Denial?

You may want to see also

Frequently asked questions

Variable Universal Life (VUL) insurance is a type of permanent life insurance that offers both death benefit protection and investment options. It provides a flexible way to build a financial portfolio while ensuring a loved one is financially secure in the event of your passing. VUL policies allow policyholders to allocate their premiums between the death benefit and various investment accounts, which can be customized to fit individual financial goals and risk tolerance.

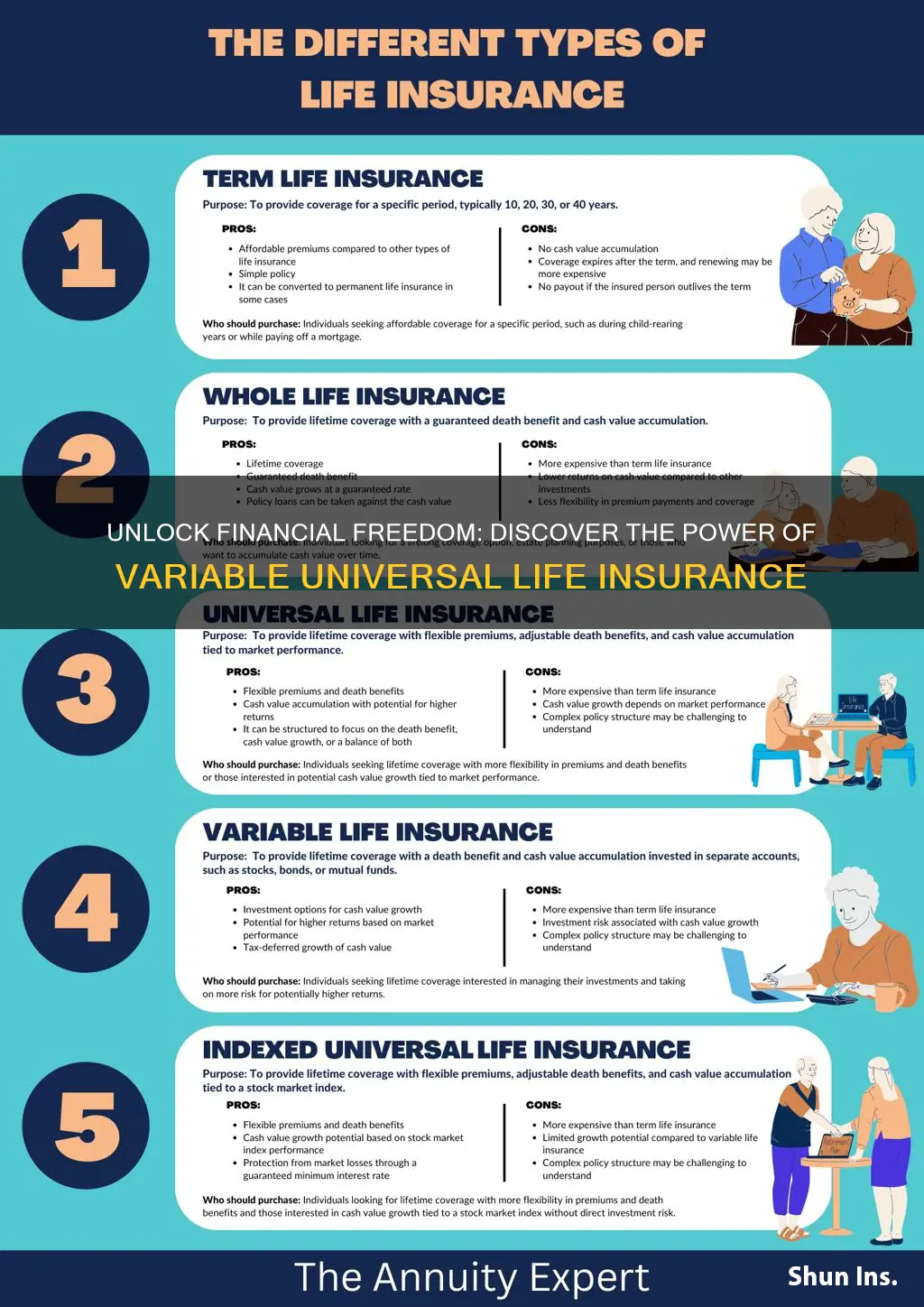

Traditional life insurance, such as term life or whole life, primarily focuses on providing a death benefit to beneficiaries. In contrast, VUL offers both insurance and investment components. With VUL, you can adjust the investment allocation to potentially grow your money, and any earnings can be tax-deferred until they are withdrawn. This feature makes VUL a versatile tool for long-term financial planning.

VUL insurance offers several advantages. Firstly, it provides a flexible premium payment structure, allowing you to adjust contributions based on your financial situation. Secondly, the investment accounts within the policy can offer potential for higher returns compared to traditional savings accounts. Additionally, VUL policies often have no fixed investment period, giving you the freedom to adjust your investment strategy over time. This type of insurance can be a valuable component of a comprehensive financial plan, especially for those seeking both insurance coverage and investment growth.