Life insurance is a vital financial tool that provides security and peace of mind for individuals and their loved ones. When considering why one might want to join life insurance, it's essential to recognize the numerous benefits it offers. Firstly, life insurance ensures financial stability for your family in the event of your untimely passing. It provides a lump sum payment, known as a death benefit, which can cover essential expenses, such as mortgage payments, education costs, and daily living expenses, allowing your loved ones to maintain their standard of living. Additionally, life insurance can offer tax advantages, estate planning benefits, and even potential investment opportunities. By joining life insurance, you take a proactive step towards safeguarding your family's future and ensuring that your legacy continues long after you're gone.

What You'll Learn

- Financial Security: Ensure your family's financial stability and peace of mind

- Long-Term Planning: Plan for the future, covering expenses and legacy

- Risk Mitigation: Protect against unforeseen events and potential financial loss

- Peace of Mind: Provide reassurance and support during challenging times

- Legacy Building: Pass on your values and financial security to future generations

Financial Security: Ensure your family's financial stability and peace of mind

Life insurance is a powerful tool that provides a safety net for your loved ones and offers a sense of financial security that is invaluable. It is a commitment to your family's well-being, ensuring that they are protected even in your absence. When you join life insurance, you are taking a proactive step towards safeguarding your family's financial future, which is a crucial aspect of responsible parenting and partnership.

The primary benefit of life insurance is the ability to provide financial stability. It ensures that your family can maintain their standard of living and cover essential expenses even if the primary breadwinner is no longer there. This financial security is especially crucial for families with children, as it guarantees that their educational needs, healthcare costs, and overall upbringing are not compromised. For instance, the insurance payout can be used to cover mortgage payments, ensuring your home remains a haven for your family, or it can be utilized to pay for your children's college education, providing them with a solid foundation for their future.

In addition to covering everyday expenses, life insurance can also be a significant source of financial support during challenging times. It can provide the necessary funds to cover funeral expenses, which can be a substantial financial burden for families. Moreover, the policy can offer a lump sum that can be invested or used to start a new business, ensuring that your family's financial future is secure and that they can maintain their lifestyle without significant disruptions.

The peace of mind that comes with knowing your family is financially protected is immeasurable. It allows you to focus on the present and future, knowing that your loved ones are taken care of. This sense of security can reduce stress and anxiety, enabling you to make the most of your time with your family. By providing financial stability, life insurance empowers you to make decisions that benefit your family's long-term goals and well-being.

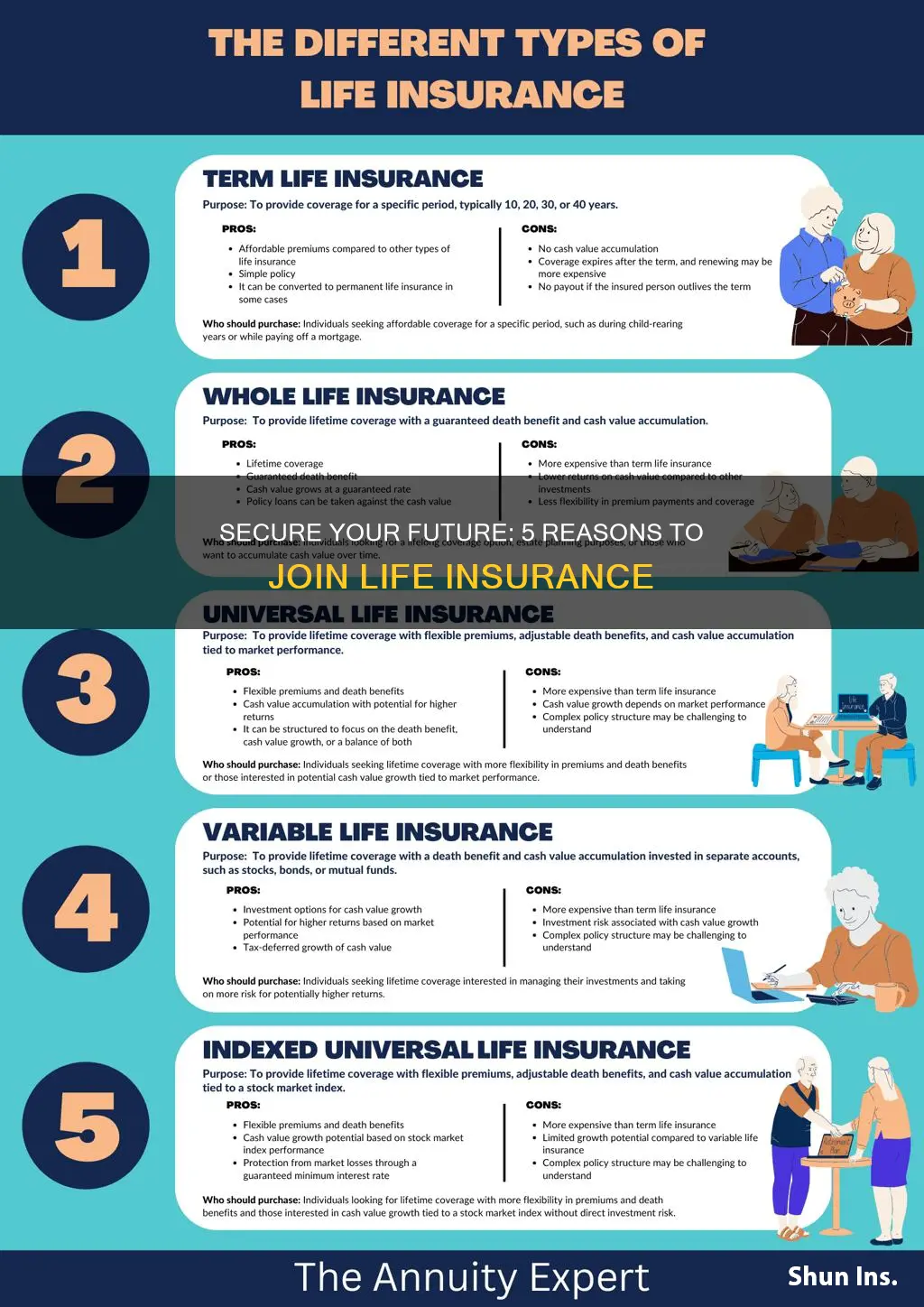

When considering life insurance, it is essential to choose a policy that aligns with your family's needs. Research different types of policies, such as term life insurance, whole life insurance, or universal life insurance, and understand the benefits each offers. Additionally, ensure that the policy has a sufficient death benefit to cover your family's financial obligations and provide for their future. By taking this step, you are not only securing your family's financial future but also demonstrating your commitment to their happiness and well-being.

How to Get Life Insurance for Your Relatives

You may want to see also

Long-Term Planning: Plan for the future, covering expenses and legacy

Life insurance is a powerful tool for long-term planning, offering a safety net that can provide financial security and peace of mind for the future. It is an essential consideration for anyone looking to secure their family's well-being and plan for the long term. Here's why long-term planning with life insurance is crucial:

Protecting Your Family's Financial Future: One of the primary reasons to consider life insurance is to ensure your family's financial stability in the event of your passing. Life insurance provides a financial safety net, offering a lump sum payment or regular income to your beneficiaries. This financial support can cover essential expenses such as mortgage payments, children's education, and daily living costs, ensuring that your loved ones are taken care of even when you're gone. By planning ahead, you can alleviate the financial burden on your family, allowing them to maintain their standard of living and achieve their goals without the added stress of financial uncertainty.

Covering Expenses and Legacy: Long-term planning with life insurance goes beyond just covering expenses. It also enables you to plan for various future expenses and leave a lasting legacy. For instance, you can use life insurance to pay for future college tuition for your children, ensuring they have the financial resources to pursue their education. Additionally, life insurance can be a valuable tool for estate planning. You can designate beneficiaries to receive a portion of your policy's death benefit, which can be used to pay off debts, purchase a new home, or invest in your family's future. This ensures that your hard-earned assets are utilized according to your wishes, providing financial security and a meaningful legacy for your loved ones.

Building Wealth and Investment Opportunities: Life insurance policies often come with various investment options, allowing you to grow your money over time. Some policies offer investment accounts where you can invest a portion of your premiums, potentially earning higher returns than traditional savings accounts. This aspect of long-term planning can help you build wealth and secure your family's financial future. By regularly reviewing and adjusting your investment strategy within the policy, you can take advantage of market opportunities and potentially increase the value of your policy.

Peace of Mind and Security: Perhaps the most valuable aspect of long-term planning with life insurance is the peace of mind it provides. Knowing that your family is financially protected in your absence can significantly reduce stress and anxiety. It allows you to focus on the present and make the most of your time, confident that your loved ones are secure. This sense of security can be a powerful motivator for making important life decisions and pursuing your goals without the constant worry of financial risks.

In summary, long-term planning with life insurance is about securing your family's future, covering essential expenses, and leaving a lasting legacy. It provides financial protection, investment opportunities, and peace of mind, ensuring that your loved ones are taken care of and that your hard-earned assets are utilized according to your wishes. By incorporating life insurance into your financial strategy, you can make informed decisions about your family's future and achieve your long-term goals with confidence.

Banks' Secret Weapon: Life Insurance Policies

You may want to see also

Risk Mitigation: Protect against unforeseen events and potential financial loss

Life insurance is a powerful tool for risk mitigation, offering a safety net against unforeseen events and potential financial loss. It provides a sense of security and peace of mind, knowing that your loved ones will be taken care of in the event of your passing. Here's how it works:

When you purchase life insurance, you're essentially entering into a contract with an insurance company. You agree to pay regular premiums in exchange for a financial benefit, typically a lump sum payment or regular income, upon your death. This contract is a form of risk transfer, where you shift the financial burden of potential loss to the insurance provider. In the event of your death, the insurance company pays out the agreed-upon amount, providing financial support to your beneficiaries. This payout can cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even daily living expenses for your family, ensuring they are financially secure during a difficult time.

The key aspect of risk mitigation here is the ability to plan for the worst-case scenario. Life insurance allows you to proactively address potential financial losses that could arise from your death. For example, if you have a young family, a life insurance policy can provide for their education, future needs, and overall well-being. It ensures that your loved ones won't be burdened with financial responsibilities, allowing them to focus on grieving and healing. Similarly, for those with a substantial estate or business, life insurance can help minimize the tax implications and ensure a smooth transition of assets to beneficiaries.

Moreover, life insurance offers a level of financial protection that can't be achieved through other means. It provides a guaranteed payout, which is especially valuable in uncertain economic times. Unlike other investments, life insurance is designed to pay out regardless of market fluctuations, providing a stable source of financial support. This is particularly important for families with long-term financial goals, such as purchasing a home, funding a child's education, or starting a business. By having life insurance, you can ensure that these goals remain on track, even if you're no longer around to achieve them.

In summary, life insurance is a critical component of risk management, offering a safety net against the financial impact of death. It empowers individuals to take control of their financial future and provide for their loved ones, even in the face of unforeseen circumstances. With life insurance, you can rest assured that your family's financial well-being is protected, allowing them to focus on the important aspects of life without the added stress of financial uncertainty.

Whole Life Insurance vs. Voluntary: Which Offers Better Protection?

You may want to see also

Peace of Mind: Provide reassurance and support during challenging times

Life insurance is an invaluable tool that offers peace of mind and a sense of security to individuals and their loved ones. It provides a safety net during life's most challenging moments, ensuring that financial burdens and emotional stress are minimized when the unexpected occurs. By having a life insurance policy in place, you can rest assured that your family's well-being and financial stability are protected, even when you're no longer around.

When faced with the loss of a loved one, the last thing one should have to worry about is the financial implications. Life insurance policies are designed to provide financial support and reassurance during these difficult times. The proceeds from the policy can cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even daily living expenses for the remaining family members. This financial support allows the bereaved to focus on grieving and healing without the added pressure of financial strain.

Moreover, life insurance offers a sense of security and reassurance to both the insured and their beneficiaries. Knowing that your loved ones will be taken care of financially can provide immense comfort. It ensures that your family can maintain their standard of living, continue with their education, or pursue their dreams, even if you're no longer present to guide and support them. This peace of mind is invaluable, as it allows your loved ones to move forward with their lives, knowing they have a financial safety net in place.

The support provided by life insurance extends beyond financial assistance. It also offers emotional reassurance, knowing that you've taken proactive steps to protect your loved ones. This can be particularly important during challenging times, as it provides a sense of control and stability. With life insurance, you're not just securing financial stability but also giving your family the gift of peace of mind, knowing they are prepared for life's uncertainties.

In summary, life insurance is a powerful tool that provides peace of mind and support during life's most challenging moments. It ensures financial security, allowing your loved ones to focus on healing and moving forward. By taking the initiative to secure a life insurance policy, you are not only protecting your family's financial future but also offering them the reassurance and support they need during difficult times. This simple yet profound act of love and care can make a significant difference in the lives of those you hold dear.

How to Borrow Money Using Your Life Insurance

You may want to see also

Legacy Building: Pass on your values and financial security to future generations

Leaving a lasting legacy is a powerful motivation for many individuals to consider life insurance. It is an opportunity to ensure that your values, life lessons, and financial security are passed on to your loved ones, even after your passing. By building a legacy through life insurance, you can provide a solid foundation for your family's future and contribute to the well-being of future generations.

One of the key aspects of legacy building is the ability to impart your values and life experiences to your children or grandchildren. Life insurance can be a tool to secure their future and provide them with the means to carry on your traditions and principles. For instance, you might want to ensure that your children have the financial resources to pursue their dreams, whether it's starting a business, pursuing higher education, or simply having the freedom to make choices without financial constraints. With the right life insurance policy, you can leave a financial cushion that allows them to build their own legacy and make a positive impact on the world.

Financial security is another critical element of legacy building. Life insurance can provide a safety net for your family, covering essential expenses and ensuring that your loved ones are taken care of during a difficult time. This financial security can include covering mortgage payments, providing for education costs, or even funding a trust that will distribute assets according to your wishes. By doing so, you are not only securing your family's present but also shaping their future, allowing them to focus on personal growth and achieving their goals.

Furthermore, life insurance can be a way to teach valuable life lessons and encourage financial responsibility. You can structure your policy to include beneficiaries who are also taught about financial management and the importance of long-term planning. This approach empowers your loved ones to make informed decisions and build their own financial security, ensuring that your legacy extends beyond your lifetime.

In summary, joining life insurance with a focus on legacy building allows you to actively contribute to the well-being and future success of your family. It provides an opportunity to pass on your values, financial knowledge, and security, ensuring that your loved ones are equipped to navigate life's challenges and build a bright future. This approach not only benefits your immediate family but also has the potential to create a lasting positive impact on future generations.

Unlock the Benefits of Index Whole Life Insurance

You may want to see also

Frequently asked questions

Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their families. It offers a safety net during challenging times, ensuring that loved ones are financially protected in the event of the insured's passing. This coverage can help cover various expenses, such as mortgage payments, children's education, funeral costs, and daily living expenses, providing a sense of stability and financial security.

Joining a life insurance policy can offer numerous advantages. Firstly, it allows you to plan for the future and ensure your family's financial well-being. The proceeds from the policy can be used to cover immediate financial obligations and provide long-term financial support to your dependents. Additionally, life insurance can help you achieve your financial goals, such as saving for retirement or building an investment portfolio, by offering various policy options and riders to suit your needs.

There are several types of life insurance policies to choose from, each with its own features and benefits. Term life insurance provides coverage for a specific period, offering a fixed death benefit if the insured passes away during that term. Permanent life insurance, on the other hand, offers lifelong coverage and includes a cash value component, allowing policyholders to build savings over time. Universal life insurance provides flexible premiums and death benefits, while whole life insurance offers guaranteed death benefits and fixed premiums.

Selecting the appropriate life insurance plan depends on various factors, including your financial goals, family's needs, and personal preferences. It's essential to assess your current and future financial obligations and determine the coverage amount required. Consider consulting a financial advisor or insurance professional who can help you evaluate different policy options, understand the terms and conditions, and make an informed decision based on your unique circumstances. Regularly reviewing and adjusting your policy as your life changes is also recommended to ensure it remains suitable.